- POL is consolidating in a descending channel, with bullish sentiment increasing despite the recent price stagnation.

- On-chain metrics such as active addresses and a stable futures funding rate support the possibility of a breakout.

POL (formerly MATIC) is experiencing a noticeable shift in market sentiment, with both crowd and smart money indicators pointing to growing optimism.

Public sentiment is at 0.95 and Smart Money is at an impressive 3.00. This bullish sentiment, combined with rising network activity, could trigger a significant move.

However, POL’s price action has yet to emerge from the consolidation phase. At the time of writing, Polygon was trading at $0.3636, down 2.49%, leaving investors wondering if this positive sentiment will translate into a sustained rally.

POL technical analysis: is there a threat of an outbreak?

Polygon’s price action continues to move within a descending channel and is struggling to break out of the consolidation phase between $0.4477 and $0.5761. Moreover, the recent candlestick pattern indicates that POL is approaching a critical point.

Therefore, the next move could determine whether the economy will recover or continue to consolidate. A break above the $0.4477 level is crucial for any upside momentum.

Source: TradingView

The Stochastic RSI, currently at 32.65, suggests that POL is near the oversold zone, indicating potential buying pressure in the near future.

Furthermore, the MACD shows a neutral signal, with minimal divergence between the MACD and signal lines, further indicating that POL could consolidate before making a decisive move.

Source: TradingView

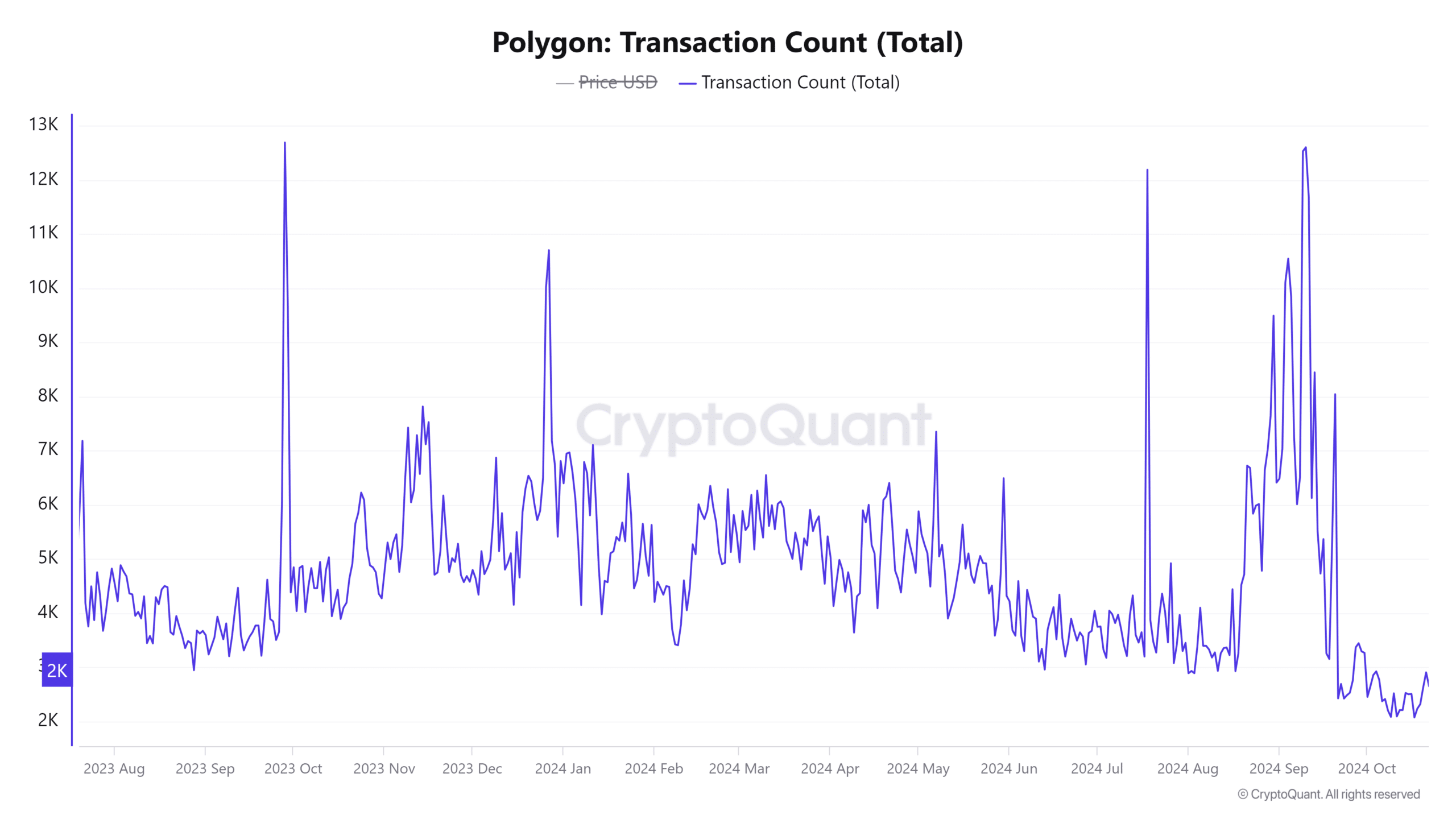

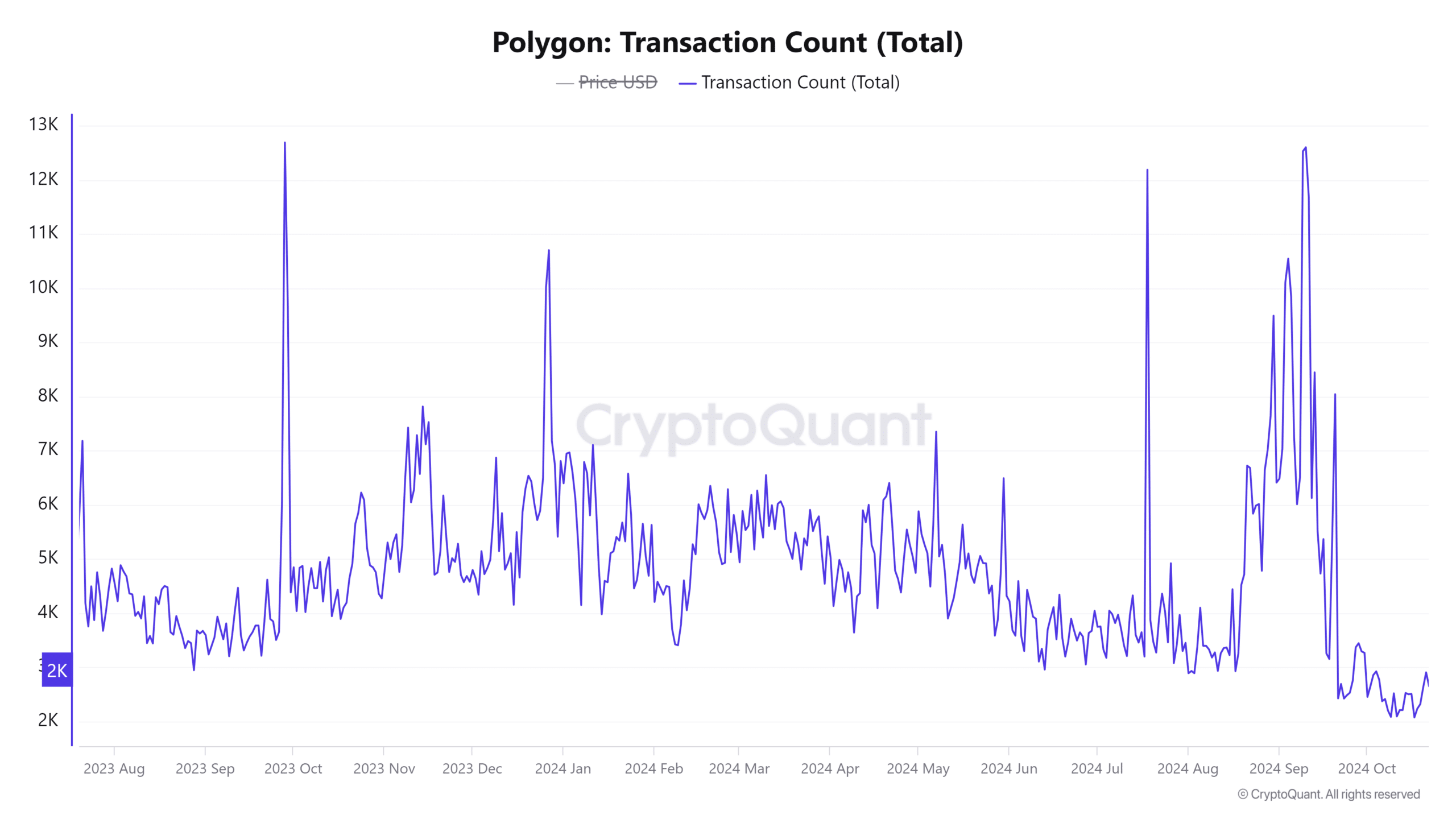

On-chain statistics: active addresses and transactions are increasing

Interestingly, Polygon’s fundamental on-chain data paints a picture of steady interest. The number of active addresses in the last 24 hours increased by 0.96%, while the number of transactions increased by 0.86% to 2,49,000, according to CryproQuant.

These incremental increases in network activity could indicate renewed interest from users, which could support the current bullish outlook.

However, without a stronger upward price move, these gains may not be enough to maintain long-term bullish momentum.

Source: CryptoQuant

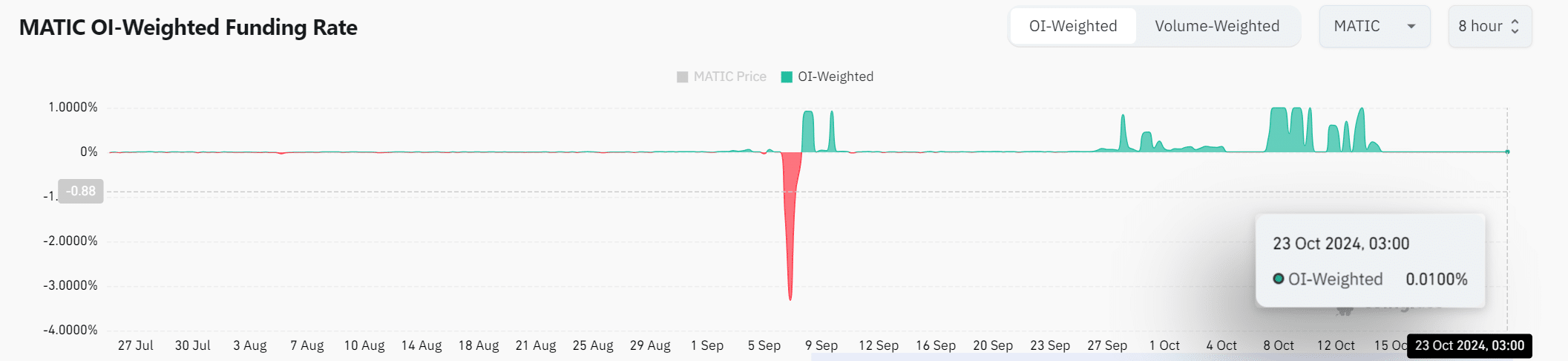

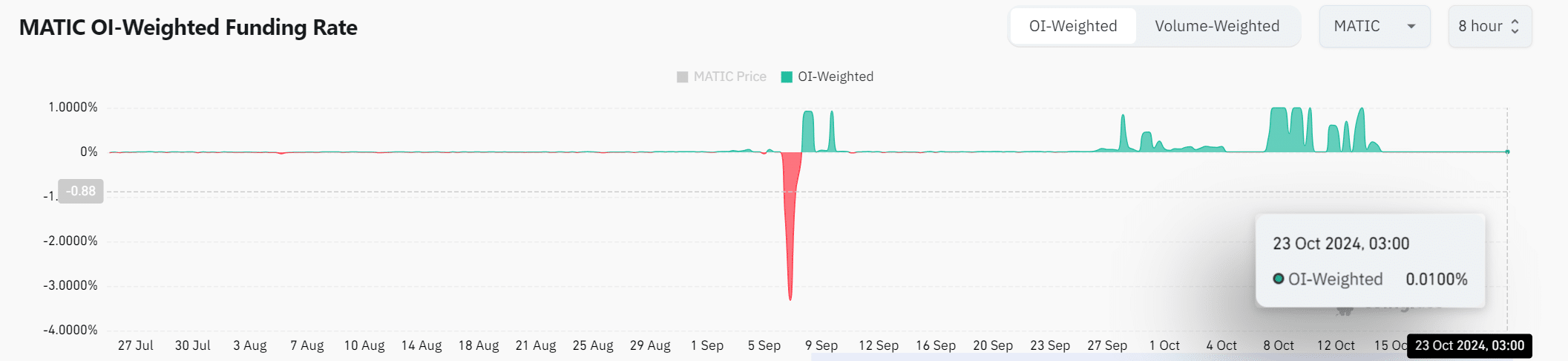

POL OI-weighted financing rate: Neutral but with potential

Looking at the futures market, the POL OI-weighted financing rate remains stable at 0.0100%. Consequently, this neutral rate suggests that neither bulls nor bears are currently exerting significant pressure.

However, any changes in this funding rate could signal a shift in momentum, especially if it aligns with increasingly bullish sentiment on smart money.

Source: Coinglass

Is your portfolio green? View the POL profit calculator

Polygon’s bullish sentiment is clear, especially from a smart money perspective. However, the key lies in whether the price can break above the resistance at $0.4477.

If POL can break out, we may see significant upside potential. However, until then, caution is advised as the price is stuck in a consolidation phase.