- UNI is approaching a critical breakout and testing the $8.66 resistance level after a strong rally.

- Social dominance and rising open interest indicate greater trader confidence in further upside gains.

Uniswap [UNI] has staged an impressive short-term rally following news of its listing on South Korea’s Upbit exchange. The price is up over 6%, while trading volumes are up over 110%.

With UNI trading at $8.16 at the time of writing, the critical question is whether this momentum will continue, pushing the price above the crucial $9.67 resistance level and towards higher targets.

UNI map analysis: is an outbreak imminent?

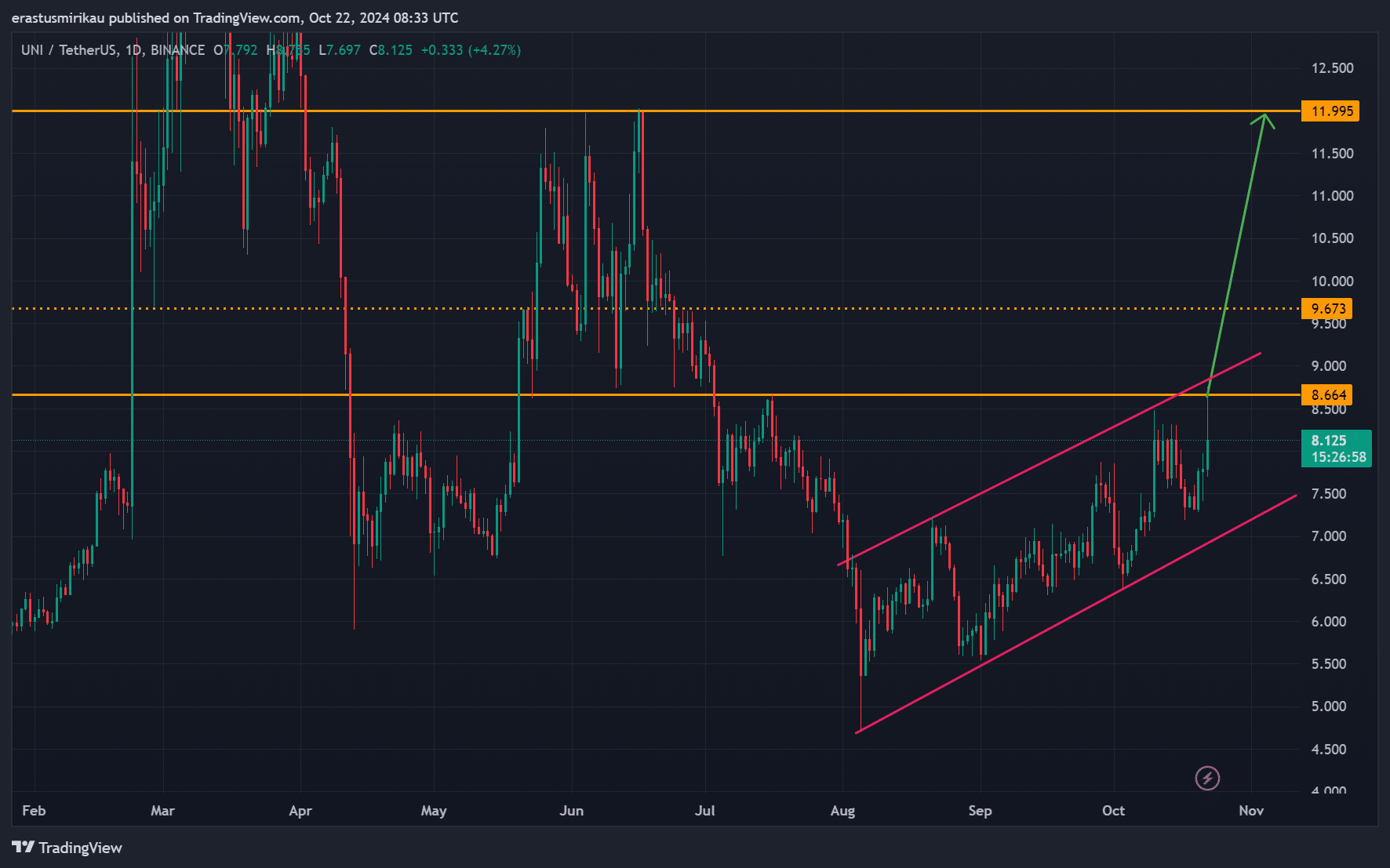

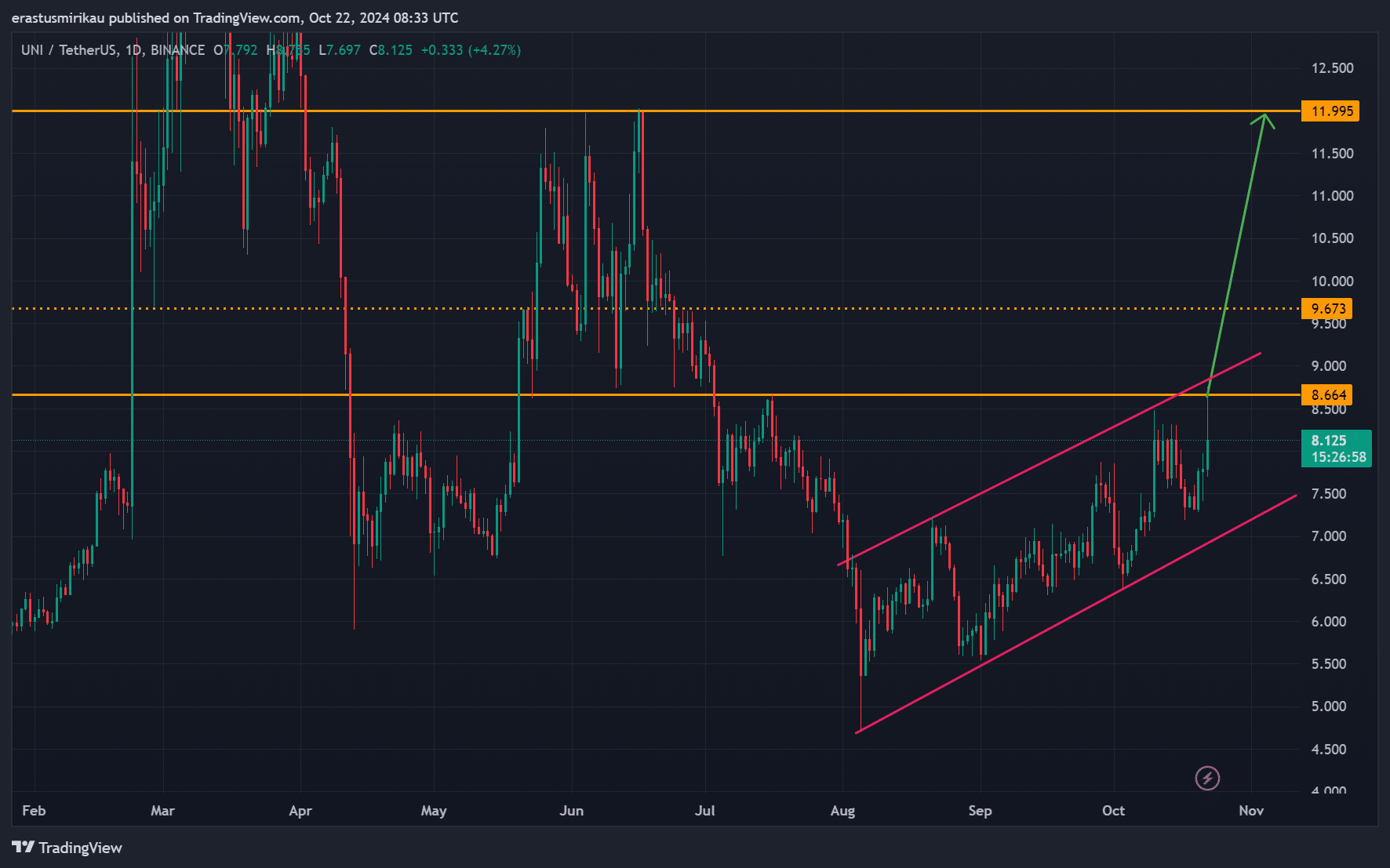

The daily chart shows that Uniswap is approaching a potential breakout from its ascending channel. Currently, the token is testing key resistance at $8.66, a level that has halted previous attempts to move higher.

Breaking this barrier would pave the way for UNI to challenge the resistance at $9.67.

If that level is breached, the next target could be $11.99. However, should Uniswap fail to break the $8.66 level, a pullback to the support area around $7.50 could follow, especially if the broader market weakens.

Source: TradingView

UNI technical indicators: how do BB and RSI fit together?

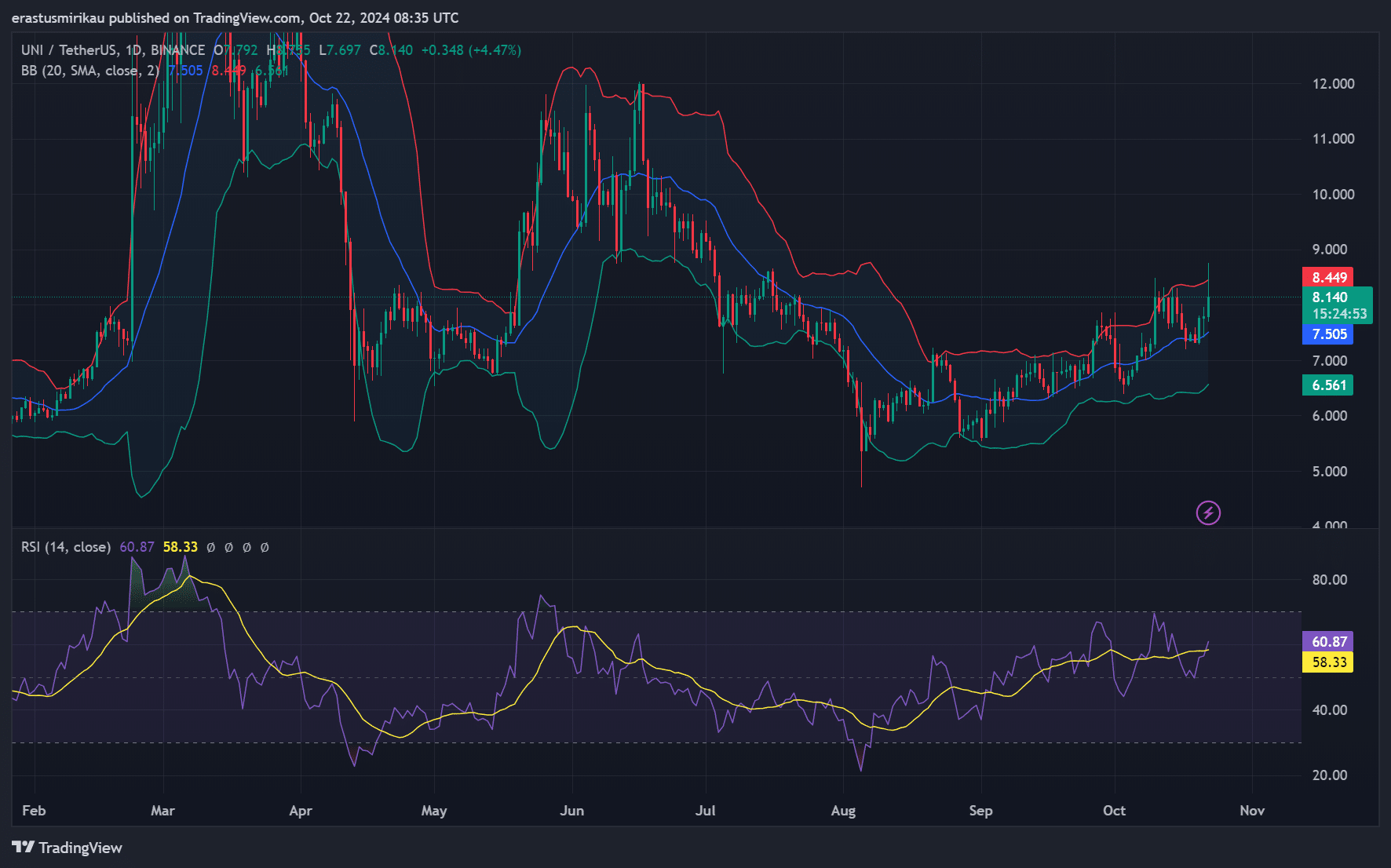

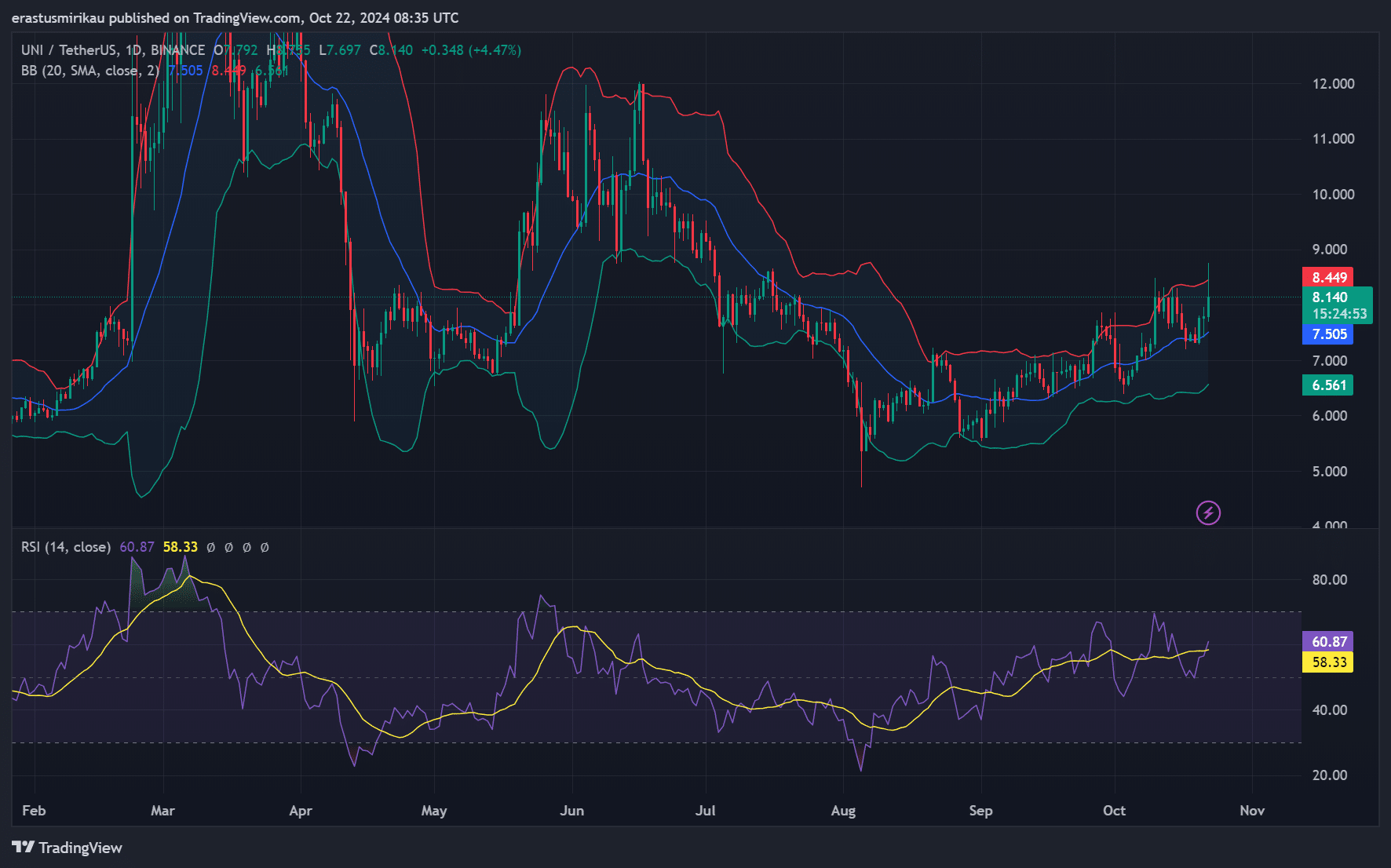

From a technical perspective, the Bollinger Bands show Uniswap moving towards the higher band, indicating increasing volatility and possibly more upside potential. Furthermore, the Relative Strength Index (RSI) stands at 60.87, just below the overbought area.

This suggests that while the bulls still have room to push prices higher, there is a risk that momentum could stall as the RSI approaches the 70 mark, which could lead to a short-term correction.

Source: TradingView

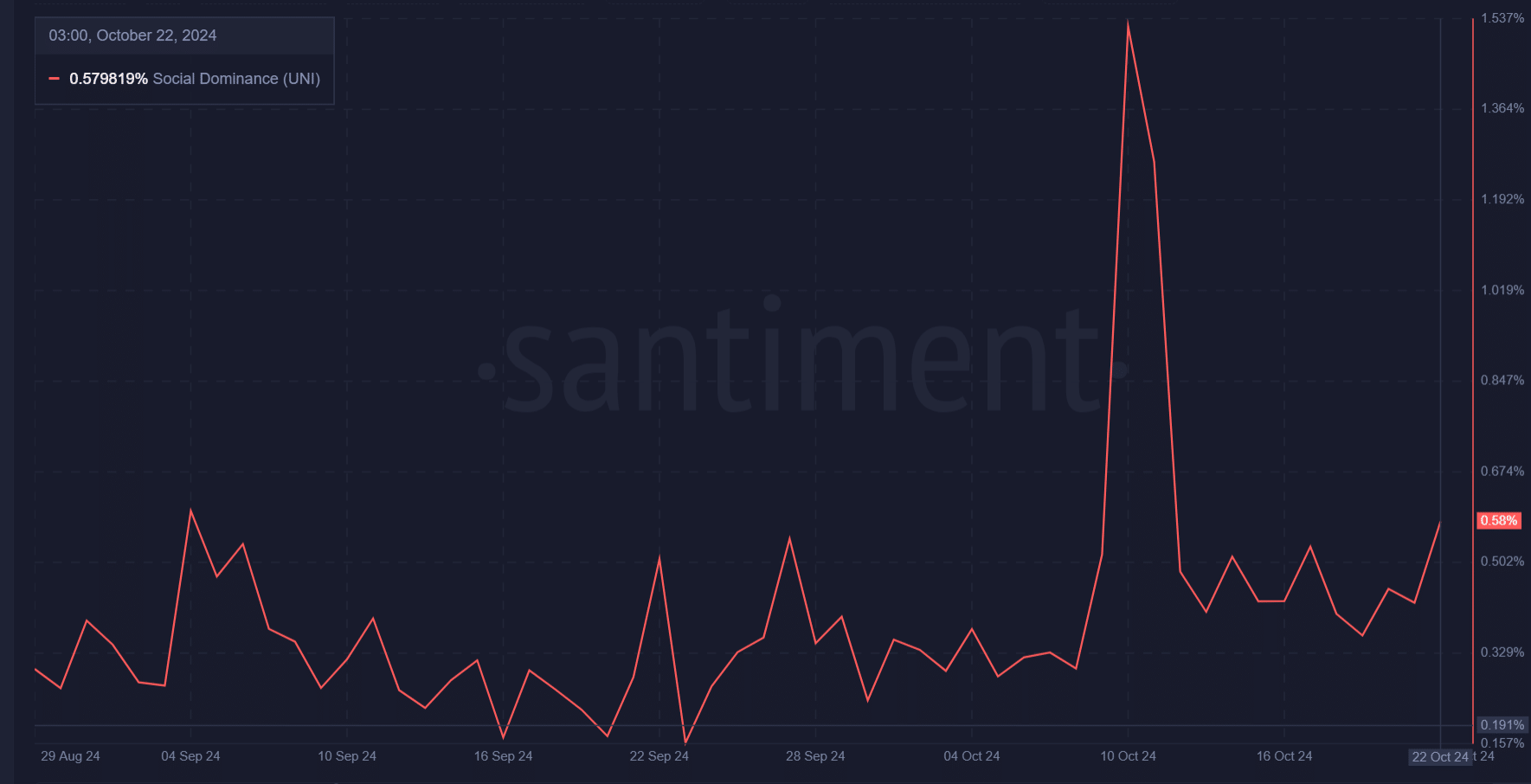

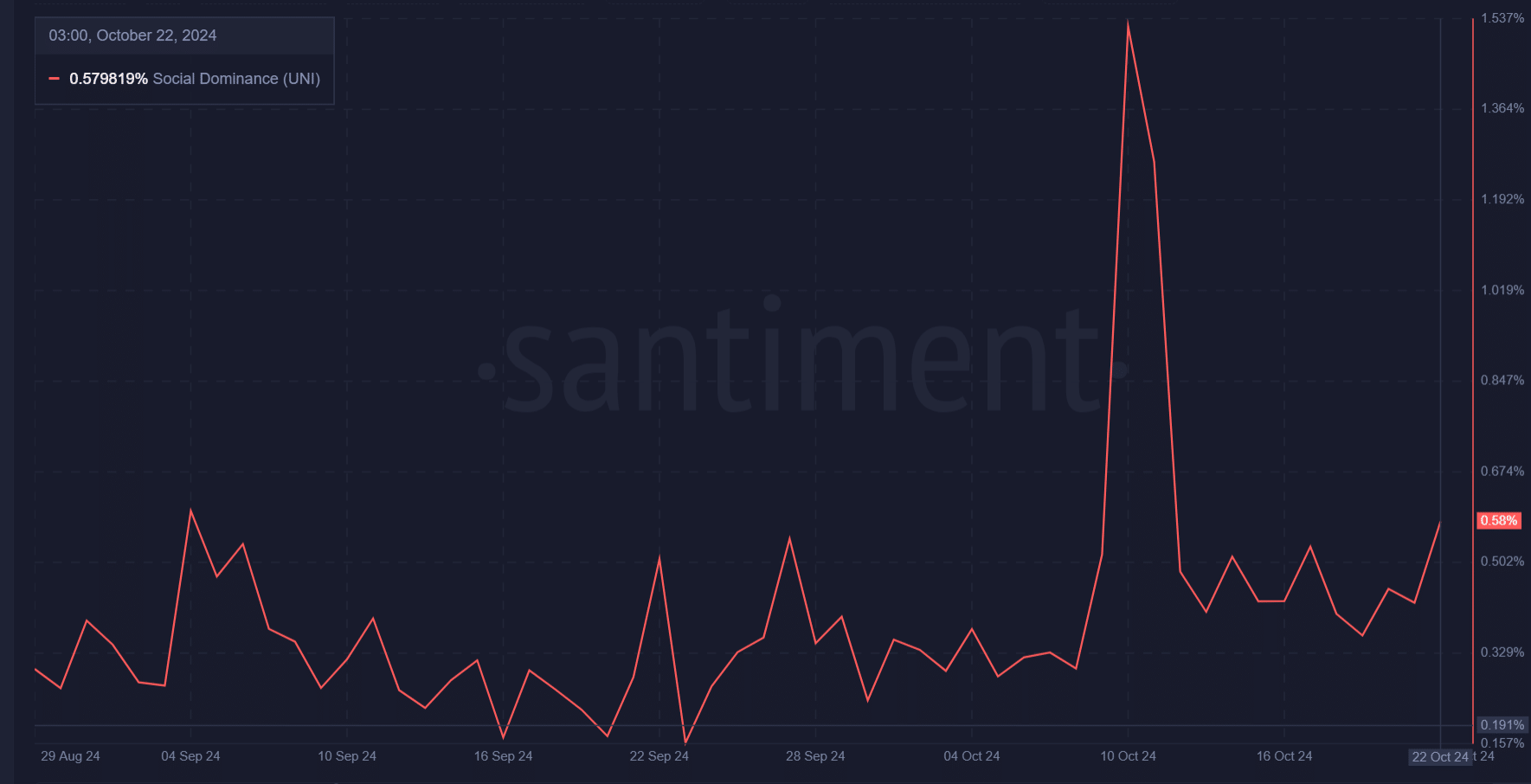

Social dominance of the UNI: what does the sentiment suggest?

UNI’s social dominance has increased to 0.579%, indicating a growing presence in community discussions and sentiment among traders. This increase follows a significant spike earlier this month and reflects continued interest in Uniswap’s Upbit listing and recent price movements.

Consequently, the increase in social dominance signals increased attention from the crypto community, which could support further price increases as more traders keep a close eye on UNI.

Source: Santiment

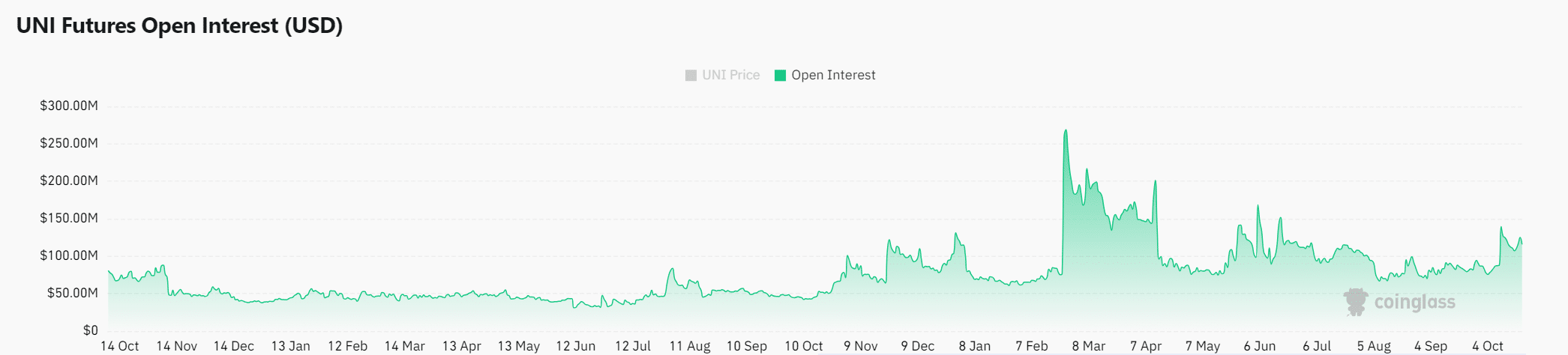

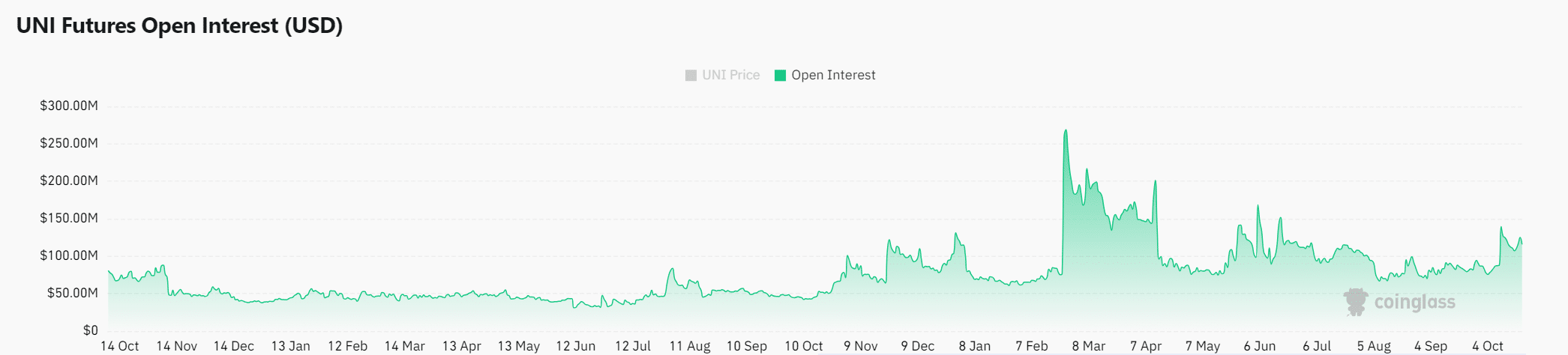

Rising open interest: will this increase the price?

In addition to the positive price action, open interest in UNI increased 11.76% to $129.94 million. This sharp increase indicates that more traders are entering the market in anticipation of a bigger move.

Therefore, growing open interest indicates increasing confidence in a bullish continuation.

Source: Coinglass

Is your portfolio green? View the UNI Profit Calculator

In short, UNI seems well positioned for a breakout but needs to overcome the USD 8.66 resistance to test USD 9.67 and possibly head towards USD 11.99. With technical indicators aligned and market sentiment strong, UNI appears poised for further gains.

However, the bulls must maintain the momentum to avoid a pullback. Therefore, traders should keep a close eye on UNI’s price action in the coming days.