- ARB is testing key resistance at $0.61, with bullish momentum pushing prices higher.

- Technical indicators point to a breakout, but on-chain data suggests caution despite positive funding rates.

Arbitration [ARB] is showing signs of a possible breakout and is currently trading around $0.60, supported by growing bullish momentum. At the time of writing, ARB is trading at $0.5995, reflecting a slight decline of 1.76% in the last 24 hours.

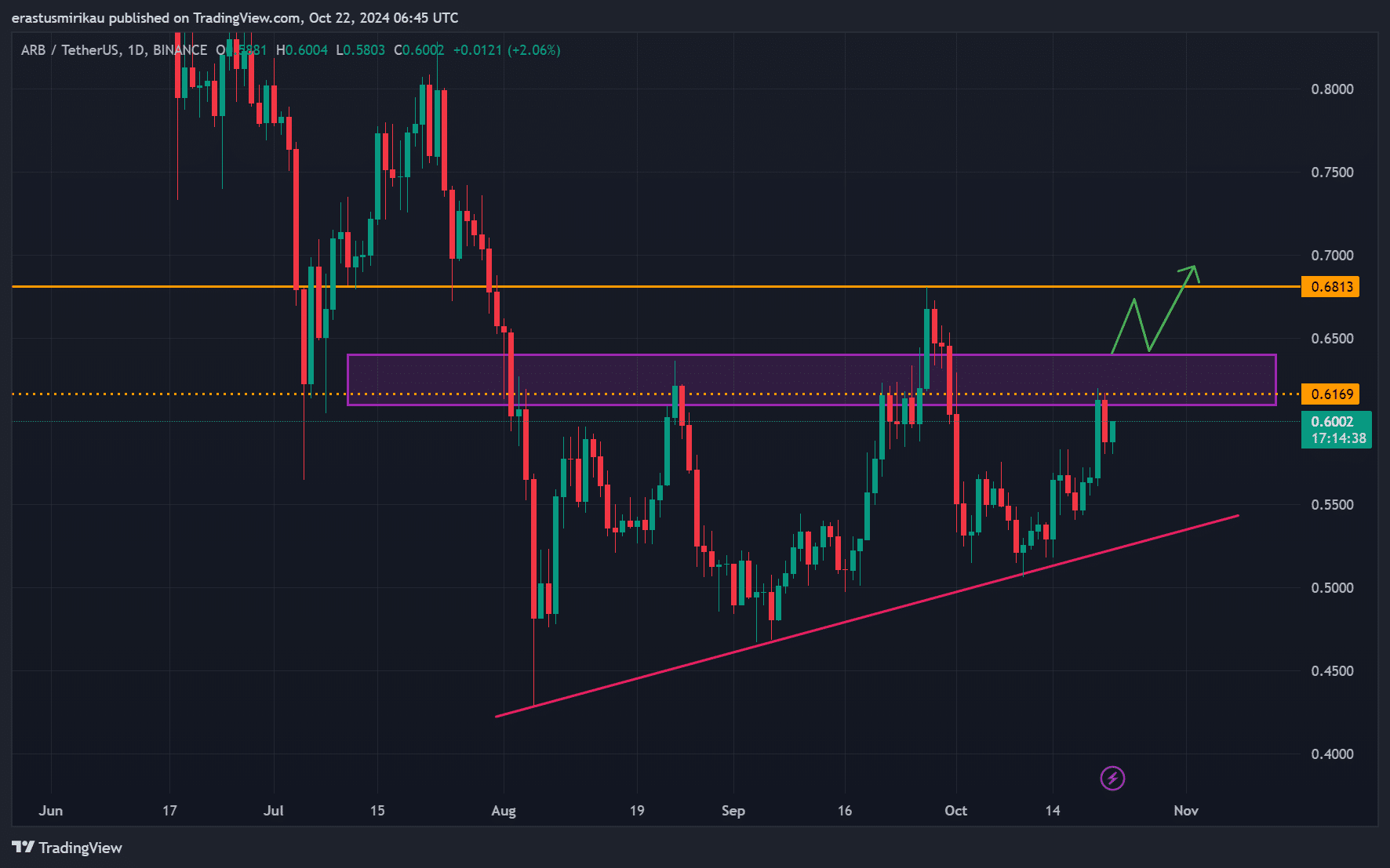

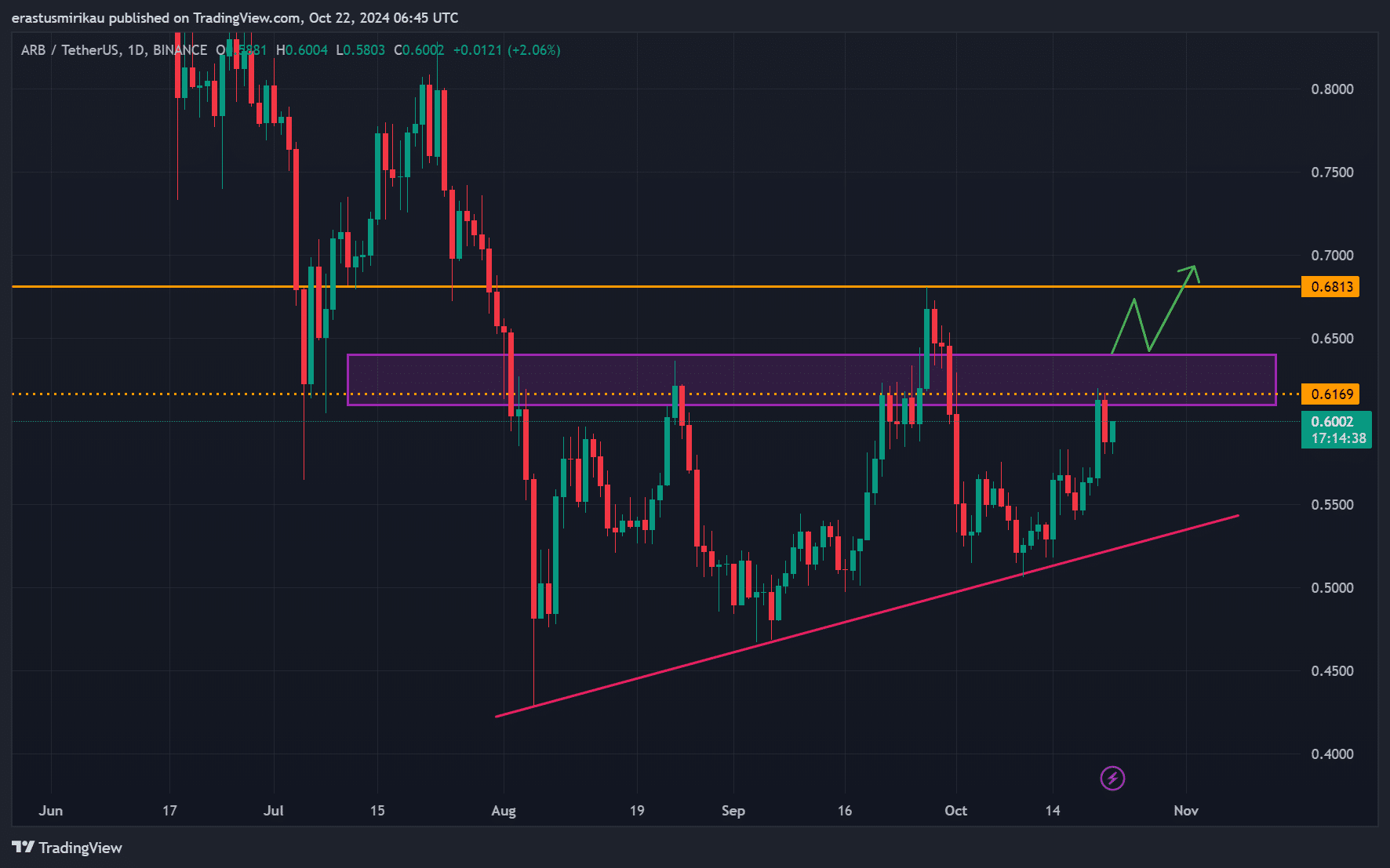

The price chart of ARB indicates that the token is testing a key resistance zone near $0.61. This horizontal resistance is proving difficult to break, but if ARB manages to break above it, the path towards $0.68 will become much clearer. The $0.55 support level remains crucial in this potential breakout.

Furthermore, the rising trendline indicates continued bullish pressure, increasing the likelihood of further upward momentum. However, failure to break past $0.61 could result in a temporary pullback, possibly towards $0.55.

Source: TradingView

Technical Indicator Analysis: Are Bulls Still in Control?

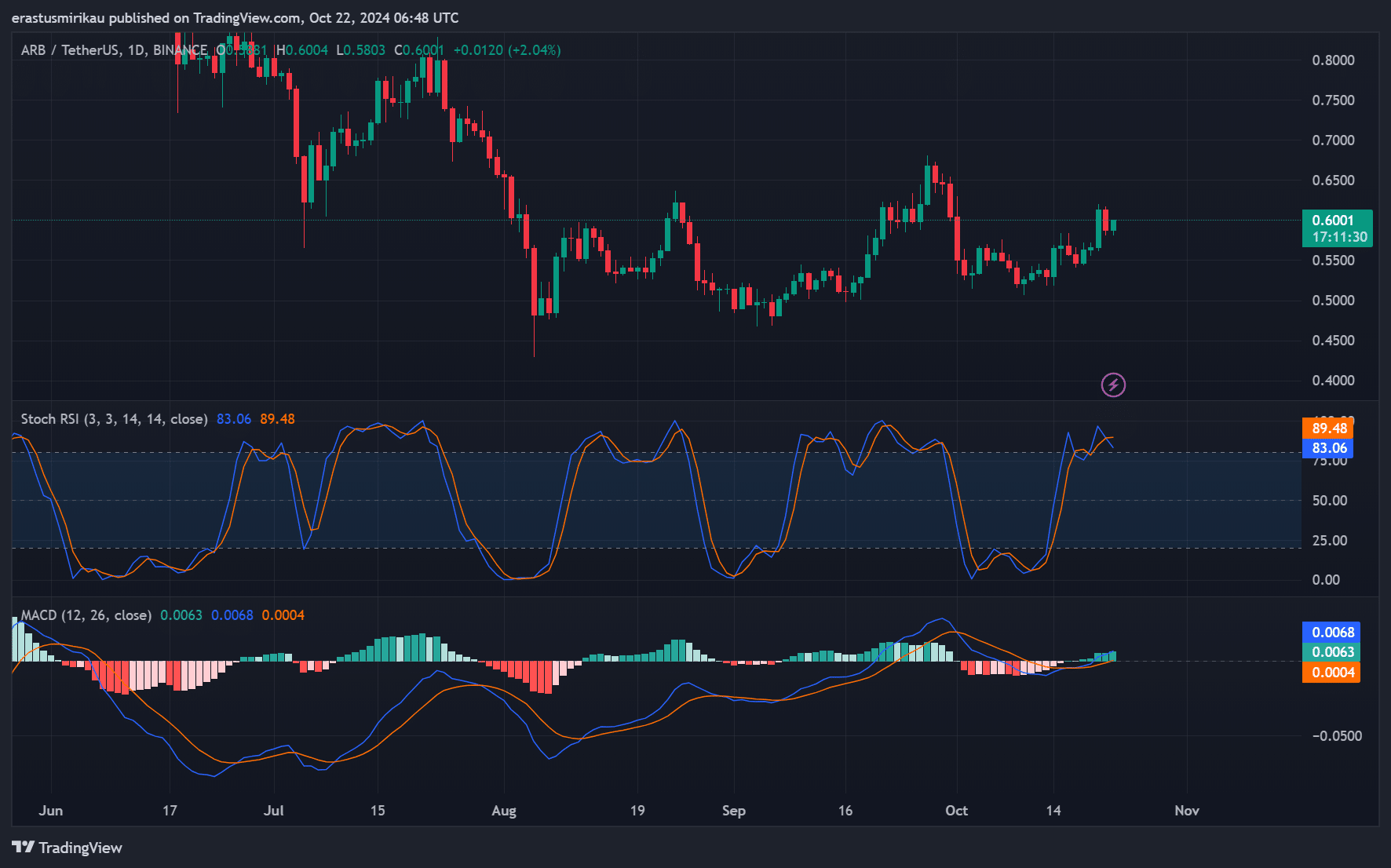

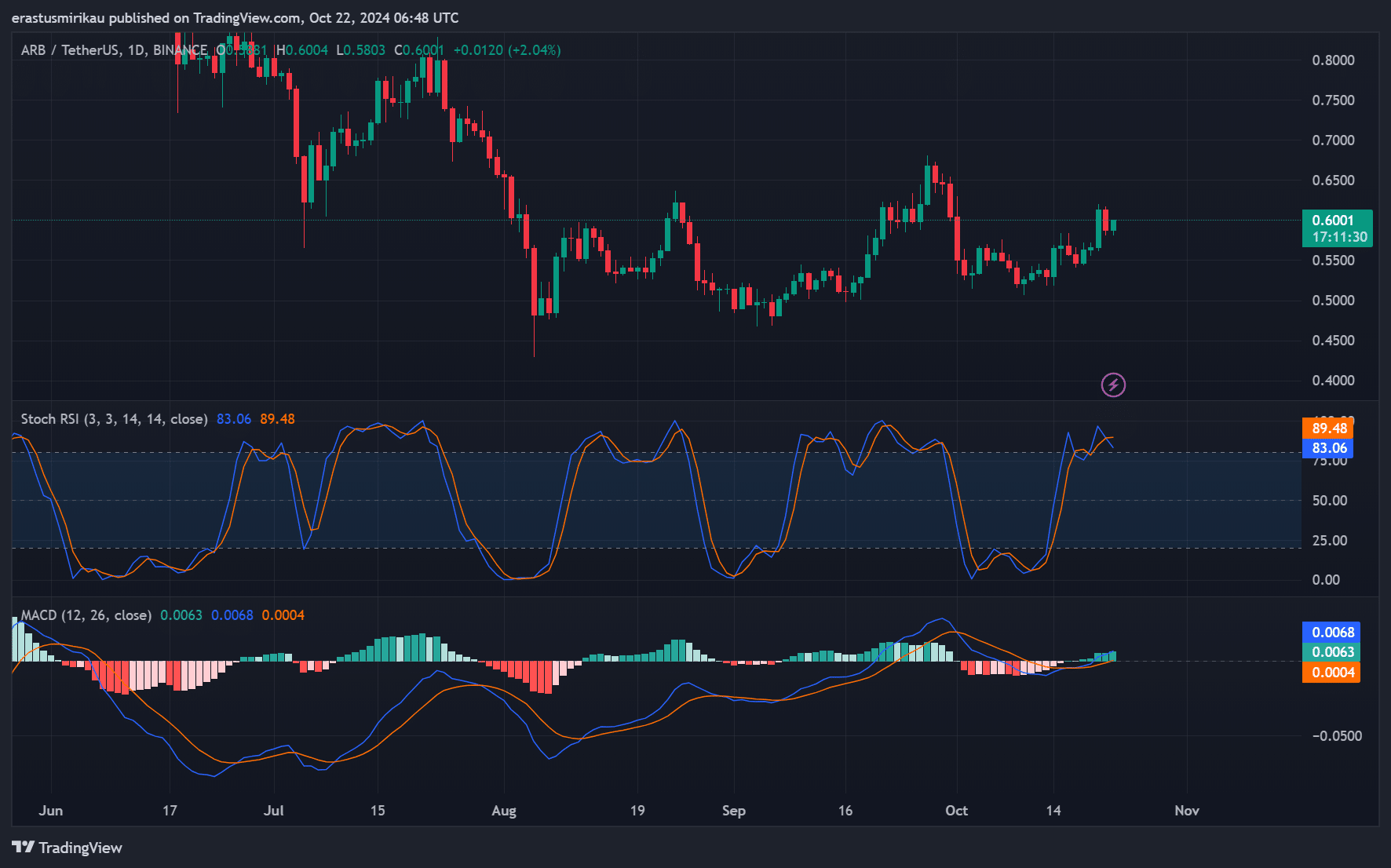

Technical indicators show a mostly bullish outlook for Arbitrum. The Stochastic RSI currently stands at 89.48, which indicates an overbought situation. So, while the upside momentum remains strong, the token may experience a slight pullback before making another push.

Furthermore, the MACD shows a positive crossover, reinforcing the possibility of continued price increases. Consequently, these indicators suggest that while short-term corrections may occur, the overall trend for ARB is bullish.

Source: TradingView

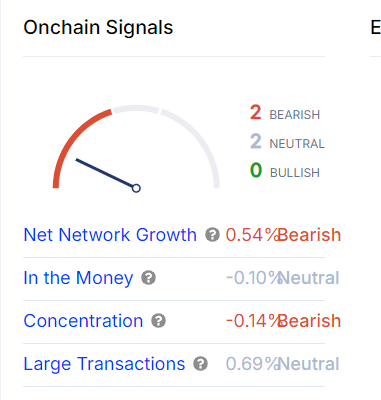

Evaluating on-chain data: mixed signals for ARB

Signals on the chain give a mixed picture of Arbitrum’s potential. Net network growth stands at 0.54%, indicating slightly bearish sentiment. Moreover, the concentration of large holders is also trending towards a bearish level of -0.14%, indicating that whales may not be accumulating.

However, in-the-money and large trade metrics remain neutral, suggesting there is still room for market recovery despite near-term uncertainties.

Source: IntoTheBlock

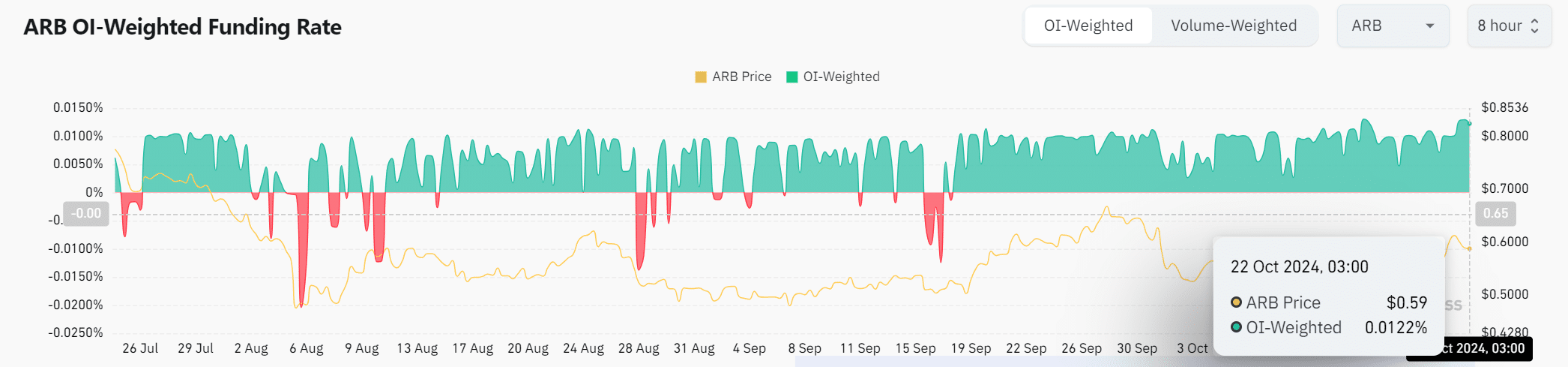

Does the OI-weighted funding rate support ARB’s bullish case?

The OI-weighted financing rate remains positive at 0.0122%, indicating optimism in the futures market. This bullish sentiment in the derivatives market could support ARB’s price breakout if it can surpass its current resistance.

Source: Coinglass

Read Arbitrums [ARB] Price forecast 2024–2025

Can ARB break out?

Arbitrum seems poised for a possible breakout if it can clear the critical resistance at $0.61. The technical and market indicators mainly point to a bullish scenario. However, traders should remain cautious about short-term corrections due to overbought signals.

If Arbitrum can hold the current support levels, the chances of a test of $0.68 become increasingly likely.