- Bitcoin attacked the crucial $70,000 level but is rejected.

- Building liquidity below $58,000 sounds the alarm for future moves.

Bitcoin [BTC] is about to break above the critical resistance level at $70,000 but was immediately rejected as it was trading at $67,000 at the time of writing.

With strong momentum building, BTC is likely aiming to capture liquidity outside this key zone, potentially paving the way for a new all-time high. The market is abuzz with speculation that Bitcoin could soon surpass this crucial price point.

As the bull market gains momentum, investors are watching closely for signs of a deeper correction, with the $67K zone being a key level to watch. Buying the dip could lead to significant gains if the correction continues.

Source: TradingView

Liquidity and open interests

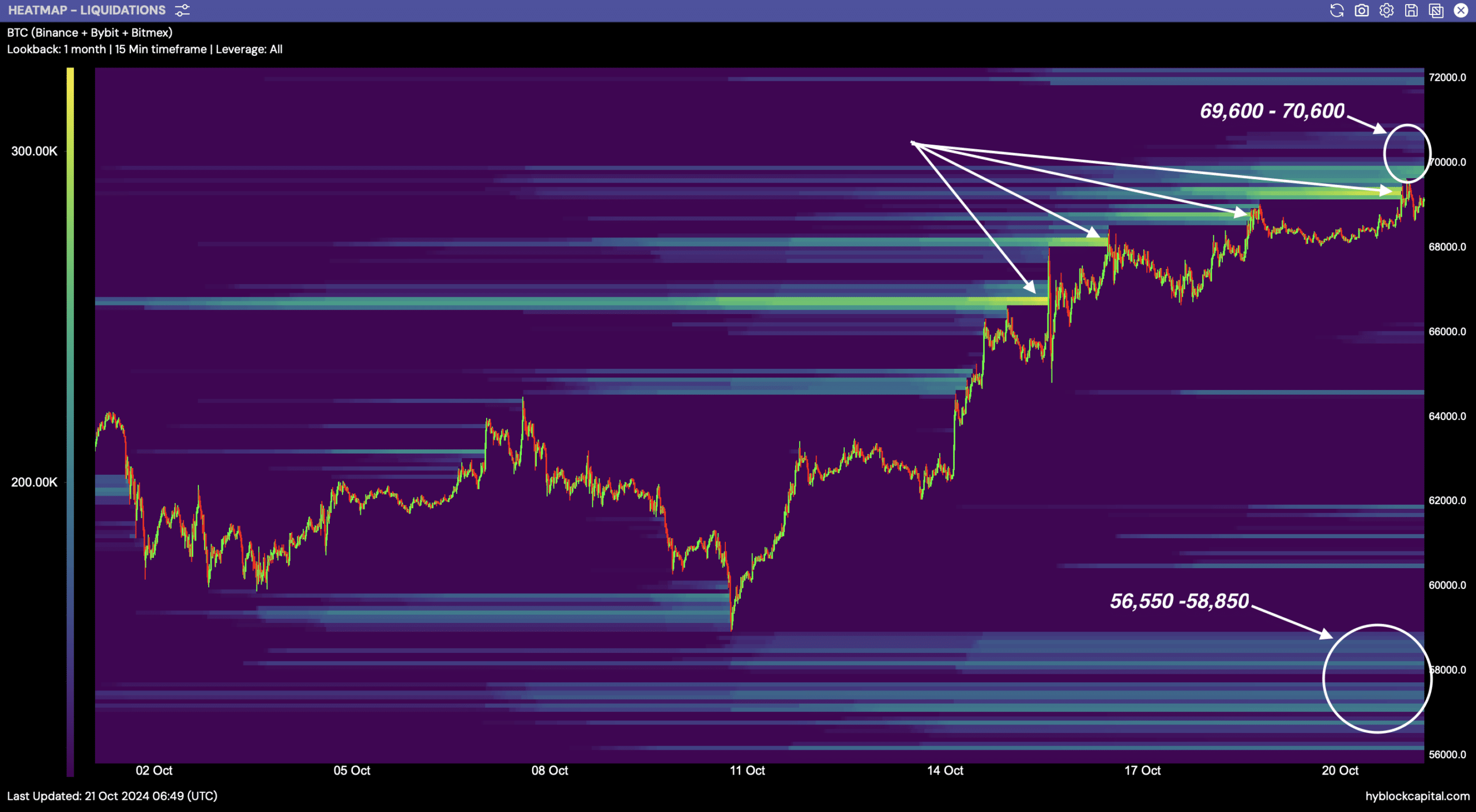

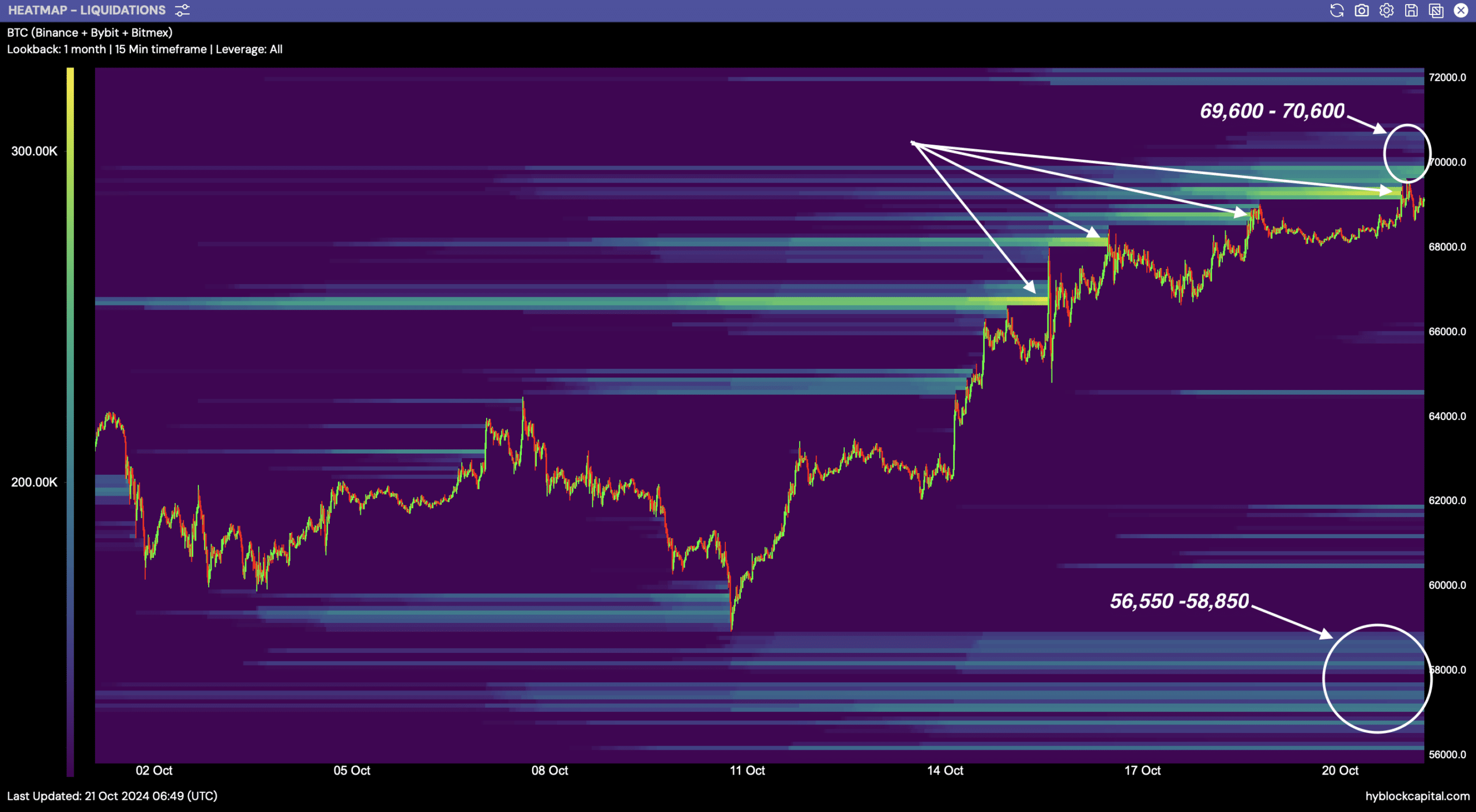

Currently, Bitcoin’s liquidity play is a major focus. A large cluster of liquidity is forming above the $70,000 level, while another pool is building below the $58,000 zone.

Analysts expect Bitcoin to retreat to $67K before resuming the uptrend. If this happens, BTC could break $73K, potentially setting a new all-time high.

However, a correction could follow once liquidity builds around the $58,000 level, potentially triggering a price revision.

Source: Hyblock Capital

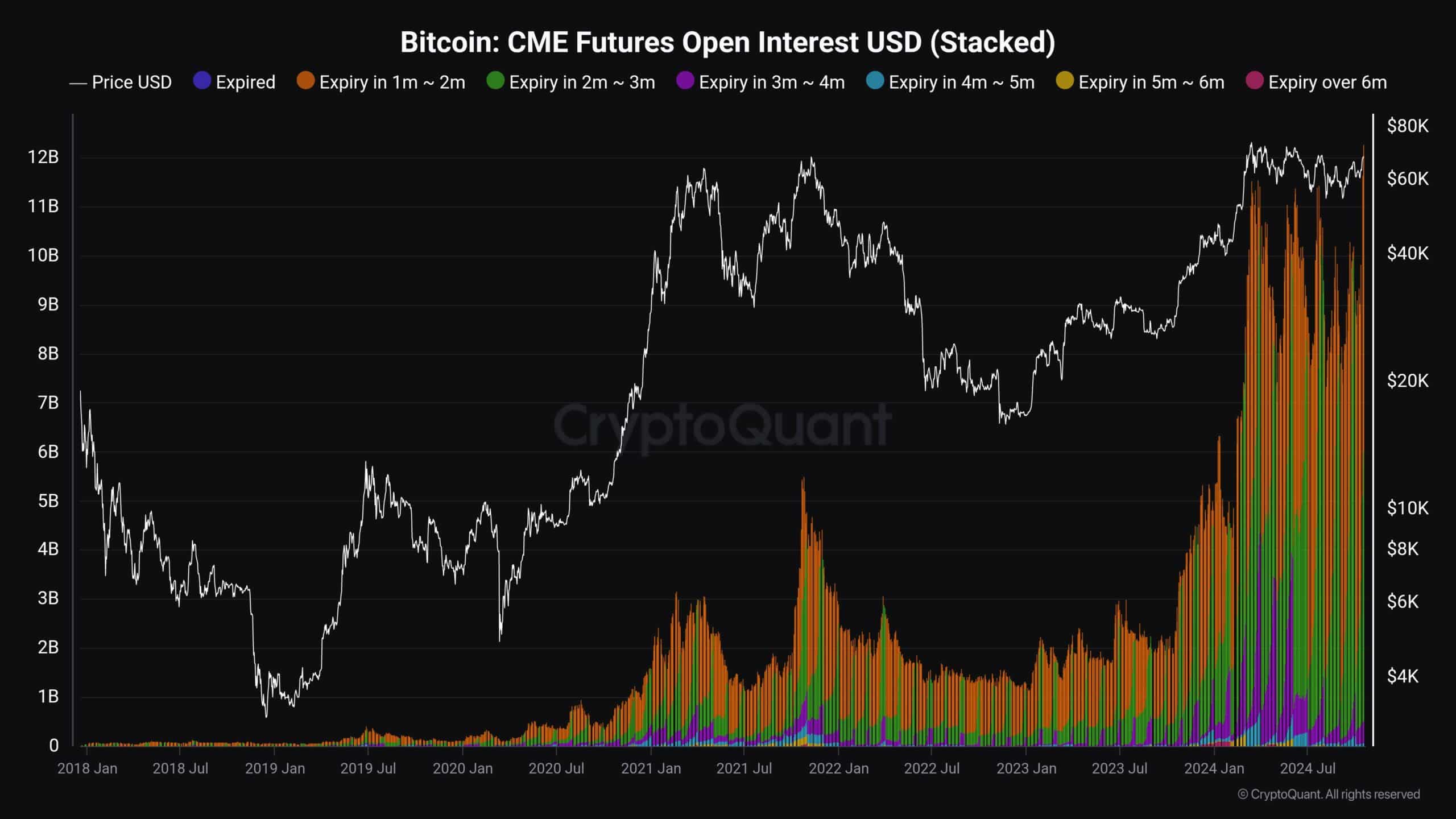

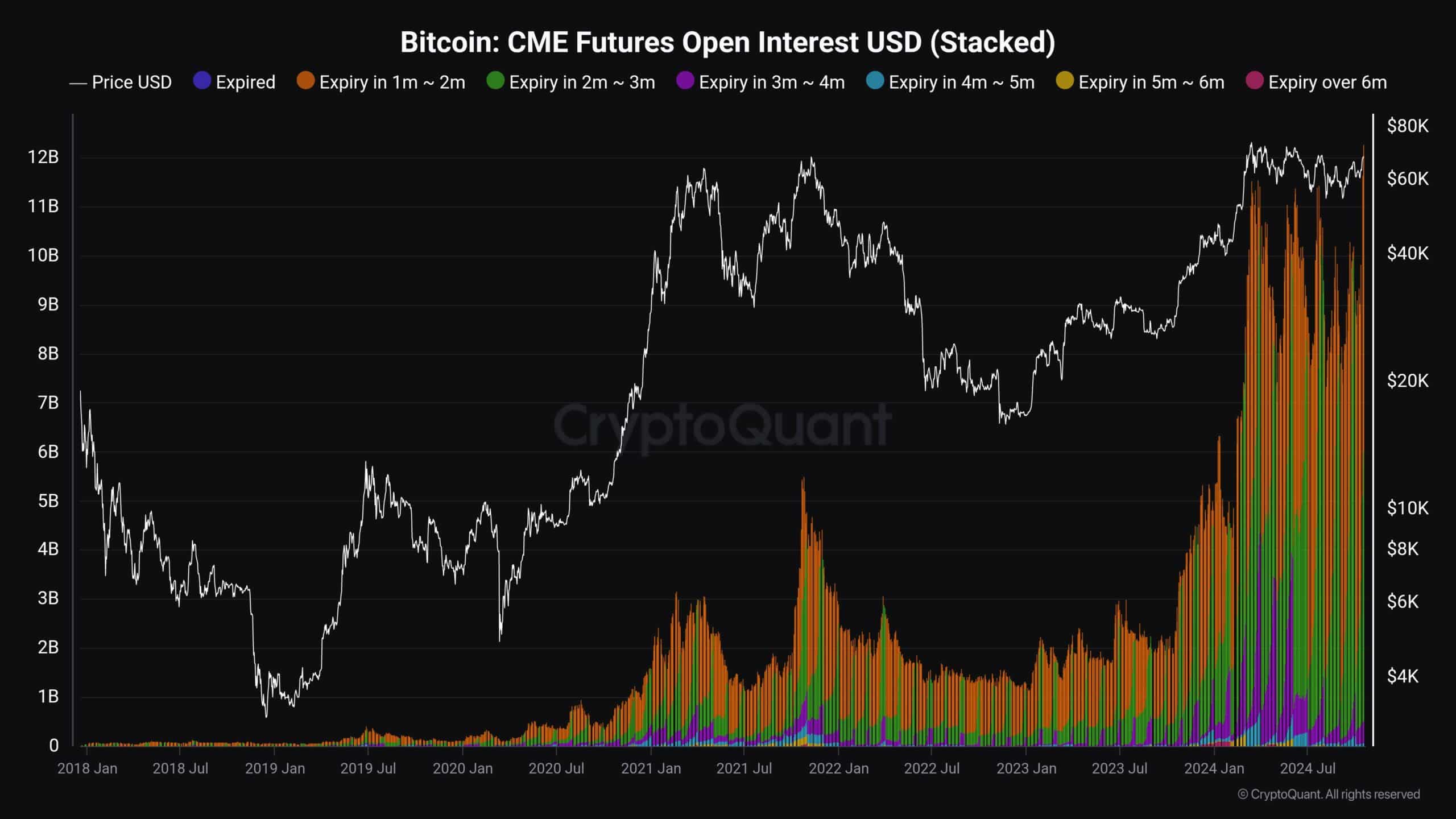

Adding to the bullish sentiment, Bitcoin’s CME Futures Open Interest has hit an all-time high of $12.0 billion. This increase indicates that more traders are betting on a higher price of BTC.

The futures market plays a major role in influencing the price of Bitcoin, and this record open interest suggests that Bitcoin is likely to cross the $70,000 level soon.

Source: CryptoQuant

The bullish momentum in the Bitcoin futures market is a strong signal for traders to keep a close eye on.

Bitcoin Spot ETFs Resurrect

Additionally, Bitcoin spot ETFs made headlines last week with significant net inflows of $2.13 billion. This marks the third largest inflow in history, underscoring the strong institutional interest.

BlackRock’s ETF, IBIT, led the charge, bringing in $1.14 billion, while Fidelity’s $FBTC took in $319 million. This influx of capital into Bitcoin ETFs further fuels optimism that the price of BTC will rise.

Source: SoSo value

Read Bitcoin’s [BTC] Price forecast 2024 – 2025

By comparison, Ethereum spot ETFs saw more modest inflows of $78.89 million, indicating that BTC remains the main focus for many investors in this bullish cycle.

As Bitcoin continues to challenge the $70,000 mark, the market is primed for potential gains. If BTC can break through and hold this level, it could signal the start of another upward rally.