- MicroStrategy’s CEO explains why Bitcoin is better.

- Saylor expresses his long-term faith in the king coin.

Bitcoins [BTC] The impressive rise over the past week has renewed optimism among investors, especially beyond that exchange traded funds (ETFs) has crossed the $20 billion inflow milestone.

However, concerns are increasing as more of BTC’s supply becomes concentrated in the hands of a few large institutions. This has led to questions about whether this centralized control increases the risk of seizure or confiscation, similar to what happened to gold in 1933 under Executive Order 6102.

Michael Saylor, executive chairman of MicroStrategy, recently addressed these concerns interview in markets with Madison.

He argued that unregulated private holders are at greater risk of seizure. Yet this risk decreases when BTC is owned by regulated entities such as BlackRock, JP Morgan and Fidelity.

Furthermore, Saylor suggested that lawmakers are unlikely to support moves that could threaten these institutions. He pointed out,

“That’s where all their pension money is invested.”

The executive also highlighted the benefits of Bitcoin being owned by regulated entities, including reduced volatility and lower risk of loss.

Bitcoin versus quantum computers

Speaking of potential risks, quantum computing is becoming a threat to current cryptographic systems, including public key cryptography. This begs the question: will Bitcoin be able to withstand this new challenge?

Well, Saylor remained quite optimistic. The CEO acknowledged that as computers evolve and become more powerful, the network will strengthen its defenses.

He emphasized the robustness of the king’s coin and stated:

“Bitcoin is the most cyber-resilient, the most powerful digital network on earth. It’s the hardest thing to hack.”

With trillions of dollars at stake, Saylor expressed confidence that those most incentivized to protect their money will ensure the latest technology is implemented into the Bitcoin network to protect it.

BTC: the superior asset?

Meanwhile, Bitcoin’s comparison to traditional assets, as well as other cryptocurrencies, is a topic of ongoing debate.

So what makes BTC a strong contender in this race for superiority? According to Saylor, BTC’s unique origin story and decentralized nature set it apart.

He referred to the launch of Bitcoin by its anonymous creator, Satoshi Nakamoto, as an “Immaculate Conception” – free of personal gain or central control, a characteristic that sets it apart from other cryptocurrencies.

Saylor argued that Bitcoin’s appeal lies in the fact that:

“All the smart money in the world has decided this is the winner.”

This claim is reflected in increasing institutional interest, including that of MicroStrategy.

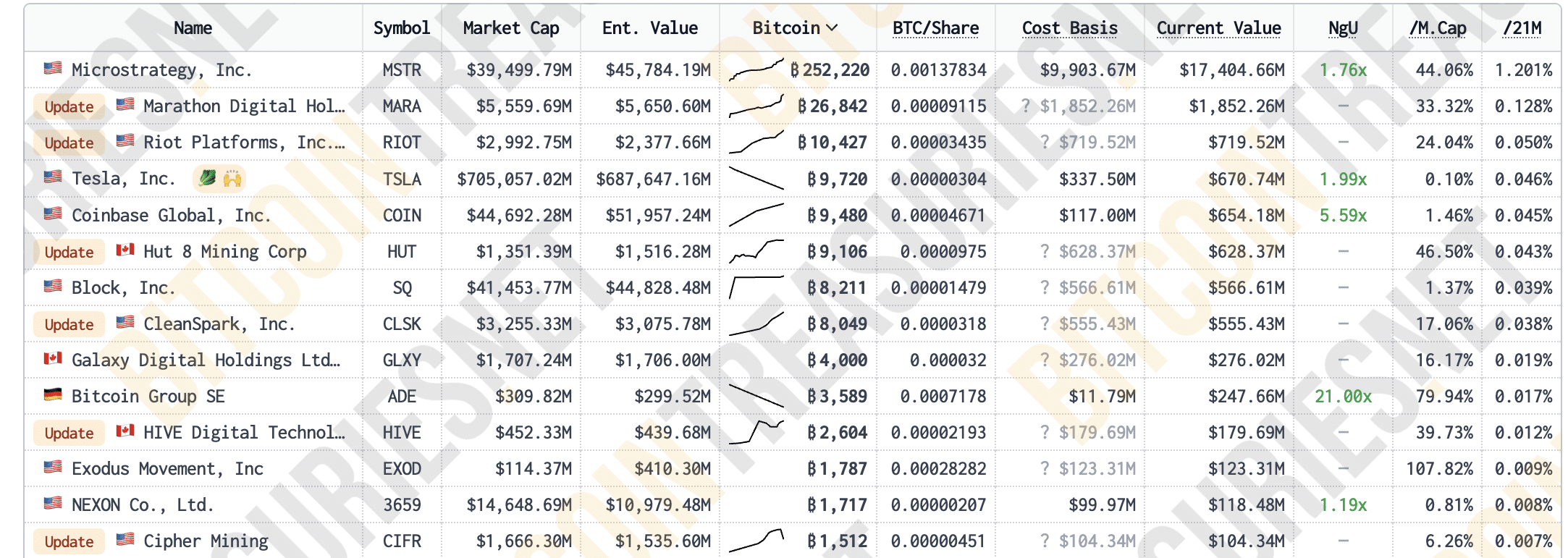

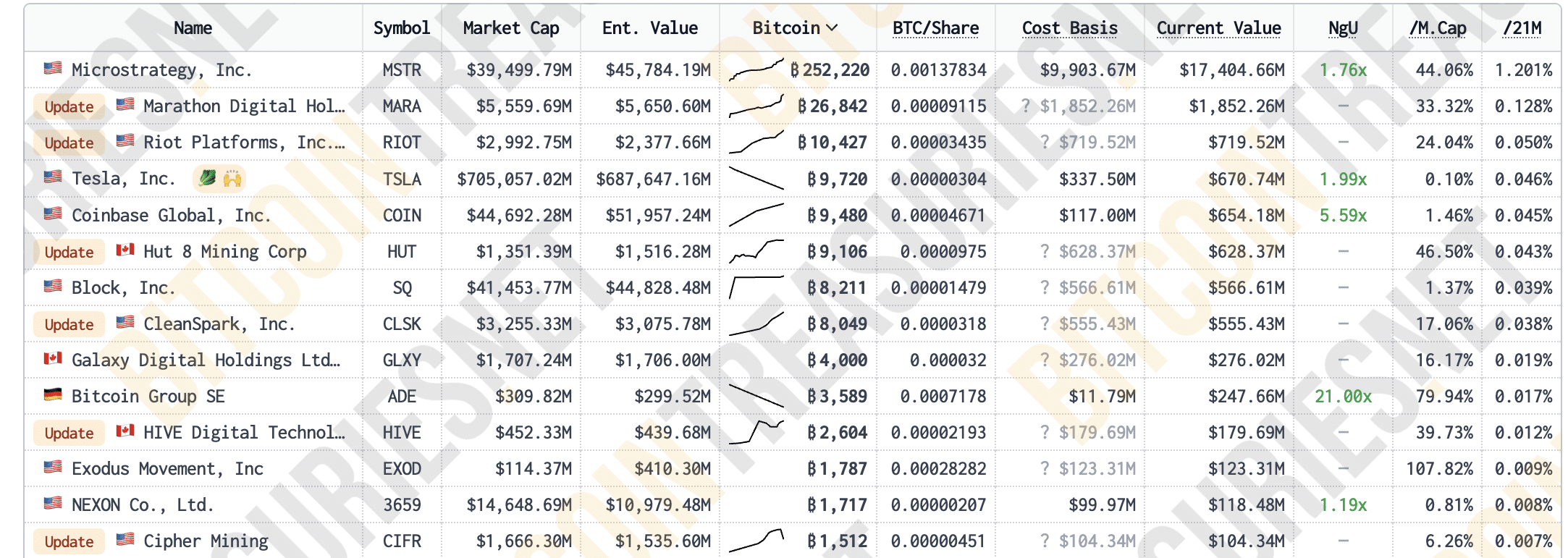

According to the latter facts of Bitcoin Treasuries, MicroStrategy owned 252,220 BTC, worth approximately $17.42 billion.

This substantial investment reflects Saylor’s continued confidence in Bitcoin’s potential as the superior digital asset.

Source: Bitcoin Treasuries