- Ethereum has hit an eight-week high as the RSI shows an increase in buying pressure.

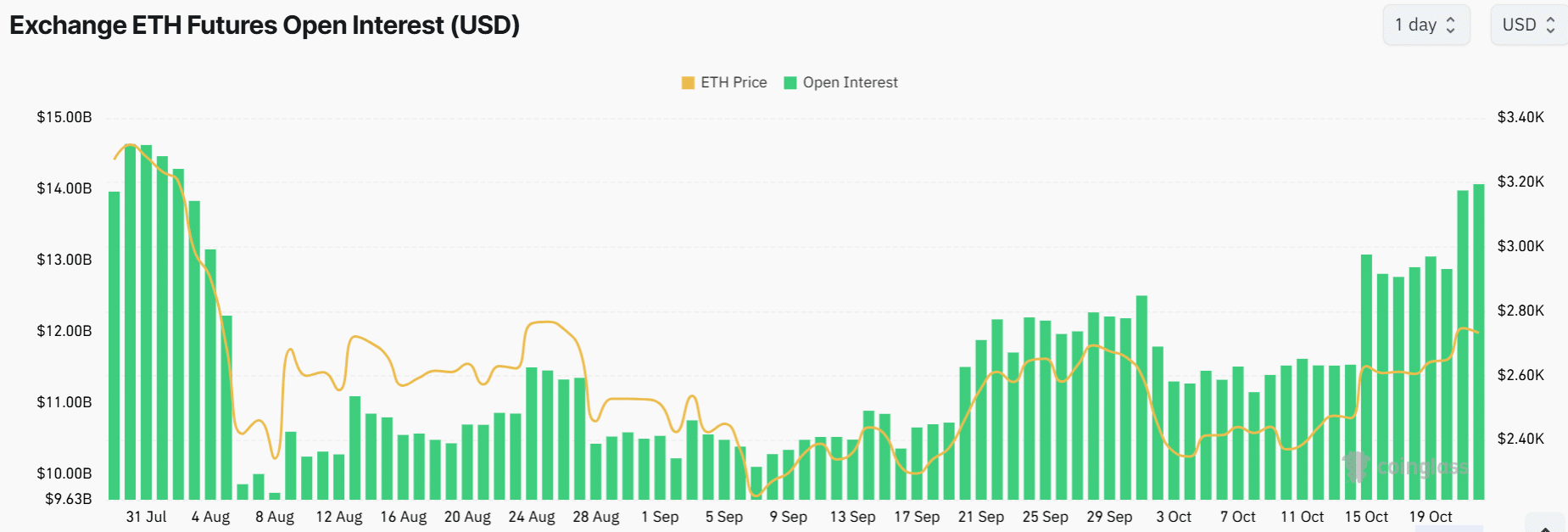

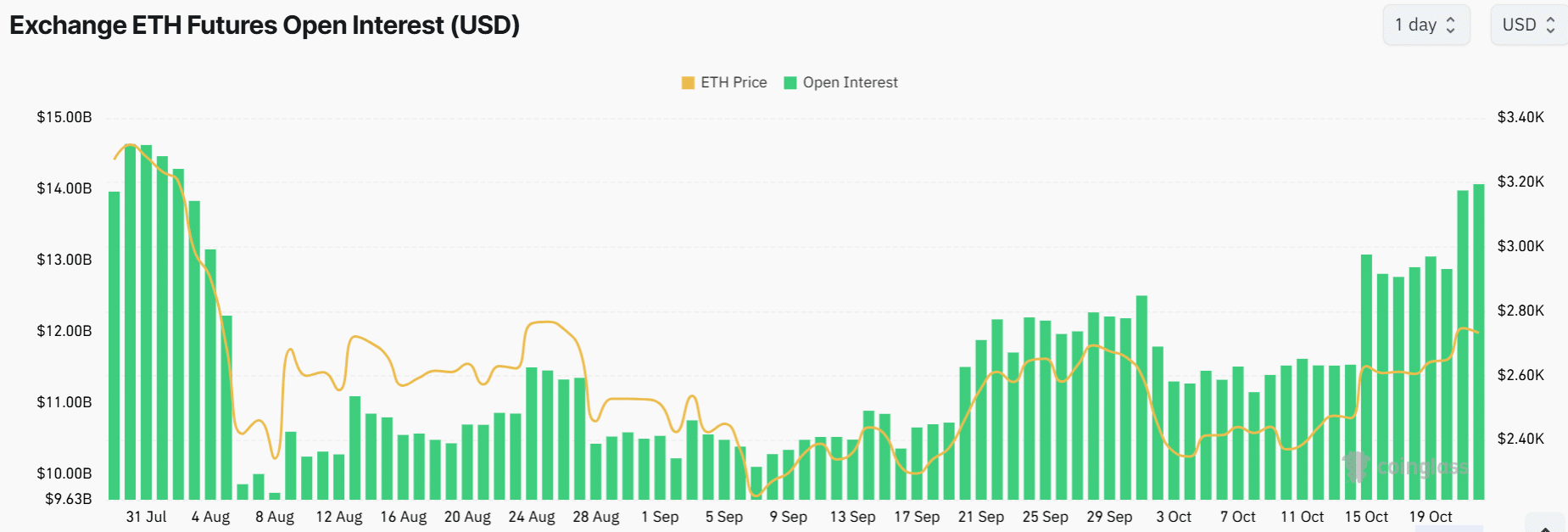

- The $14 billion open interest shows increased market participation by derivatives traders.

Ethereum [ETH] trading at an 8-week high of $2,735 at the time of writing, after gaining almost 4% in 24 hours. According to CoinMarketCaptrading volumes have increased by more than 100%, indicating increasing market interest.

The gain saw ETH record the highest number of short liquidations in the crypto market. At the time of writing, over $23 million worth of ETH shorts had been wiped out Mint glass.

A high number of short liquidations is a bullish sign as it indicates that short sellers are turning into buyers to close out their positions. A look at Ethereum’s one-day chart suggests that these bullish trends could continue.

Ethereum is showing bullish signs

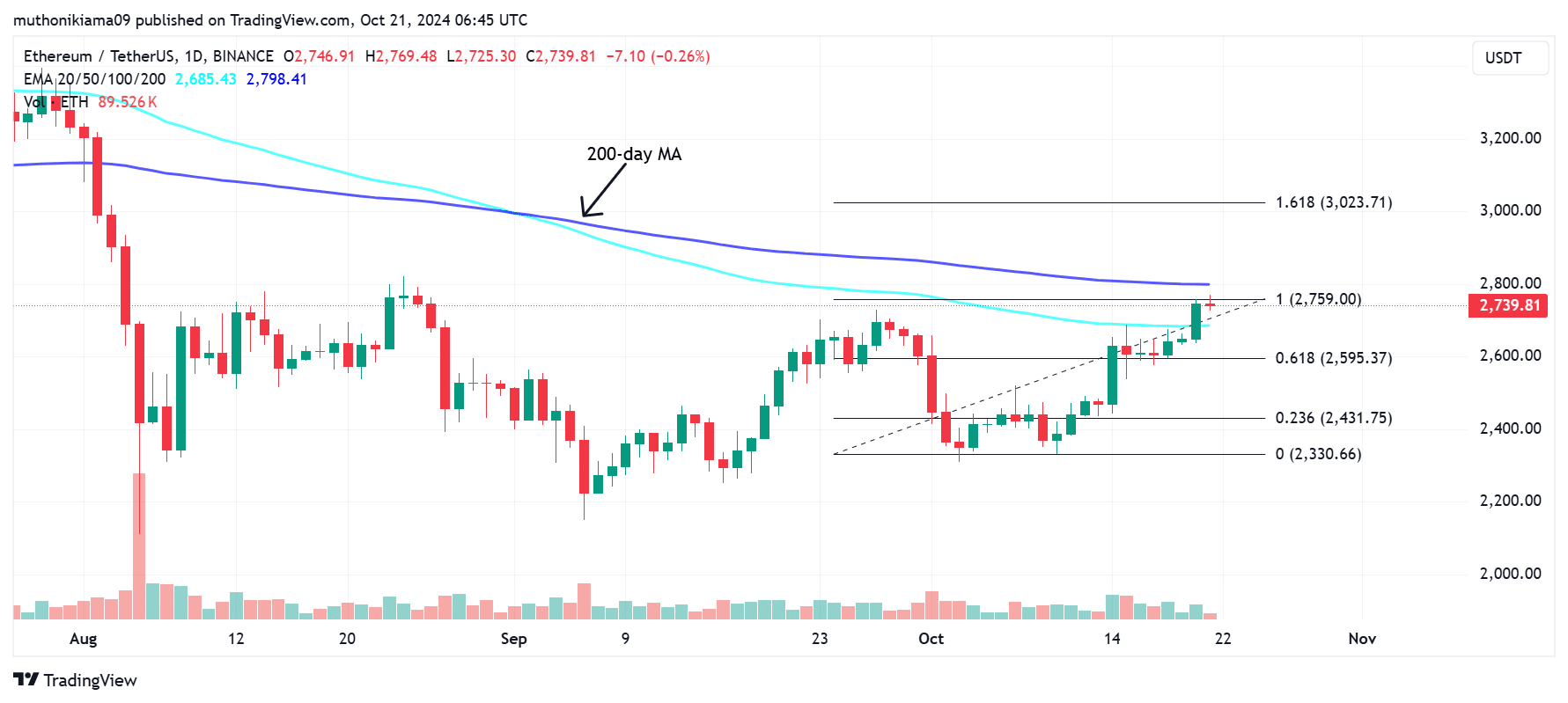

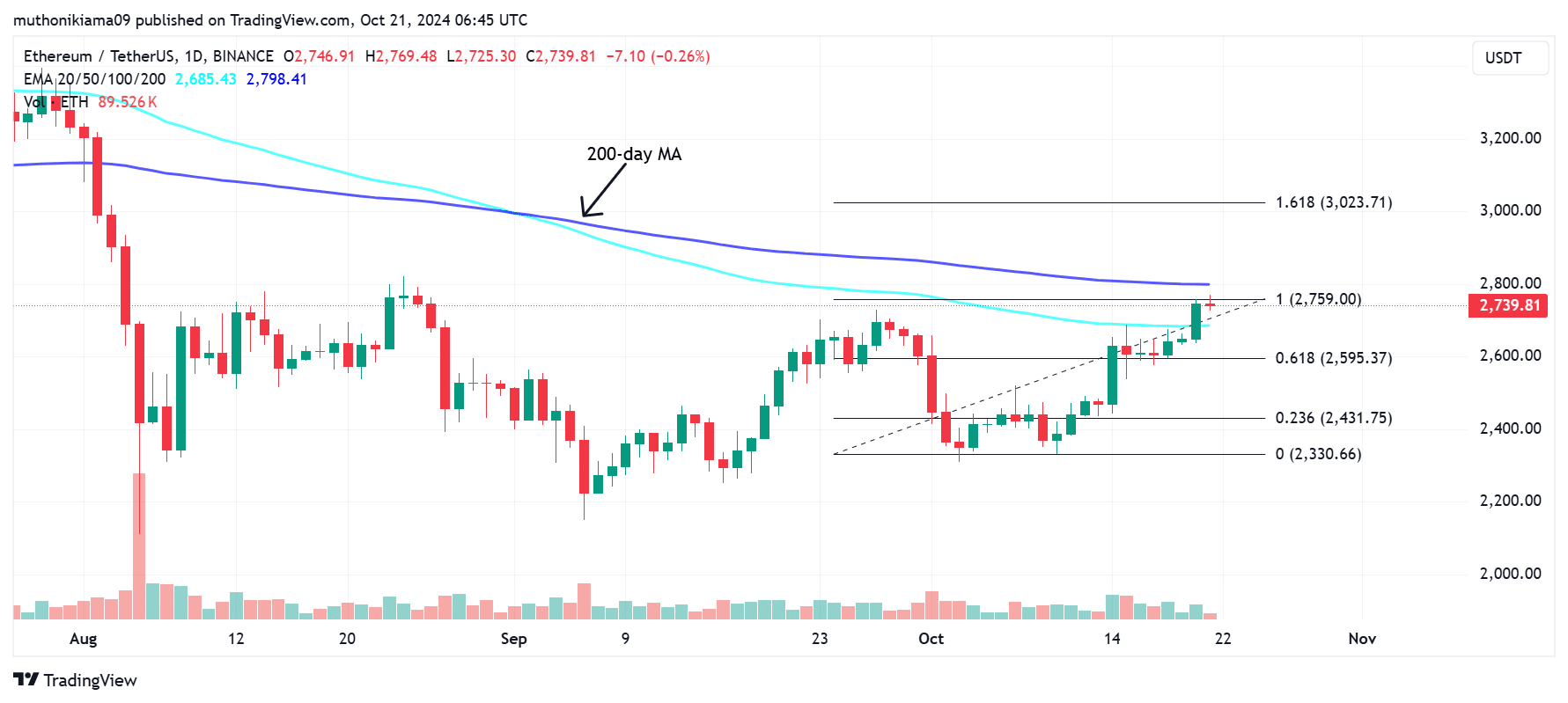

ETH reversed the 100-day exponential moving average (EMA) to $2,685 as the uptrend strengthened. The uptrend later faced resistance as ETH approached the 200-day EMA.

The 200-day EMA, which is currently around $2,800, is a psychological level for traders. If ETH makes a decisive break above this resistance, the altcoin will have entered a long-term bullish trend, which could see it rise to the 1.618 Fibonacci level above $3,000.

Source: Tradingview

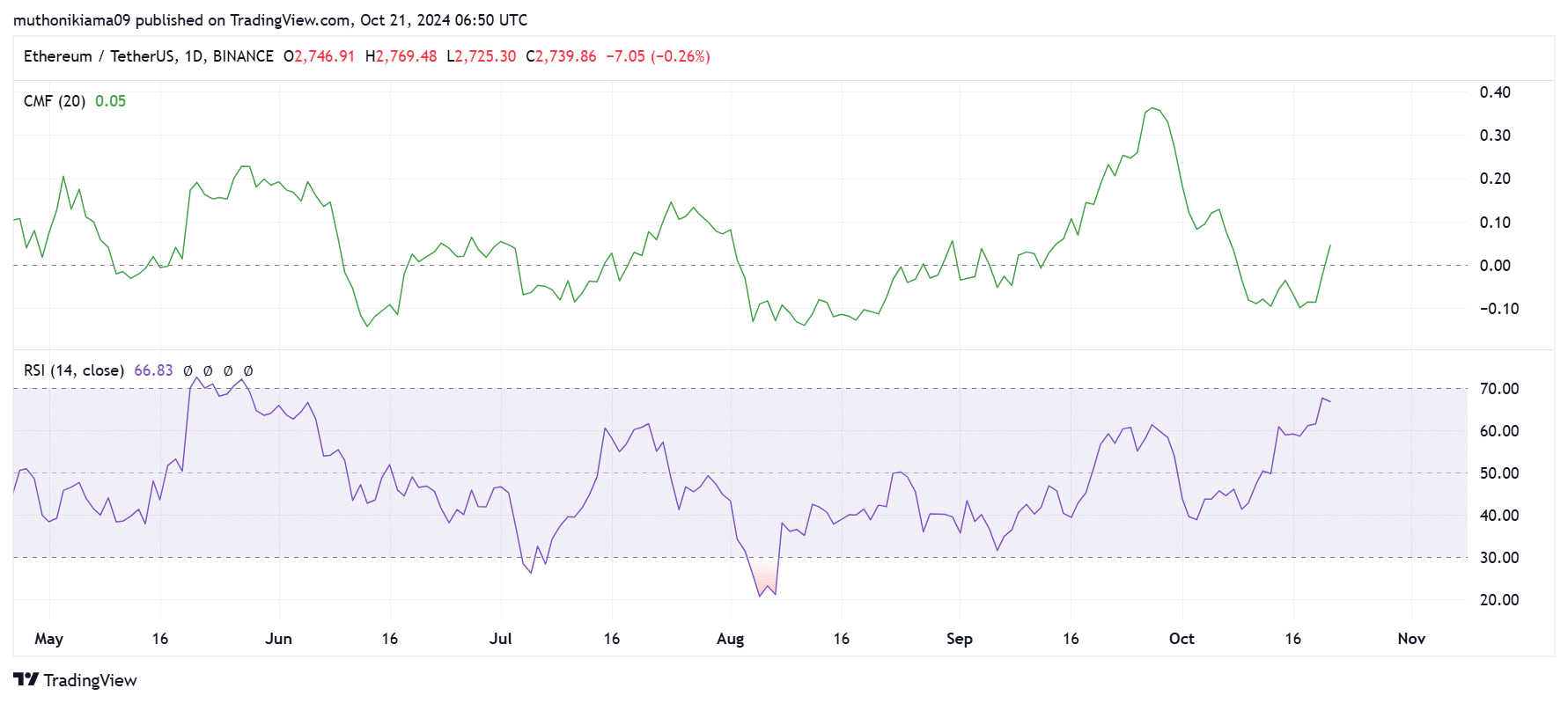

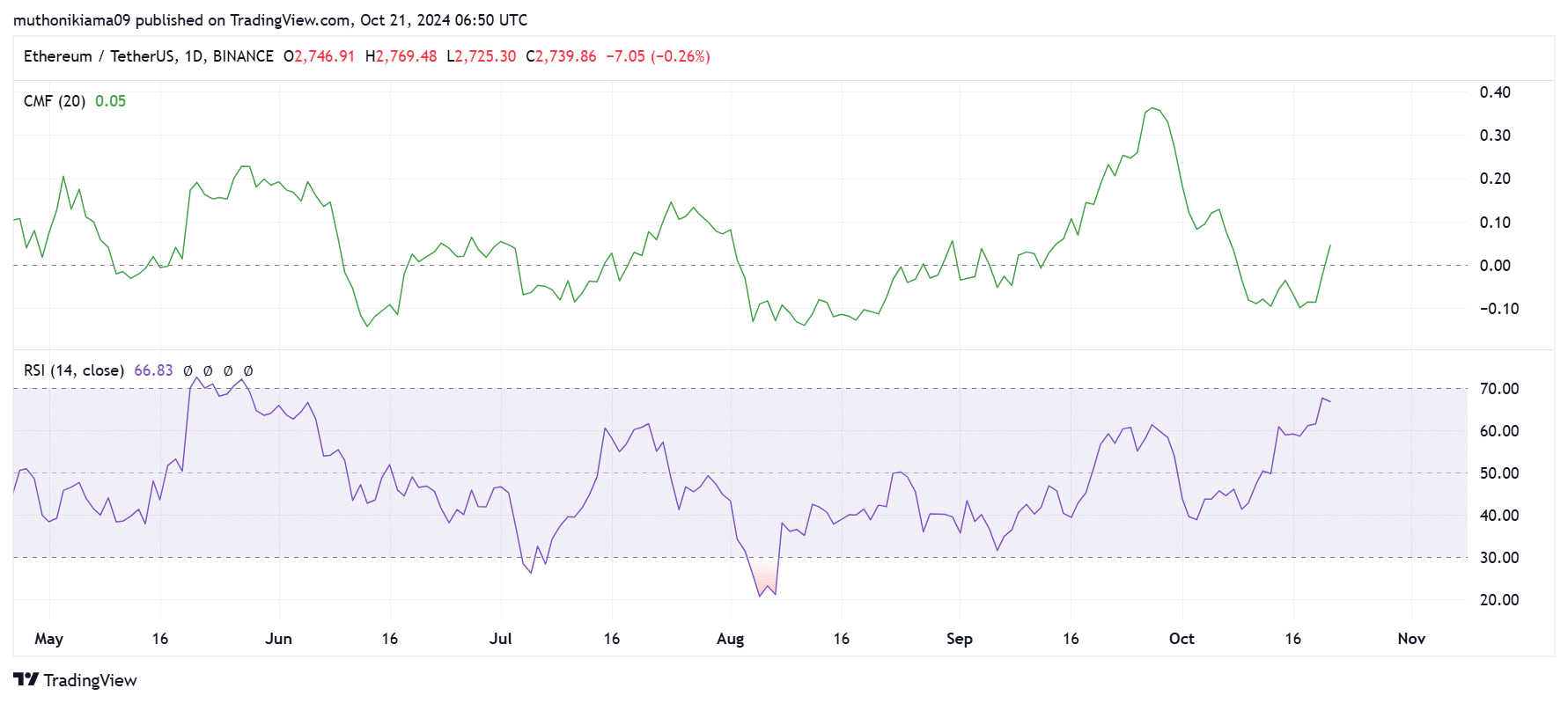

Technical indicators suggest that a break above the 200-day EMA is likely. The Chaikin Money Flow (CMF) has turned positive for the first time in almost two weeks, showing that more capital is flowing into ETH.

Additionally, the Relative Strength Index (RSI) has reached higher highs and reached its highest level since June, indicating high buying pressure.

Source: Tradingview

Despite an influx of buyers, Ethereum’s RSI at 66 shows it is not overbought. This indicates that there is room for growth.

Open interest and leverage ratio spikes

Ethereum’s open interest has risen to its highest level since August, as shown by data from Coinglass. This metric stood at $14 billion at the time of writing, indicating a large number of market participants and capital are flowing into ETH.

Source: Coinglass

A rise in open interest is usually bullish when traders open long positions. However, this increase can also lead to price volatility.

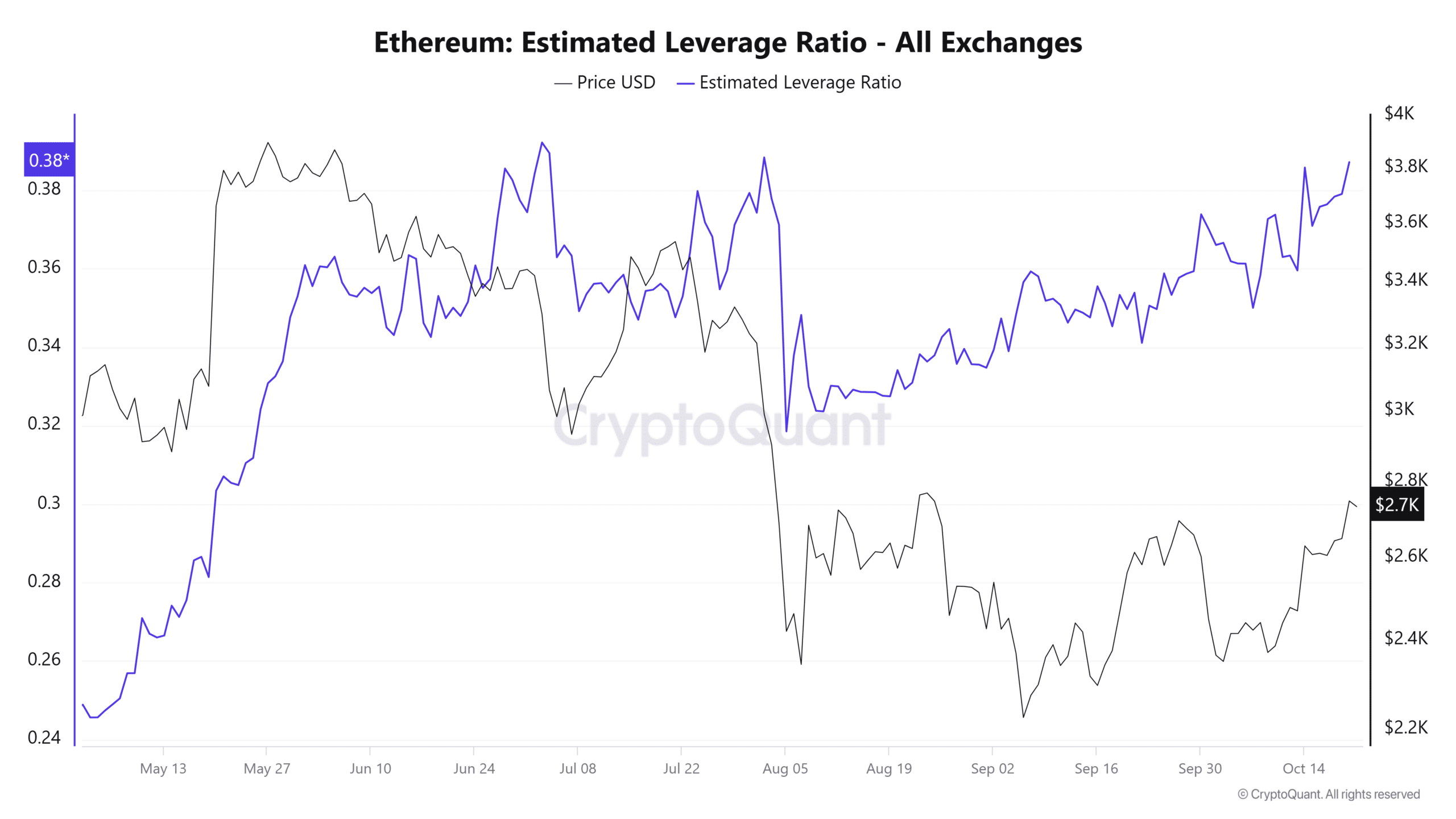

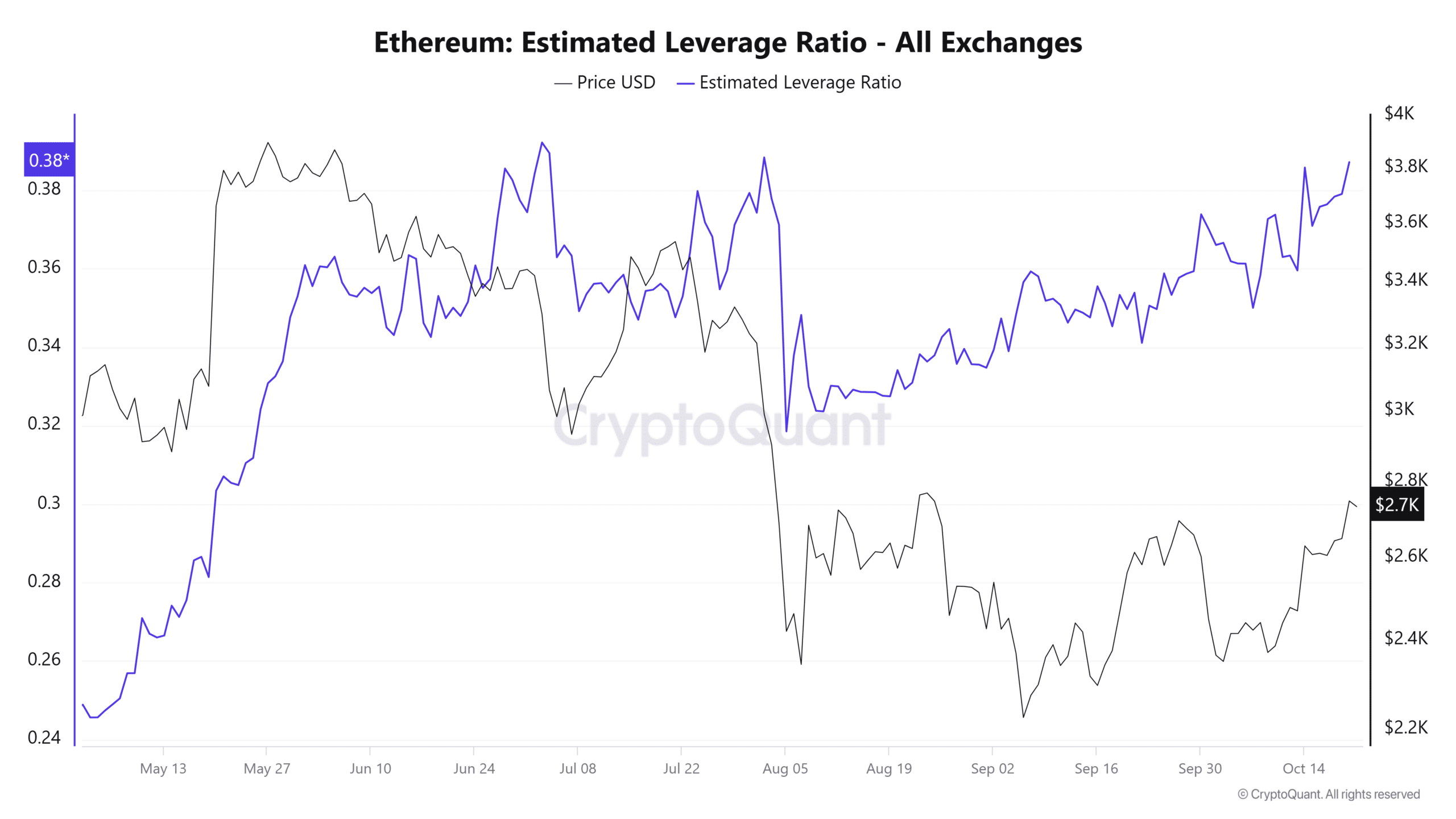

Ethereum’s estimated leverage ratio is nearing a three-month high, indicating an influx of borrowed capital. If ETH makes sudden moves, it could result in a large number of forced liquidations, causing volatility.

Source: CryptoQuant

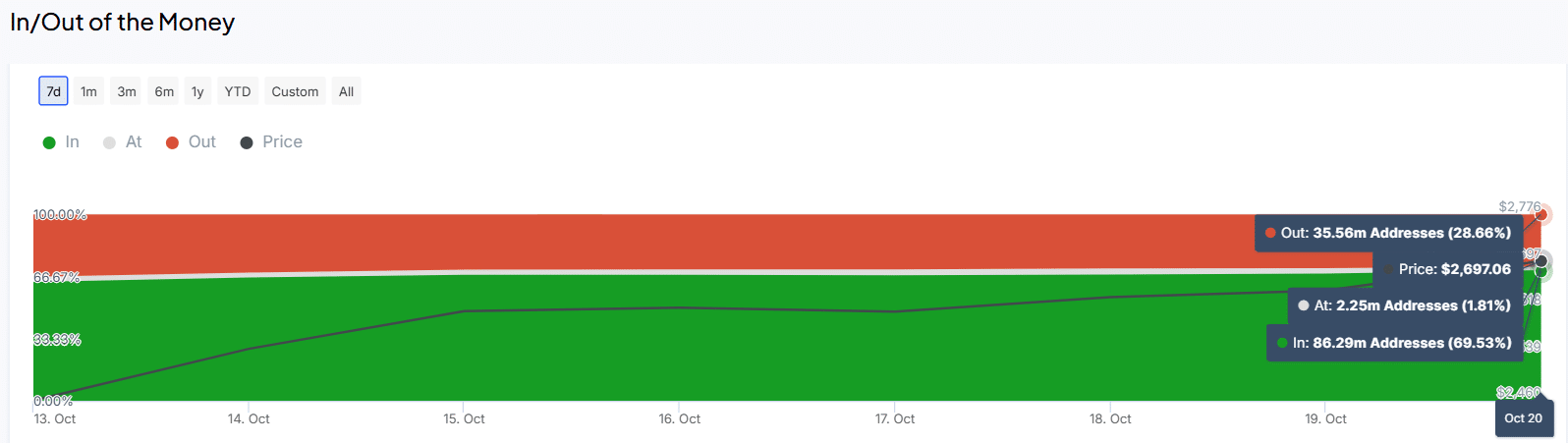

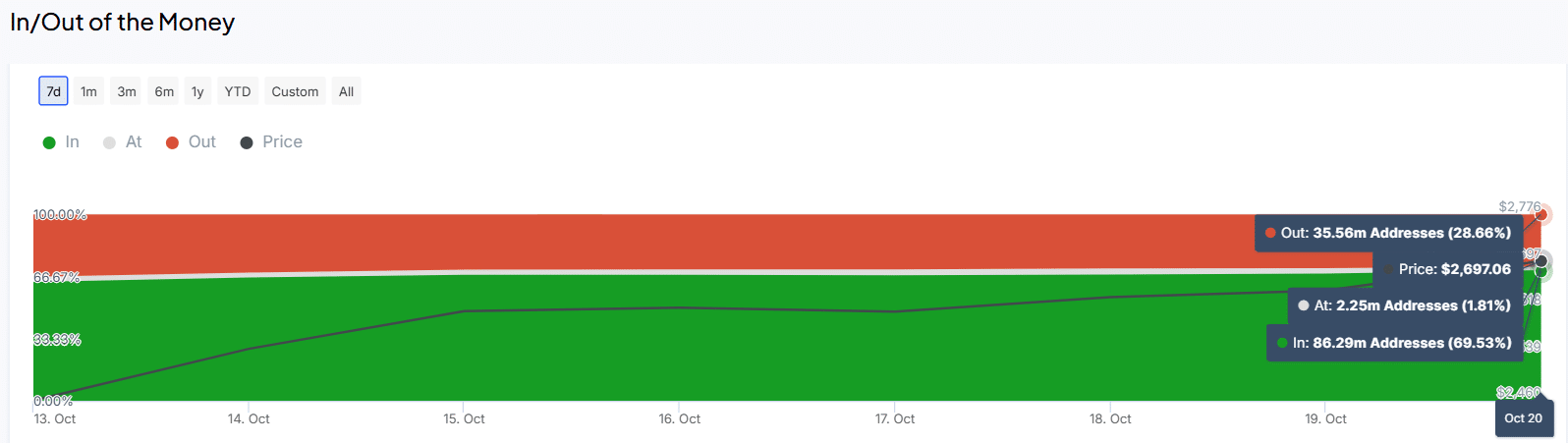

Ethereum wallets in profit

Ethereum’s recent gains have also resulted in a spike in wallets being In The Money (in profits). At the time of writing, 69% of all ETH addresses were profitable, representing a 6% increase over the past seven days.

Source: IntoTheBlock

Read Ethereum’s [ETH] Price forecast 2024–2025

On the other hand, losing wallets at the time of writing stood at 35 million addresses, a notable drop from 42 million addresses in just one week.

As more Ethereum wallets become profitable, this could result in positive sentiment around ETH.