- Sleeping Bitcoin whales have awakened, with decade-old addresses being reactivated.

- Now FOMO could give momentum to $73,000, but there’s a catch!

A perfect storm of macro factors – ranging from the post-halving wave, the ‘Uptober’ frenzy, the impending end of the election cycle and Fed rate cuts – has fueled a parabolic rally, sending Bitcoin [BTC] to $69K in just 10 trading days.

However, unlike previous rallies, this time the bulls have actively defied bearish pressure, with daily lows barely above 1%.

While this rapid rise could stoke fear among traders, causing them to lock in gains and exit positions, the market now needs a major catalyst – likely whale conviction – for the current price to be considered a major entry point.

A long-dormant Bitcoin whale is resurfacing

A after on X (formerly Twitter) revealed that a dormant Bitcoin wallet, which had been inactive for over a decade, was recently reactivated. This wallet contains 25 BTC, worth approximately $1.7 million.

It is important to look at the timeline of this movement. The reactivated wallet has held 25 BTC since 2013, when Bitcoin’s price ranged from $100 to $266.

With the recent meteoric rise of Bitcoin, the owner of this wallet now owns a valuable asset. Notably, this is the second time in just two days that an ancient whale has resurfaced.

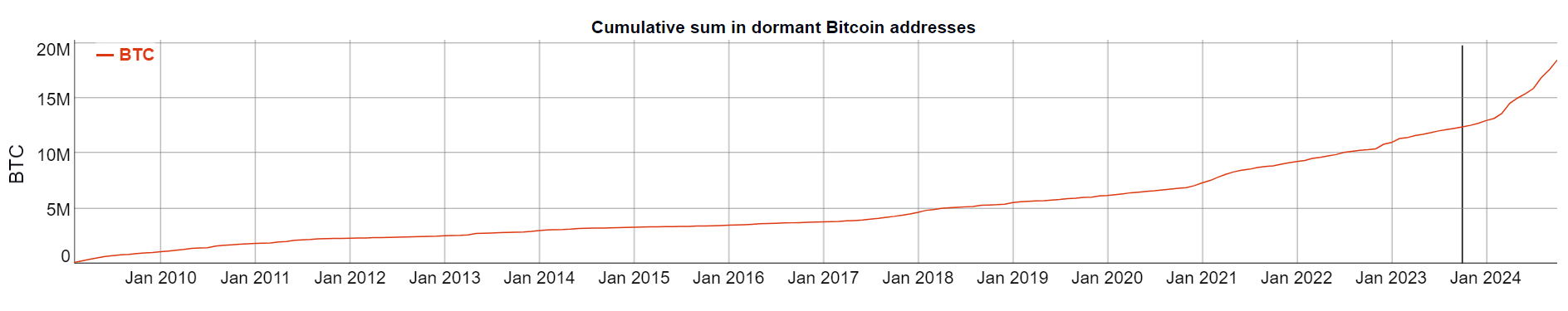

Source: BitInfoCharts

Over the past decade, the amount of BTC stored in dormant wallets has reached an ATH of 19 million BTC. At a price of $69,000, this amounts to approximately $1.311 trillion.

A rising amount in dormant portfolios usually indicates a bullish trend, showing that holders are choosing to wait for a potential price increase rather than cash out. However, it also means that there is a large supply of Bitcoin that could flood the market if these dormant holders decide to sell.

As these wallets become active again, it is crucial to monitor their activity. If the owners see the current price as an opportunity to make money, it could attract more buyers and create FOMO in the market. On the other hand, if they think there is little room for growth, we could see a significant pullback.

The trust of major players is crucial

Interestingly, AMBCrypto has uncovered a compelling pattern that could indicate increasing volatility in the market.

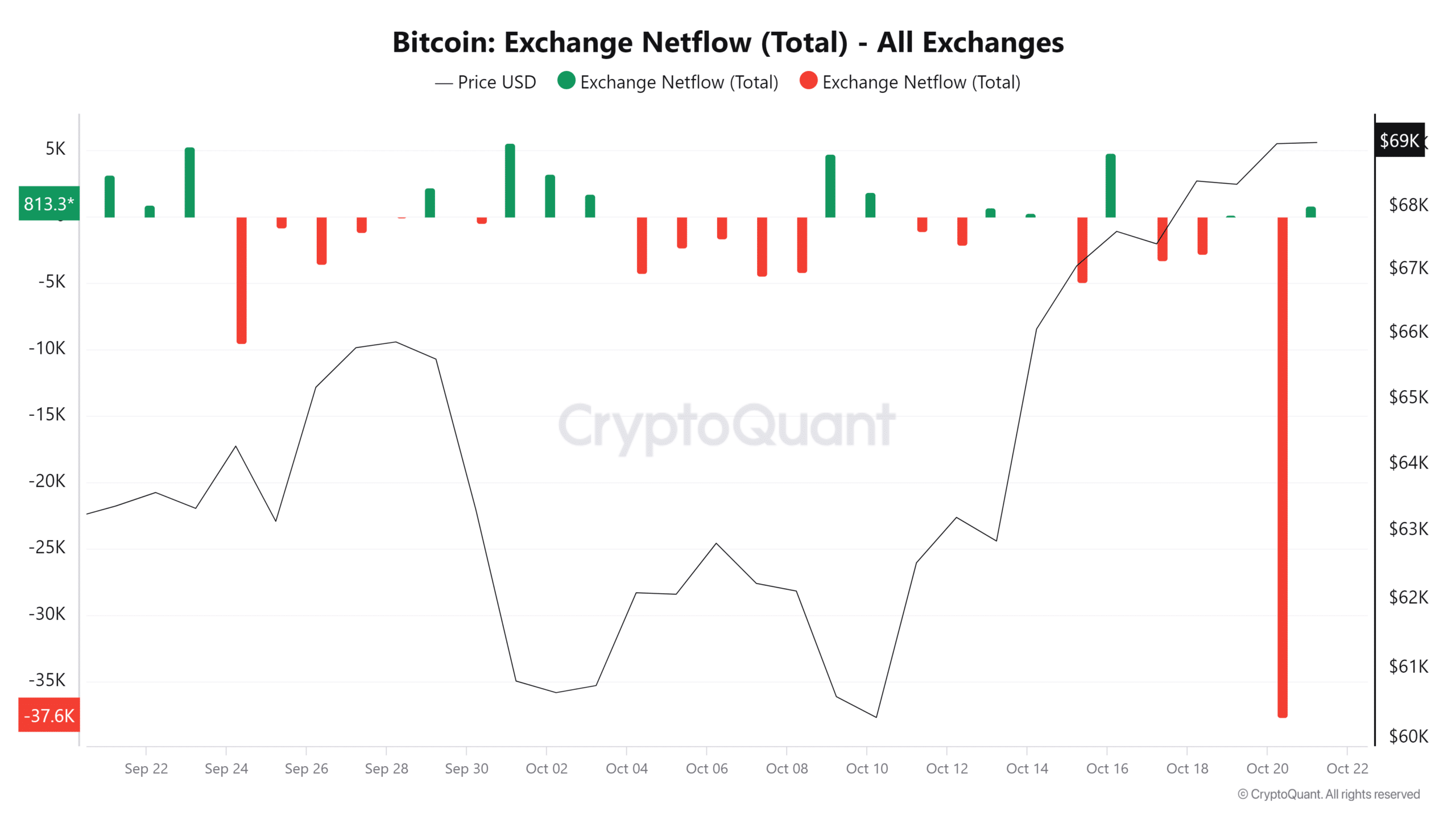

Just a day ago, a huge long red candle appeared on the chart below, showing that almost 38,000 BTC went public. This inflow led to a noticeable spike in foreign exchange reserves.

Source: CryptoQuant

However, despite this aggressive sell-off, Bitcoin’s price action remained relatively steady, closing above $69,000 – a level it had not reached in four months.

This anomaly can likely be attributed to whale intervention, which has absorbed much of the selling pressure. In fact, this is not just speculation; it is backed by real data. As shown in the graphicOn the same day, almost 40,000 BTC were purchased by large holders.

Is your portfolio green? Check out the BTC profit calculator

Overall, whales play a crucial role in this cycle. Their support is essential to prevent the market from overheating, which could otherwise signal a potential top and lead to mass capitulation.

However, IIf their confidence wavers, a retracement may be imminent.