- BOME is down 4.89% in the past day.

- Market indicators indicate that the uptrend is losing steam and that a pullback is imminent.

Over the past month, memecoins have experienced strong upward momentum, reviving optimism about a memecoin-driven bull run. BOOK OF MEME [BOME] has been an important part of all of this.

So, since hitting a local low of $0.0056, BOME rose to a local high of $0.011.

Since then, however, the memecoin has undergone a strong market correction. At the time of writing, BOME was trading at $0.009244. This represented a drop of 4.89% over the past day.

Although the memecoin is up 30.09% weekly, the latest price action raises questions about the sustainability of the uptrend.

What the BOME charts say

According to AMBCrypto’s analysis, BOME saw a shift in market sentiment. This shift implied that the memecoin will see a pullback before attempting a new uptrend.

Source: TradingView

For starters, Bome’s ADX has risen from a low of 13 to 31 at the time of writing. As ADX rose, +DI fell from a high of 45 to 36. This showed that the current trend was losing momentum.

Moreover, the Relative Strength Index has fallen from 76 to 61, while the MA has risen from 48 to 57. This suggests that sellers are trying to dominate the market.

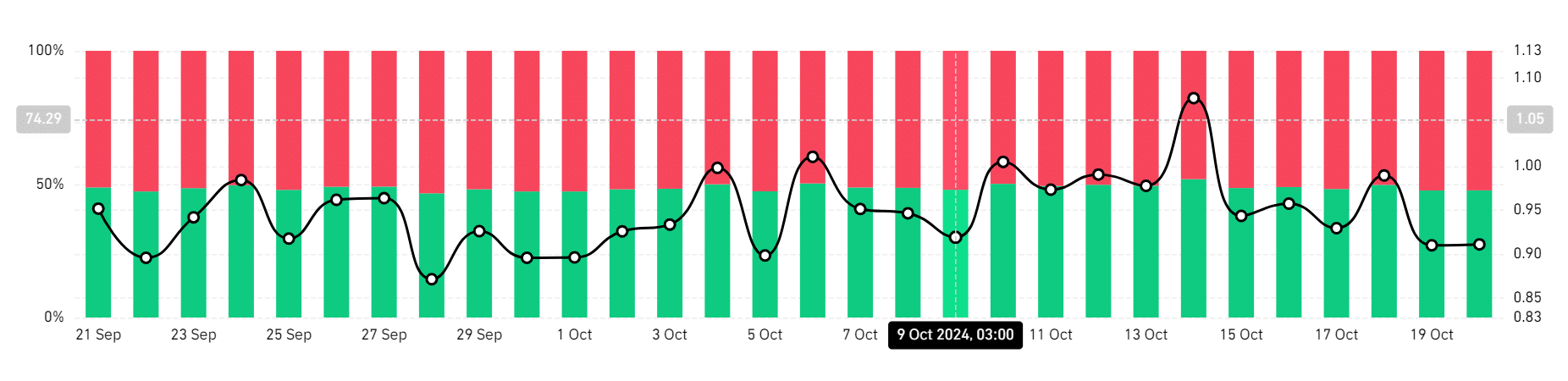

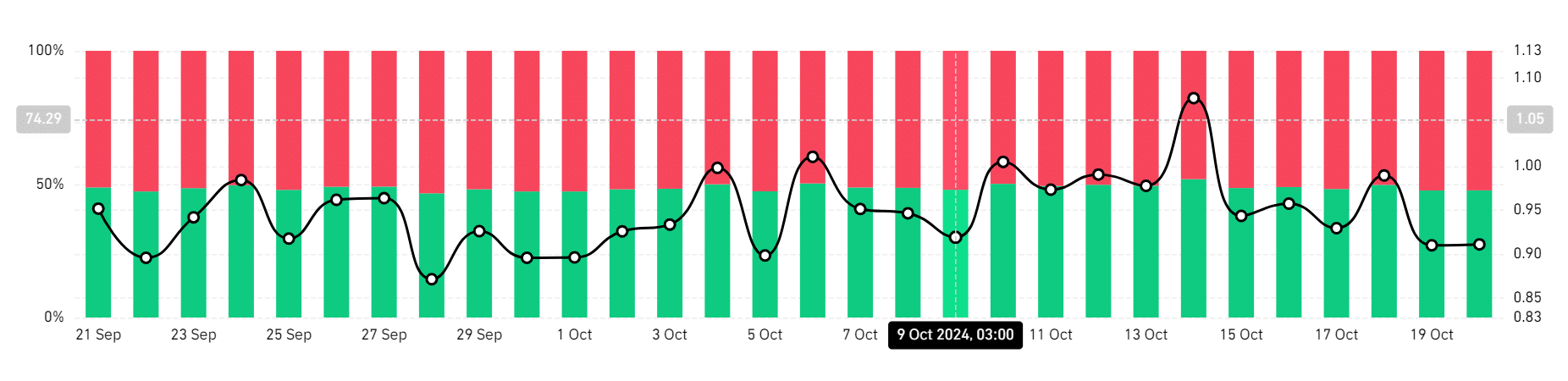

Source: Coinglass

Looking further, BOME’s Long/Short ratio fell below 1 to 0.9585, with shorts taking up 51.06% of total positions. This implied that most investors expected prices to fall on a daily basis.

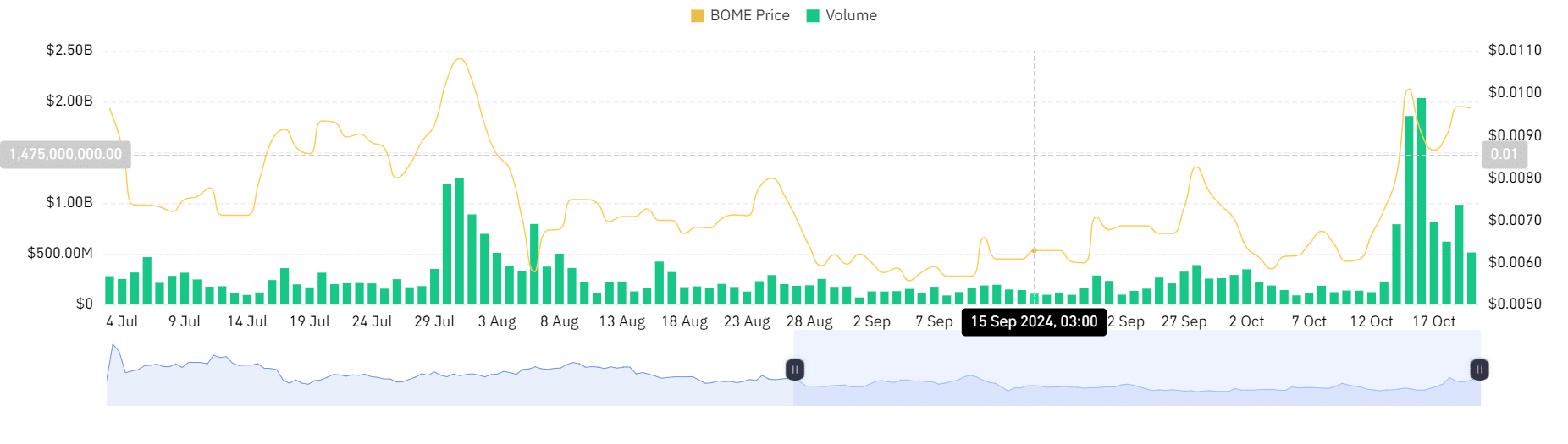

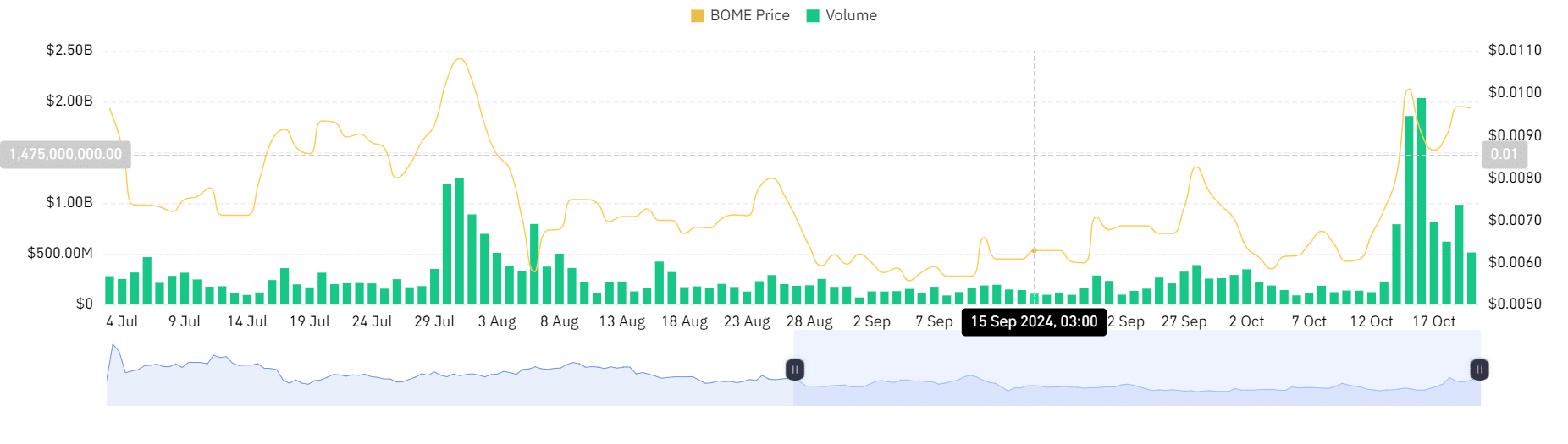

Source: Coinglass

Similarly, the memecoin’s trading volume had dropped from $2.03 billion to $512.14 million. This marked a decline of 74.77% in the past week.

So there was less capital inflow into the memecoin, indicating reduced demand and participation.

Read the BOOK OF MEMEs [BOME] Price forecast 2024–2025

Simply put, BOME is experiencing a shift in sentiment to bearish. If this continues, the memecoin will fall further.

On a pullback, BOME will find its next support at $0.008485 before attempting a new uptrend. If the bulls then retake the market, the memecoin will regain the $0.01 resistance level.