- Bitcoin ETFs surpassed $20 billion in inflows in their debut year, outpacing gold ETFs by a factor of 10.

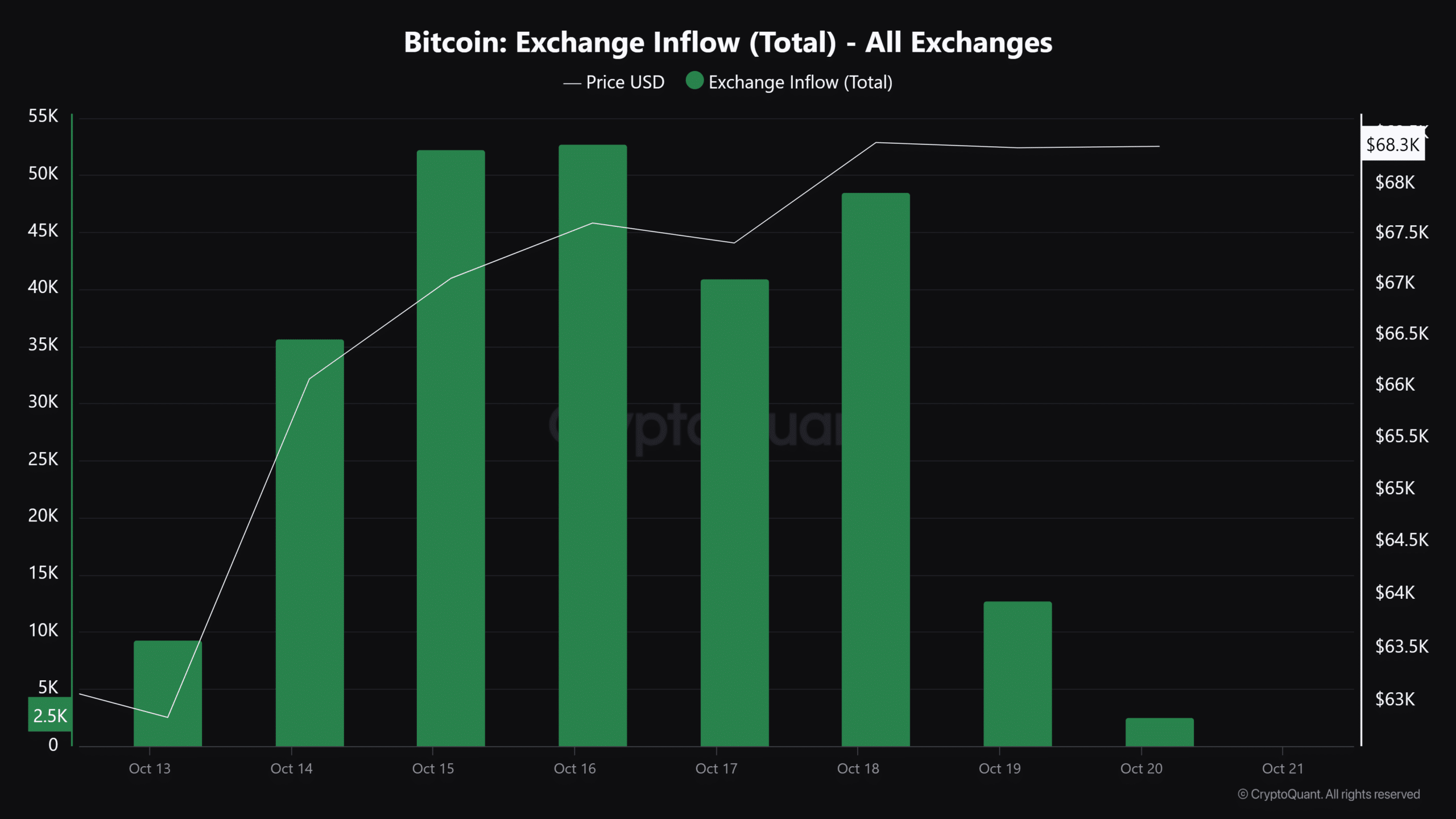

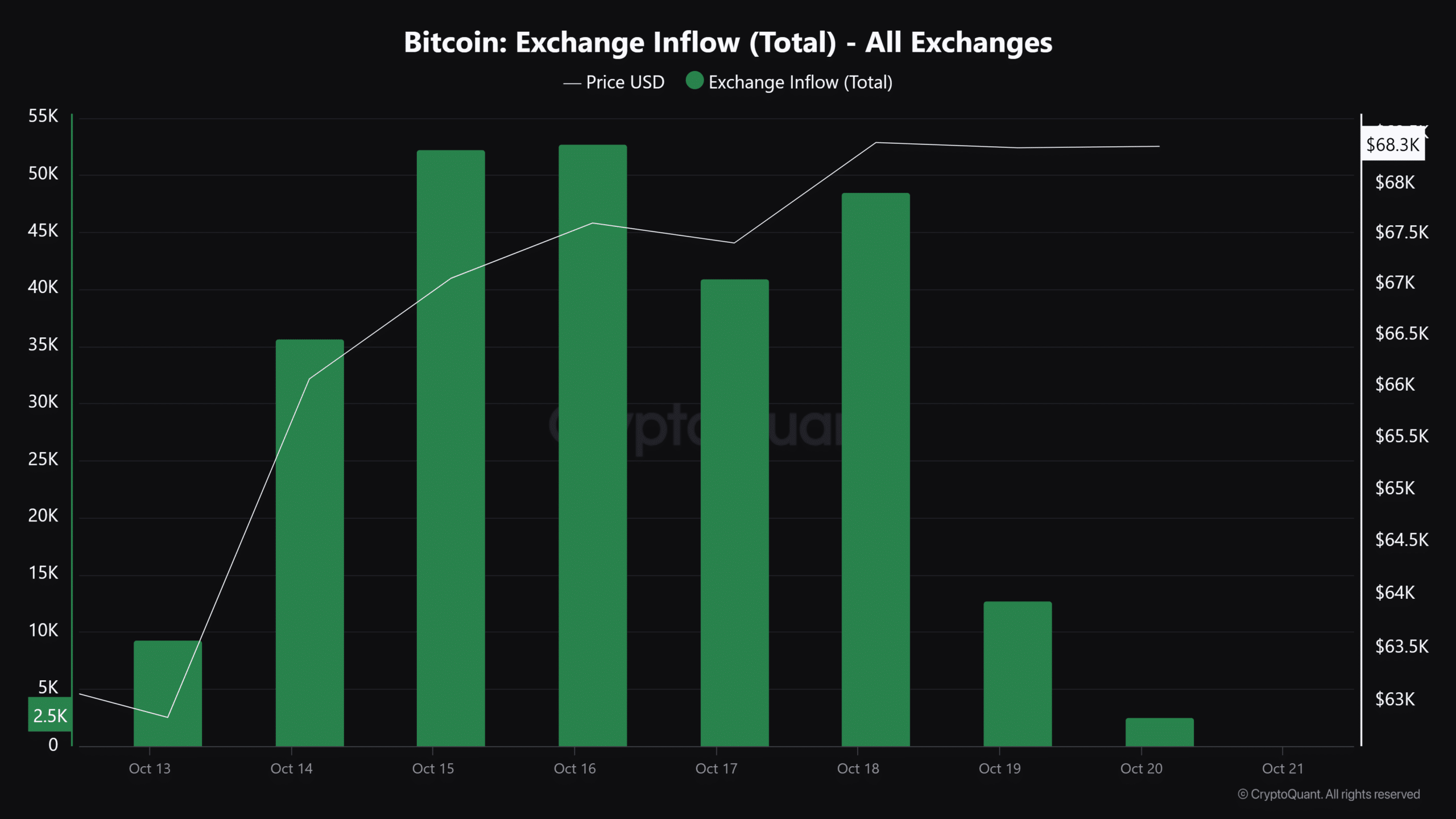

- BTC exchange inflows drop 95.93% in 48 hours, while social volume rises steadily.

American Bitcoin [BTC] ETFs have surpassed an impressive $20 billion inflows in their first year, as recently reported tweet from MartyParty.

This is in stark contrast to gold ETFs, which attracted much lower inflows in their first year.

The rapid adoption of BTC ETFs underlines the growing interest in digital assets, further strengthening Bitcoin’s position as a major player in the investment universe.

Bitcoin exchange inflows are declining

While ETFs are seeing heavy inflows, Bitcoin inflows on the exchanges have fallen significantly over the past 48 hours, by over 95.93%.

This signals a shift in investor behavior as fewer participants move their BTC to exchanges.

Consequently, the decline in inflows can be an indicator of the bullish attitude of the holders as they choose to hold the assets rather than sell them.

Source: CryptoQuant

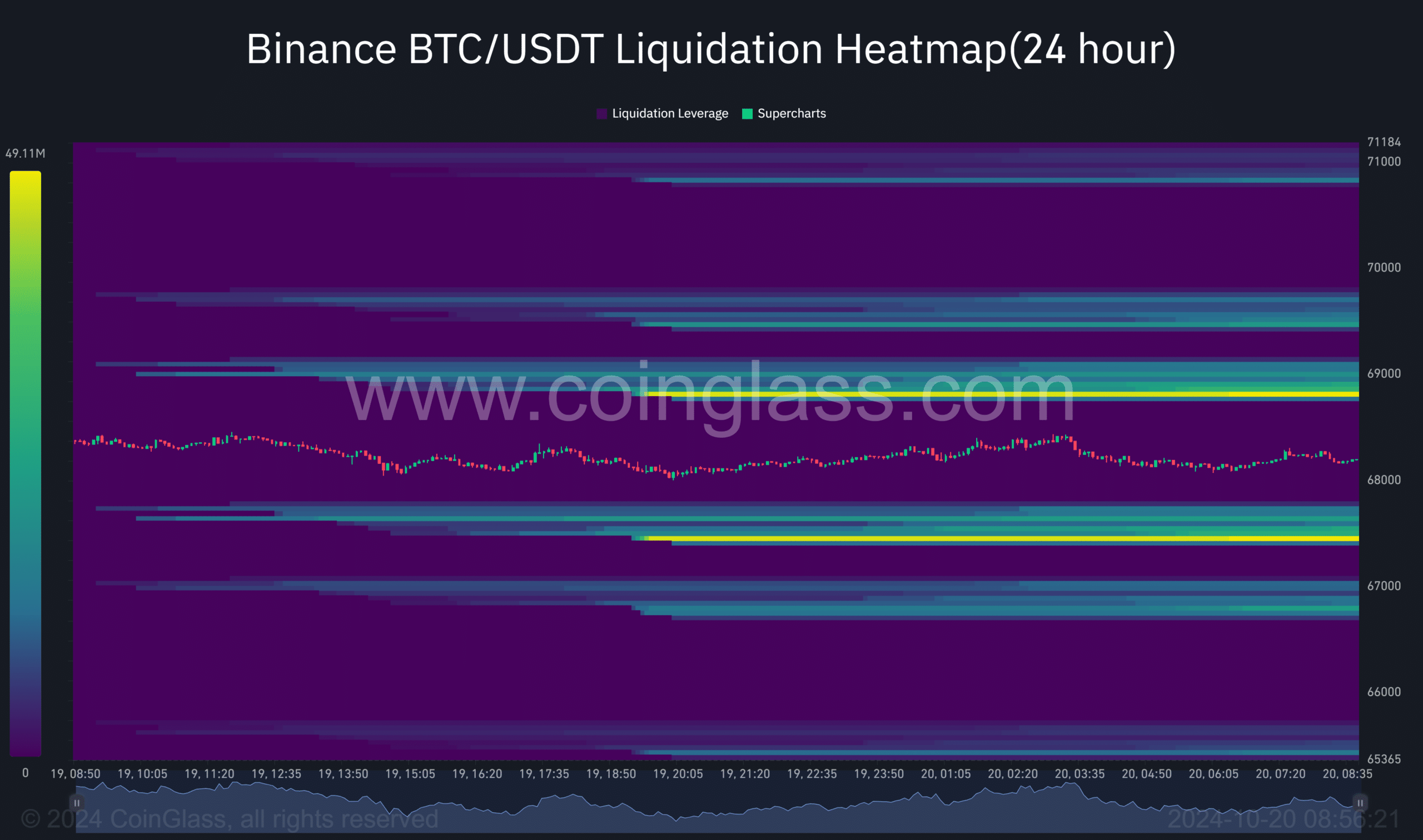

The liquidity heatmap is at equilibrium

AMBCrypto analysis of the liquidity heatmap data revealed an equilibrium in Bitcoin’s liquidity levels.

In the last 24 hours alone, liquidity at the $68.8k and $67.5k price levels has reached equilibrium, with 49.12 million at both points.

Perhaps this could indicate that BTC is consolidating and gathering energy to push prices higher.

Source: Coinglass

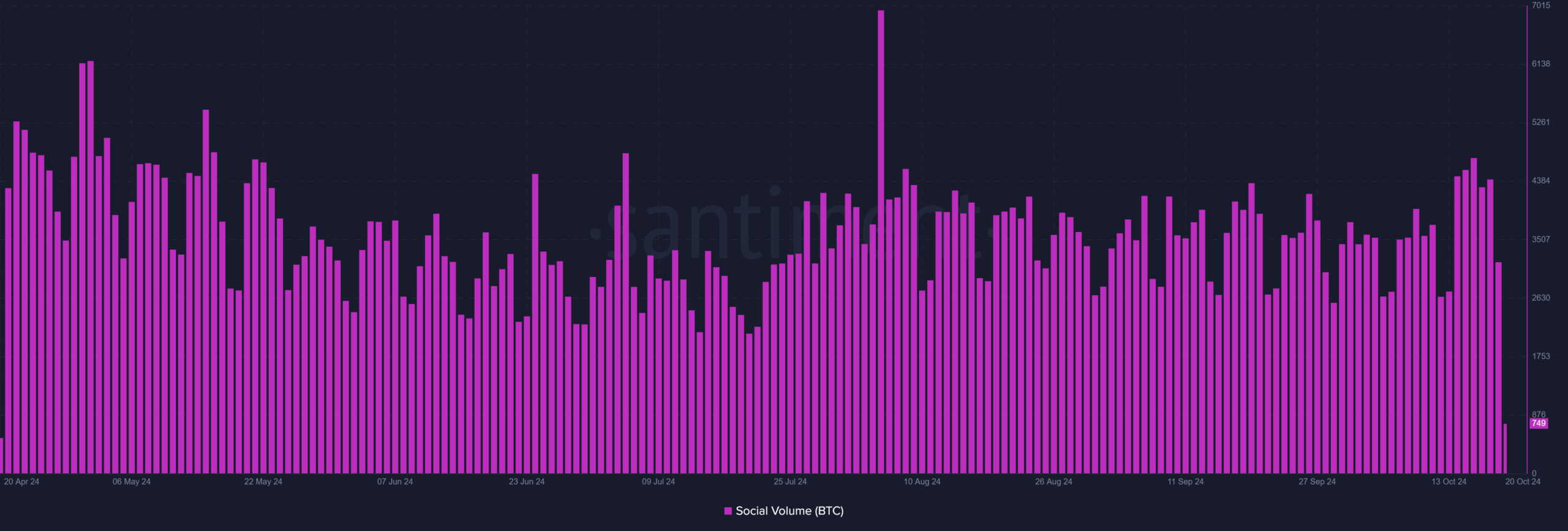

Bitcoin’s social volume is increasing

Complementing the inflows into the ETF and the stability of the market is the gradually increasing social volume of BTC.

Since October 12, Bitcoin social volume has increased, indicating greater engagement and interest within communities.

This flurry of social activity suggests that Bitcoin is once again a hot topic, with more people than analysts and investors talking about its price, technology and future potential.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Historically, as social volume increases, so does market interest and activity.

Source: Santiment

The success of BTC ETFs, declining currency inflows, balanced liquidity, and increasing social engagement all point to a bullish market outlook for Bitcoin.