- Bitcoin HODLing has climbed to impressive levels, with holders now expecting higher prices.

- Worth assessing the potential risk in case of a big sell-off

Bitcoin investors have been eagerly awaiting Bitcoin to regain the $70,000 price level. This can be proven by the huge amount of unrealized profits – a sign that BTC holders have chosen to HODL in anticipation of higher prices.

In fact, according to a recent one CryptoQuant AnalysisBitcoin currently has over $7 billion in unrealized gains. This observation highlights the level of HODLing and expectations of higher price levels. However, it also underlines the potential for a massive retracement if or when profit taking resumes.

If Bitcoin holders start taking profits off the table, the selling pressure could lead to an outcome similar to what happened in late July. At the time, the price collapsed sharply within days. So far, the prevailing optimism has allowed BTC to maintain its gains on the charts.

At the time of writing, Bitcoin was trading at $68,350, less than 2.4% away from $70,000. The cryptocurrency also appeared to be approaching the next resistance range between $69,400 and $71,500.

Bitcoin flows fall to lowest level in 2024

Bitcoin exchange flows can give us interesting insights into the crypto’s latest bullish wave.

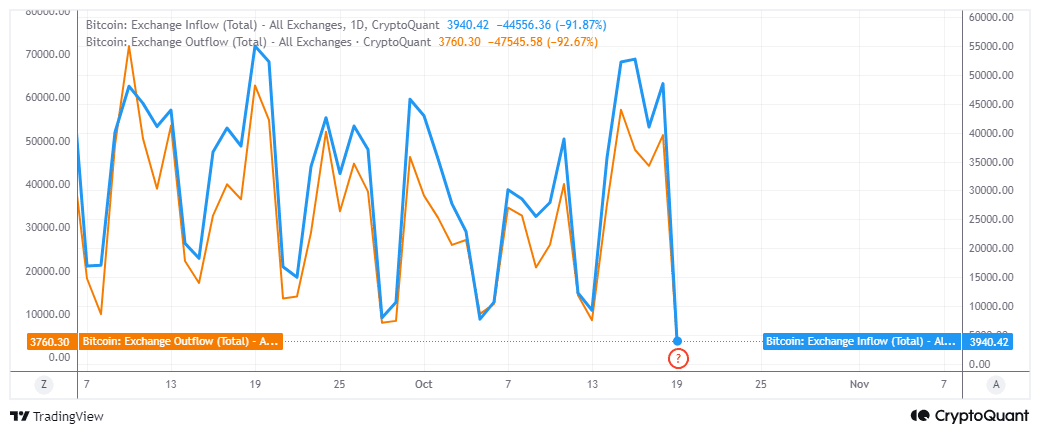

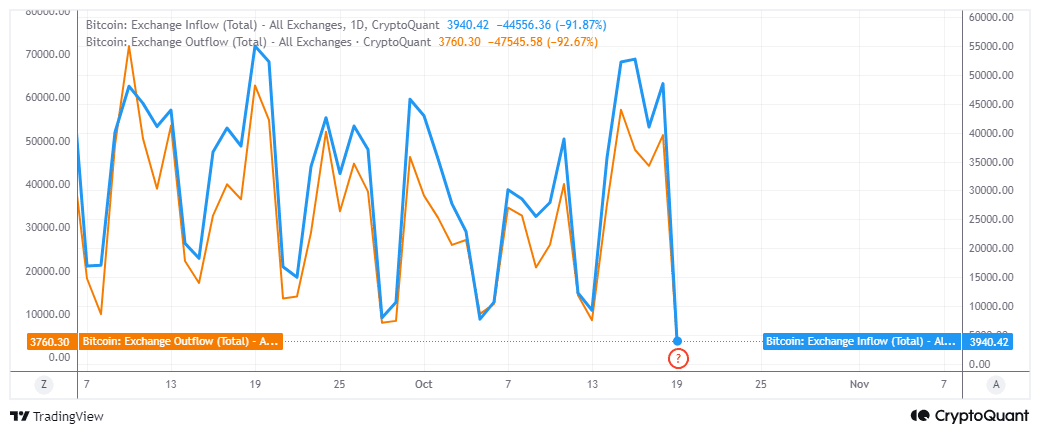

The last increase in both foreign exchange inflows and outflows occurred between October 13 and 16. Since then, however, currency flows have cooled to their lowest levels this year.

Source: CryptoQuant

In fact, data shows that 3,760 BTC disappeared from exchanges in the last 24 hours. About 3,940 BTC went to exchanges, meaning that the inflows to the exchanges were slightly higher than the outflows.

Fluctuations in exchange rates suggest that BTC may be poised for a resurgence in volatility. However, will a new swing-up have bullish or bearish energy? That remains to be seen, although address flows may give us some insights.

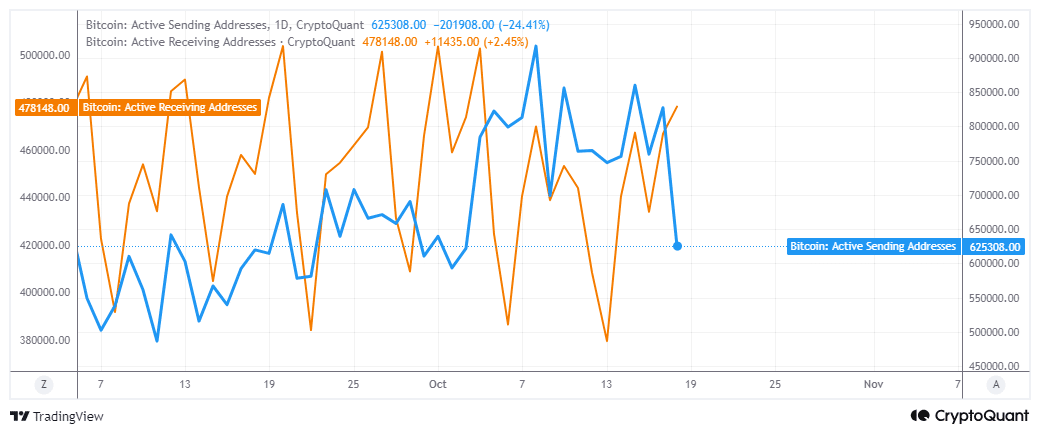

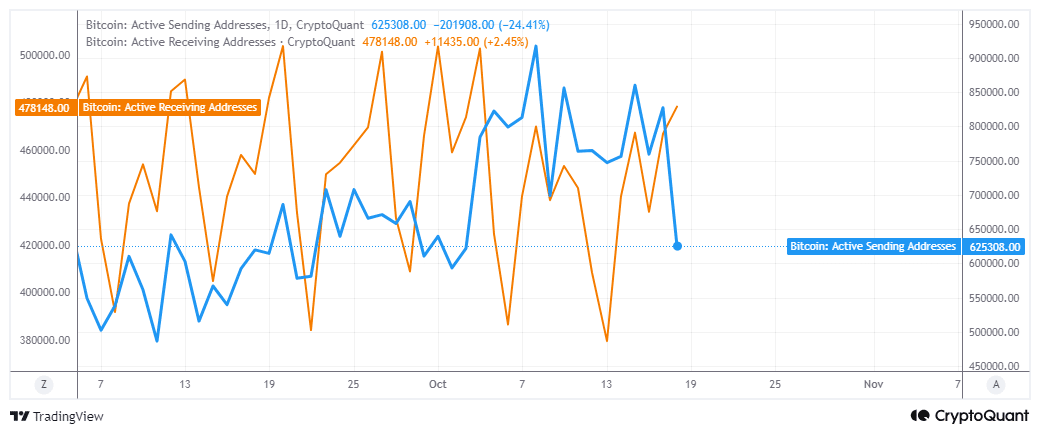

The number of active shipping addresses has been decreasing since mid-October. For example, they dropped from 860,161 addresses on October 15 to 478,148 addresses on October 18.

Source: CryptoQuant

On the contrary, the number of receiving addresses grew from 379,545 addresses on October 13 to 625,308 addresses on October 18. The data also showed that not only did addresses buying Bitcoin outpace addresses selling it, but receiving addresses grew while sending addresses retreated.

Address activity confirmed a shift, indicating easing selling pressure despite the recent price increase. While these outcomes indicate that Bitcoin could move higher, there could still be a surprise wave of selling pressure in the market.