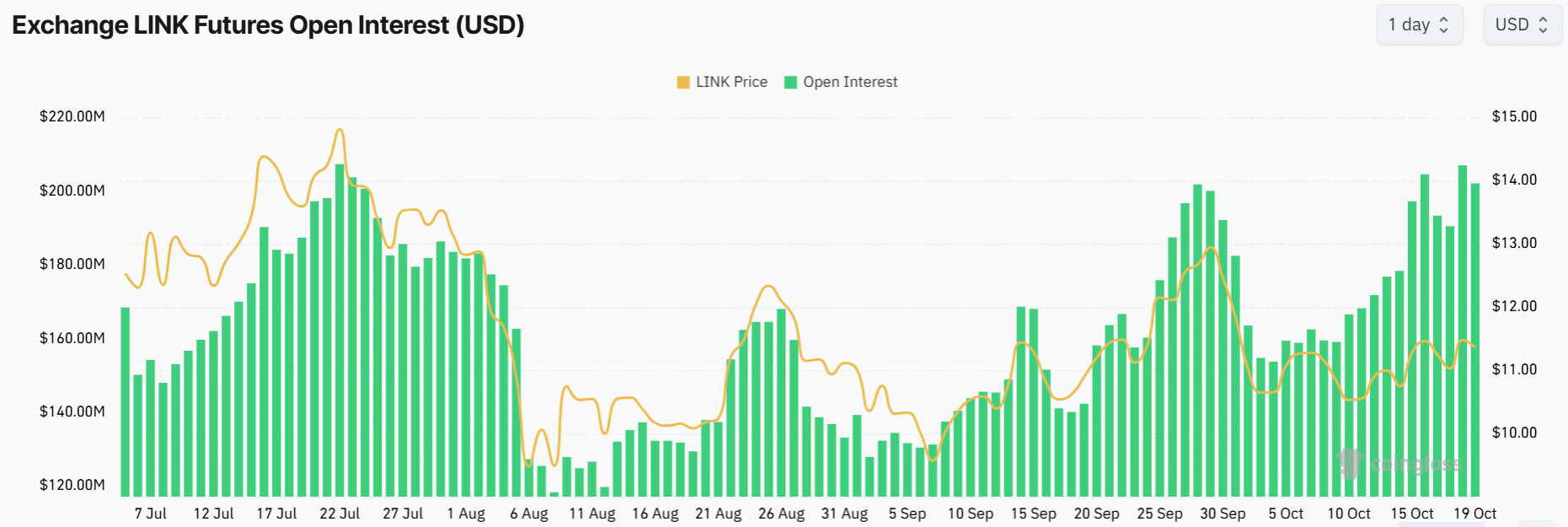

- Chainlink’s Open Interest rose to a three-month high of $206 million

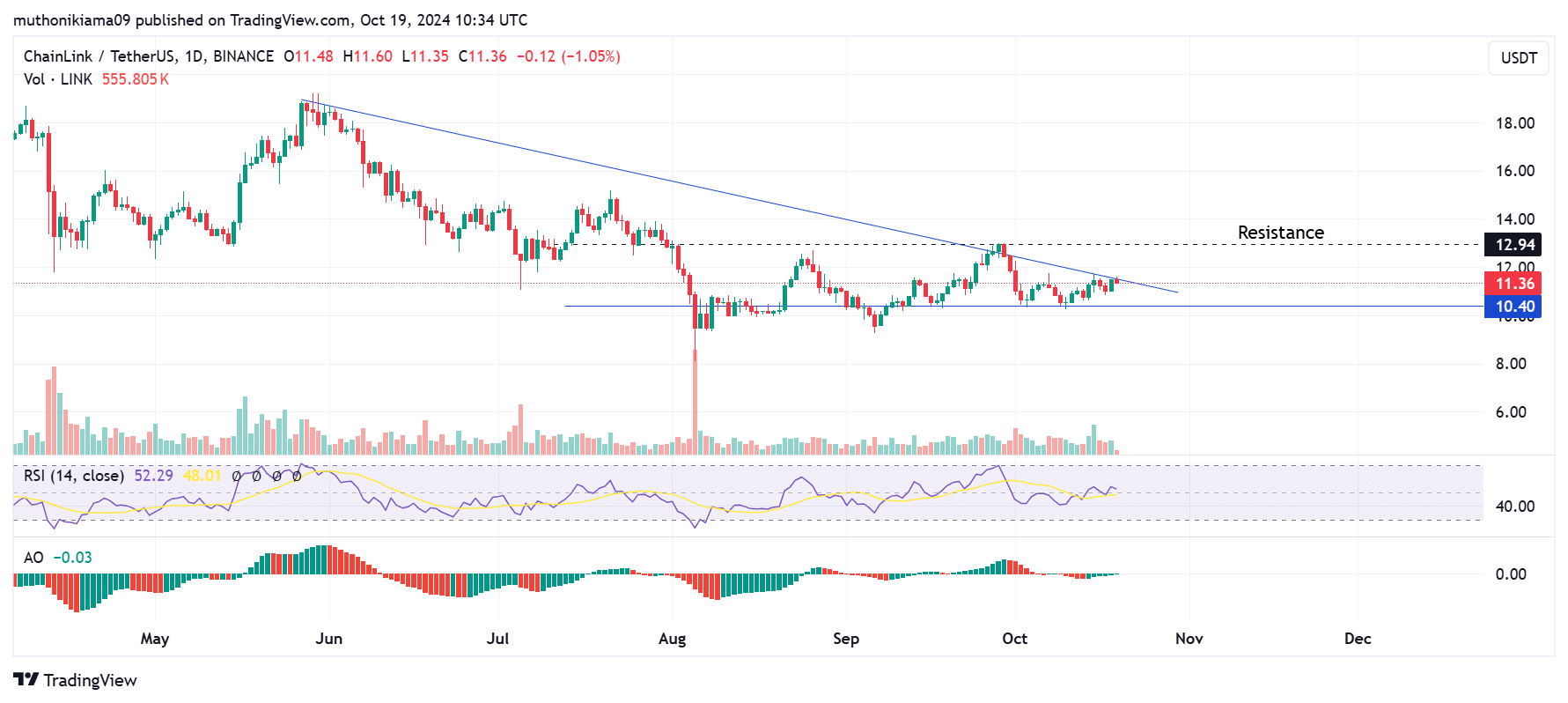

- A descending triangle pattern on the daily chart highlighted a prevailing bearish trend

Chain link (LINK)at the time of writing, could be seen signs of a weakening uptrend. LINK was trading at $11.38 after falling 0.6%. This is despite a 4% increase in the past seven days. In fact, spot trading volumes also fell by around 9% – a sign of that declining interest in the altcoin.

On the contrary, a look at the Futures market revealed that more traders have opened positions on LINK lately. Open Interest (OI) jumped to a 13-week high of $206 million – a sign of increased activity among derivatives traders as they speculate on future price movements.

Source: Coinglass

However, it is worth noting that this spike in OI often preceded a decline in LINK prices. For example, the last time LINK’s OI was at this level was on July 22. The altcoin’s price dropped 45% in just two weeks.

In late September, LINK’s OI shot back to a two-month high before the price fell nearly 20%.

Therefore, if Chainlink follows historical trends, bearish sentiment could quickly emerge.

Chainlink is sending bullish signals

On the daily chart, LINK’s Relative Strength Index was at 52 – a near-neutral level that suggests buyers are slightly outnumbering sellers. The RSI line was above the signal line, indicating that bullish momentum may be in play.

However, at the time of writing, this line appeared to be tilting south – a sign that sellers have entered the market.

This weak bullish sentiment was further evidenced by the bars of the Awesome Oscillator (AO). Although the bars were green, they remained negative, indicating a lack of enough buyers to support an uptrend.

Source: Tradingview

LINK also formed a descending triangle pattern, which mostly hinted at a bearish continuation. The altcoin was trading at the upper limit of this channel at the time of writing, showing that bulls have attempted to take control.

However, a breakout is often accompanied by high purchasing volumes. In fact, the volume histogram bars showed few buyers amid periods of selling activity.

If buyers reenter the market and LINK disproves this bearish thesis, the next resistance would be at $12.94. Conversely, if the bearish trend continues, LINK is likely to drop to test the support at $10.40.

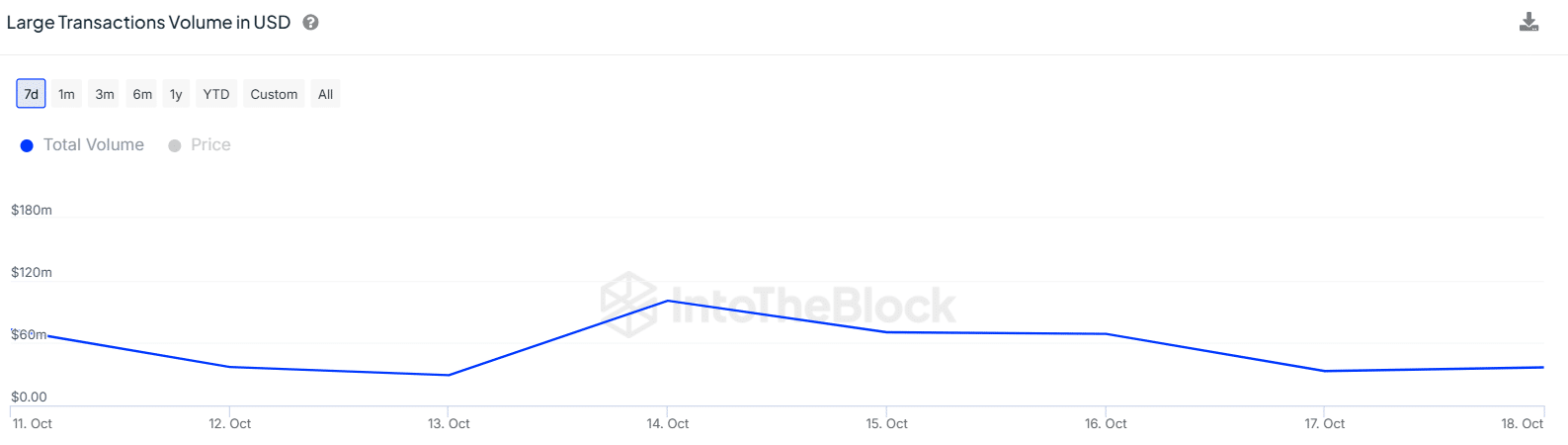

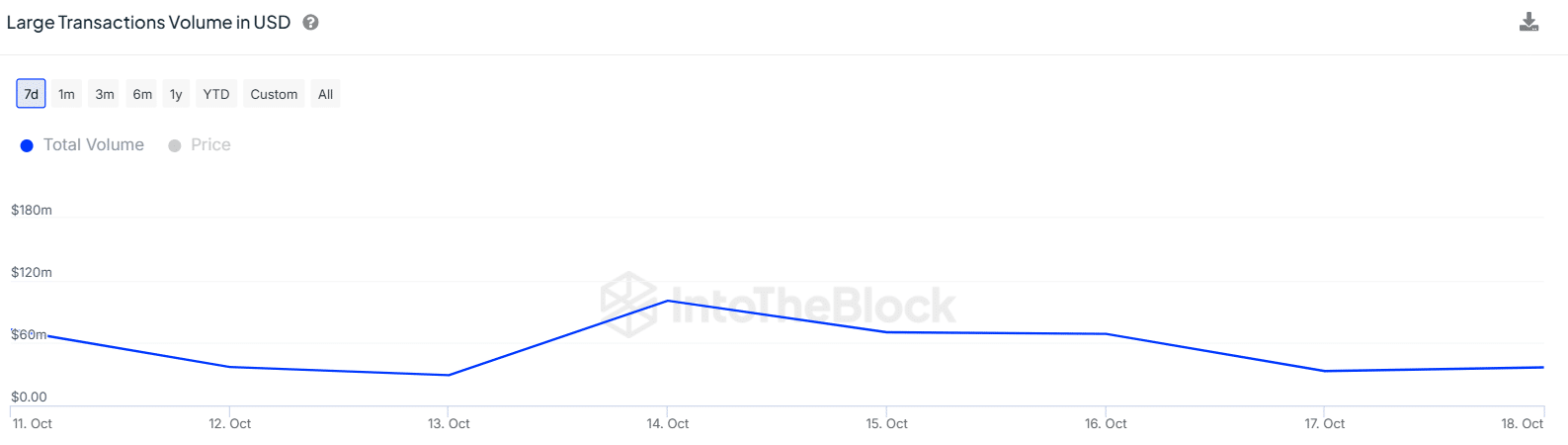

One of the catalysts needed to support LINK’s upward trend is whale activity. The large transaction volumes peaked earlier this week at $100 million. At the time of writing, these volumes had fallen to $36 million – a sign that whales are now inactive. This could soon result in suppressed price performance on the charts.

(Source: IntoTheBlock)