- Bitcoin Open Interest soared, while supply on the exchanges fell sharply

- A price correction could push BTC to $66,000 or even $62,000

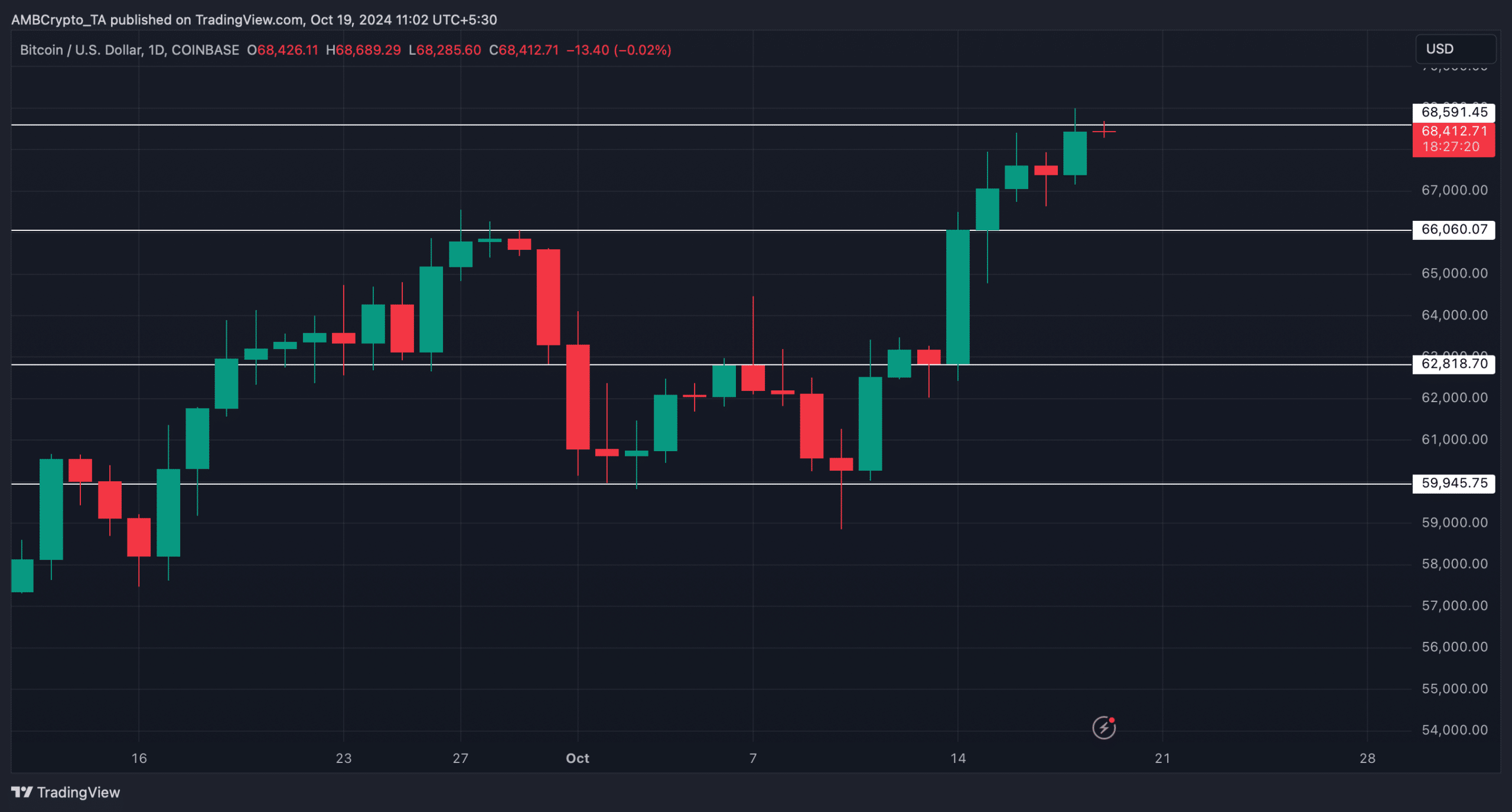

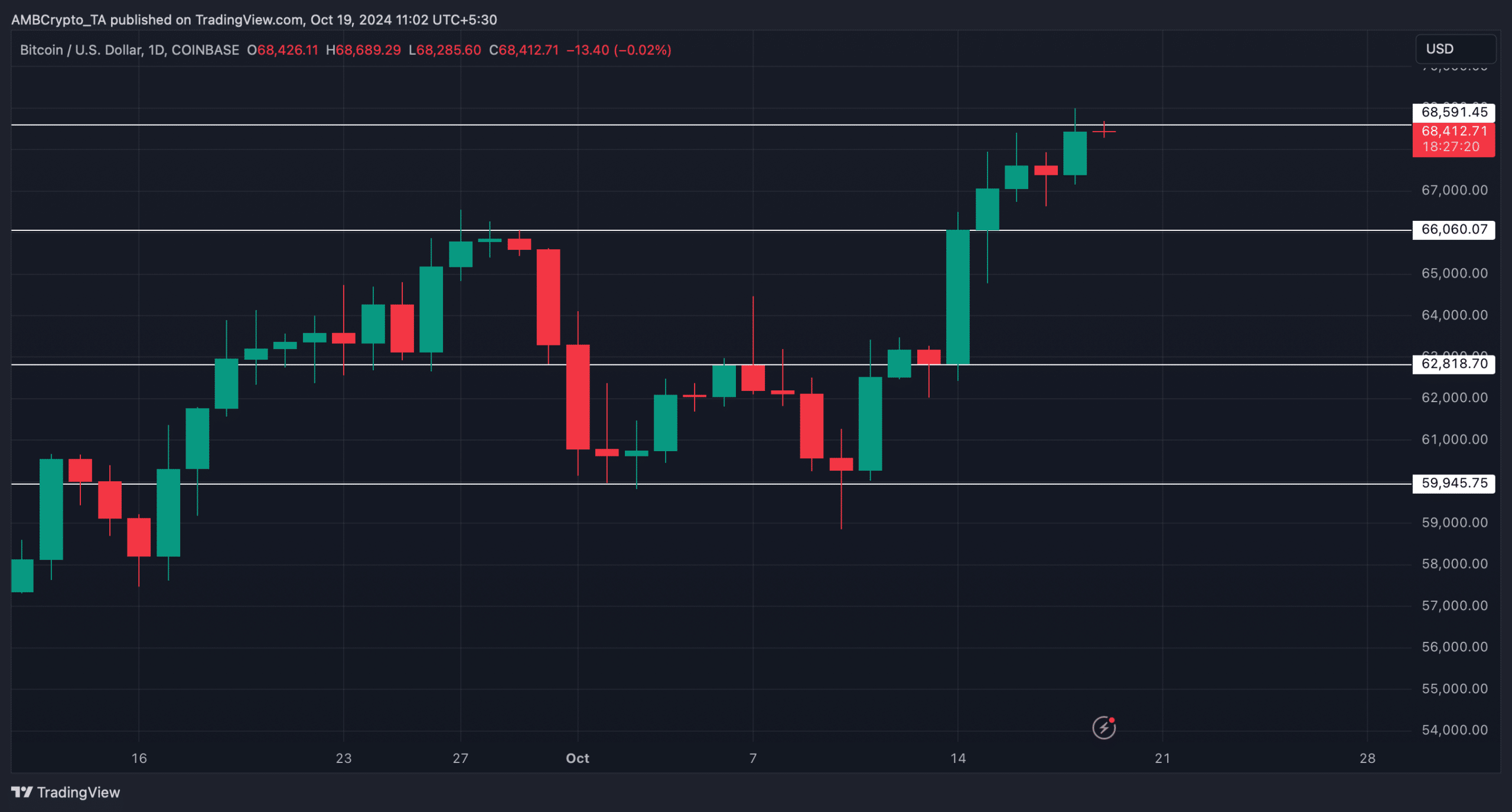

Bitcoin [BTC] has been on a steady rise over the past week. The latest bull trend even allowed the King Coin to cross the $68,000 mark on the price charts. However, the prevailing trend can change quickly, albeit for a short time.

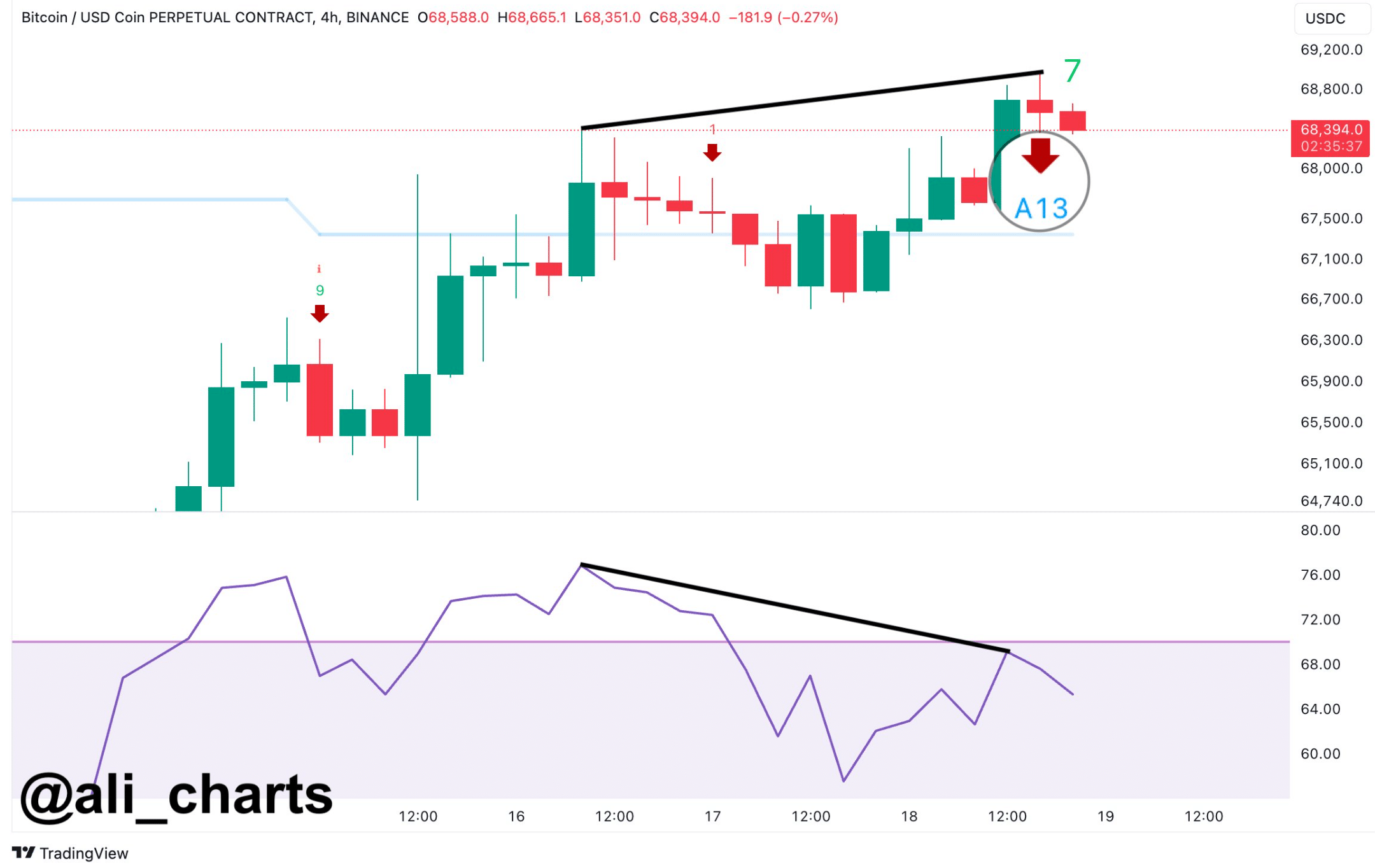

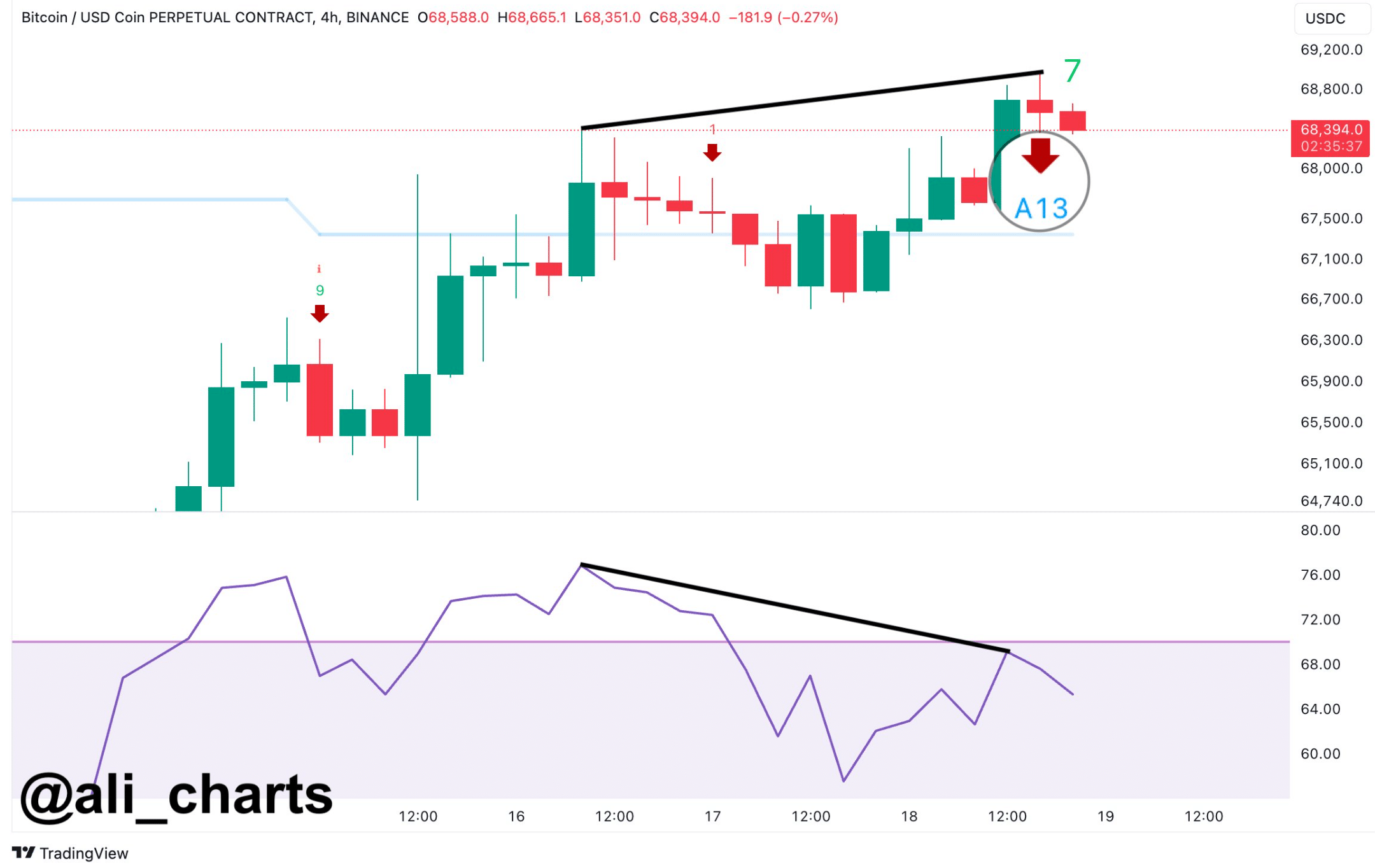

This seemed to be the case, especially as a bearish divergence appeared on Bitcoin’s price chart.

Bitcoin’s Key Strengths

According to CoinMarketCapThe price of the crypto rose by more than 9% last week, allowing it to rise above $68,000. AMBCrypto reported earlier a few developments that could have played a major role in BTC’s most recent rally.

For example, Bitcoin supply on exchanges fell to its lowest level in five years. This clearly meant that buying sentiment was dominant in the market – indicating a price increase.

Apart from that, also AMBCrypto reported how BTC’s Open Interest soared. To be precise, Bitcoin Open Interest reached a record $20 billion, just 8% below its ATH. When the measure rises, it means there is a good chance that the ongoing price trend will continue.

Satoshi Club, a popular X-handle that shares updates related to cryptos, recently posted tweet points to yet another important development. According to the same information, the supply of BTC at addresses that purchased something in the past twelve months is now at its highest level in two years. This trend has accelerated recently as ETFs saw $2.1 billion in inflows over the past five days.

Nevertheless, not everything has worked in the king’s favor. Ali, a popular crypto analyst, shared one tweetwhere there is a bearish divergence. This indicated that there were opportunities for a price correction in the short term. Therefore, it is worth taking a closer look at the current state of Bitcoin.

Source:

Is a price correction inevitable?

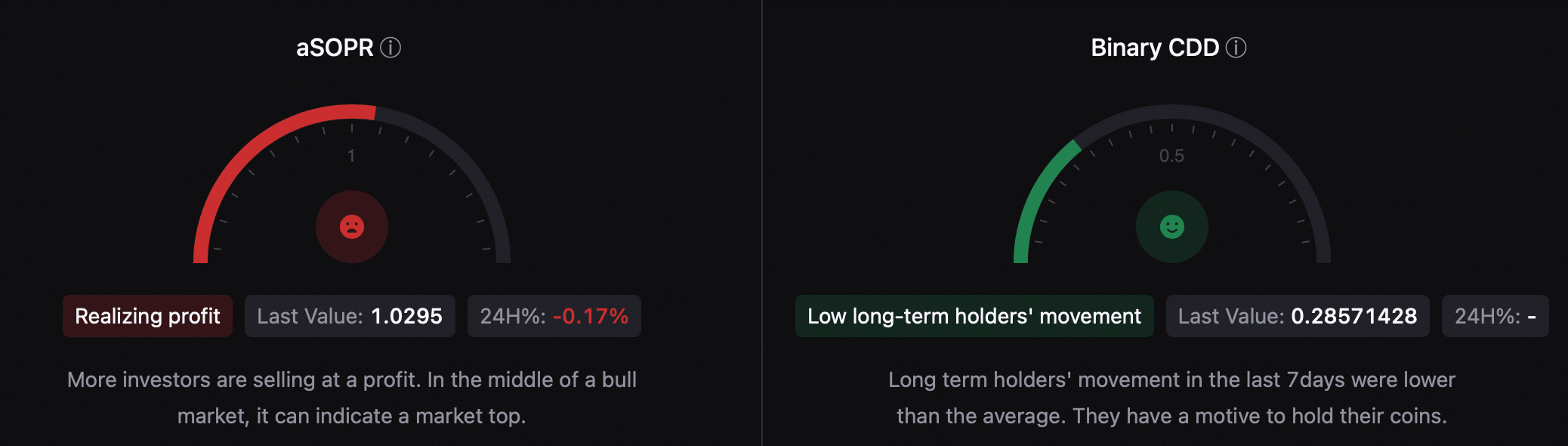

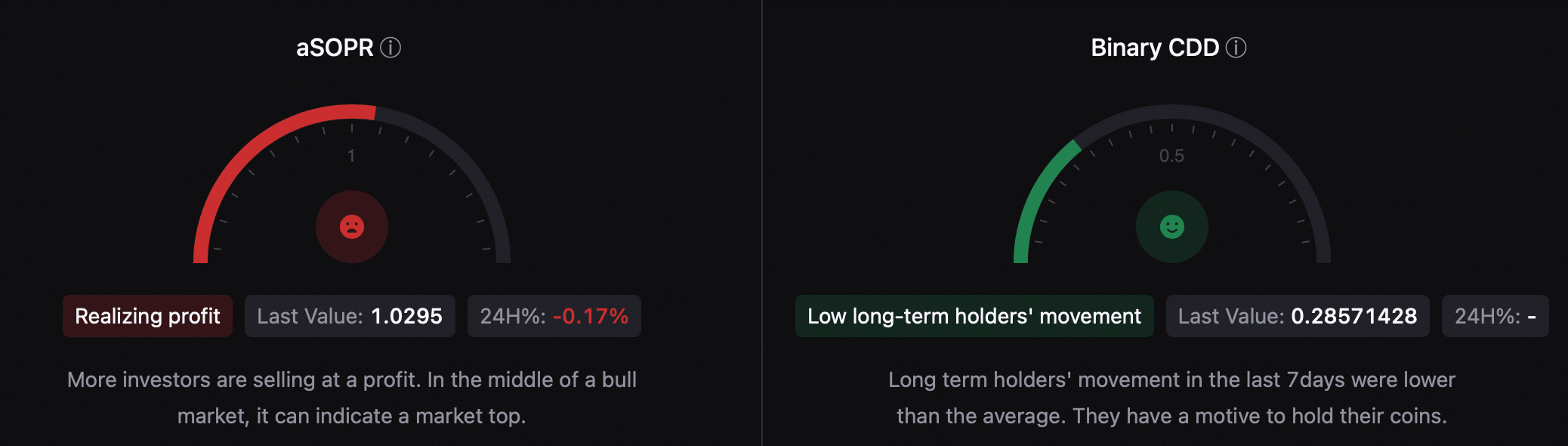

AMBCrypto’s analysis of CryptoQuant facts produced some interesting figures. For example, the king coin binary CDD was green, meaning that the movement of long-term holders over the past seven days was lower than the average. They have a motive to hold on to their coins.

However, the aSORP suggested that more investors have sold at a profit. In the middle of a bull market, this could indicate a market top.

Additionally, the NULP was also bearish as it indicated that investors were in a belief phase where they were in a state of high unrealized gains.

Source: CryptoQuant

Finally, we then looked at Bitcoin’s daily chart to find the possible support to which the coin could fall in the event of a price correction.

Read Bitcoins [BTC] Price prediction 2024–2025

According to our analysis, a price correction could cause BTC to drop again to $66,000. A slip below that level could push the coin further to $62.8k.

Source: TradingView