- Spot Bitcoin ETFs reached historic numbers in terms of net inflows.

- BTC was only $6,000 away from ATH.

Discover Bitcoin [BTC] Exchange Traded Funds (ETFs) continued to break records and defy expectations.

In a notable development, cumulative total net inflows into Spot Bitcoin ETFs have crossed the $20 billion mark for the first time since their launch in January.

This record level was reached after a massive inflow of $1.5 billion in just four days.

Eric Balchunas, senior ETF analyst at Bloomberg, marked the significance of this milestone on X (formerly Twitter). He stated,

“TThe most imp number and hardest metric to grow in the ETF world.”

He further compared it to gold ETFs, noting that:

“IT It took gold ETFs about 5 years to reach the same number.”

BlackRock records the highest inflow

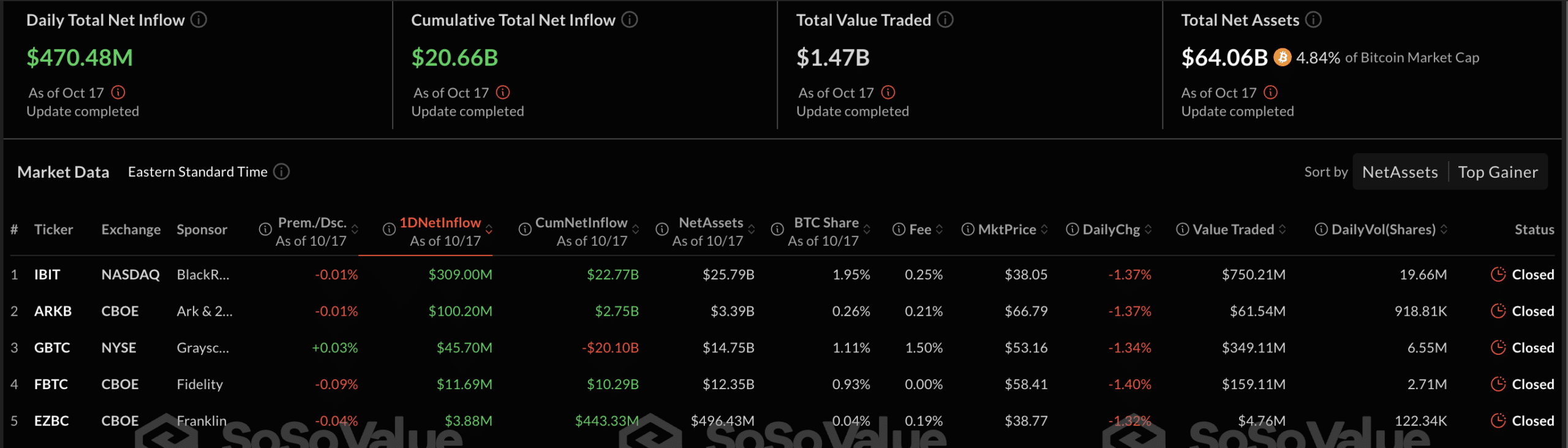

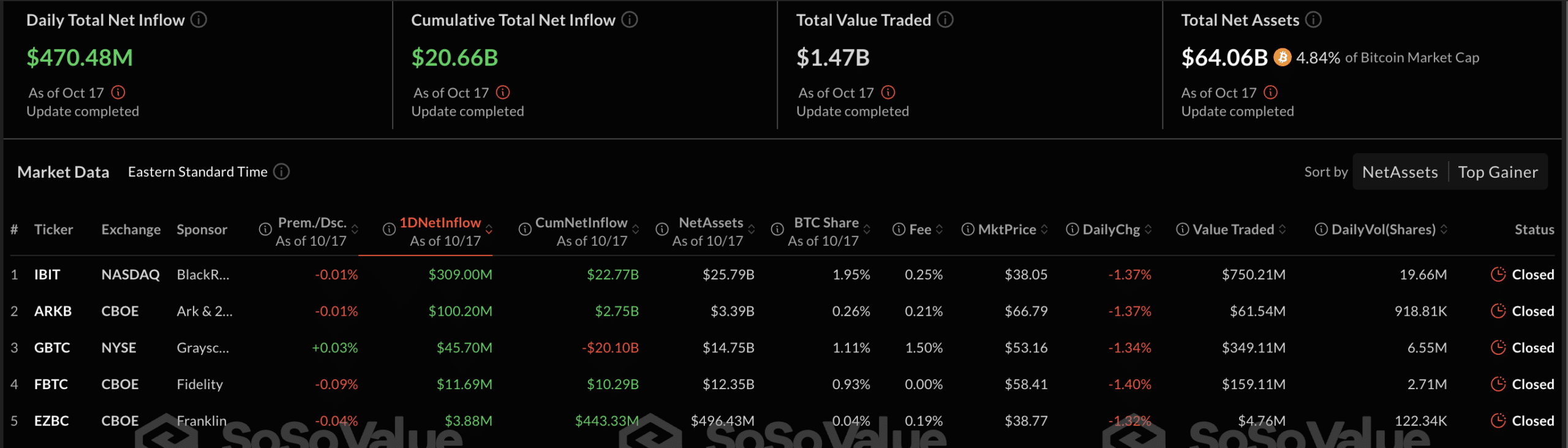

It’s worth noting that BlackRock’s iShares Bitcoin Trust (IBIT) has been a major contributor to these inflows. Facts reported from SoSo Value revealed that BTC Spot ETFs saw total net inflows of $470 million on October 17.

Of which IBIT led the way with an impressive $309 million. Ark Invest and 21Shares’ ETF ARKB followed with net inflows of $100 million.

Source: SoSo value

As a result of these inflows, total assets in spot Bitcoin ETFs now stand at $64 billion.

On October 16, IBIT experienced a substantial net inflow of $393.4 million, marking the largest inflow since July.

At the time of writing, BlackRock’s net assets were over $25 billion. The product accounted for 1.95% of the total Bitcoin market share of $1.3 trillion.

Is there a new ATH nearby for BTC?

The increase in the number of spot Bitcoin ETFs was not the only bright spot this week. The cryptocurrency market has brought the long-awaited ‘Uptober’ rally to life.

After a brief dip to around $58,000 on October 10, BTC skyrocketed to a high of over $68,000 in just six days.

Over the past week, the stock rose by double digits and rose about 12%. At the time of writing, Bitcoin was trading at $67,786, just 8% lower than its all-time high (ATH) of over $73,000.

As a result, optimism among traders has increased, with many speculating that this bull cycle could propel Bitcoin to new highs.

The combination of bullish sentiment and a potential supply shock has led to renewed enthusiasm and interest in the assets, suggesting the rally may be far from over.

Bitcoin: 10th most valuable asset in the world

While the King Coin remains the largest cryptocurrency by market value, it has also managed to secure its place among the top tier of monetary assets. According to CompaniesMarketCap, Bitcoin is now the 10th largest monetary assets worldwide.

This achievement underlines Bitcoin’s growing influence not only on digital assets, but also on global financial markets.