- SHIB’s technical indicators pointed to positive momentum, but a bullish trend still needs confirmation

- Rising transactions and lower reserves supported SHIB, but MVRV hinted at possible profit-taking

Shiba Inu [SHIB] is in the news today after it saw a massive 14,575% increase in burn rate, removing 279 million tokens from circulation. Consequently, this token burn has created a wave of positive sentiment, pushing SHIB’s price up 3.43% to $0.00001889 over the past 24 hours.

However, will this momentum drive SHIB’s long-term growth?

SHIB Technical Analysis – Is the Token Ready for a Rally?

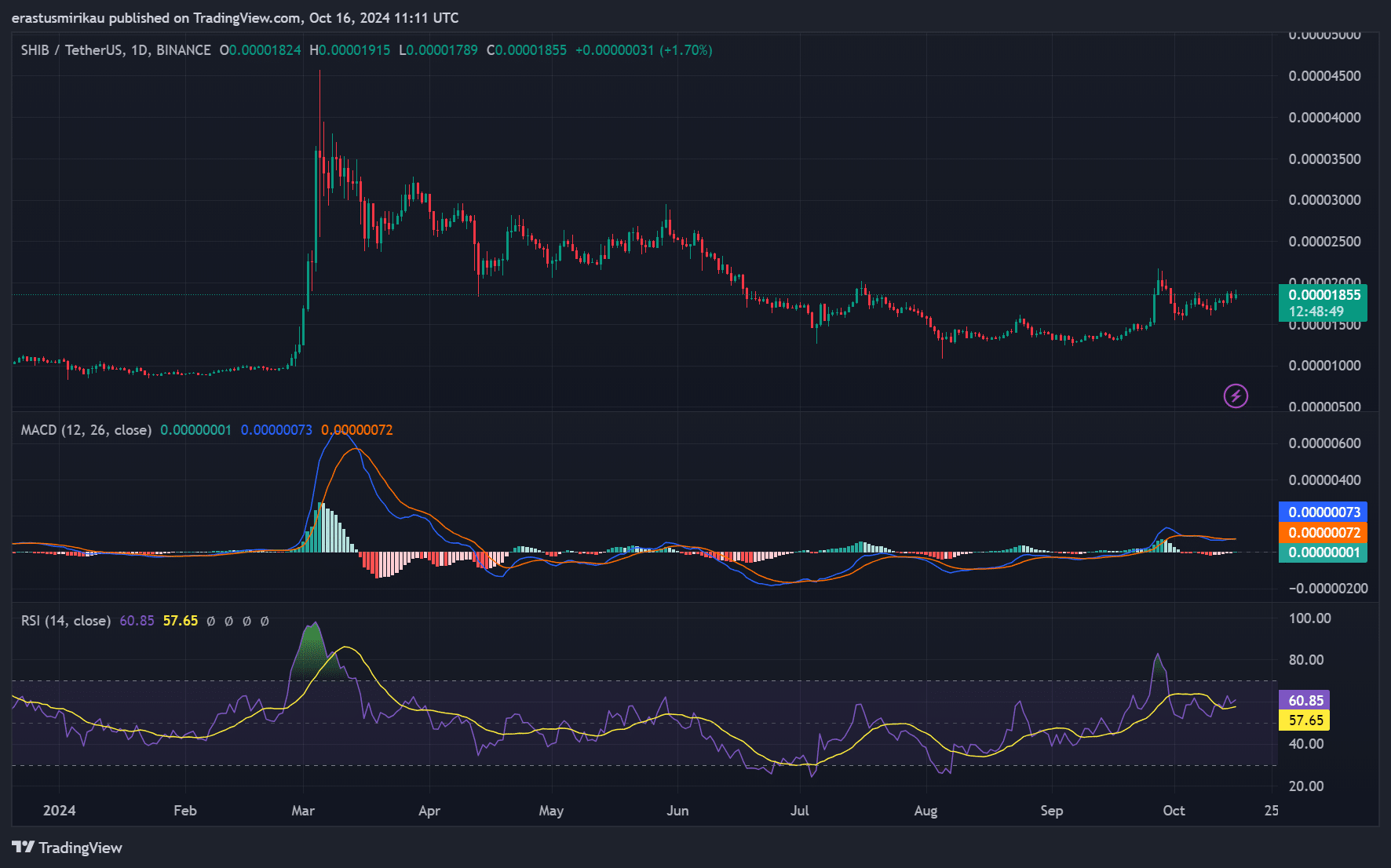

The memecoin’s technical indicators showed a cautiously optimistic outlook. The MACD has recently entered positive territory, indicating upward momentum. However, this early signal was still not strong and further confirmation is needed before a clear bullish trend can be established.

The RSI stood at 60.85 at the time of writing, indicating that Shiba Inu is not yet overbought, with potential room for further price growth.

Therefore, these signals suggested that SHIB could continue to rise. However, investors should proceed cautiously and pay attention to stronger indicators.

Source: TradingView

Rising transactions and active addresses – a bullish sign?

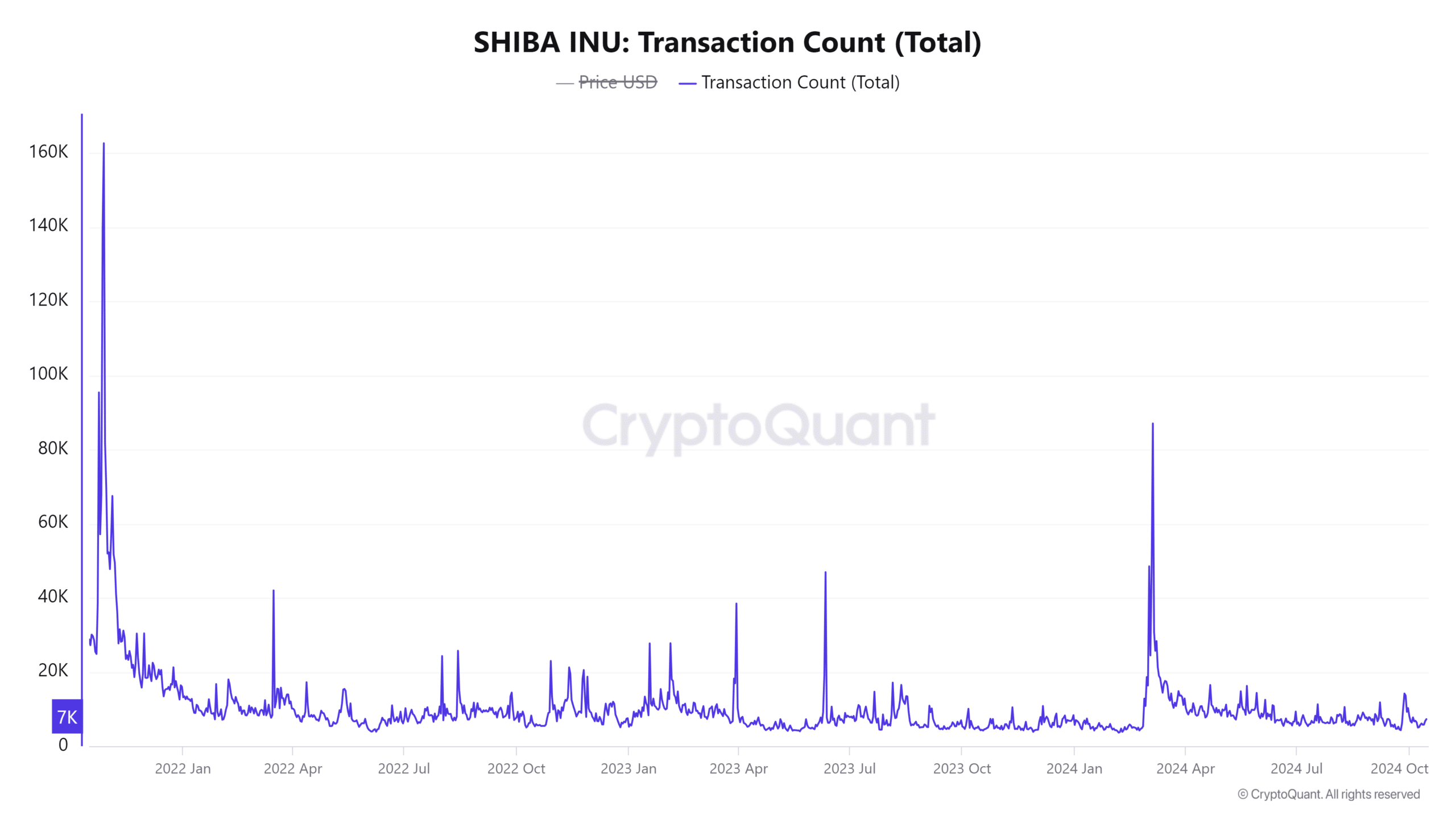

Moreover, SHIB’s growing network activity contributed to the bullish situation. The total number of active addresses increased by 37.93% and reached 6,391 in the last 24 hours. CryptoQuant data. In addition, the number of transactions doubled, by 100% to 7,083.

These statistics indicated increased engagement and growing demand for the token. An increase in activity is often a sign of a healthier network. And this could lead to a continued price increase.

However, for Shiba Inu to continue its upward trajectory, the network must maintain its high activity level.

Source: CryptoQuant

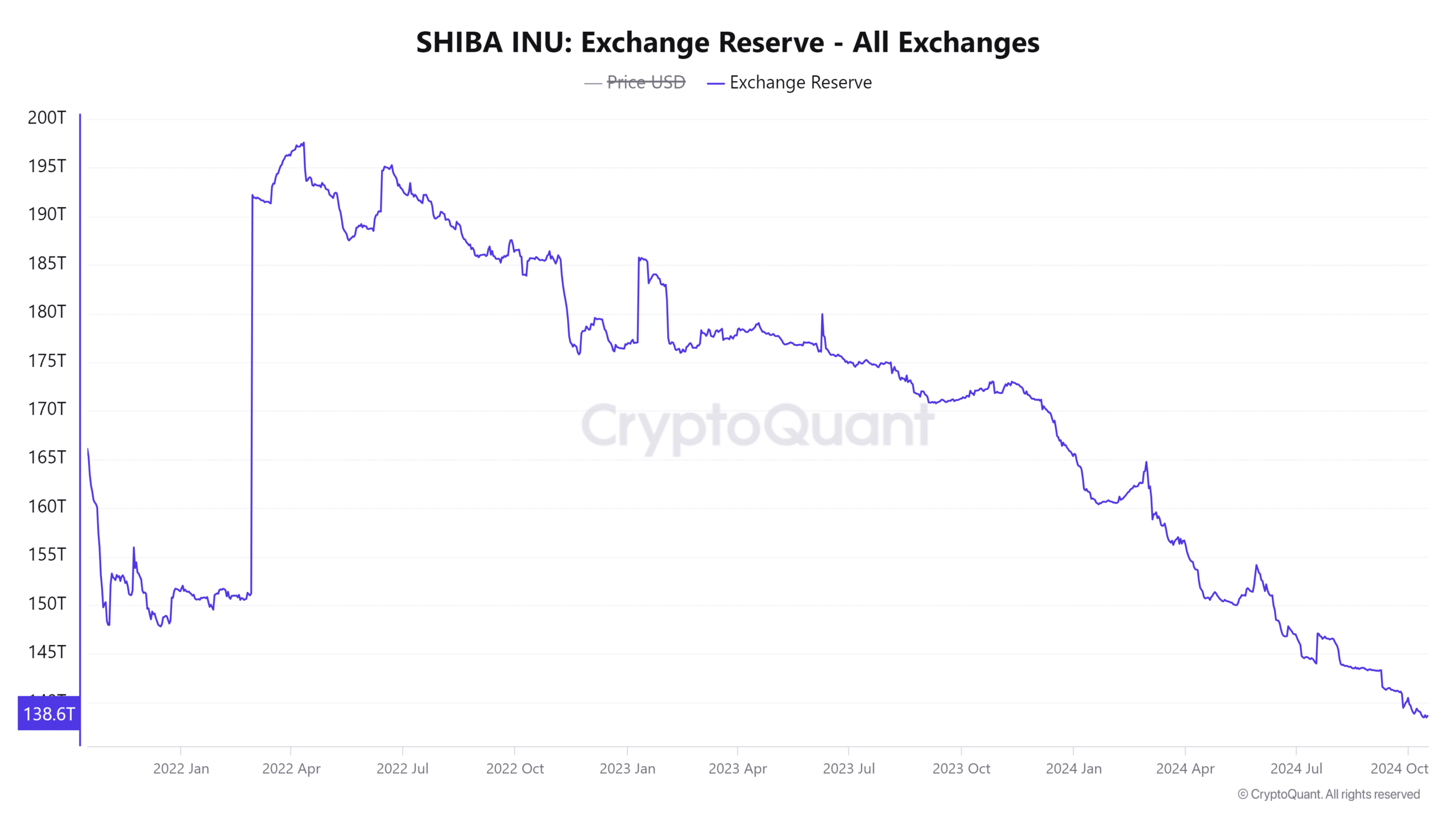

Declining foreign exchange reserves – What does this mean for SHIB?

Currency reserves fell slightly by 0.04%, while figures for the same stood at 138.61T tokens at the time of writing. In general, declining foreign exchange reserves mean that there are fewer tokens available for sale – a sign that holders may be accumulating rather than selling.

This trend could reduce selling pressure and support further price increases. However, the small change in reserves calls for cautious optimism and traders should keep an eye on any significant shifts in this measure.

Source: CryptoQuant

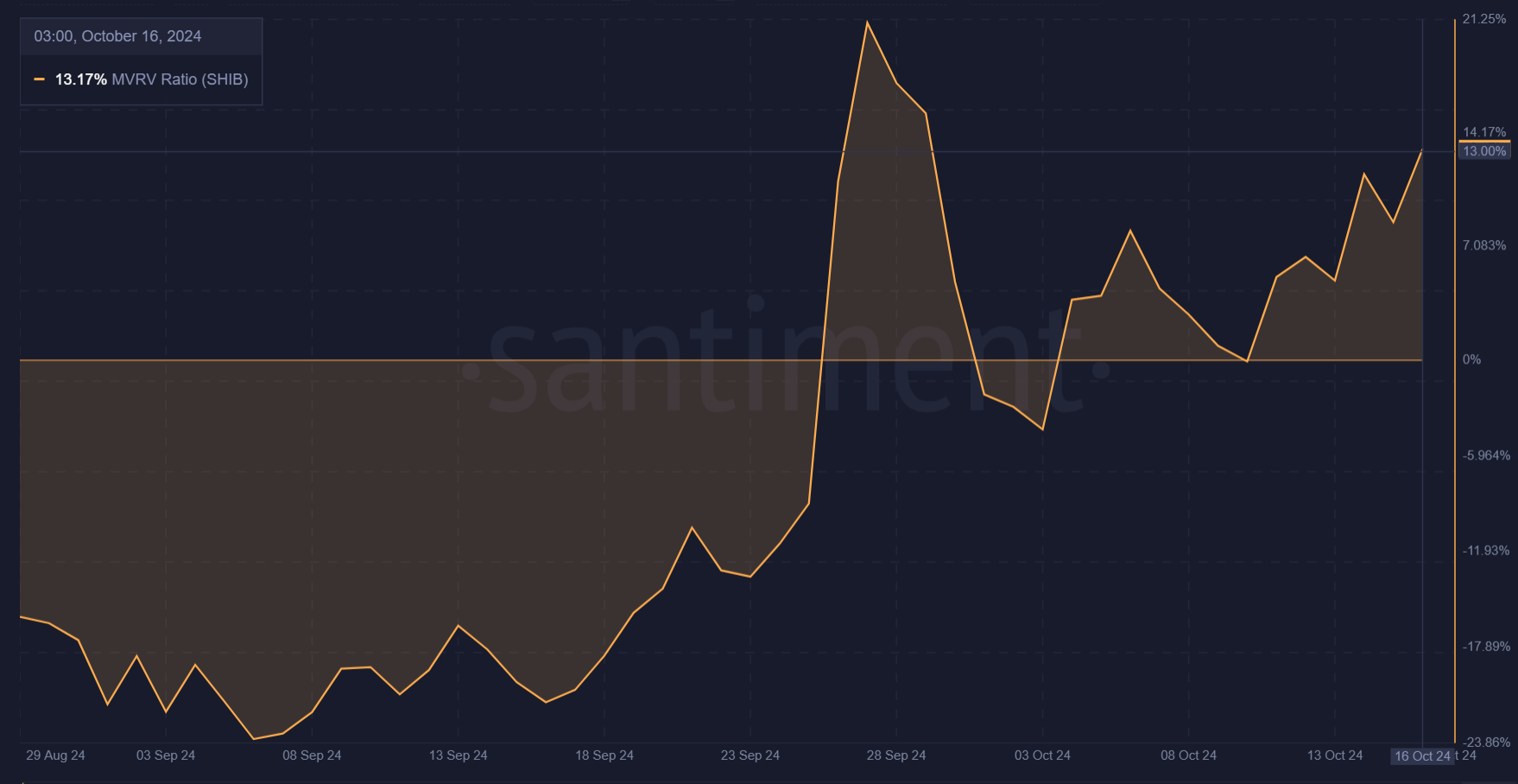

SHIB’s MVRV Ratio – Should Investors Be Cautious?

Finally, the MVRV (Market Value to Realized Value) ratio stood at 13.17% at the time of writing – a sign that the token may be slightly overvalued. Consequently, this could mean that short-term holders are sitting on profits and may soon be able to take profits as well.

While the increase in the MVRV does not necessarily predict a price decline, it does underline the potential selling pressure. This could limit SHIB’s advantage.

Source: Santiment

Read Shiba Inu’s [SHIB] Price forecast 2024–2025

Simply put, SHIB’s increase in fire rates has created excitement, but technical indicators pointed to the need for cautious optimism.

While rising transactions and active addresses are promising signs, Shiba Inu’s slightly increased MVRV ratio indicated that profit-taking could slow momentum.