- The price of XRP rose by more than 3% last week.

- The Long/Short ratio suggested a price drop towards $0.48.

XRPThe company’s price action continued to favor investors over the past week as both the daily and weekly charts were green. An analysis predicted that the token was about to show a massive bull run.

However, the reality may be different.

How are things going with XRP?

CoinMarketCaps data revealed that XRP bulls were dominant last week, as the token’s price rose more than 3%.

Things remained bullish in the past 24 hours as well, as XRP witnessed a 2% price increase over the past day.

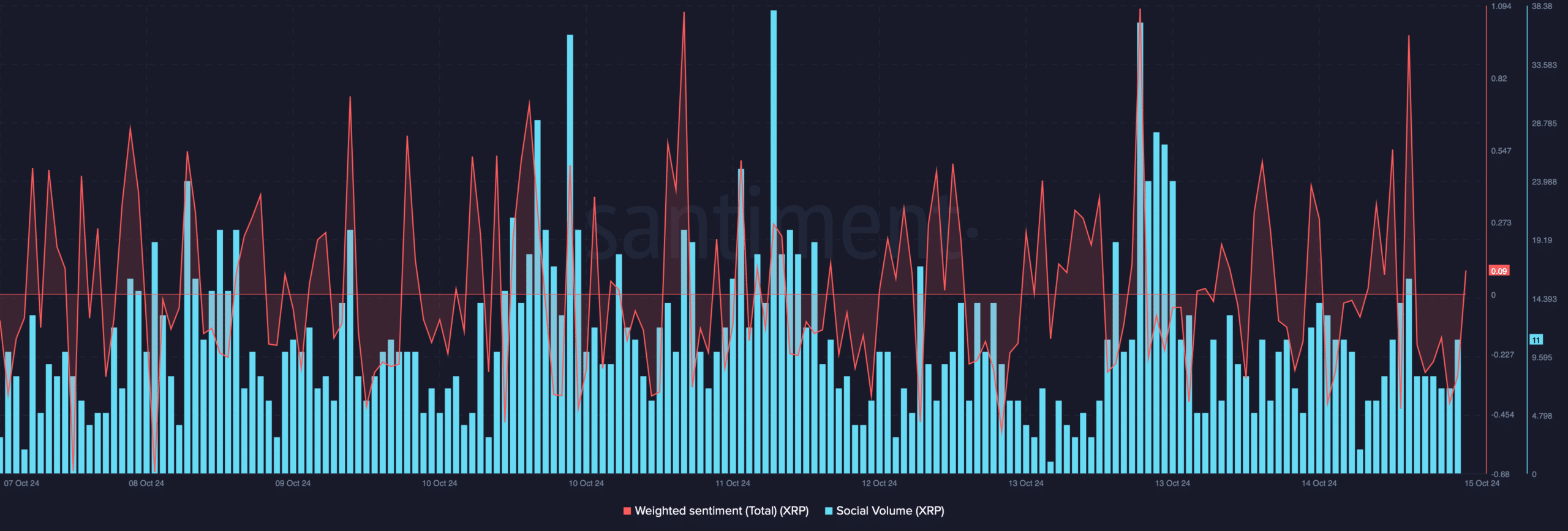

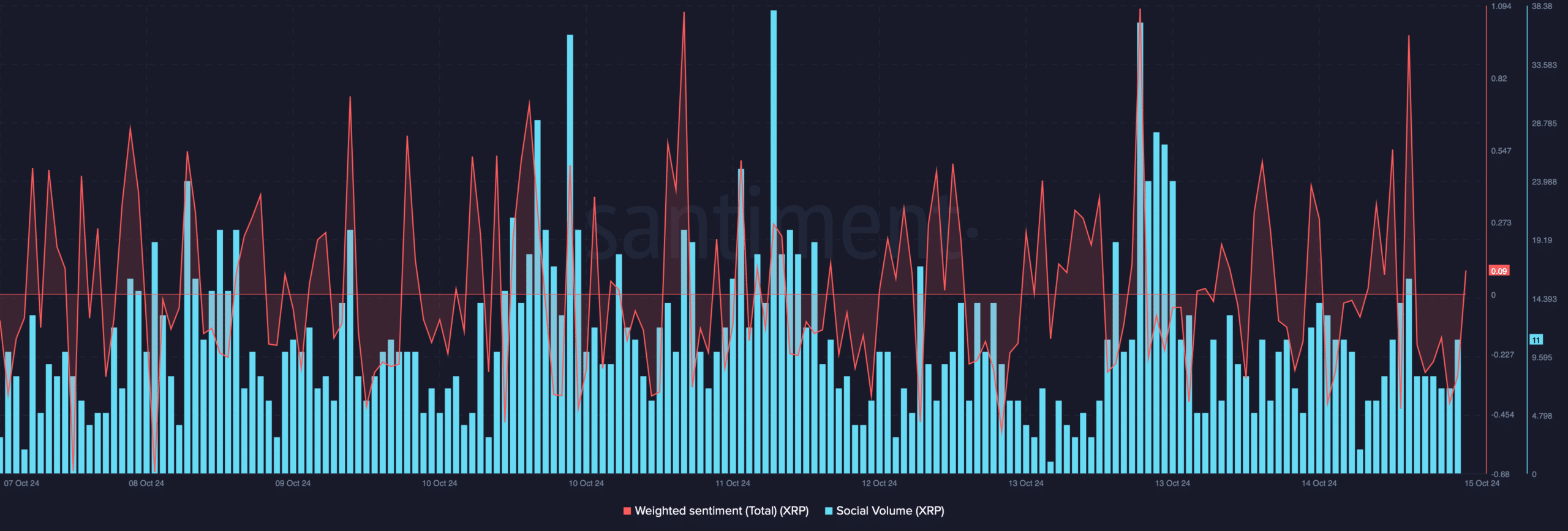

However, this latest price increase could not positively impact the token’s social metrics. For example, the token’s social volume dropped, reflecting a decline in the token’s popularity.

Weighted sentiment also fell, meaning bearish sentiment around the token increased.

Source: Santiment

The near future of XRP

A few days ago, Amonyx, a popular crypto analyst, posted one tweet suggesting that XRP was waiting for a massive bull rally. The analysis appeared to take Elliott Wave Theory into account.

Source:

For the uninitiated, Elliott Wave Theory in technical analysis describes price movements in the financial market.

The theory involves plotting the tops and bottoms of a price chart and helps identify when an asset’s price might rise.

Returning to Amonyx’s tweet, a bullish pattern was highlighted, and XRP was testing resistance. A breakout could have sparked a bull rally.

A similar episode has occurred in the past, allowing XRP to initiate a bull run. However, this did not happen on this occasion as the token witnessed a correction.

Therefore, AMBCrypto planned to take a closer look at XRP’s on-chain data to figure out where the token was headed.

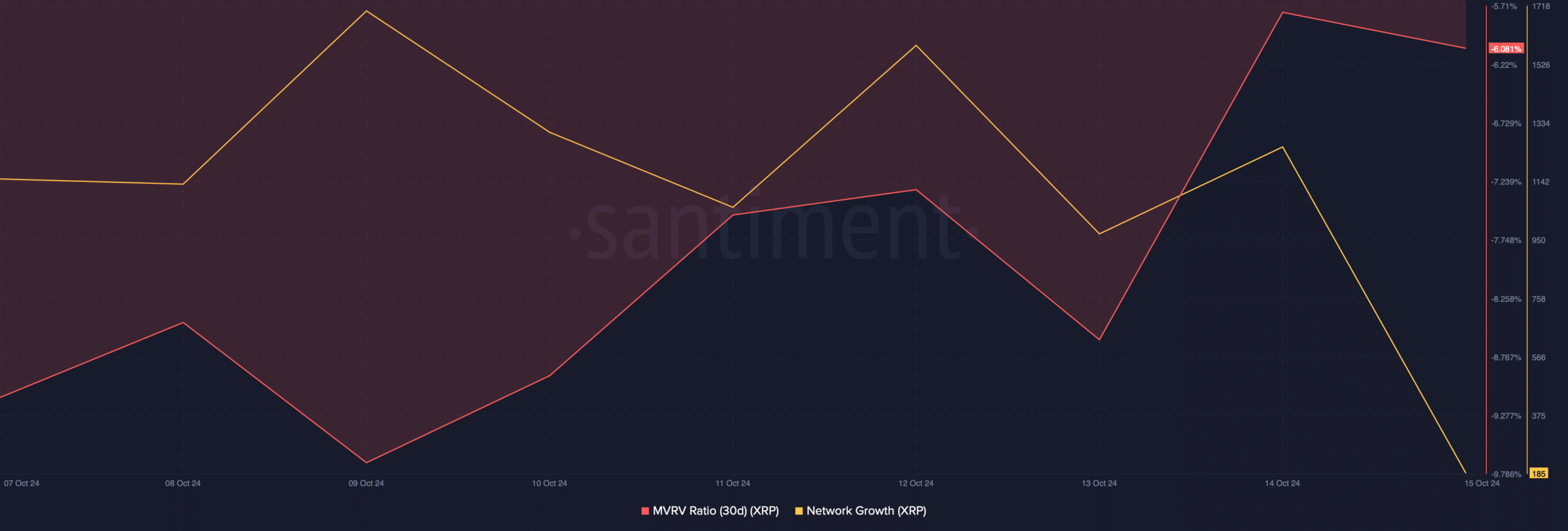

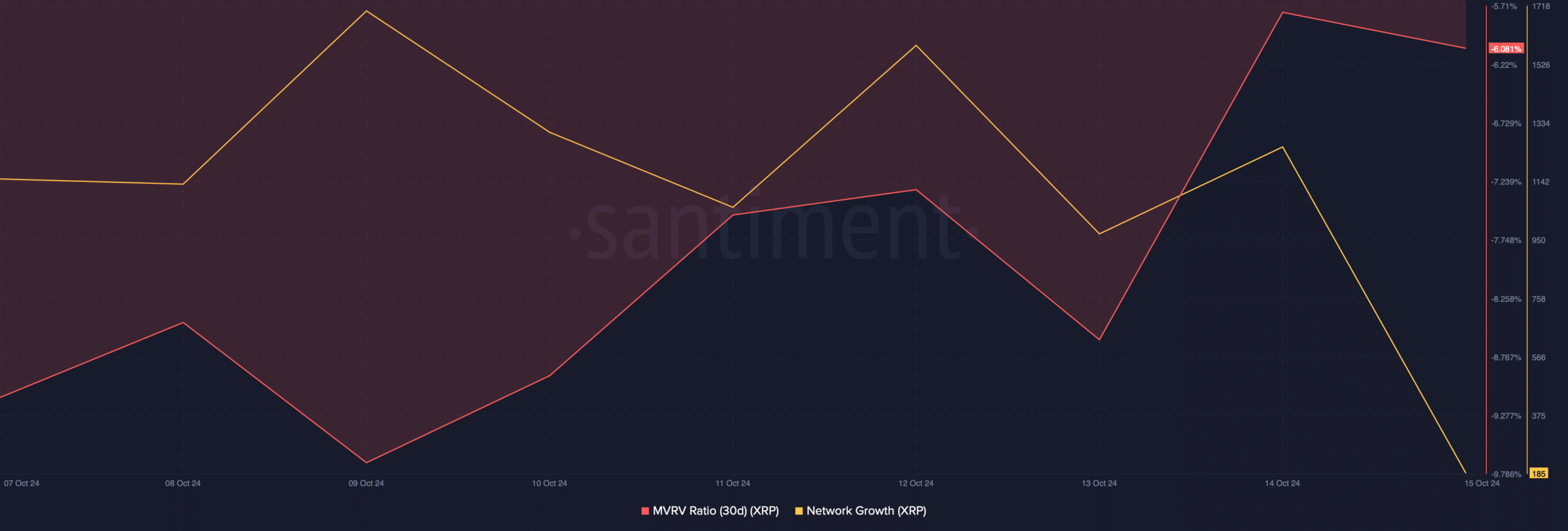

According to our analysis of Santiment’s data, network growth has fallen sharply over the past week. This indicated that fewer new addresses were being created to transfer the token.

Mint glass’ facts revealed that XRP’s Long/Short ratio also fell. When the measure falls, it means that there are more short positions in the market than long positions, which can be considered a bearish sign.

Nevertheless, the MVRV ratio looked hopeful as it improved in recent days.

Source: Santiment

Realistic or not, here it is The market capitalization of XRP in terms of BTC

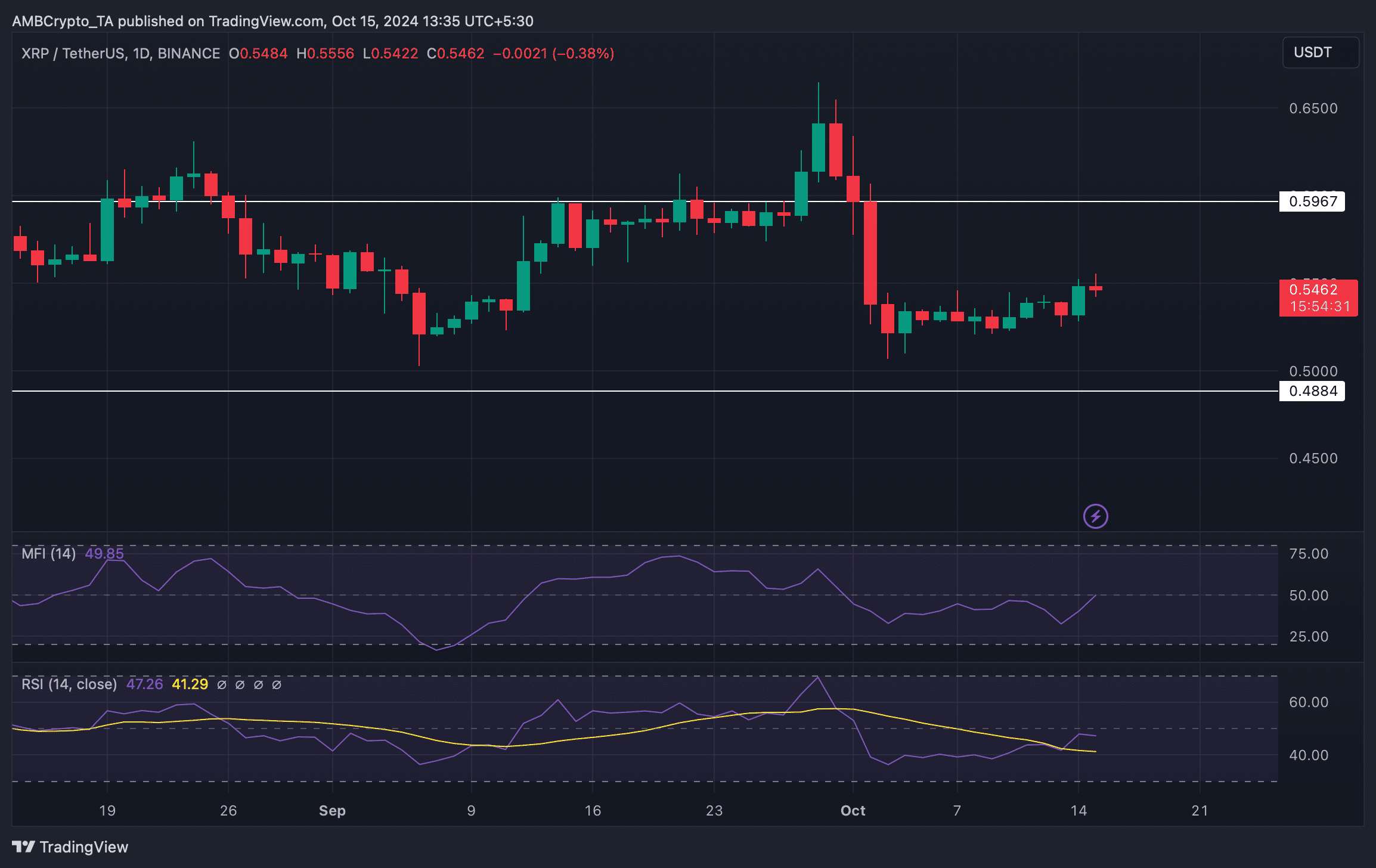

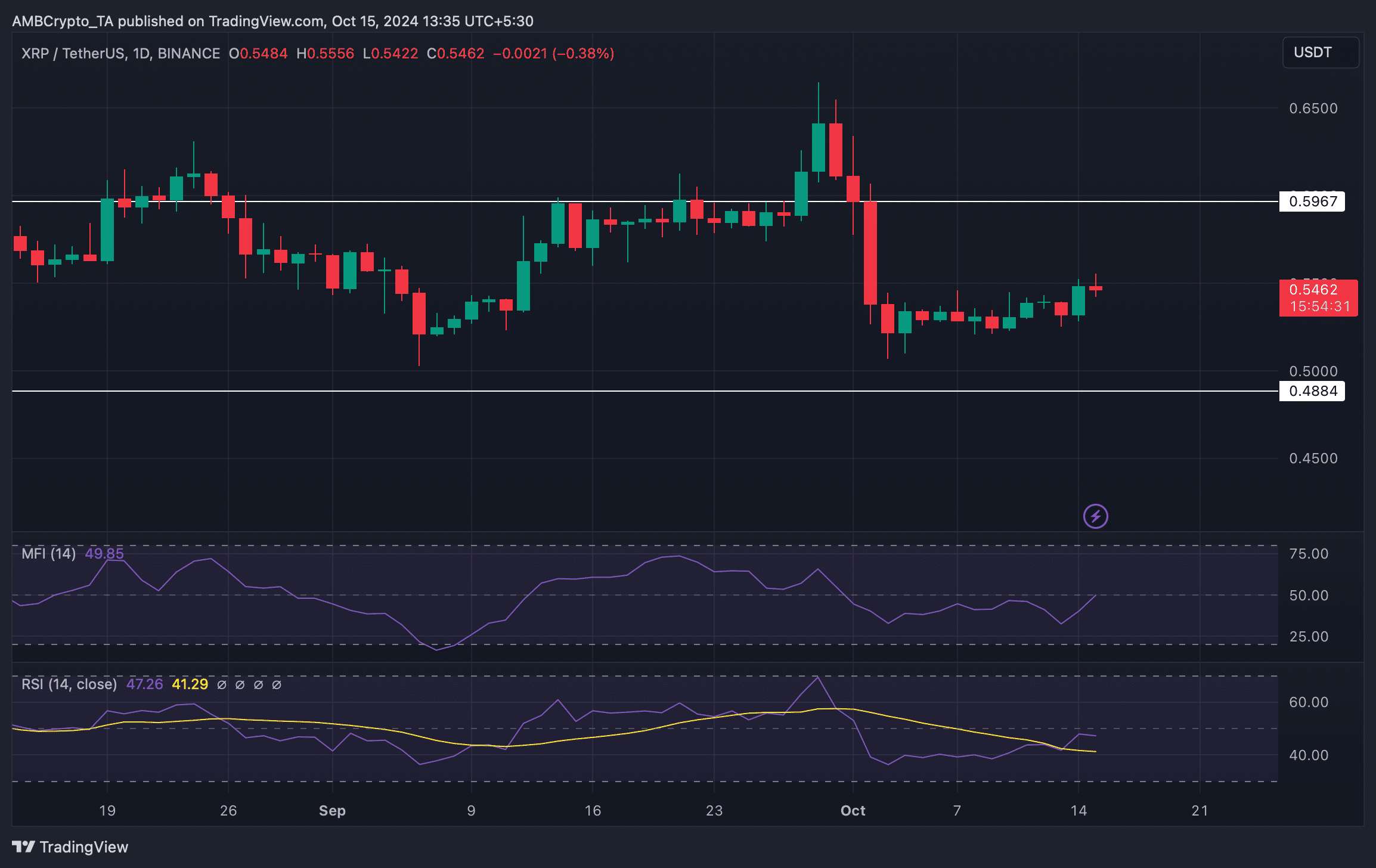

We then took a look at the token’s daily chart to better understand the possible goals the token can achieve in the coming days. According to our analysis, the Relative Strength Index (RSI) registered a downward trend.

If that results in a price drop, XRP could soon drop to $0.48. However, the Money Flow Index (MFI) moved north, indicating a possible price increase towards $0.59.

Source: TradingView