This article is available in Spanish.

Bitcoin saw a significant increase, from a low of $62,050 on Sunday to a high of $66,500 late Monday. As of Tuesday, BTC price corrects slightly below this key resistance level but hovers above $65,000. Several critical factors contributed to the rally, including a short squeeze coinciding with the upcoming US elections, strong spot market demand for Bitcoin, and substantial inflows into US Bitcoin Exchange Traded Funds (ETFs).

#1 Short squeeze and US election influence

Yesterday’s price increase can be partially attributed to the liquidation of leveraged short positions. This is what Singapore-based trading company QCP Capital writes in their latest release investor comment that nearly $80 million worth of leveraged Bitcoin and Ethereum shorts were liquidated, putting upward pressure on the market. While some speculate that the postponement of Mount Gox’s repayment deadline to October 2025 played a role, this news was already published on Friday, indicating that other factors were at play during Monday’s rally.

Related reading

“While there are many factors that could explain today’s move, it’s a pretty interesting time when we look at historical price action. We are in mid-October and just three weeks away from the US elections,” notes QCP Capital. In both 2016 and 2020, Bitcoin remained within a tight trading range for months before a significant rally began about three weeks before US Election Day. In 2016, Bitcoin doubled in price from $600 in the first week of January after the election. Similarly, in 2020 it rose from $11,000 to a high of $42,000 in January.

This year, October – often called “Uptober” due to its historically strong performance – was disappointing, with Bitcoin up just 1.2% compared to an average of 21%. The current rally, which comes three weeks before the US election, suggests history could repeat itself, potentially fueling further share price gains as investor optimism increases.

#2 Strong demand for Bitcoin

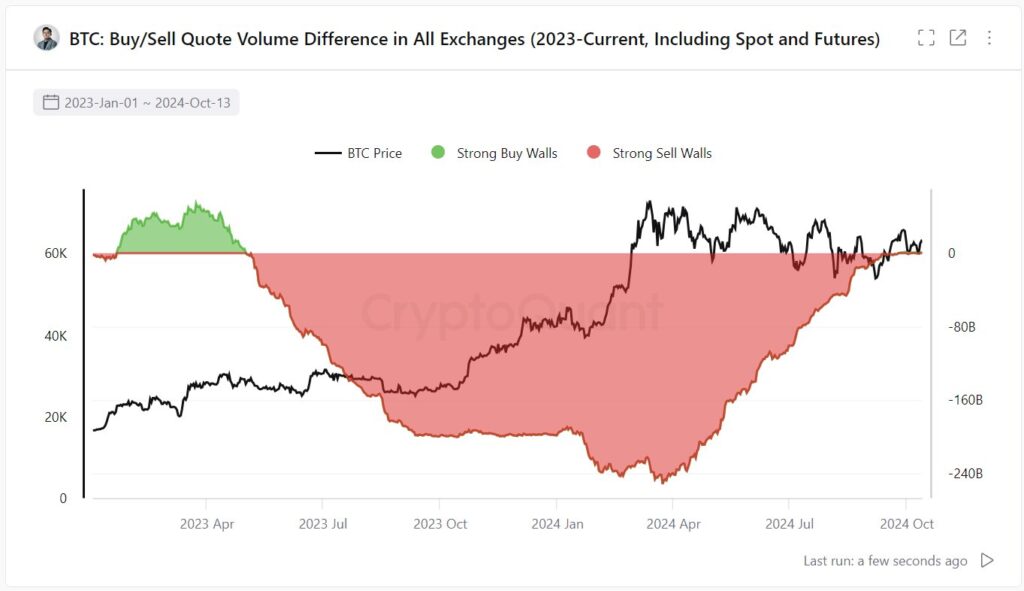

For the first time since mid-2023, Bitcoin buy orders are matching sell orders in spot market order books on several exchanges. Ki Young Ju, Founder and CEO of CryptoQuant, marked this development via X: “Bitcoin buy walls on all exchanges are now strong enough to neutralize sell walls.”

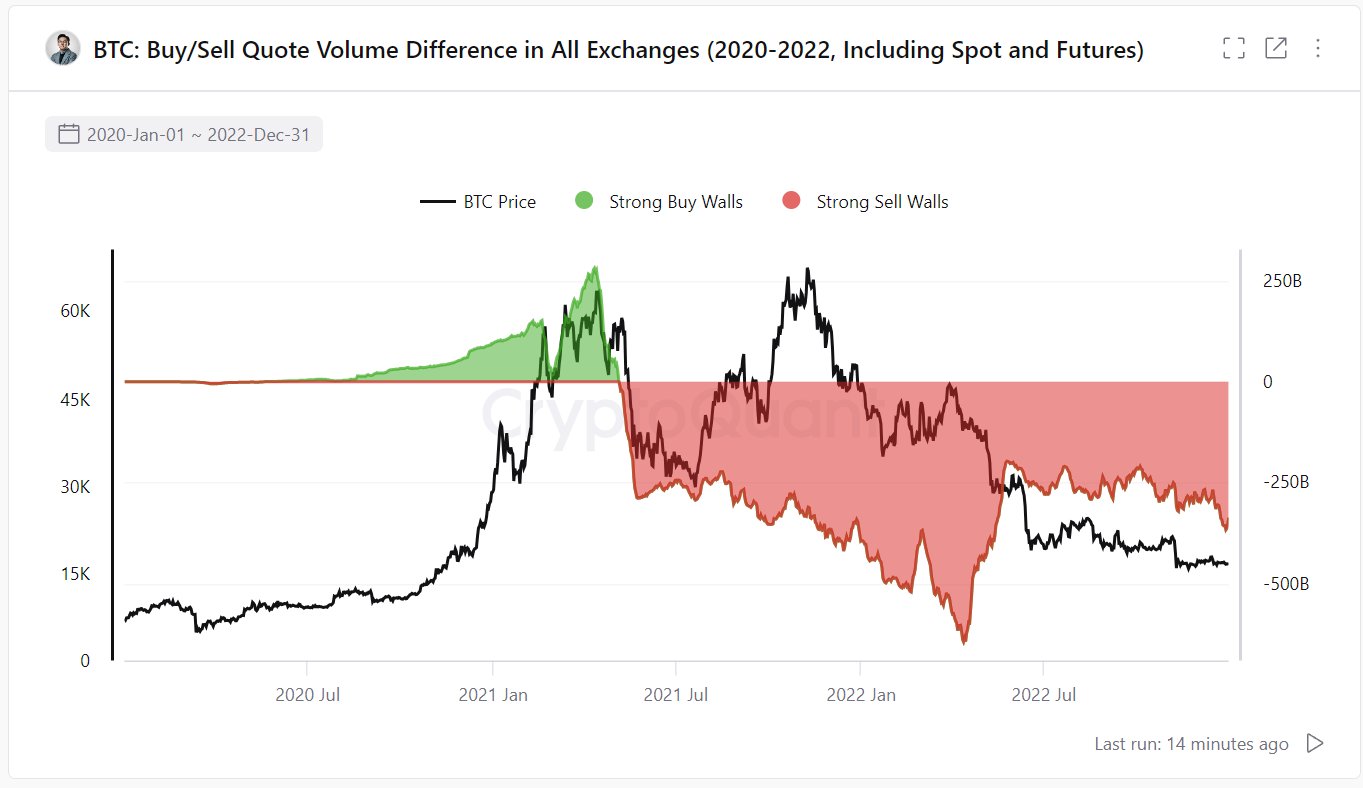

This shift marks a significant change from the trend observed since May 2021. “Data from the last cycle (2020-2022). It is the accumulated difference between quoted buying and selling volumes. Since May 2021, the selling walls have been consistently thicker than the buying walls until the end of the cycle,” says Young Ju.

#3 Increase in Bitcoin ETF Inflows

Monday saw one of the highest Bitcoin ETF inflows ever, with a total of $555.9 million – the largest net inflow day since June 3. This substantial capital inflow was distributed among several large asset managers. BlackRock received $79.5 million, Fidelity attracted $239.3 million, Bitwise collected $100.2 million, Ark Invest saw inflows of $69.8 million, and the Grayscale Bitcoin Trust (GBTC) experienced inflows of $37.8 million.

Related reading

Nate Geraci, president of The ETF Store and host of the ETF Prime podcast, commented about this inflow through Net inflows are now approaching a 10-month net inflow of *$20 billion*. Simply ridiculous and destroys any pre-launch demand estimate. This is NOT “degen retail” $$$ IMO. It is advisors and institutional investors who continue to slowly adopt it.”

At the time of writing, BTC was trading at $65,750.

Featured image created with DALL.E, chart from TradingView.com