- While the token appears positioned for further gains, technical indicators suggest a potential minor pullback.

- Market statistics give a mixed picture of FLOKI’s price direction, reflecting uncertainty among traders.

A renewed interest in Floki [FLOKI] led to a 7.46% increase in trading activity over the past 24 hours, pushing the memecoin’s price to $0.0001488.

The key question now: can this rally sustain itself and drive FLOKI to new highs? Or will a short-term dip precede a stronger upward move? AMBCrypto’s analysis explores these possibilities and more as traders look for the next move.

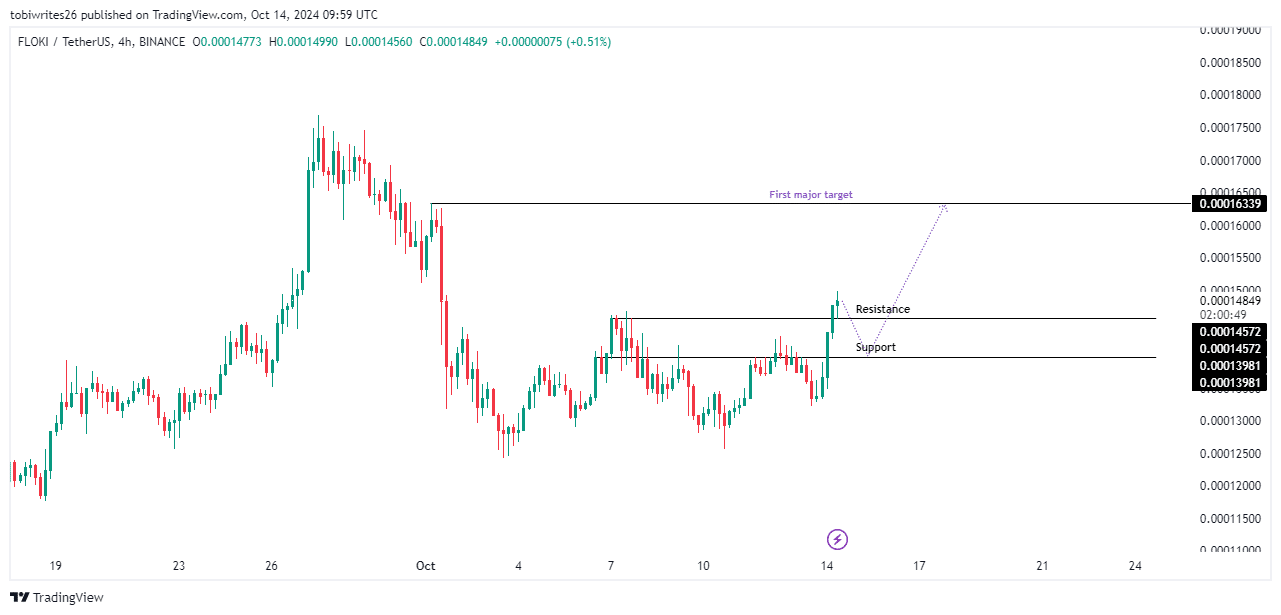

FLOKI’s chart analysis: Bullish, but important resistance in play

FLOKI remains bullish on the 4-hour chart, but if it fails to hold above the key resistance level at $0.00014572 and shows a downtrend, it could fall towards the support at $0.00013981.

With this support, FLOKI is expected to resume its uptrend and target the first major level at $0.00016339. However, if current momentum continues, the token could rise towards this target without experiencing the expected pullback.

Source: trading view

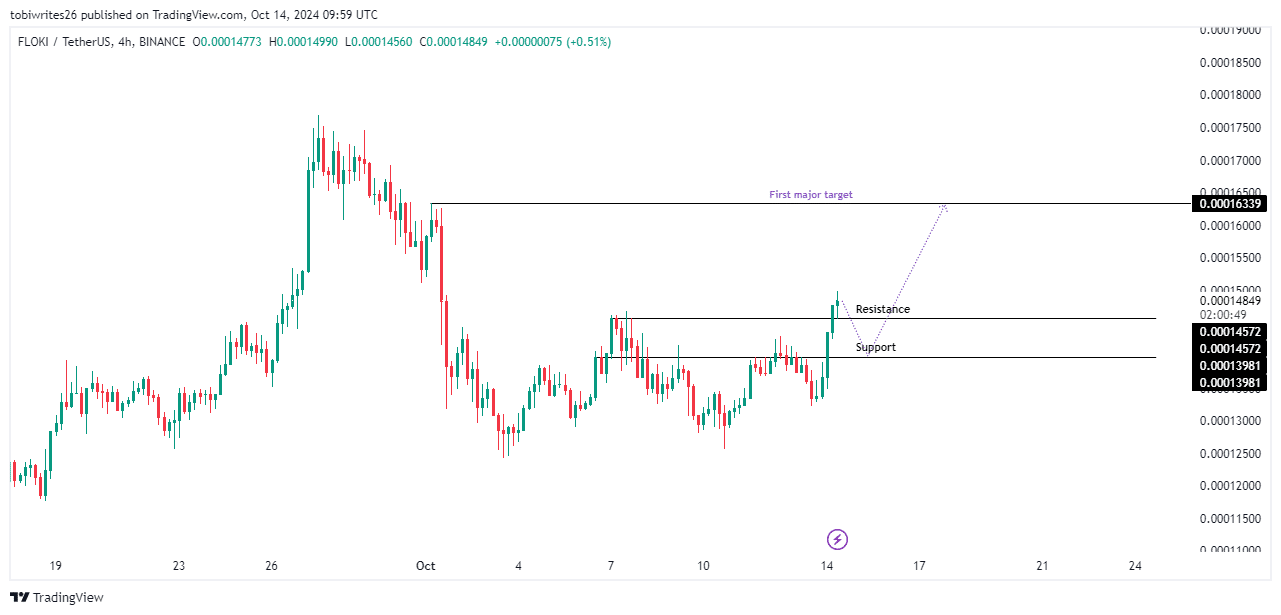

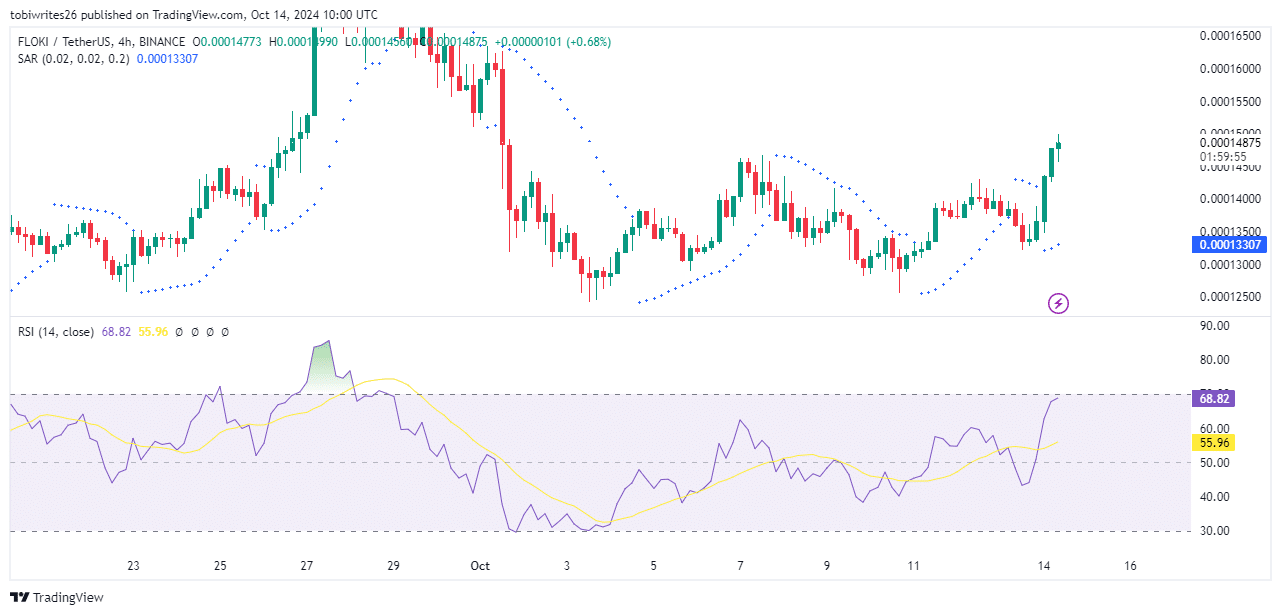

To gauge FLOKI’s next move and assess market sentiment, AMBCrypto analyzed key technical indicators.

The bullish narrative holds for FLOKI

Technical indicators suggest that FLOKI’s bullish momentum remains intact, with the asset likely to continue its upward trajectory.

The Parabolic SAR (Stop and Reverse) indicates that bullish momentum is strong, indicating that a decline to the marked support level may not happen anytime soon.

The role of the Parabolic SAR is to help traders identify price direction and potential reversals: dots below the price indicate an uptrend, while dots above suggest a downtrend.

Likewise, the Relative Strength Index (RSI) continues its climb towards the overbought area above 70. If this level is reached, FLOKI could face a pullback. For now, however, the asset remains firmly bullish.

Source: trading view

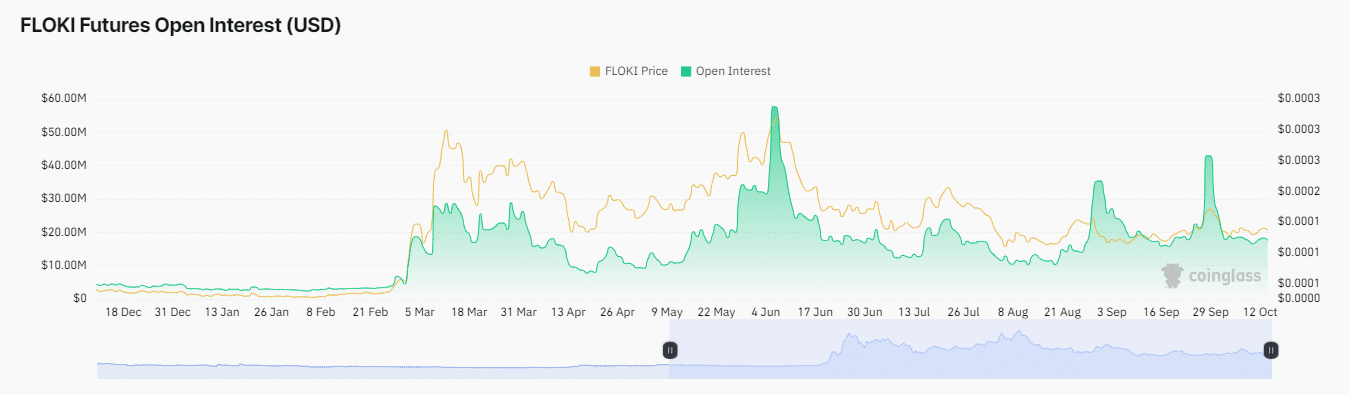

However, on-chain readings show market participants are cautious and somewhat hesitant to fully commit to the rally, pointing to a possible near-term dip.

Rally lacks full support

Traders are hesitant to back FLOKI’s recent rally, both due to Open Interest and liquidation facts indicate that bearish sentiment still prevails.

Open Interest, which measures market sentiment by tracking the balance between long and short positions, continues to trend downward, reflecting a bearish market.

Despite a 15% price increase in the last 24 hours, this increase has not yet significantly affected the chart, indicating that the bears still remain in control.

Source: Coinglass

Realistic or not, here is FLOKI’s market cap in BTC terms

Similarly, liquidation data – which is used to determine the direction of the market by analyzing which side is experiencing losses – shows that long traders have lost more than $63,000 in the past day.

These indicators suggest the market remains bearish, and without a notable shift in sentiment or volume, FLOKI is likely to see further declines.