- Memecoins that topped the gainers list last week may be in need of a correction.

- Meanwhile, low-cap assets could see short-term gains.

The second week of October started Bitcoin [BTC] breaking resistance to test the critical $64K level. This marks a strong recovery from last week’s dip where BTC briefly reached $58,000.

During that phase, the major memecoins posted significant gains, with some even posting triple-digit gains as capital flowed out of Bitcoin.

However, many of these memecoins are now trading below their previous peaks, signaling a potential distribution phase as the market focus returns to BTC.

With Bitcoin on the rebound and most high-cap memecoins heading for a slump, AMBCrypto is seeing a pattern that indicates the market may be approaching the tail end of the market. memecoin fad rather than the start of a ‘super cycle’. If this trend continues, a broader market cooldown could be imminent.

The best memecoins are lagging behind

This graphic indicates that the past week featured a memecoin-led cycle, with 3 out of 5 coins dominated by memes, each gaining over 30% in just one week.

This moment marked a shift; While low-cap altcoins usually gain momentum when BTC bottoms, traders are now turning en masse to high-cap memecoins for high-risk, high-reward opportunities.

Essentially, the recent BTC correction caused a capital flight into these larger tokens. But as traders lock in their profits, the funds may soon flow into smaller, low-capitalization memecoins, reminiscent of the altcoins’ surges after every Bitcoin top.

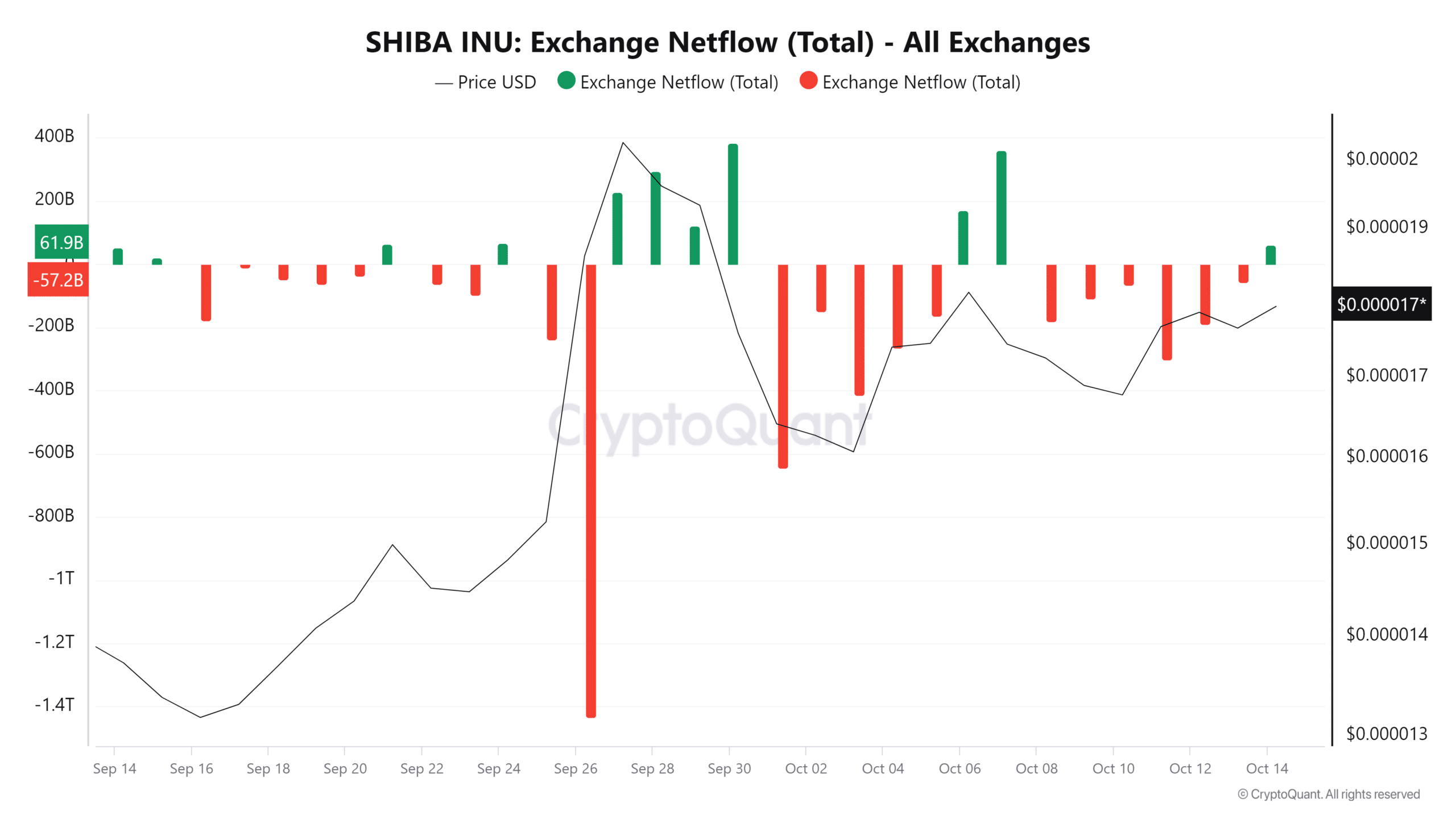

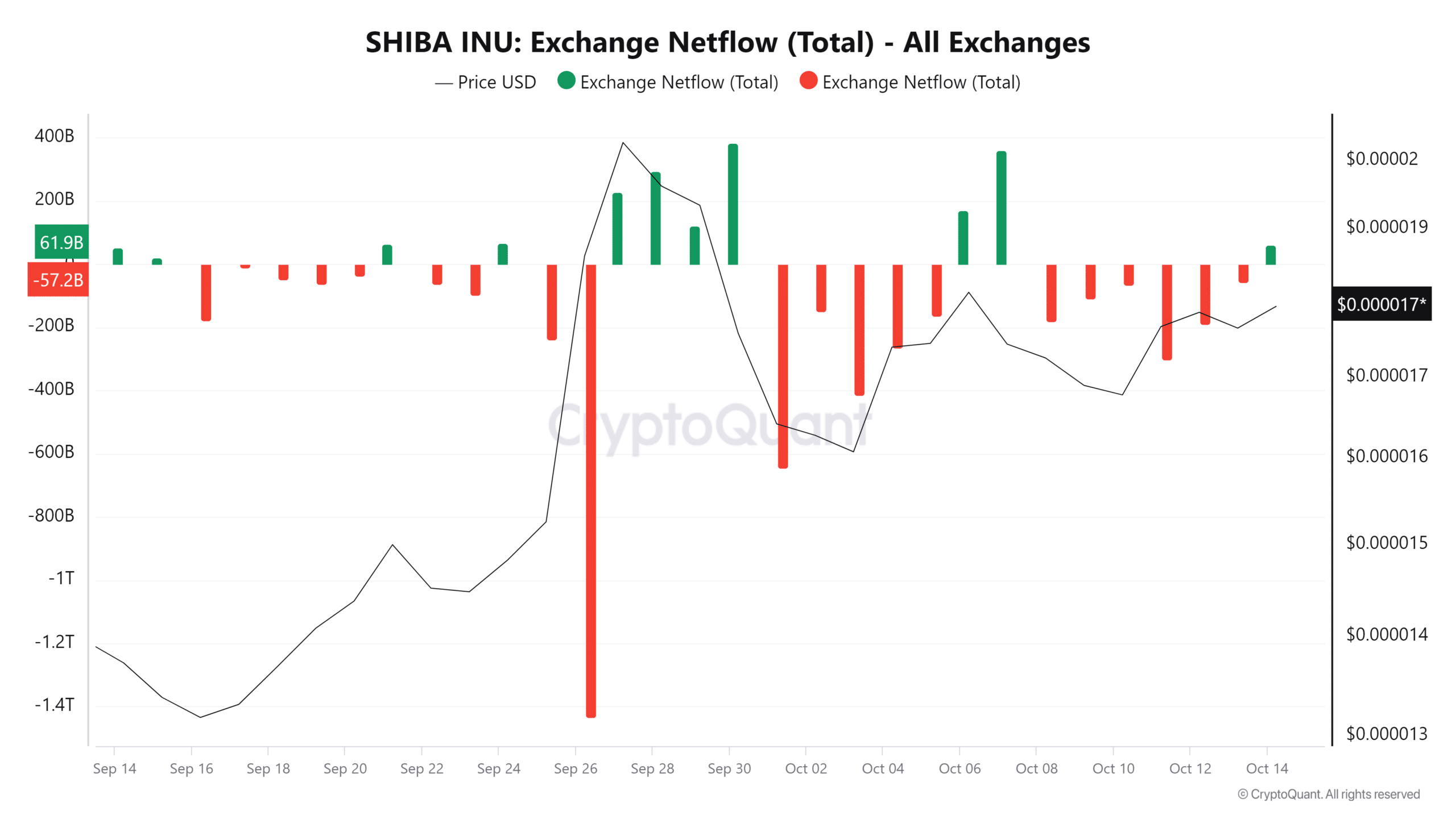

Source: CryptoQuant

SHIBthe second largest memecoin with a market cap of over $10 billion, has consistently outperformed Bitcoin, posting higher daily gains during every green candlestick on the daily price chart.

This increase can be attributed to a strategy employed by traders during Bitcoin pullbacks as they shift their focus to accumulating high-cap memecoins. It was striking last week that there was a net outflow of 58 billion SHIB from the total stock exchanges.

However, with Bitcoin now breaking a key resistance level, the renewed optimism has prompted these traders to offload their holdings, resulting in a surge in SHIB inflows totaling 62 billion.

In summary, many top memecoins could be poised for a correction as Bitcoin gears up for its next parabolic ascent. So the next memecoin super cycle could begin once BTC reaches a depletion point around $66,000.

Low-cap tokens may see a short-term rise

Typically, a rise in BTC price increases investors’ risk appetite, prompting them to explore more speculative assets, including lower-capitalization memecoins.

Despite their higher volatility, these assets are seen as attractive options for quick and substantial returns. As a result, they may experience a surge in demand in the short term.

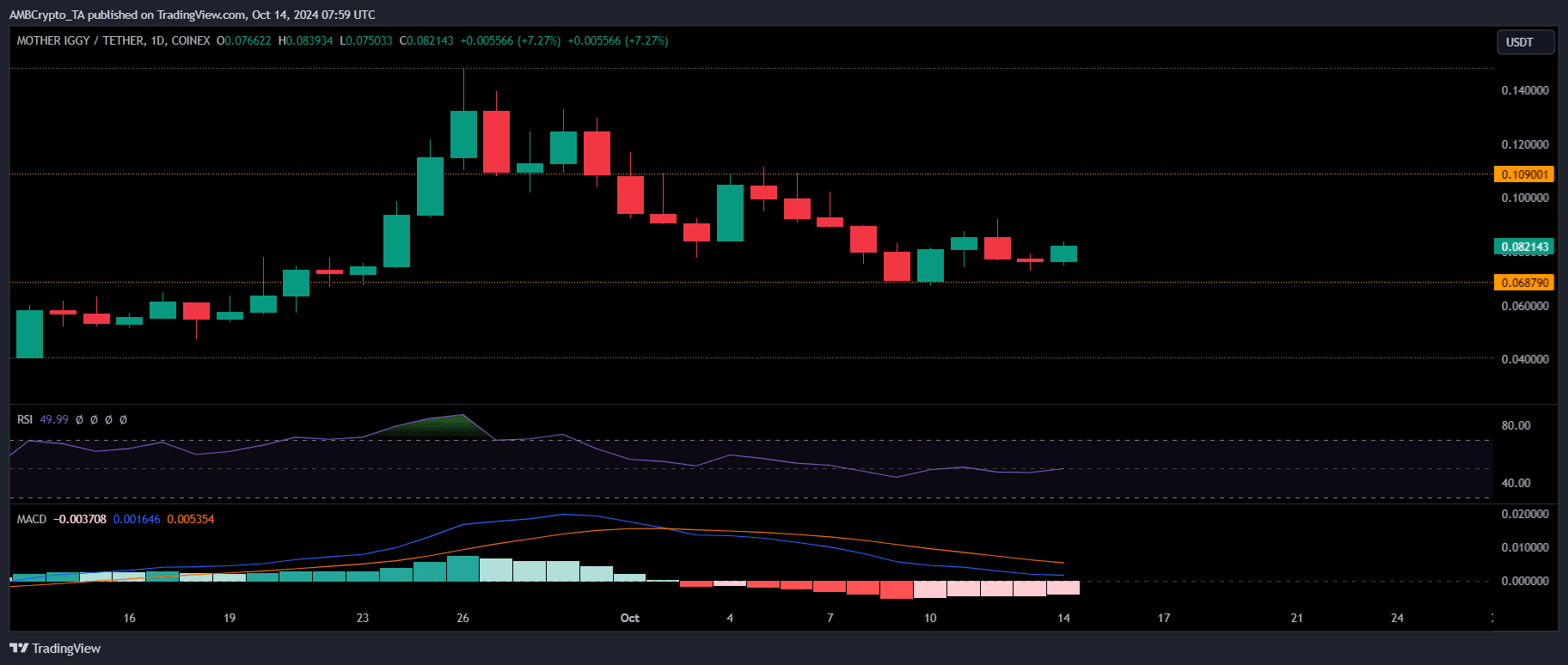

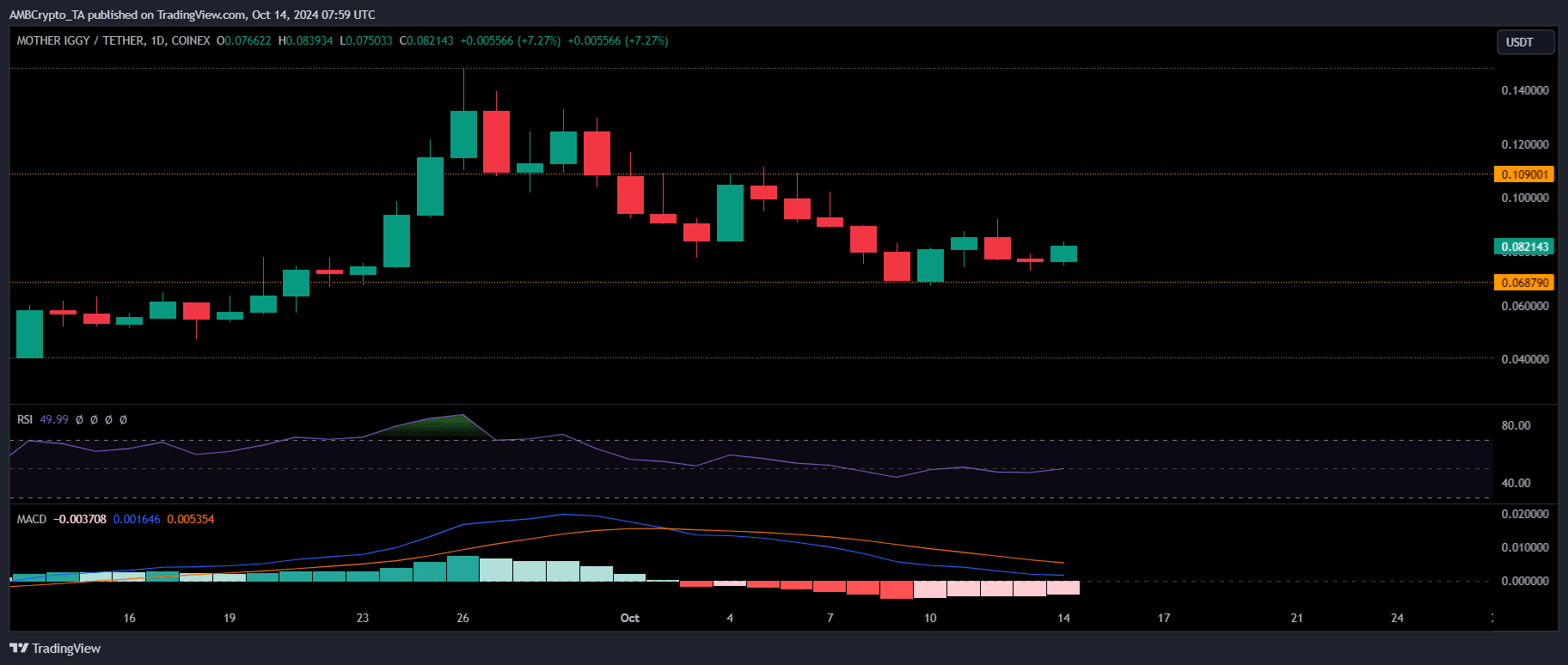

Source: TradingView

A notable example is Mother Iggy [MOTHER]a famous Solana-based memecoin with a market cap of $85 million. The token has regained traction, rising more than 5% to $0.83 in the past 24 hours. This marks a significant recovery from last week’s 10% decline.

Realistic or not, here is SHIB’s market cap in BTC terms

Historically, a similar pattern occurred during the first weekly cycle when BTC reached $62,000, allowing MOTHER to test the $1 ceiling. If this trend continues, memecoin could be on the cusp of a bullish reversal.

Overall, the market sees large memecoins stagnating while smaller market cap tokens rise, mirroring the trend after BTC tops out as capital shifts to smaller coins as bigger players divide their holdings.