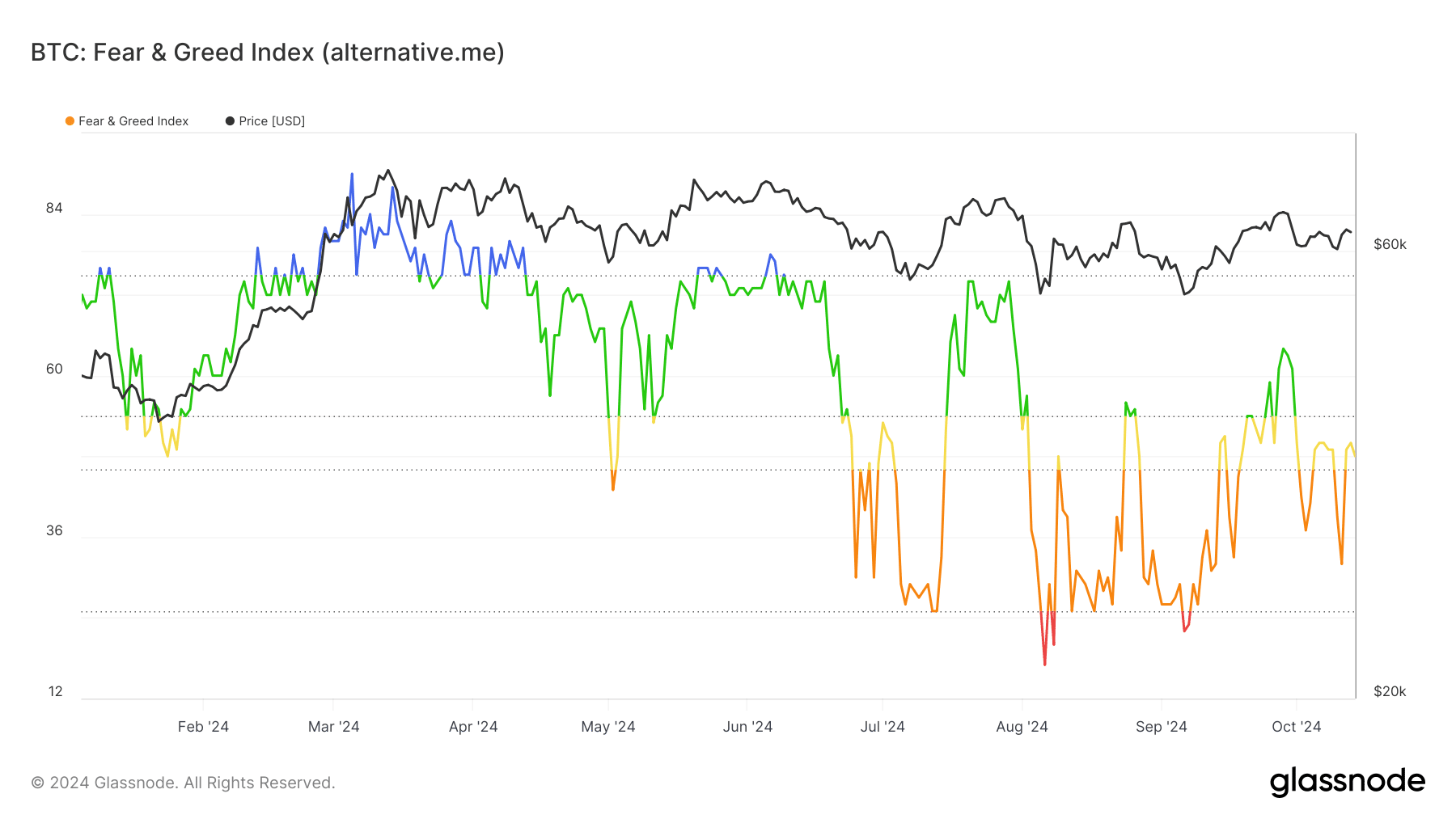

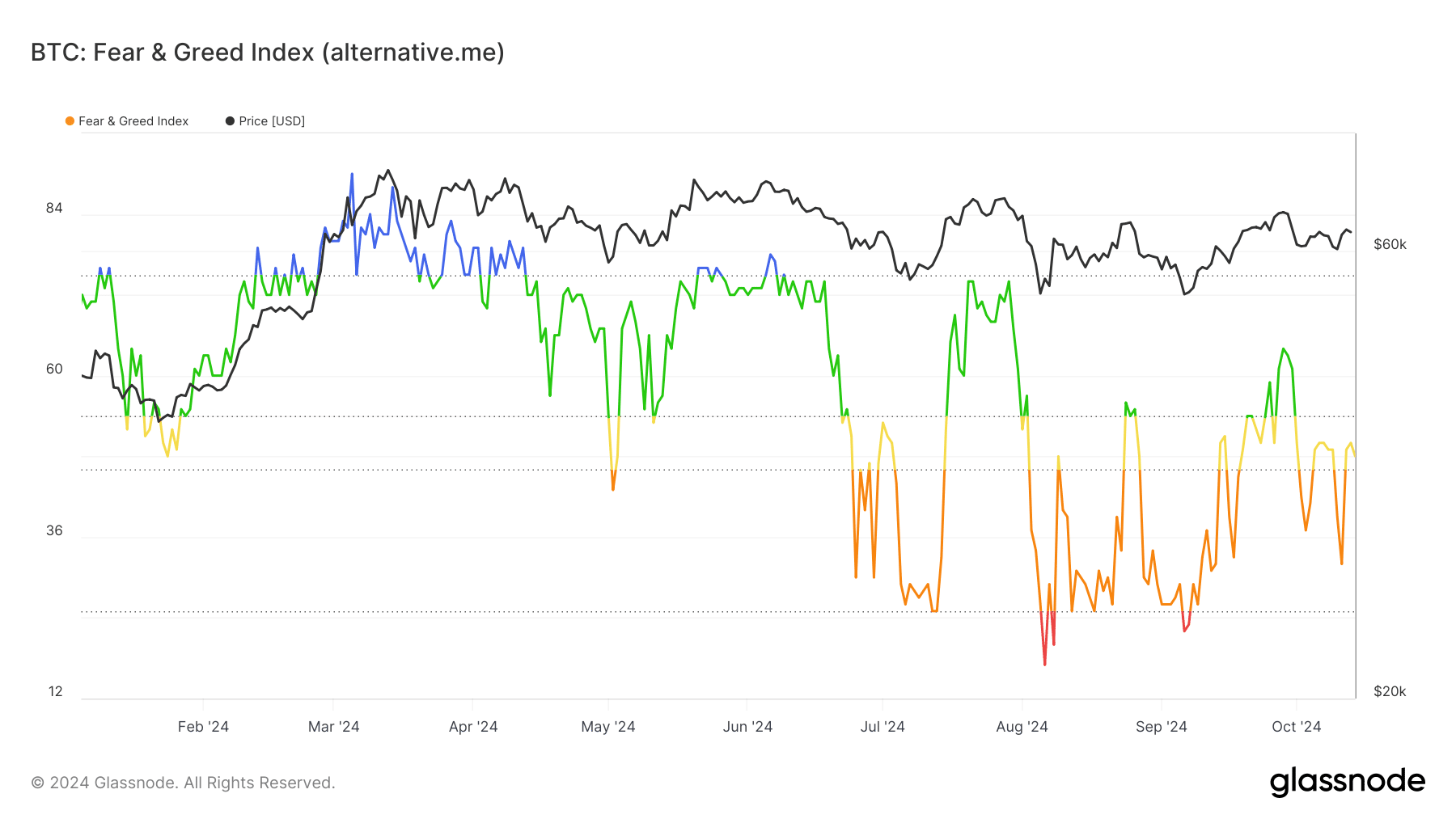

- The Bitcoin Fear and Greed Index has shifted to a neutral score of 48, indicating balanced market sentiment.

- Bitcoin has surpassed its 200-day moving average and is currently trading around $64,850 after rising 3%.

The past few days have been a rollercoaster for Bitcoin [BTC]where the price moves through volatile trends. However, recent data indicates that market sentiment is starting to stabilize.

The Bitcoin Fear and Greed Index shows that traders’ emotional response has shifted from extremes of fear and greed to a more neutral outlook.

Bitcoin’s fear and greed index turns neutral

According to Glass junctionThe Bitcoin Fear and Greed Index stood at 48 at the time of writing, indicating neutral sentiment in the market. This marks a shift from the increased fear and greed that followed recent price swings.

The index, which measures market sentiment based on factors such as volatility, volume and social media trends, suggests traders are taking a wait-and-see approach after a period of intense market movement.

Source: Glassnode

Earlier this week, on October 11, the index fell to 32, reflecting a state of fear among traders. Interestingly, this coincided with a rise in the price of Bitcoin to around $62,000.

Despite this upward price movement, sentiment at the time remained cautious, likely in response to previous price declines.

BTC moves with feelings of fear and greed

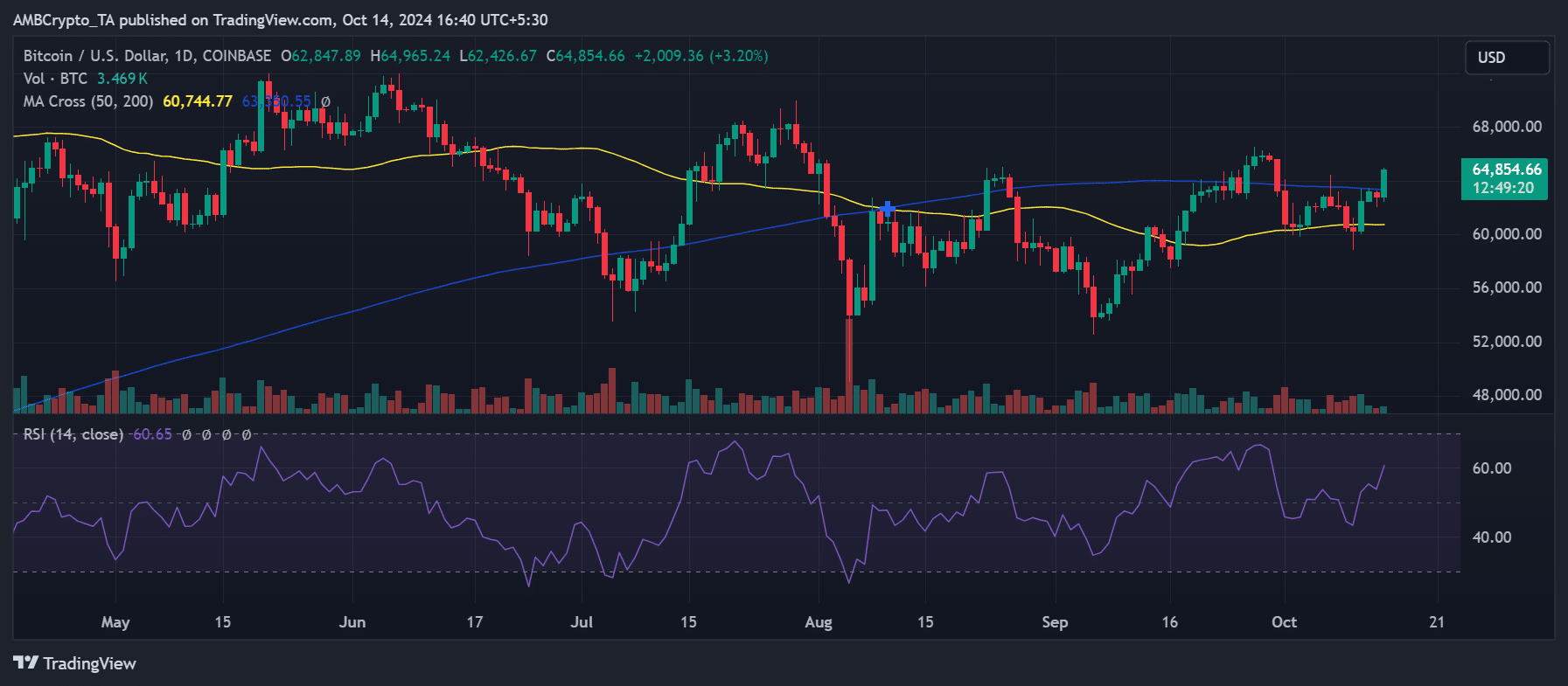

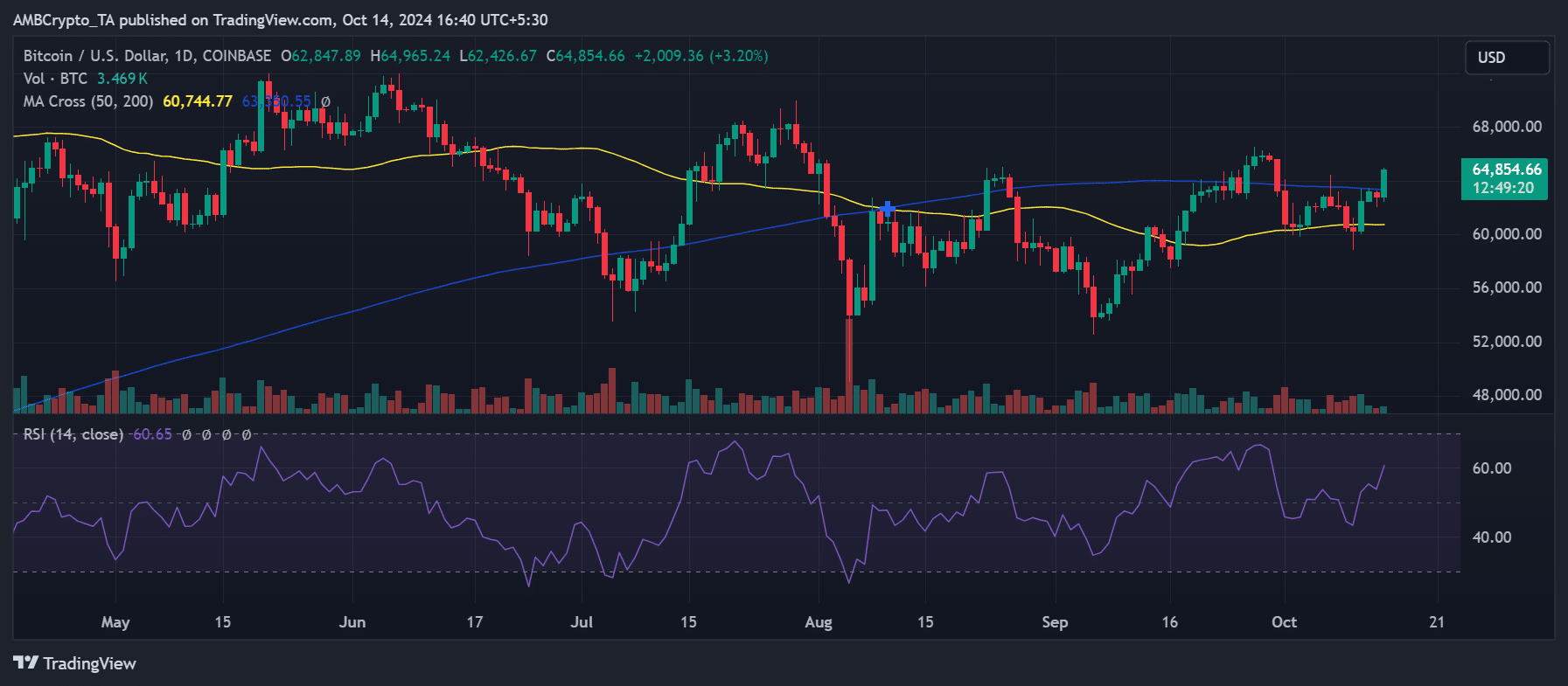

AMBCrypto’s analysis of Bitcoin’s price trend showed that the decline in the Bitcoin Fear and Greed Index on October 11 was a response to previous price action.

Before the price surge, Bitcoin had suffered a series of declines, which dropped its value to around $60,000 – a level below the 50-day moving average (yellow line), which acted as a key support level.

Source: TradingView

However, on October 11, the market recovered. Bitcoin saw a 3% increase, bringing the price back to $62,500, putting the price above the 50-day moving average.

Despite this, the price remained below the 200-day moving average (blue line), a stronger resistance level.

At the time of writing, Bitcoin is trading at around $64,850, yielding another 3%.

This uptrend has allowed BTC to break past the 200-day moving average, which had served as resistance around the $63,000 price.

The combination of these price movements and the neutral sentiment on the Bitcoin Fear and Greed Index suggests that the market is in a state of cautious optimism.

Active addresses remain stable

Although the Bitcoin Fear and Greed Index reflected neutral sentiment, the number of active addresses has remained remarkably stable.

Santiment data showed that the seven-day average of active addresses had remained consistent, with around 3.5 million active addresses.

At the time of writing, there were approximately 3.52 million active addresses, reflecting continued engagement with the network.

Source: Santiment

Read Bitcoin’s [BTC] Price forecast 2024-25

This steady number of active addresses indicated continued interest from long-term holders, which could serve as a basis for future price increases.

Despite the changing sentiment, the stability of network activity could be a sign that Bitcoin’s long-term prospects remain positive.