- Bitcoin’s dominance has soared to new heights, indicating bullish market sentiment.

- Still, waning interest from new investors may hinder this upward trajectory.

Bitcoin [BTC] Its dominance has risen to a new high, almost 57% of the total market share against altcoins. This rise matches BTC’s renewed momentum as it crosses the $64,000 mark and is now trading at $64,400.

This price range is becoming increasingly important due to its similarity to the late August rally, when bearish pressure pushed BTC below $55,000 in just two weeks.

So this level now represents a major battlefield, with the potential to determine BTC’s next big move.

Bitcoin’s dominance does not guarantee a recovery

Essentially, Bitcoin’s dominance demonstrates BTC’s share of the overall crypto market.

As the first and largest cryptocurrency by market capitalization, BTC maintains a leading position, and traders are closely monitoring its dominance as an indicator of market sentiment.

Currently, the outlook is optimistic, with a significant portion of stakeholders walking away from net losses positions. However, to achieve a breakout, these investors must avoid losing their positions.

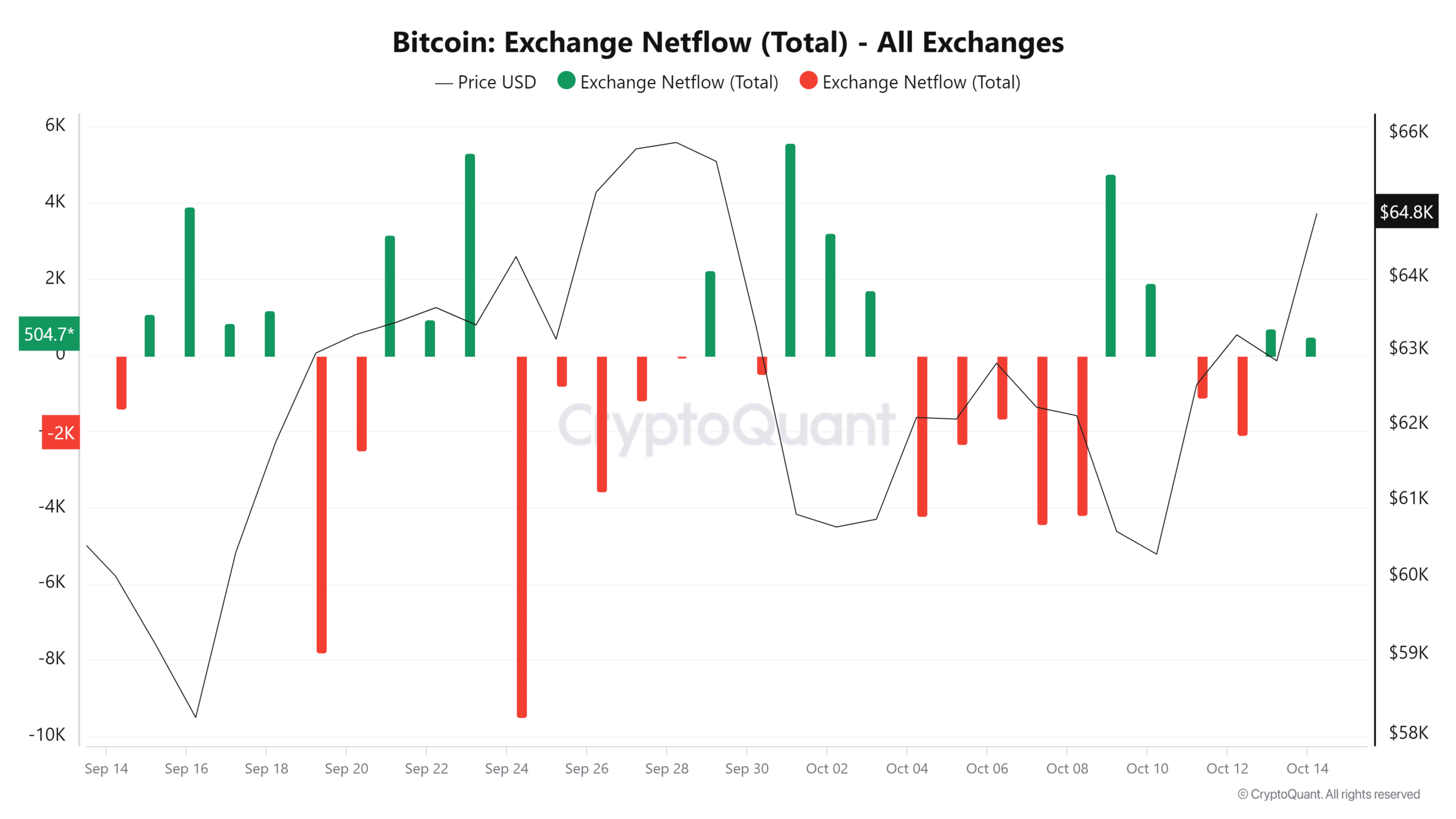

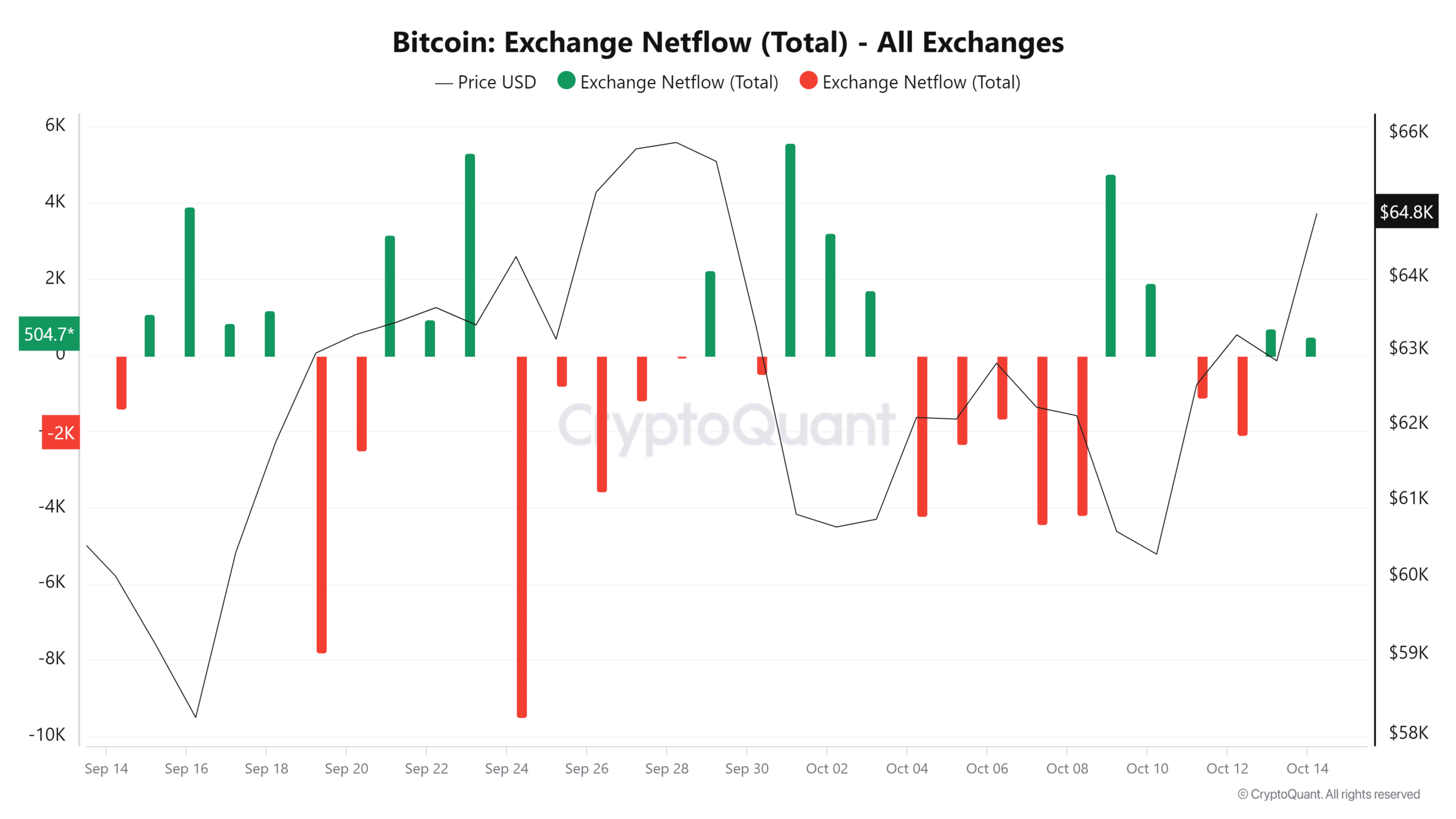

Historically, an increase in Bitcoin deposits on exchanges has coincided with daily price drops. If traders don’t view the current price as a “dip,” the projected rise to $66K could falter.

Source: CryptoQuant

Moreover, what is more worrying is the lack of new investors entering the market despite the high Bitcoin dominance. This lack of fresh capital could prevent BTC from reaching its next price target.

If this trend does not reverse in the next two days, Bitcoin could face a correction that could pull the price back to $62,000.

In short, the current $64,000 level has not yet turned to support, indicating uncertainty among investors about entering the market at this price. Many may be waiting for a retracement to buy when BTC hits a local low.

A new retracement may be necessary

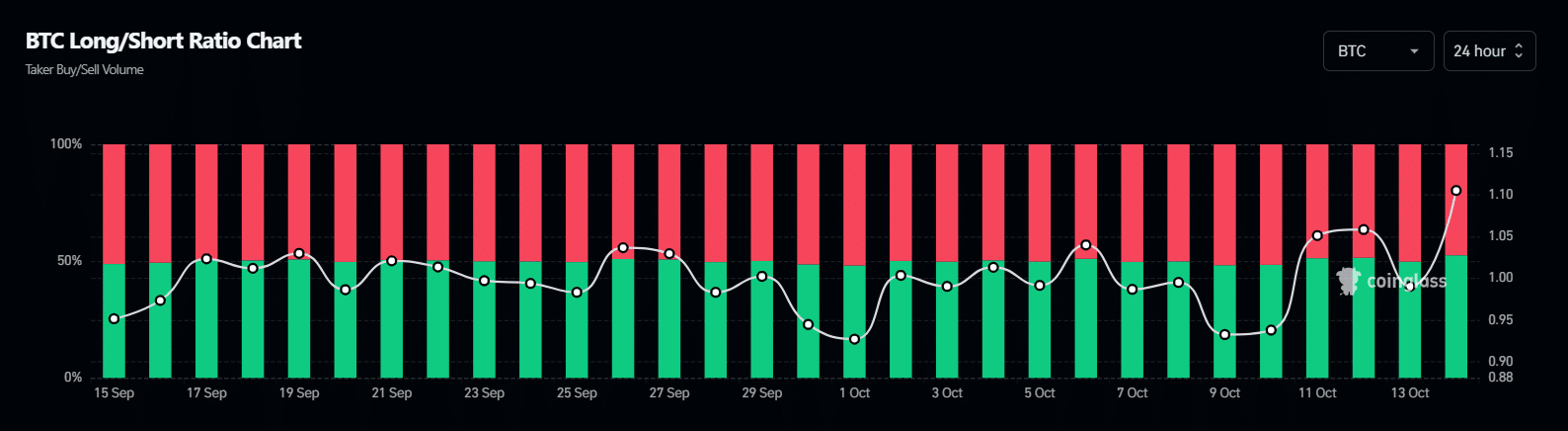

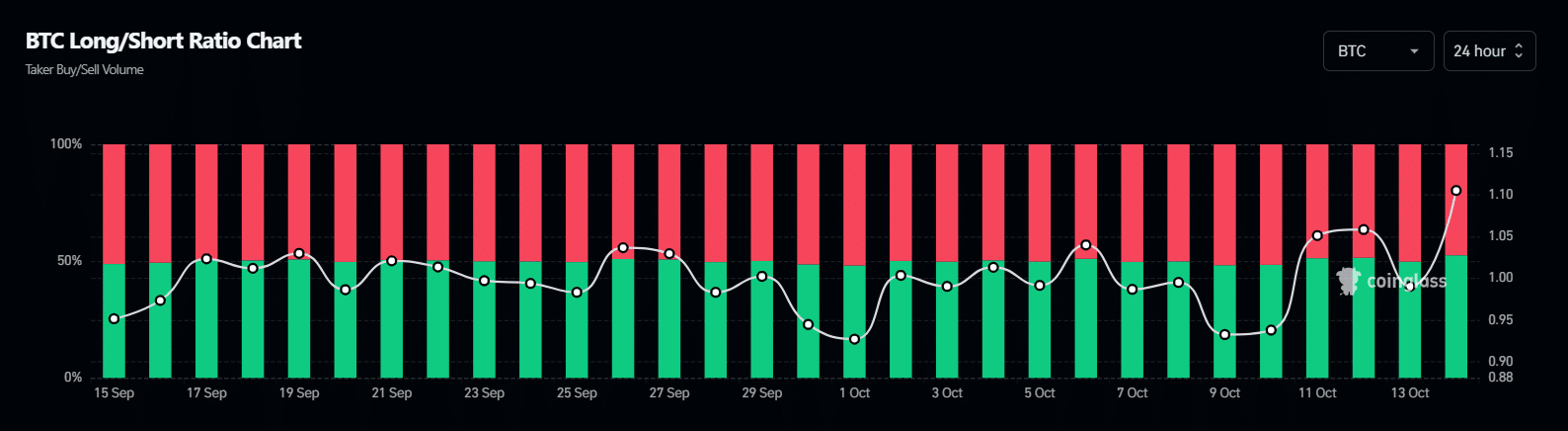

In its attempt to repeat the late July rally when BTC closed close to $66,000, Bitcoin’s dominance has fallen three times since then, driven mainly by speculative traders.

For example, during the late September cycle when BTC was close to its price target, excessive shorting led to a pullback as longs were forced to sell their positions.

Currently, a majority of futures traders are betting on a recovery, as evidenced by the spike in the red zone.

Source: Coinglass

However, caution is advised as traders in the spot market do not share the same bullish outlook for BTC as those in the derivatives market.

This difference could be exploited by short sellers, who are likely to increase their positions, taking advantage of the lack of new capital entering the market.

Read Bitcoin’s [BTC] Price forecast 2024-25

Therefore, in addition to high Bitcoin dominance, it is crucial to convert the $64K level into support. This can happen if new buyers see the current price as an opportunity to buy the dip.

Conversely, if they falter, a return to the $62,000 – $64,000 range may be necessary for a healthy shakeout before BTC can break above $66,000.