- Investors and long-term holders expected better returns from Bitcoin based on historical trends

- The big sell-off earlier this month showed disbelief in the bullish scenario

Bitcoin [BTC] was rejected at $66.5k after a strong rally in late September. October is a month that generally sees positive returns for the currency, but not this time, at least so far. At the time of writing, BTC was actually down 4% from the opening of the month.

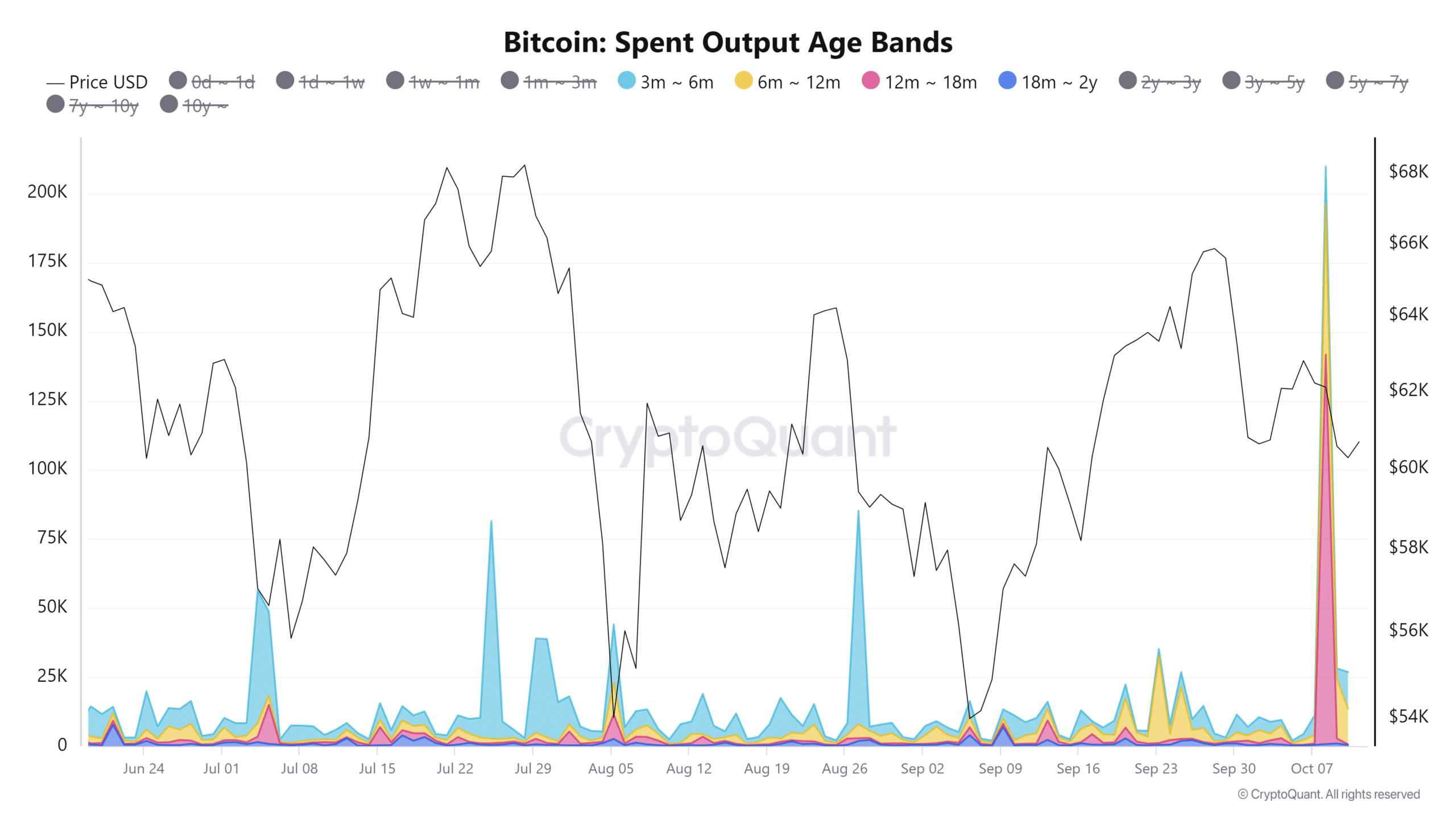

Source: CryptoQuant

The output spent age range statistics showed that many holders with longer term horizons, such as 12-month and 18-month ranges, chose to sell Bitcoin on October 8.

Short-term holders also joined in, leading to a selloff not seen since January 2021.

Bitcoin’s halving yield does not match expectations

In one message on XCryptoQuant Founder and CEO Ki Young Ju noted that we are on track for the longest sideways price action in a half year. In the 2020 cycle, Bitcoin started its rally in mid-October.

BTC’s first quarter performance far exceeded that of 2020, but the two years got off to very different starts. In 2024, spot exchange-traded funds (ETFs) were approved in the US, leading to a huge wave of demand.

In 2020, the outbreak of the coronavirus pandemic loomed and every analyst and investor was on the verge of panic over the threat of economic damage.

A counterargument is that the longer the consolidation phase, the stronger the breakout. Could this happen to Bitcoin, or is the king coin more mature and less susceptible to the crazy gains it has made in previous cycles? Only time will tell.

Buy the dip scenario

Crypto analyst nest pointed out on X that the first two weeks of October have historically seen volatility and an apparent downturn before recovery.

The price promotions of 2021, 2023 and 2024 were compared. In each of these cases, the market structure turned bearish before a bullish trend emerged in the second half of the month.

Read Bitcoin’s [BTC] Price forecast 2024-25

This could encourage the idea of buying the dip. It is unknown whether Bitcoin can move as strongly as it did in the previous cycle, but long-term holders would likely prefer to HODL rather than sell in light of disappointing Bitcoin performance.