- Bitcoin Spot ETFs saw inflows worth $253.54 million on October 11, coinciding with a 3% price increase

- However, Ethereum Spot ETFs continue to struggle, with a cumulative negative net flow of -$558.88 million

Bitcoin Spot ETFs ended last week with positive net inflows, marking the second time in the week that they saw an increase. While four major Bitcoin Spot ETFs contributed to these inflows, others saw zero flows.

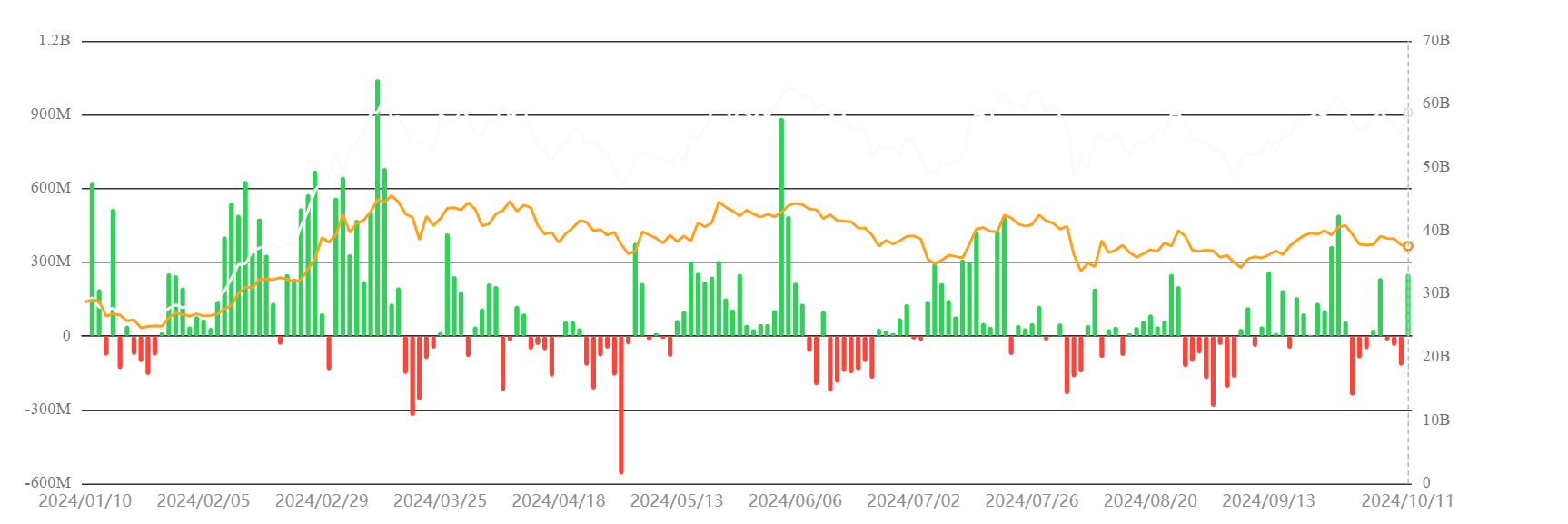

Meanwhile, Ethereum spot ETFs have consistently recorded negative net flows. By doing this, they lag behind Bitcoin in terms of positive movement.

Bitcoin ETFs are seeing positive inflows

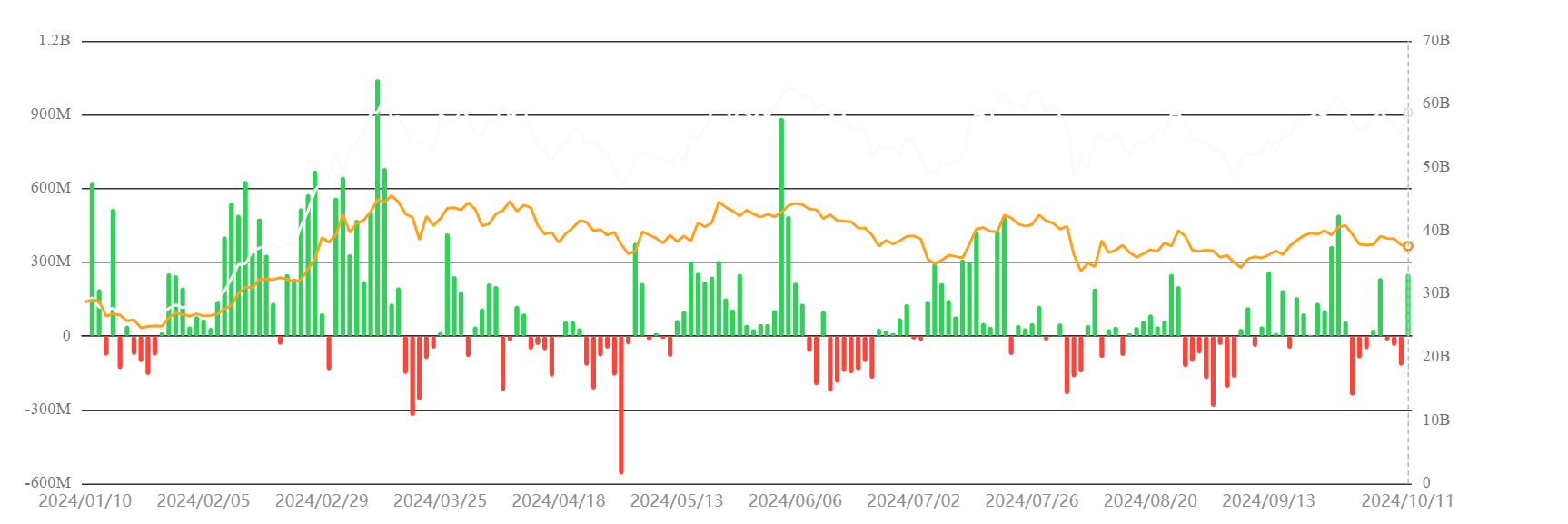

According to data from SosoValueBitcoin ETFs recorded inflows of $253.54 million on October 11. This was the second episode of inflows for Bitcoin ETFs during the week, following three consecutive days of outflows.

Fidelity, Ark 21 Shares, Bitwise, InvescoGalaxy and VanEck were responsible for the inflows among the ETFs. On the contrary, BlackRock and several other ETFs saw no flows during this period.

Source: SosoValue

Breaking down the above figures, it can be seen that Fidelity had the largest inflows with $117 million, while Ark 21 Shares followed closely with $97.6 million. Bitwise contributed $38.8 million, with the remaining inflows distributed among the other ETFs.

At the time of writing, the cumulative total net flow for Bitcoin spot ETFs was $18.81 billion, with a total net asset value of $58.66 billion.

Bitcoin’s price rise and ETF inflows are aligned

The inflows into Bitcoin spot ETFs have coincided with positive price movement for BTC. After several days of negative flows and price declines, Bitcoin rose by more than 3% on October 11, from $60,279 to $62,518. This uptrend continued on October 12, with Bitcoin trading around $63,000 at the time of writing.

If Bitcoin maintains its positive momentum throughout the weekend, additional ETF inflows could follow in the coming week – a sign of growing investor interest.

Ethereum spot ETFs are seeing negative net flows

On the contrary, Ethereum spot ETFs have struggled to see the same level of positive inflows as Bitcoin ETFs. While Ethereum saw a small inflow of $3.06 million on October 11, seven of the nine Ethereum ETFs reported zero inflows, and the day before there were no inflows at all.

– Read Bitcoin (BTC) price prediction 2024-25

The cumulative total net flow for Ethereum Spot ETFs remains negative at –$558.88 million, with a total net asset value of $6.74 billion. Despite occasional inflows, Ethereum’s Spot ETF’s performance has lagged behind Bitcoin’s, underscoring a more challenging market environment for ETH investors.