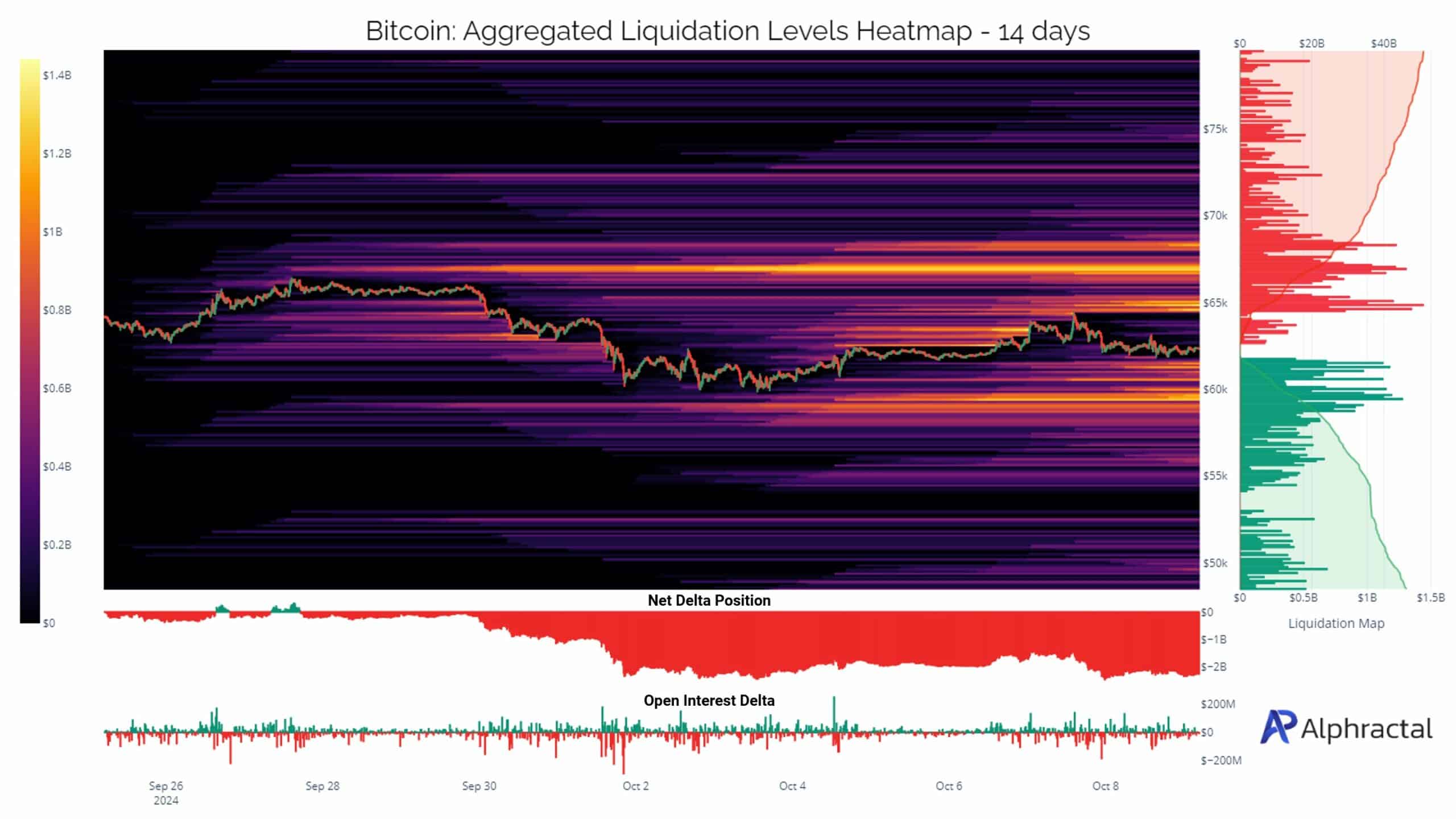

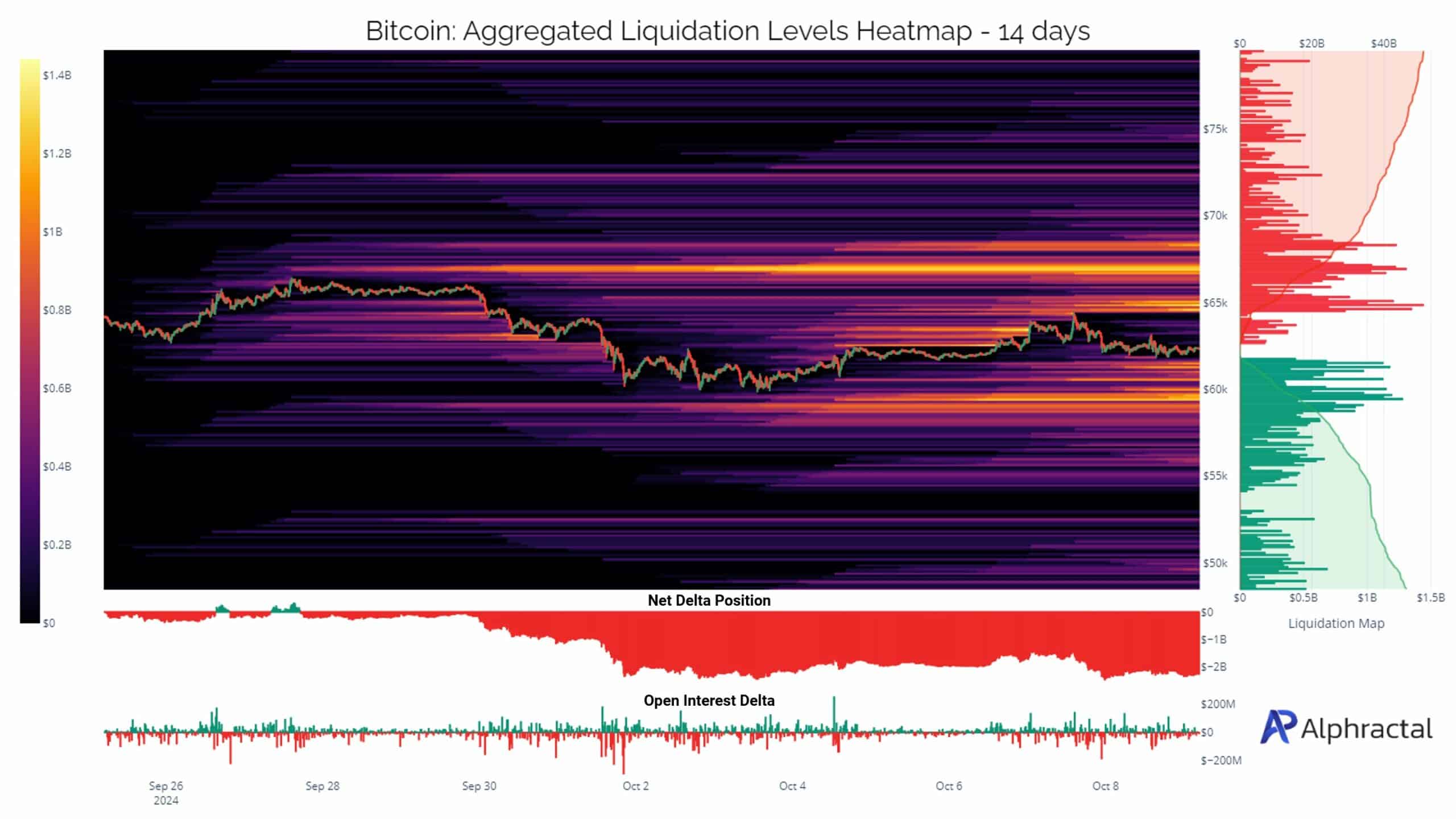

- The highest liquidation level for Bitcoin was $67,000.

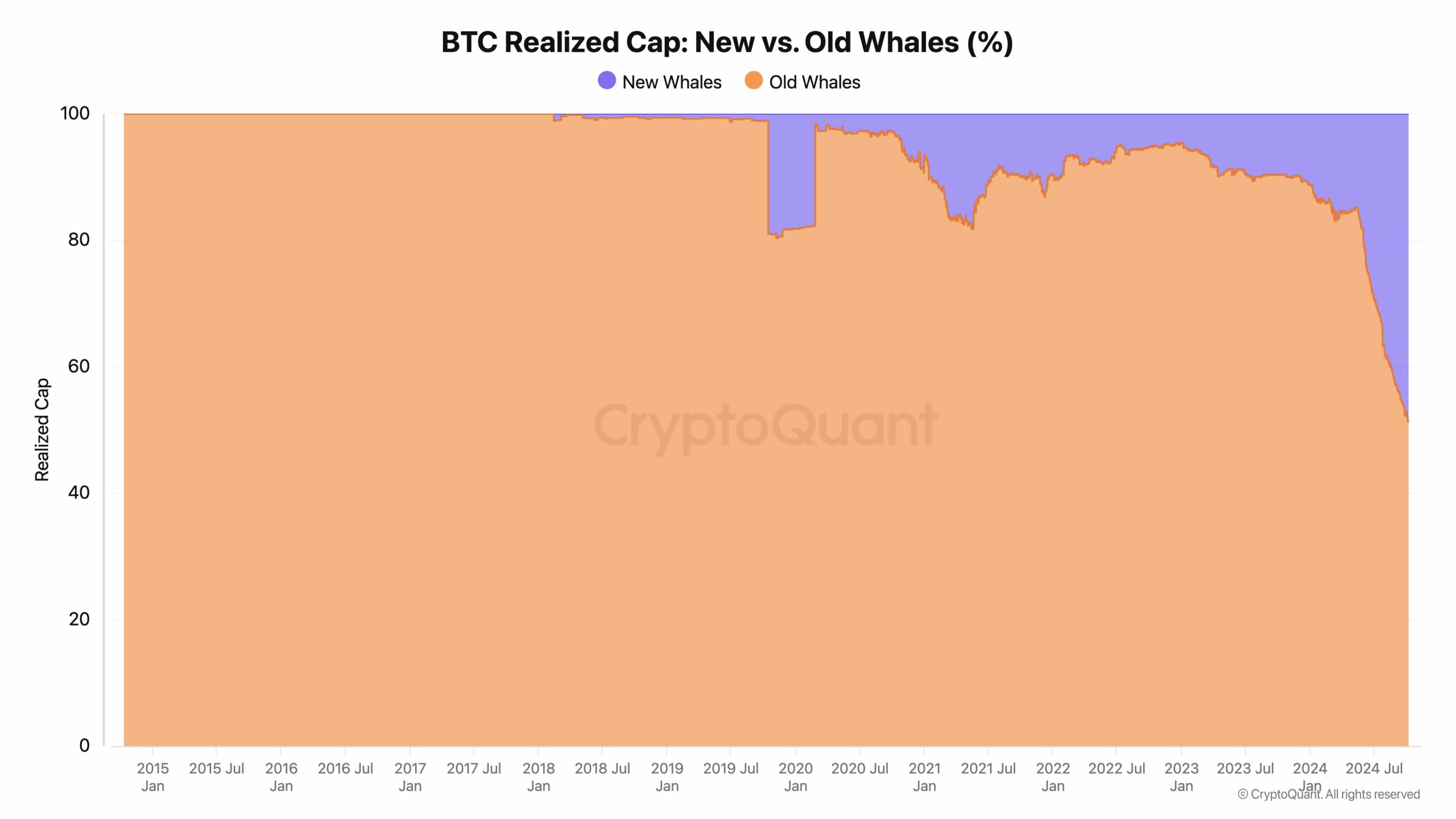

- There was a generational change among these major investors in Bitcoin.

The cryptocurrency market is always curious about the key levels for Bitcoin [BTC]especially during periods of high volatility.

Currently, it is expected that Bitcoin could see a significant move due to large liquidation levels, which could force traders to take decisive actions.

Over the past week, BTC has seen a notable concentration of long positions on major exchanges, creating large liquidation pools.

The key Bitcoin level is at $60,000, but when the analysis was extended to two weeks, the $67,000 zone emerged as the highest liquidation level.

Source: Alpharactal

This indicates that Bitcoin could potentially move into this zone as its price tends to trend towards areas of high liquidity over time.

Bitcoin has also shown resilience when examining technical indicators. The cryptocurrency has managed to maintain its position above the bull market support band for another week.

It has not achieved three consecutive weekly closes above this level since May, but there is hope that bulls can push the price further from here. This is especially important given the recent consolidation in the market.

Source: TradingView

Bitcoin is also relatively strong compared to stocks, making the $67,000 target look increasingly attainable.

BTC whales and active addresses

Another factor to consider is the changing landscape of Bitcoin whales. There is currently a generational change taking place among these major investors.

New whales have invested $108 billion in Bitcoin since its inception, while older whales hold $113 billion.

The ratio between these groups is decreasing and new whales are slowly gaining influence.

This shift suggests new money is entering the market, which could push the price of BTC higher over time, although the market remains unpredictable.

Source: CryptoQuant

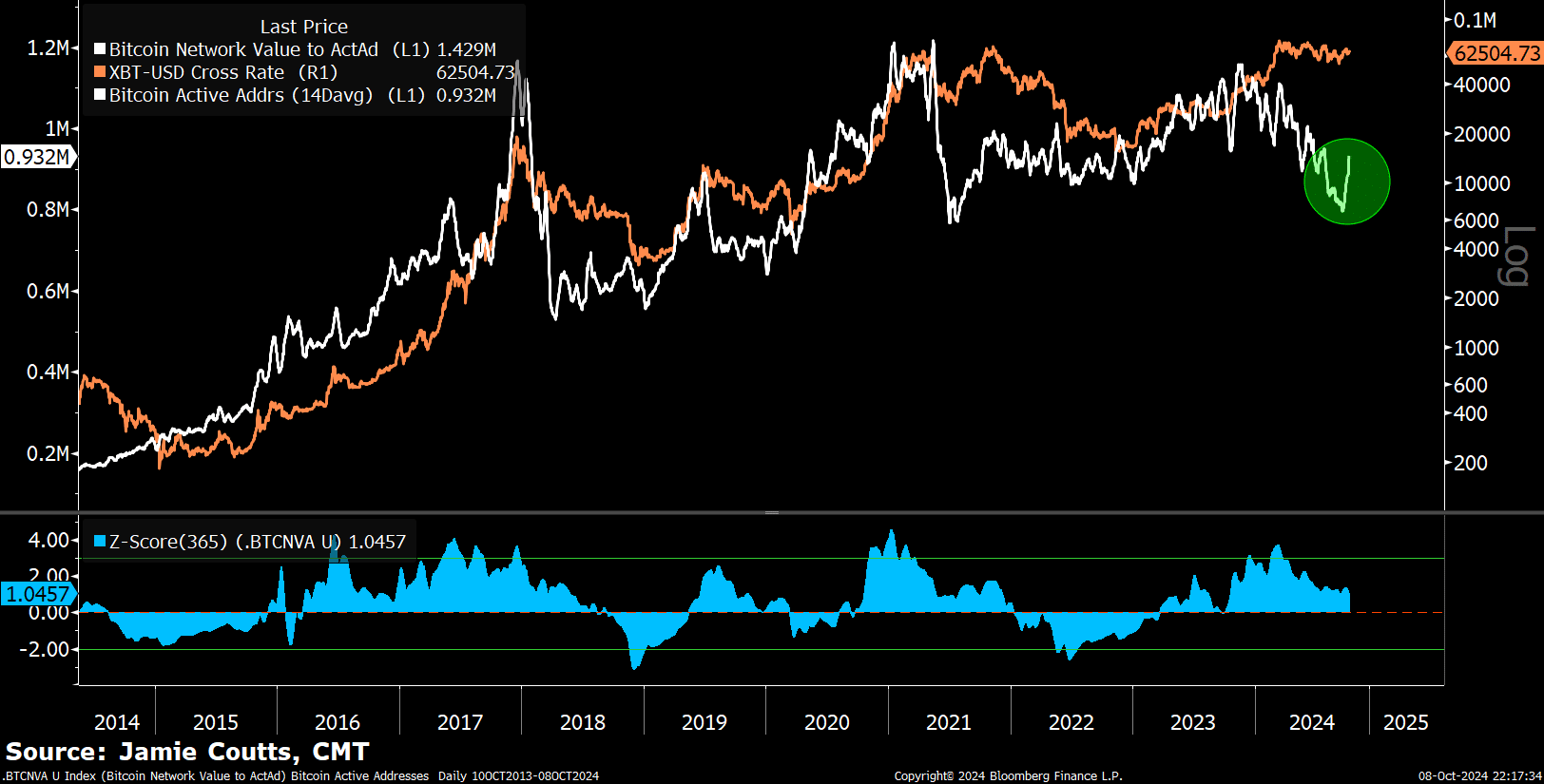

In terms of on-chain metrics, Bitcoin’s number of active addresses has recently seen a resurgence after an 11-month downward trend.

Although the predictive power of this measure has declined over the past four years, it remains an important indicator of network activity.

The reduced correlation between active addresses and price is likely due to several factors.

This includes the rise of ETF flows as a key price driver, increased payment activity on L2s such as the Lightning Network, and changes in on-chain behavior driven by innovations such as Ordinals and NFTs.

Source: Jamie Coutts, CMT

Read Bitcoin’s [BTC] Price forecast 2024–2025

While there is optimism that Bitcoin could surpass its all-time high during this cycle, a corresponding increase in the number of active addresses on the base chain would help validate the growing value of the network.

Because Bitcoin functions as a global monetary network, it exhibits organic network growth across all metrics. With the right conditions, BTC could soon be on its way to testing the $67K level.