- Crypto investors have reportedly shifted focus to the recent Chinese stock rally

- Will investors return to crypto trading if the uptrend in stocks falters?

Chinese shares’ rally has weakened after a disappointing stimulus package, raising hopes of a possible shift in the economy Bitcoin [BTC] and crypto trading.

Since late September, Asian shares have recovered on solid stimulus packages from the Chinese government and expectations that the policy could continue into 2024.

According to Alex Kruger, economist and market analyst, the markets expected The Chinese government has announced an additional budget package of $1.4 trillion. However, only a $14 billion package was announced.

This dampened market optimism, with most Chinese stocks regaining recent gains. How does that affect BTC and crypto trading?

China’s influence on crypto trading

According to a recent Bloomberg reportthe Chinese stock rally may have prompted some crypto investors to reallocate capital to these booming stocks. The report cited Tether’s USDT discount against the US dollar (USD) since late September as a crucial indicator.

One expert noted that this coincided with China’s quantitative easing program and could indicate “panic buying” of Chinese stocks.

“As traders rush to convert back into fiat, it can be inferred that they are panic buying Chinese stocks.”

Ergo, investors could have sold their USDT to buy Chinese stocks. Now that the Chinese stock market rally has been temporarily suppressed, will they shift the focus back to BTC and crypto trading?

According to Singapore-based crypto trading firm QCP Capital, the waning Chinese stock rally could give BTC a boost. The company declared,

“As the Chinese rally wanes, we anticipate a reallocation of capital to crypto, reflecting the growing maturity of the sector as an alternative risk asset.”

However, it added that the upcoming earnings season and September US CPI data, due on October 10, could be downside risks. They could complicate the crypto market prospects.

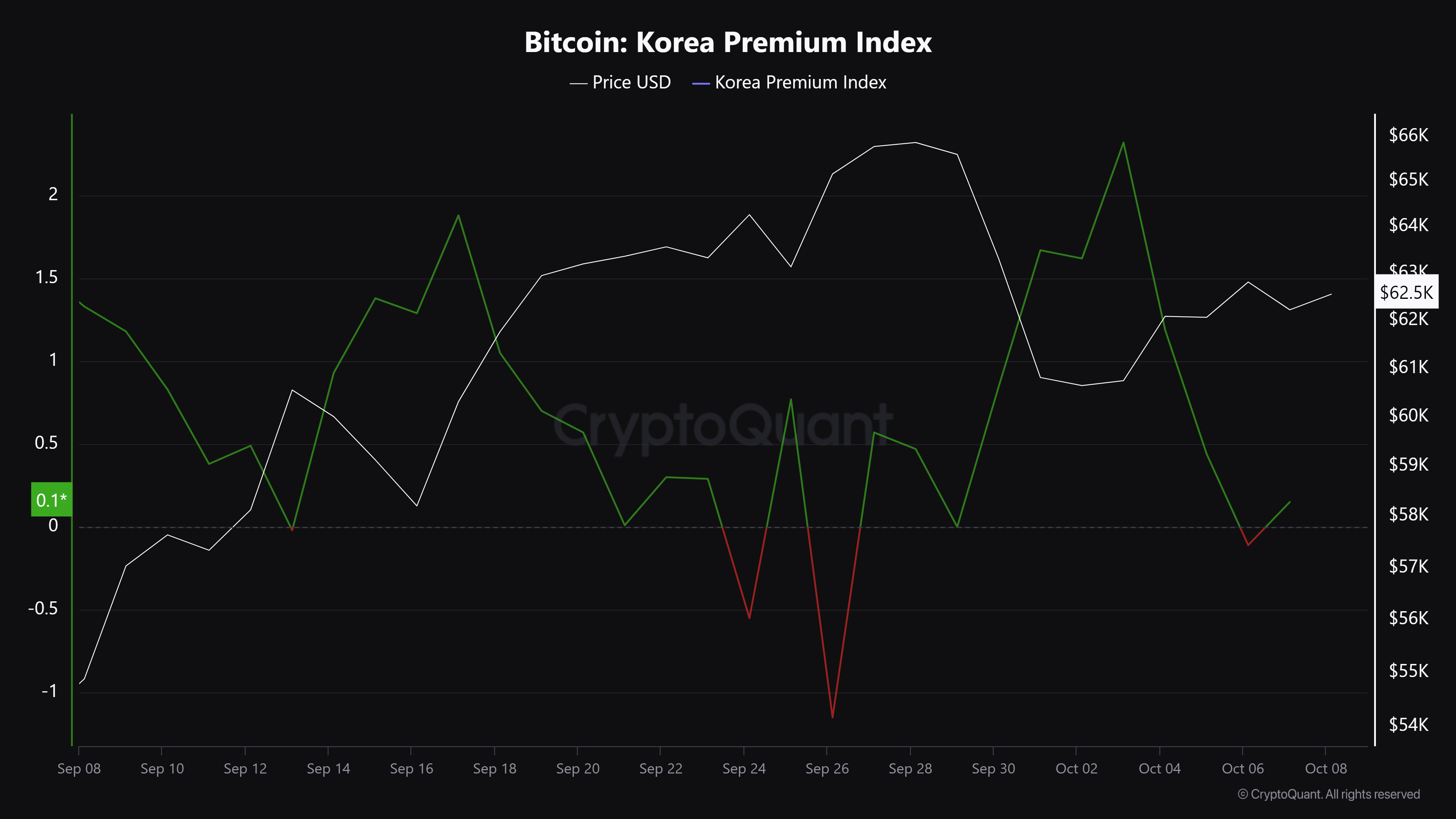

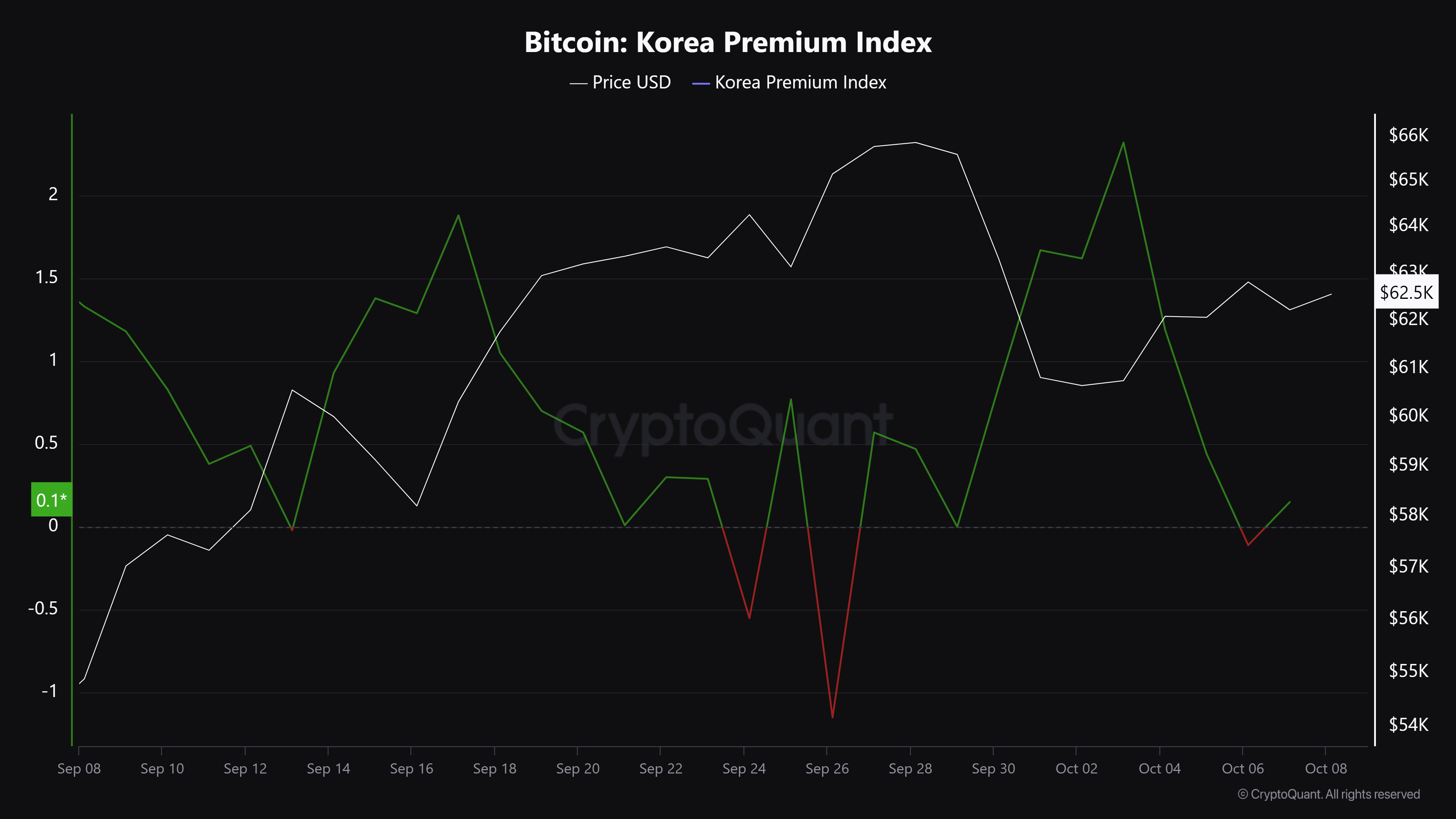

Source: CryptoQuant

Meanwhile, the BTC Korean Premium Index formed a V-reversal pattern at the time of writing. After falling in the first week of October, interest rates were above the neutral level.

The metric, also known as Kimchi Premium, tracks BTC price differences between South Korean and foreign exchanges. A higher premium would indicate stronger demand for BTC in Korea than abroad.

The aforementioned positive outcome indicated little Korean demand for this asset. At the time of writing, BTC was valued at $62.5k, down about 1% from the weekly charts.