Despite price consolidation within a tight range at a support level, it appears that XRP bulls are back in the market as trading volume skyrockets. On October 7, 2024, most of the top cryptocurrencies experienced a notable price increase, but the price of XRP has remained stable over the past 24 hours.

XRP Current Price Momentum

Currently, XRP is trading around $0.538 and has experienced a modest price increase of 0.75% over the past 24 hours. During the same period, trading volume has skyrocketed by 90%, indicating strong participation from investors and traders, which is a positive sign for XRP holders.

XRP Technical Analysis and Upcoming Levels

According to expert technical analysis, XRP appears bullish but has been stuck in a consolidation zone between $0.512 and $0.545 for the past five trading days. Based on recent performance, the price of XRP tends to experience a 20% rally when the price reaches this level.

However, if XRP breaks out of this consolidation zone and closes a daily candle above the $0.55 level, there is a good chance that it could rise 20% to reach the $0.65 level in the coming days.

This bullish outlook is further supported by XRP’s Relative Strength Index (RSI), which is currently in oversold territory, indicating a possible bullish price reversal in the coming days. However, it is still trading below the 200 Exponential Moving Average (EMA) on the daily time frame, indicating a downtrend.

Bullish statistics in the chain

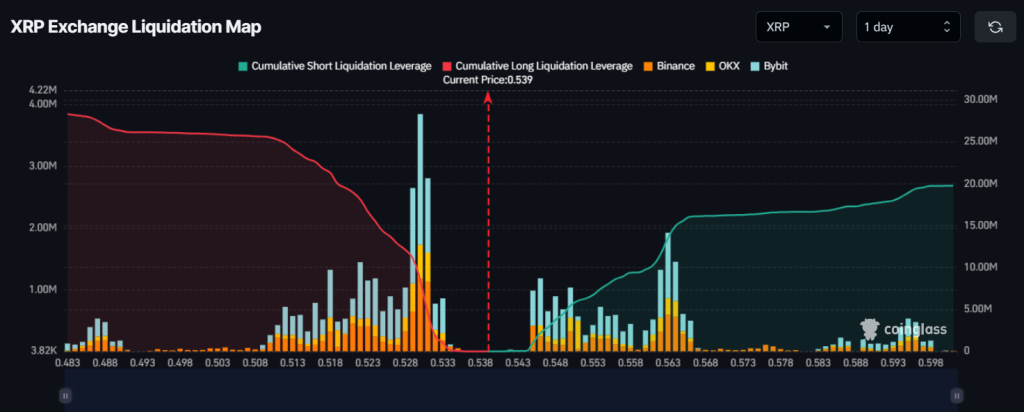

In addition to the technical analysis, XRP’s on-chain metrics also support this bullish outlook. According to the on-chain analytics company Mint glassThe key liquidation levels are at $0.53 and $0.563 as traders are over-indebted at these levels.

However, data shows that bulls have placed more than $8.45 million in long positions in the belief that the market will not fall below the $0.53 level.

Furthermore, XRP future open interest has risen 3.75% over the past 24 hours and has been steadily increasing, indicating growing interest from traders, with many likely betting more on long positions.