- As the number of active addresses increased, the total value locked (TVL) of AAVE decreased

- On the contrary, technical analysis suggested a potential rally for AAVE

There has been an aggressive sell-off of 11.27% in the AAVE market over the past 24 hours. However, this recent downturn may not end anytime soon as other market developments point to a continued decline in the charts.

And yet, the technical analysis pointed to a possible turnaround, showing that AAVE is at a crossroads. Therefore, AMBCrypto analyzed AAVE’s potential future moves, in light of these conflicting indicators.

Investor withdrawal is driving AAVE’s decline

According to DeFiLlamathere has been a notable decline in the Total Value Locked (TVL) in AAVE. What this means is that investors are withdrawing from the protocol.

In fact, AAVE’s TVL had fallen to $11.941 billion at the time of writing. If these trends continue, AAVE will likely see further declines.

Here, TVL measures the total value of assets deposited within decentralized finance (DeFi) protocols. Figures for this often represent total market participation and capital deployment.

Source: DefilLama

This trend of investor withdrawal can be underlined by an increase in the number of active addresses. At the time of writing, the price had risen 6.85% to above 1,020, indicating increased activity, mainly sell-offs, while AAVE’s price fell on the charts.

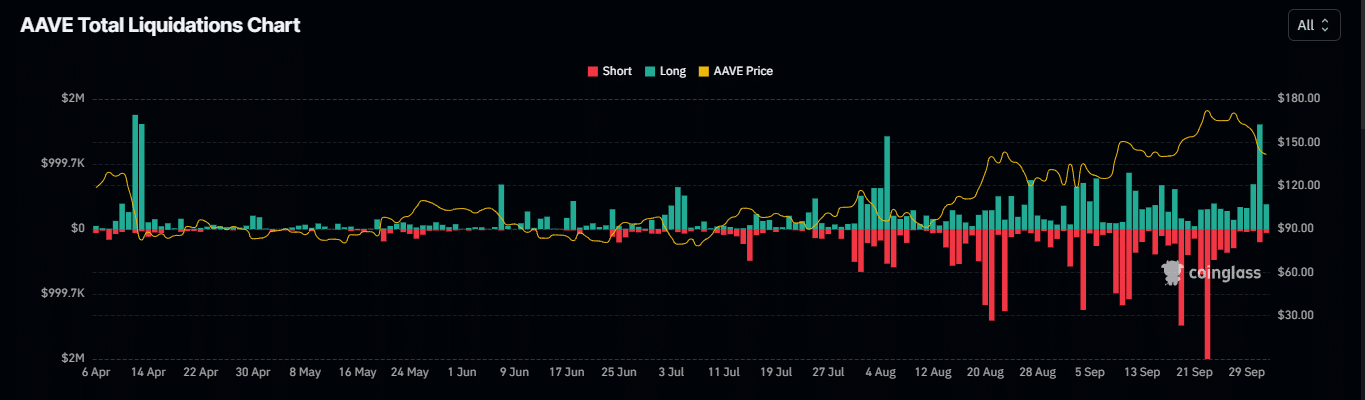

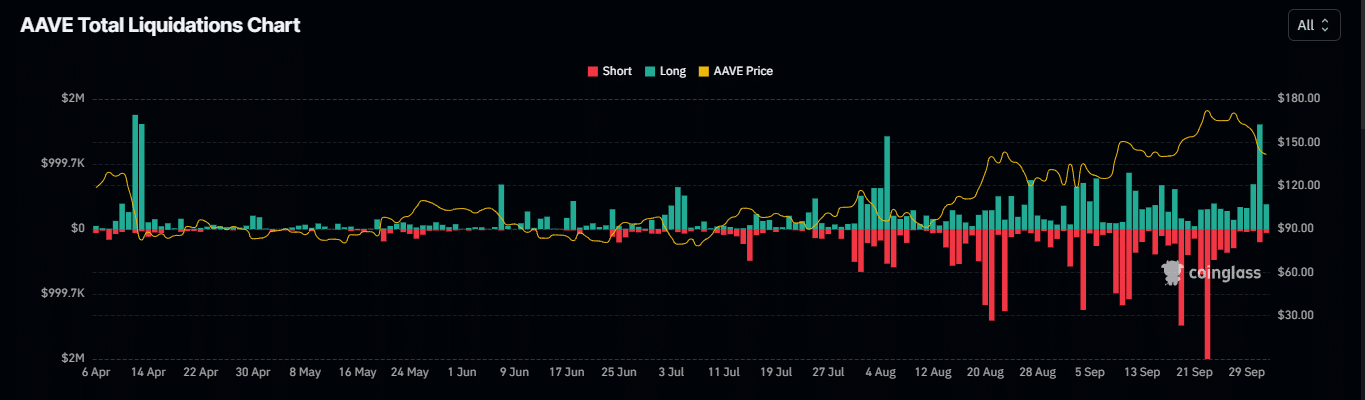

Big losses for long traders on AAVE

Traders who bet on a continued upward trajectory for AAVE suffered significant losses as the market turned against them.

According to Mint glass$1.91 million has been wiped out after traders bet on AAVE’s rise on the charts.

Furthermore, there appeared to be an imbalance between long and short positions, with a significant tendency to lose on long positions.

Source: Coinglass

Here the negative sentiment was further reflected by the Open Interest. The charts saw a drastic drop of 20.23% in Open Interest, suggesting a possible continuation of the sell-off by AAVE holders.

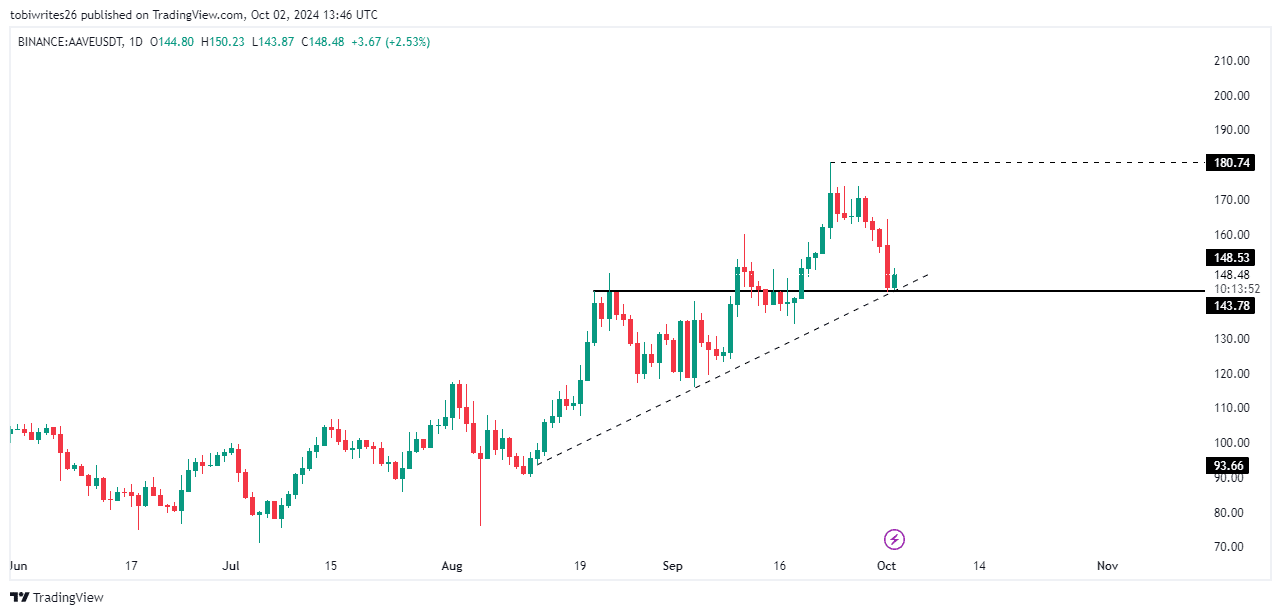

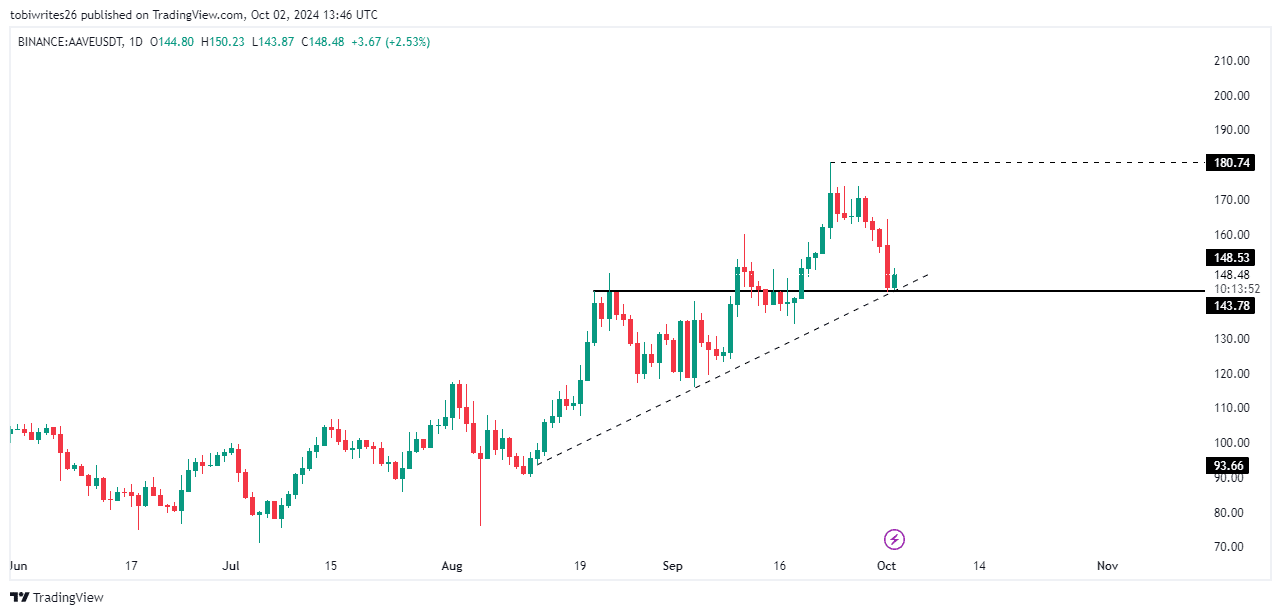

Technical analysis points to a possible turnaround for AAVE

Technical indicators on the chart suggested that AAVE may be positioned for an upward move. Especially since it has reached an important confluence of circumstances that could drive the price higher.

AAVE has reached a critical point on the chart, a point where a horizontal resistance line meets a diagonal resistance line. AAVE responded positively and showed signs of an upward trend. If this resistance level holds, AAVE could rise to $180.74.

Source: trading view

Conversely, if this resistance level does not hold, AAVE could fall, possibly reaching a level of $119.