- TON dropped from the $6 price level on the charts

- However, TON volume maintained its upward trend

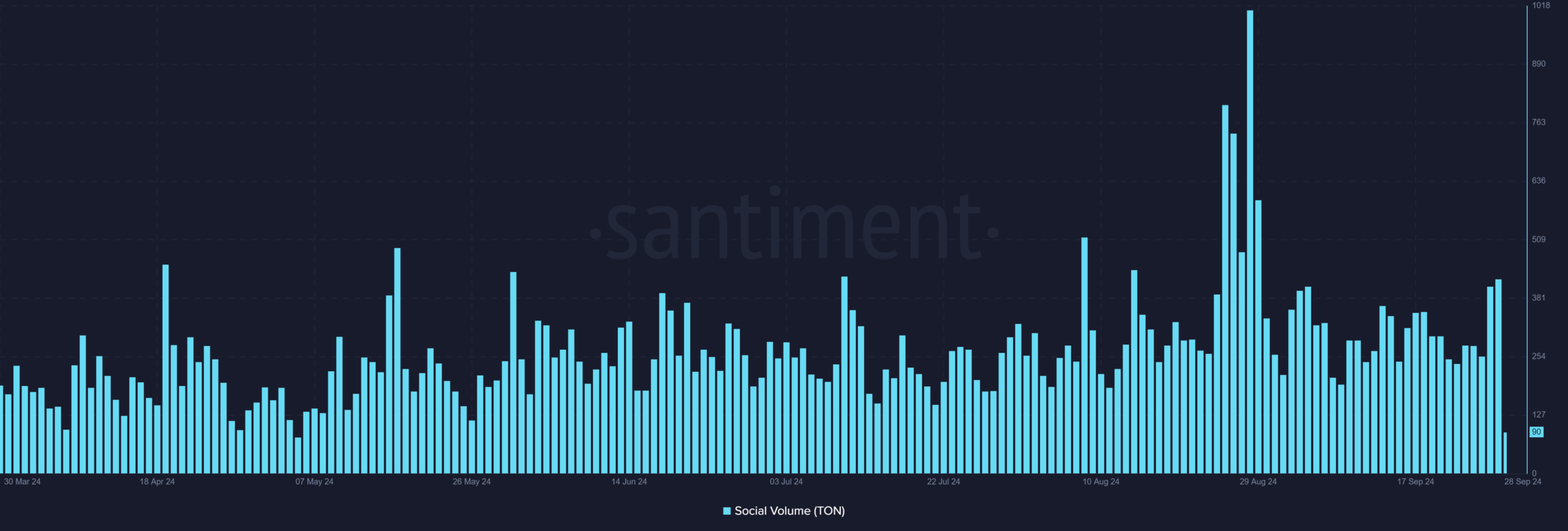

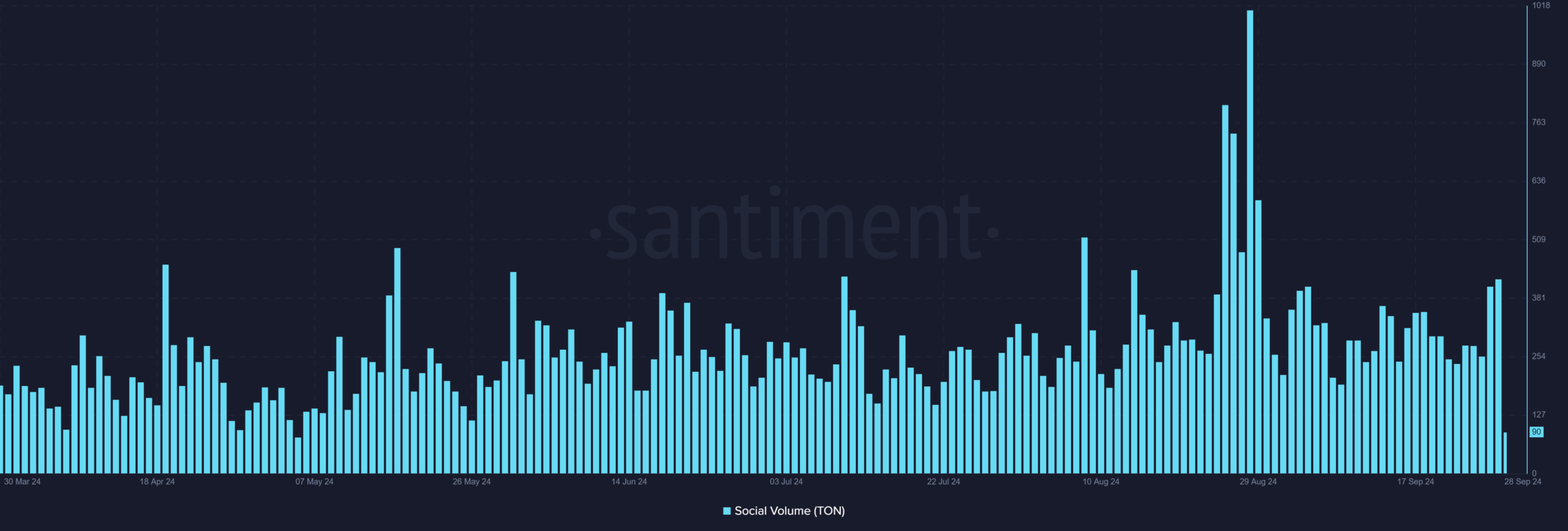

The Open Network (TON) recently recorded a notable increase in social volume, driven in part by the launch of coin minting for one of its mini-apps, Hamster Kombat. This increase in attention has positioned TON as one of the trending cryptocurrencies in the market, with market indicators presenting both bullish and bearish examples for the asset.

TON’s social volume is increasing

Data from Santiment revealed that Toncoin’s social volume exceeded 400 in the past two trading sessions. This was a significant increase, as interest rates remained below this level for several weeks.

Although not a huge peak, this hike is still remarkable. And it is a sign of the growing interest within the network.

Source: Santiment

Further analysis suggested that TON is currently the seventh most trending token on Santiment. However, sentiment analysis showed that negative sentiments dominated the trend.

The recent Hamster Kombat coin event and the fluctuations in TON’s price have contributed to TON’s prominent position among trending assets.

Toncoin’s latest price move

At the time of writing, Toncoin was trading at $5,933, after a slight decline of 0.79%. The 50-day moving average (yellow line) was $5,755, while the 200-day moving average (blue line) was $6,209.

The price recently moved above the 50-day MA but remained below the 200-day MA. This could be a sign of a short-term bullish reversal within a longer-term bearish trend.

Source: TradingView

Technical indicators

Parabolic SAR – The dotted marks were below the price, indicating bullish momentum. This meant that buyers were gaining more and more control, and the uptrend may continue as long as the Parabolic SAR remains supportive.

Average True Range (ATR) – The ATR stood at 0.302, indicating moderate volatility. The recent drop in ATR could indicate a more stable price trend with less erratic movements.

Bull and bear scenarios for Toncoin

If TON can maintain its position above the 50-day MA and move towards the 200-day MA at $6,209, it could confirm a stronger bullish trend. Breaking the 200-day MA would be a significant bullish signal, potentially attracting more buyers and driving the price higher.

Conversely, if TON encounters resistance at the 200-day MA and cannot maintain its position above the 50-day MA, it could return to the $5.50 level or lower. In this scenario, the previous downtrend would resume as buyers lose momentum.

Increase in Toncoin’s volume and TVL

Finally data from DefiLlama indicated a positive shift in Toncoin trading volume. Over the past seven days, volume has increased from approximately $21 million to over $38 million. There has also been a modest increase in Total Value Locked (TVL), with the same at the time of writing at a figure of around $439 million – an addition of around $10 million in recent days.

– Read Toncoin (TON) price forecast 2024-25

Trading volume may continue to grow as Hamster Kombat coin minting gains momentum. Should the bullish scenario for TON materialize, the TVL could see further gains. This would be a sign of increased investor interest and capital inflow into the network.