- KAT has seen a significant increase, with an increase of over 40% in one day.

- However, the chances of a sustainable recovery remain uncertain.

Carat [KAT] has shown significant market activity, with a trading volume of $52,172.73 in the last 24 hours, marking a notable increase of 345% from the day before.

Currently, KAT’s price is 20.14% above its all-time low, reflecting an increase of over 40% in the last 24 hours and trading at $0.000549 at the time of writing. This golf in trading volume and price indicates growing interest and activity in the market.

Indicators suggest KAT may be undervalued

For context, KAT tokens are available for trading on both decentralized and centralized exchanges. The most popular exchange to buy and trade Karat is SyncSwap, where the most active trading pair KAT/USDC has had a trading volume of $225.73 in the last 24 hours.

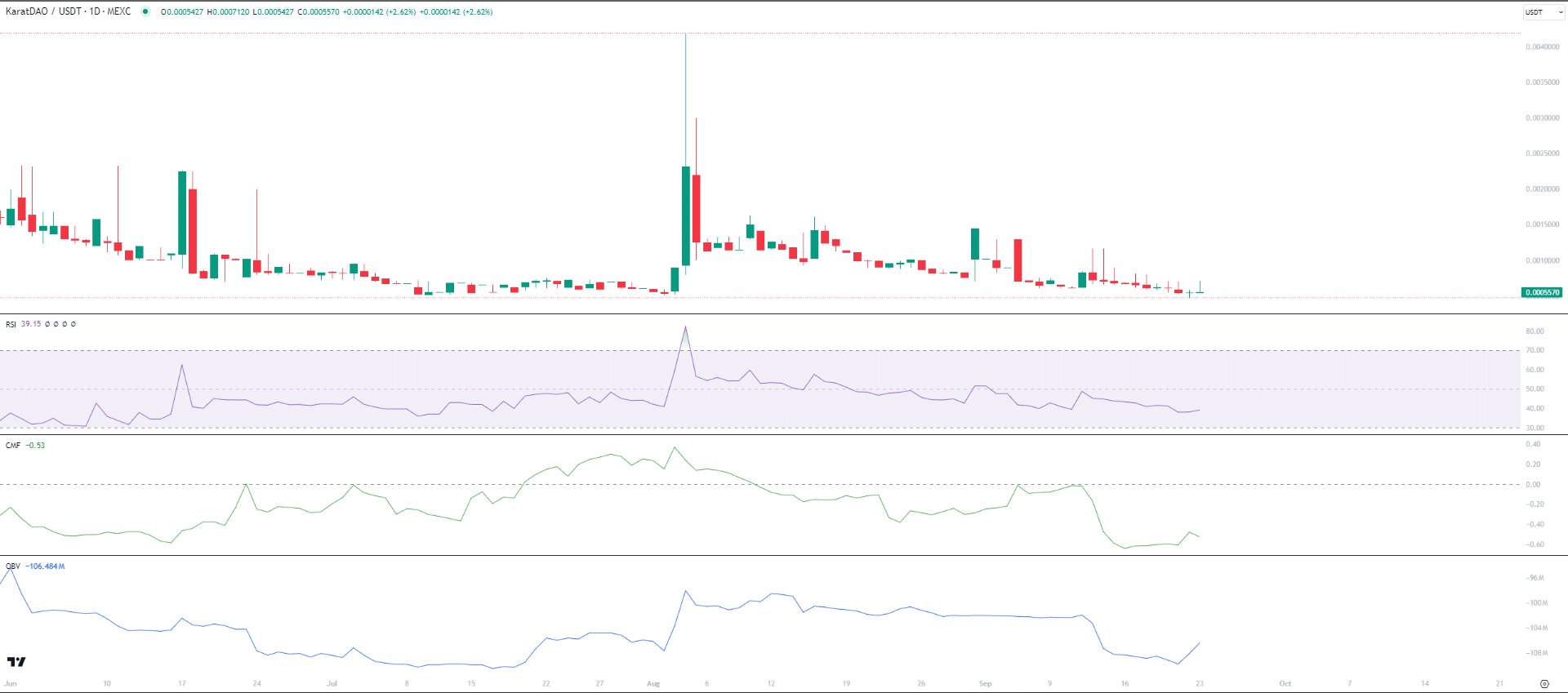

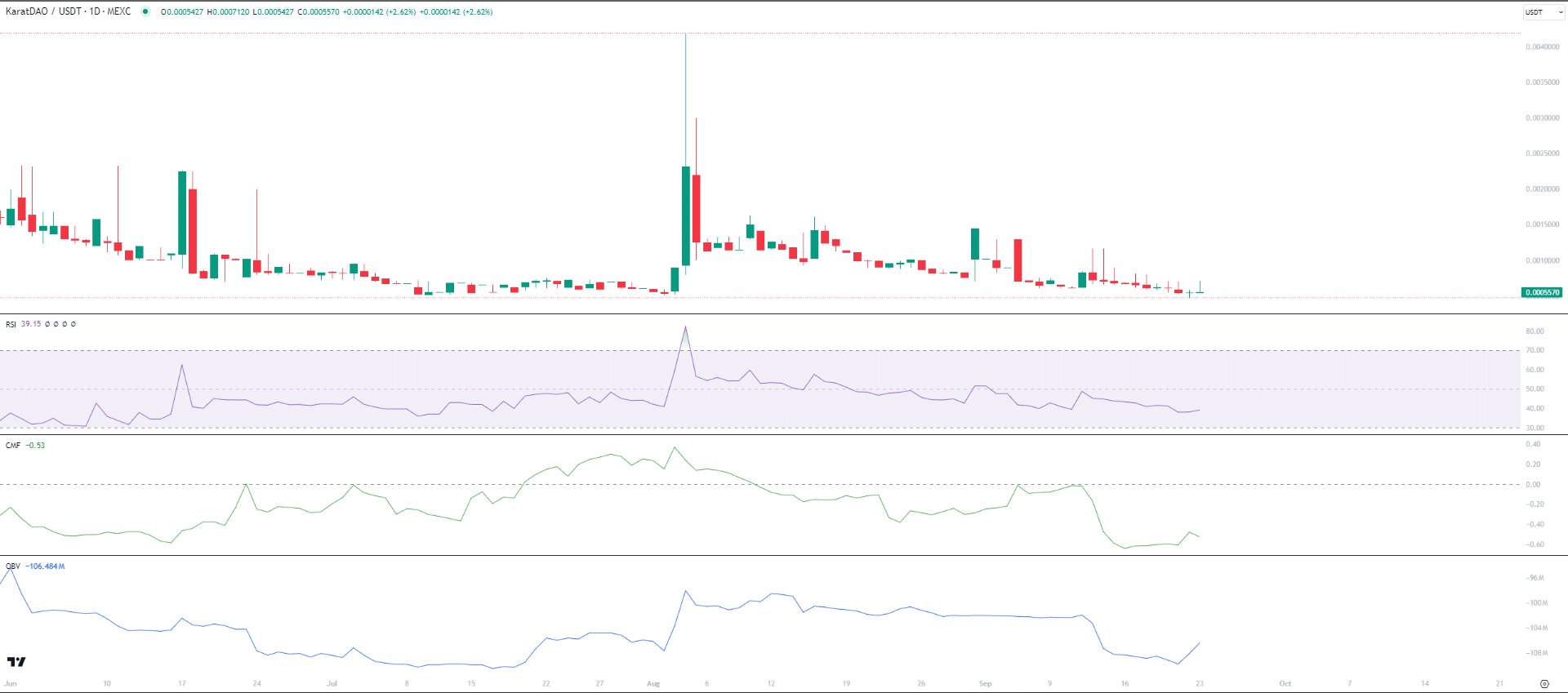

Despite initial optimism, KAT has suffered a dramatic decline, leading to more than a month of consolidation. On the daily price chart, KAT’s next challenge is to overcome the resistance at $0.001 before aiming for an earlier rejection at $0.002.

Source: TradingView

While the increase in trading volume increases confidence in KAT’s future value, key indicators suggest KAT may be undervalued, as evidenced by a declining RSI.

Simply put, an RSI below 40 typically indicates that the token is oversold, indicating that investors are not recognizing potential future gains and exiting amid the market’s volatility.

Likewise, a sharp decline in the CMF indicates a lack of capital entering the market. However, optimism continues with a spike in the OBV, indicating that daily active trading is increasing, possibly fueled by Bitcoin’s small increase.

For a price recovery, AMBCrypto has identified conditions that should match the increasing trading volume. If these conditions signal bullish trends, leading to spikes in the RSI and CMF, a correction could be on the horizon.

A change in sentiment is needed

If bulls aim to restore CAT near the original ATH, changes in several quarters are essential.

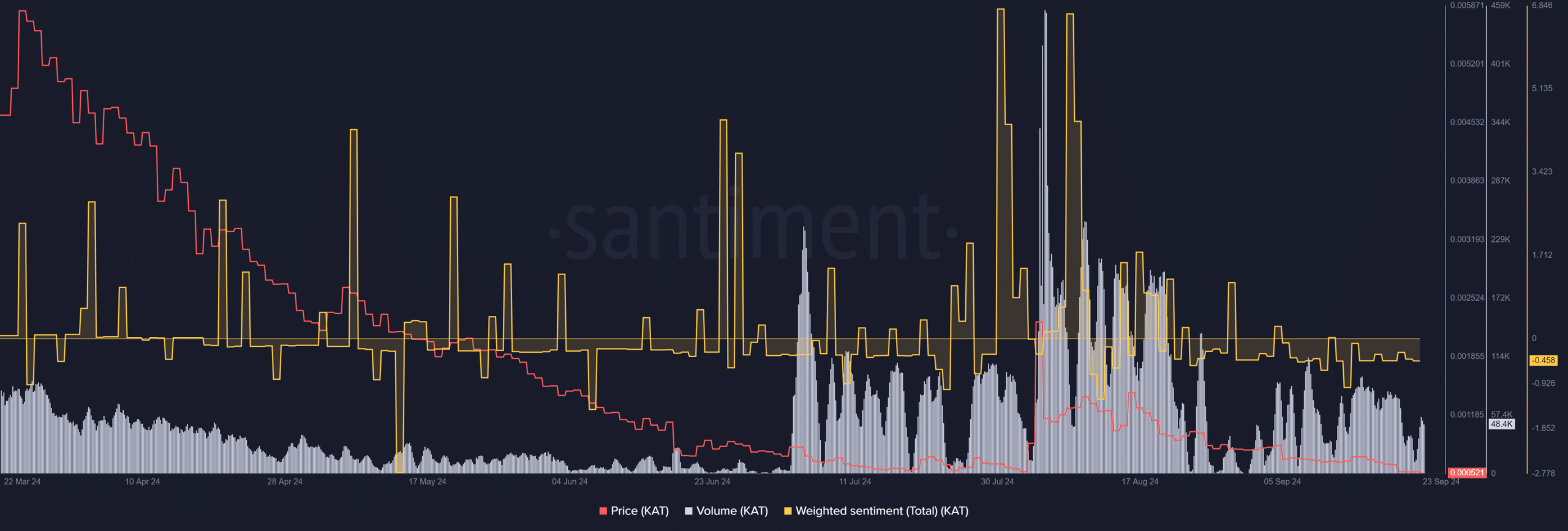

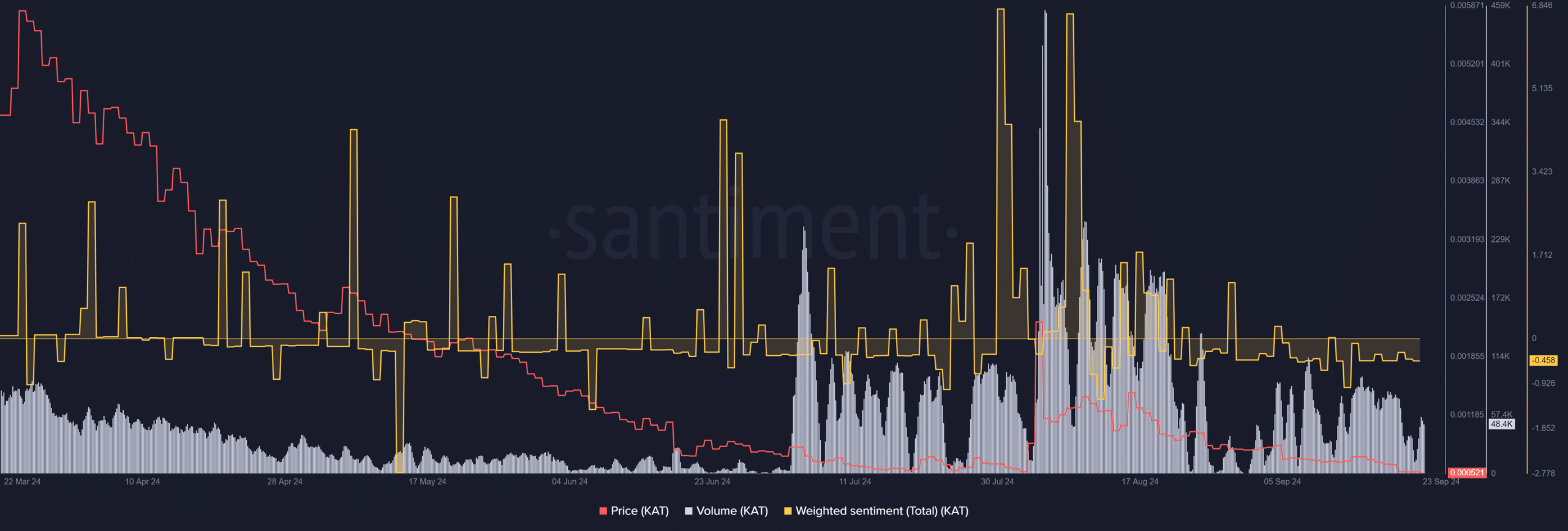

First, the 180-day chart below shows a volume spike coinciding with Bitcoin’s bullish moves during the early August cycle. Since then, however, total volume on the Karat Network has dropped dramatically from $128,000 to less than $50,000 today.

Source: Santiment

Furthermore, a spike in volume corresponded to a positive sentiment shift, allowing KAT to test the USD 0.002 resistance. However, despite a fourfold increase in volume, sentiment has now turned negative.

The lack of positive sentiment could undermine recent bullish attempts to counter the pullback that sent the token soaring 40%.If this sentiment remains unchanged, it could jeopardize any potential price spike.

Overall, a definitive price recovery is unlikely. If bulls show a little more aggression, they can cause a slight increase. However, a climb to the resistance at $0.002 remains out of reach for the time being.