- Bitcoin’s dominance is weakening as altcoin performance rises.

- If this trend continues, a potential price correction could be tempered.

Bitcoin [BTC] The bears thwarted another breakout attempt, maintaining pressure as the bulls remained above $62,000. With a price of $63,390 at the time of writing, a swing to $70,000 may not be imminent.

While some analysts predict a recovery, others suggest that BTC’s dominance is reaching its peak, signaling a possible dip. Could this set the stage for an altcoin season?

Bitcoin’s dominance could be in jeopardy

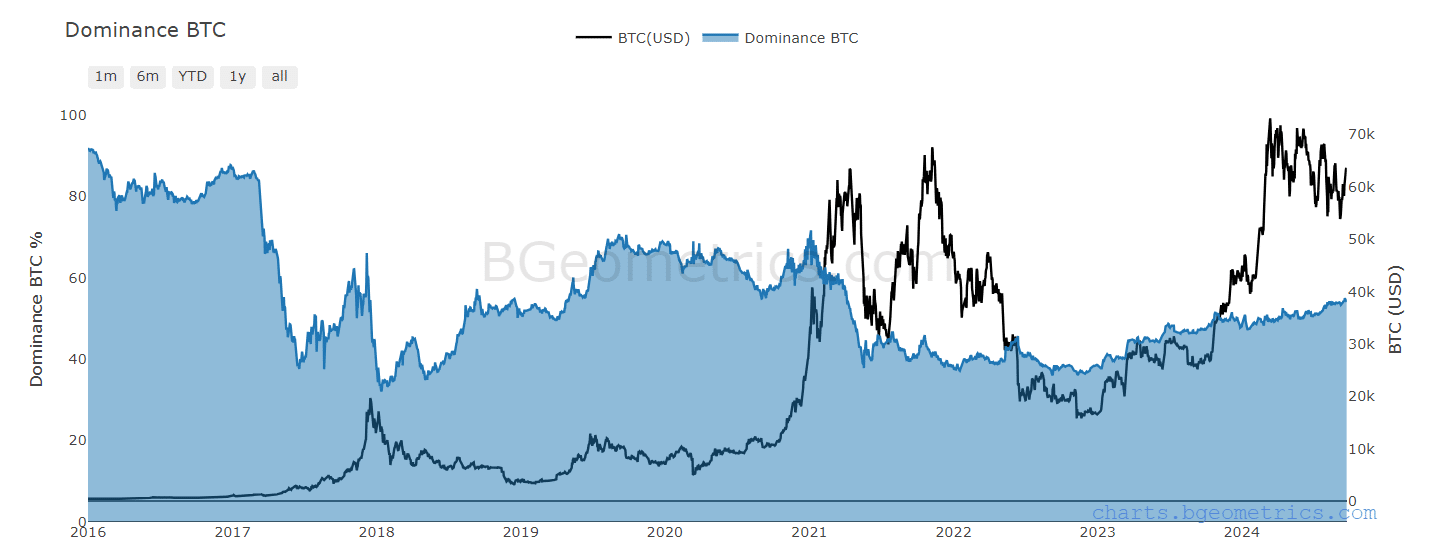

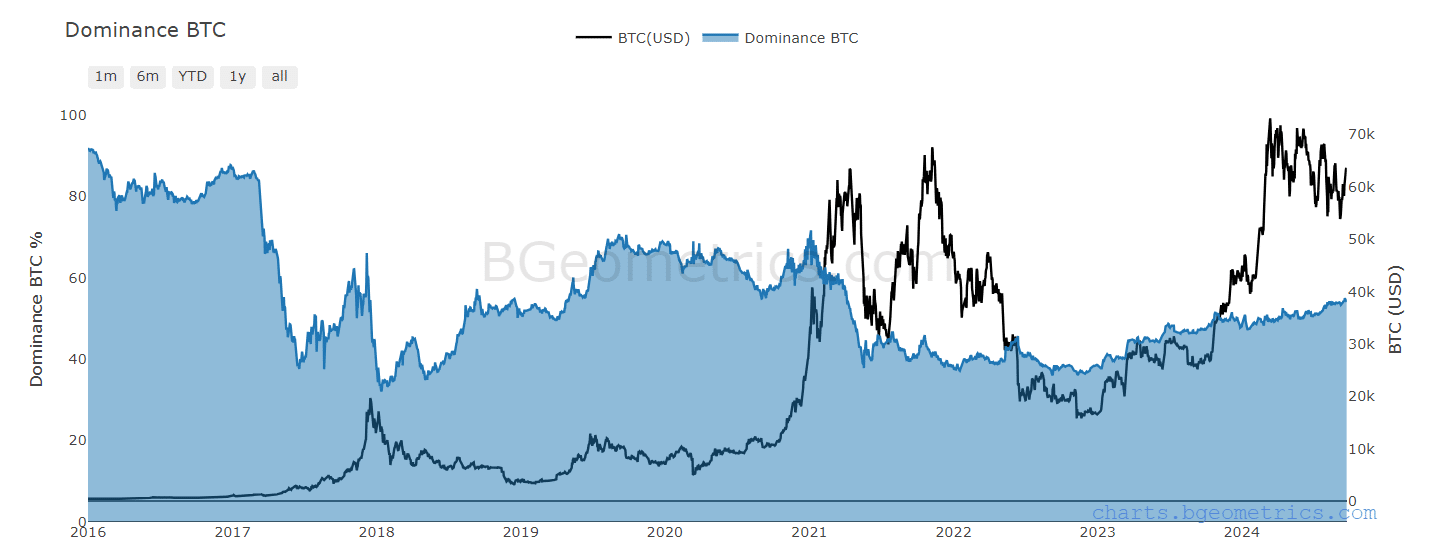

Historically, Bitcoin’s dominance has played a crucial role in the forecreaching market tops, reflecting Bitcoin’s massive share of the crypto market.

Typically, when BTC approaches a major resistance level, a corresponding spike in its dominance is often observed.

However, the chart below revealed a difference during BTC’s ATH of $73K in March. Despite the price increase, BTC’s dominance remained flat, indicating a disconnect between price action and market dominance.

Source: BGeometrics

According to AMBCrypto, this indicated growing interest in altcoins, with investors seeing them as less risky alternatives to Bitcoin amid the surge in value.

Interestingly enough, it belongs to Ethereum [ETH] recent price action supported this hypothesis, as ETH has overtaken BTC by double-digit growth over the past week, rising over 15% to $2,656 at the time of writing.

In summary, should altcoin investors keep an eye on BTC’s crucial resistance level for a possible surge? This can be crucial for predicting the next market movements.

Diversification indicates a potential market top

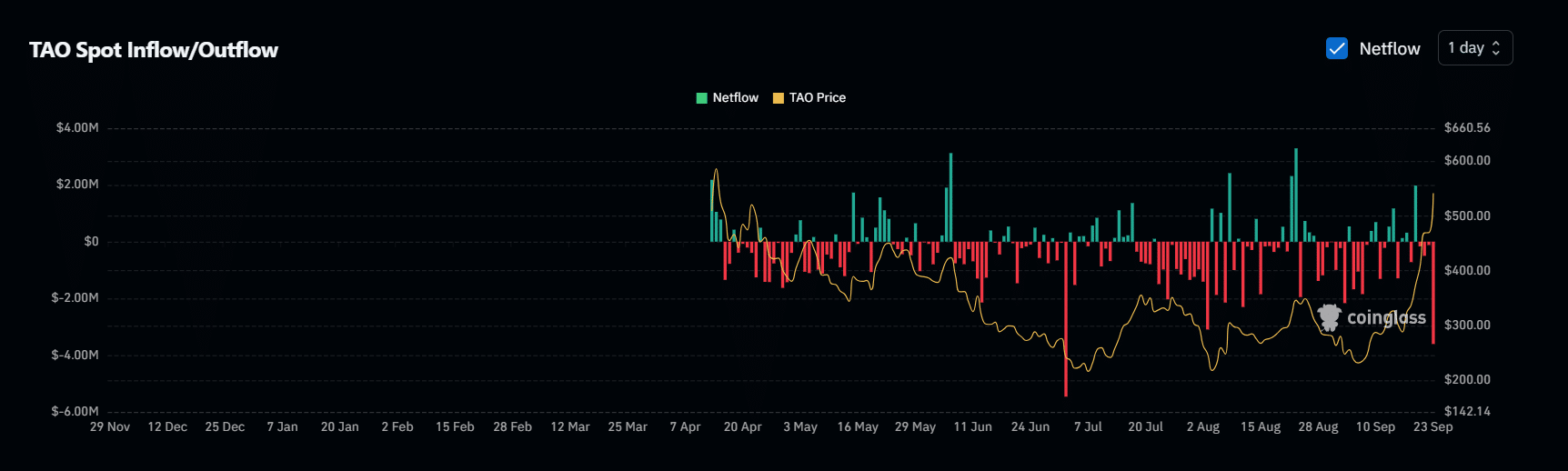

According to this Data shows that 15 altcoins have outperformed Bitcoin over the past 90 days, with TAO leading the pack, with an impressive 80% gain against BTC.

While this number is half of what is needed for an altcoin season, the significant difference certainly challenges Bitcoin’s dominance.

Furthermore, TAO has recorded a staggering 18% increase in the past 24 hours, far exceeding BTC’s 2%, reinforcing AMBCrypto’s previous hypothesis.

Notably, TAO’s rise coincided with Bitcoin breaking the key $63,000 range.

Currently, a spike in TAO outflows has reached a two-month high of $3 million, indicating that investors are switching to altcoins as BTC prices rise, indicating a direct correlation between the two.

Source: Coinglass

Simply put, this correlation signals a potential market top, as many investors lose confidence in a trend reversal and shift their capital to less risky alternatives.

If this trend continues, a price correction to $68K – the next resistance – could be tempered, especially as Bitcoin’s dominance weakens as more altcoins enter the top 50, paving the way for a potential altcoin season. What are the chances?

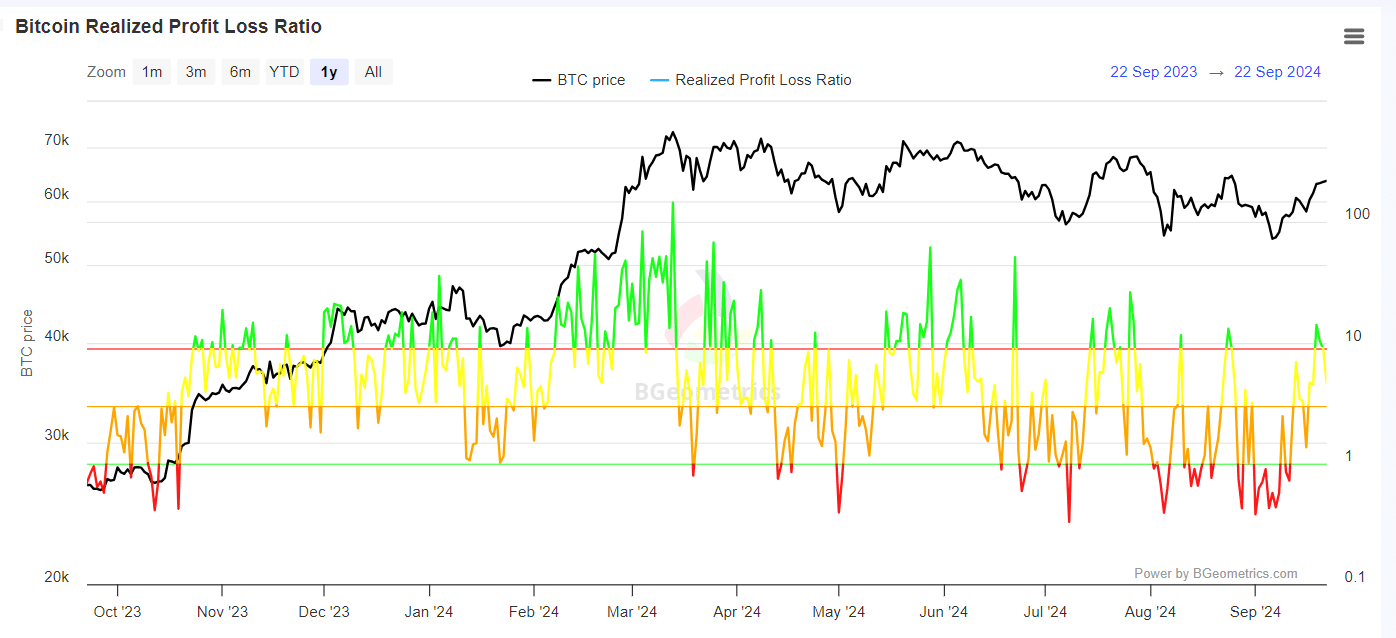

The market is at a crucial moment

Interestingly, on the day Bitcoin retested the $63,000 range, a significant portion of investors made profits, as evidenced by the green wig approaching 14.

However, when the bulls failed to trigger a breakout and bear dominance reasserted itself, a significant portion of stakeholders started realizing losses.

Source: BGeometrics

If these investors lose confidence in a price correction, it could lead to panic selling, further weakening Bitcoin’s dominance.

Furthermore, this could lead to a shift in asset allocation towards altcoins, which investors may consider a safer option.

In short: the market is at a crucial moment. If Bitcoin dominance continues and the bulls support a breakout, the altcoin season could falter unless BTC reaches its next resistance at $68,000.

Read Bitcoin’s [BTC] Price forecast 2024-25

However, if bulls fail to maintain the $64,000 range and a retracement below $60,000 occurs – which seems likely – many altcoins could see a temporary rise.

But for a sustainable altcoin season, confidence in future profits is essential, which is directly or indirectly related to Bitcoin’s dominance. Monitoring it is therefore essential.