- Bullish indicators are forming, but breaking $146 is crucial for a rally towards $180 or higher.

- Analysts predict a potential consolidation phase for AAVE.

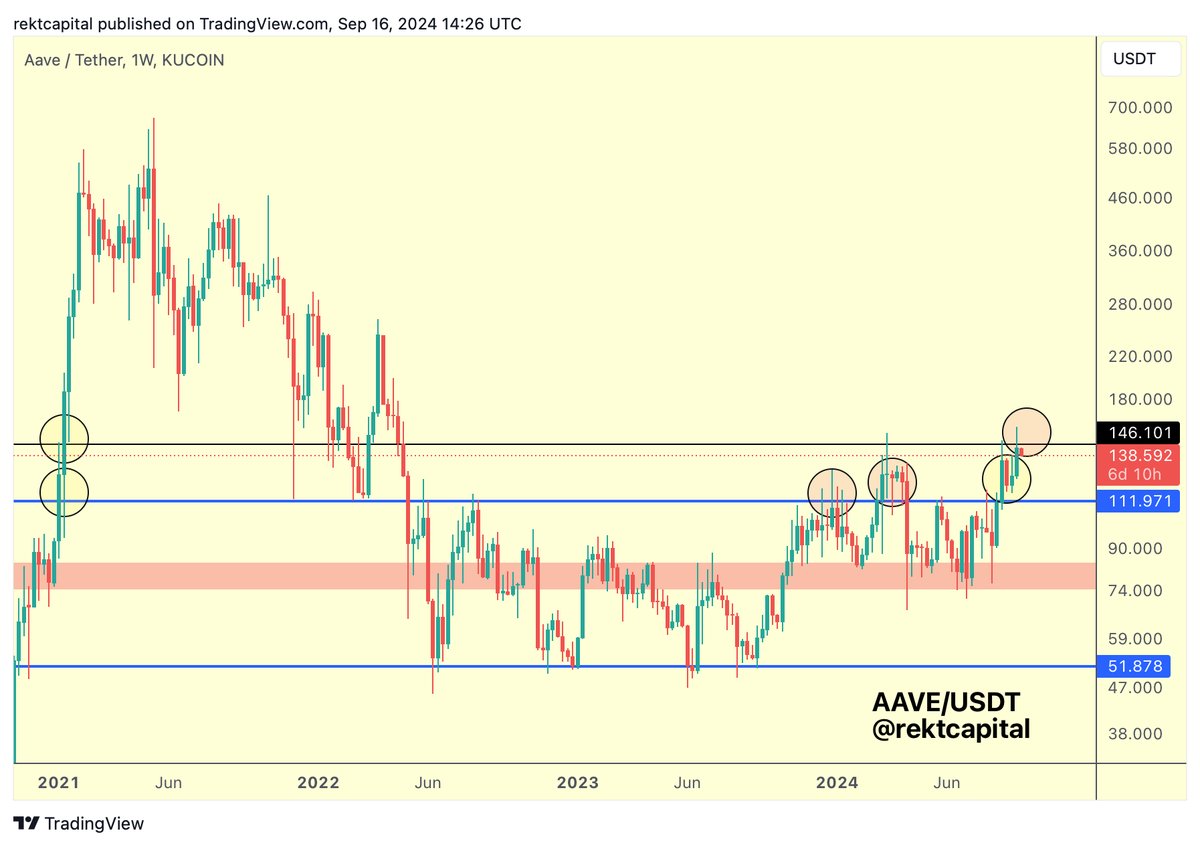

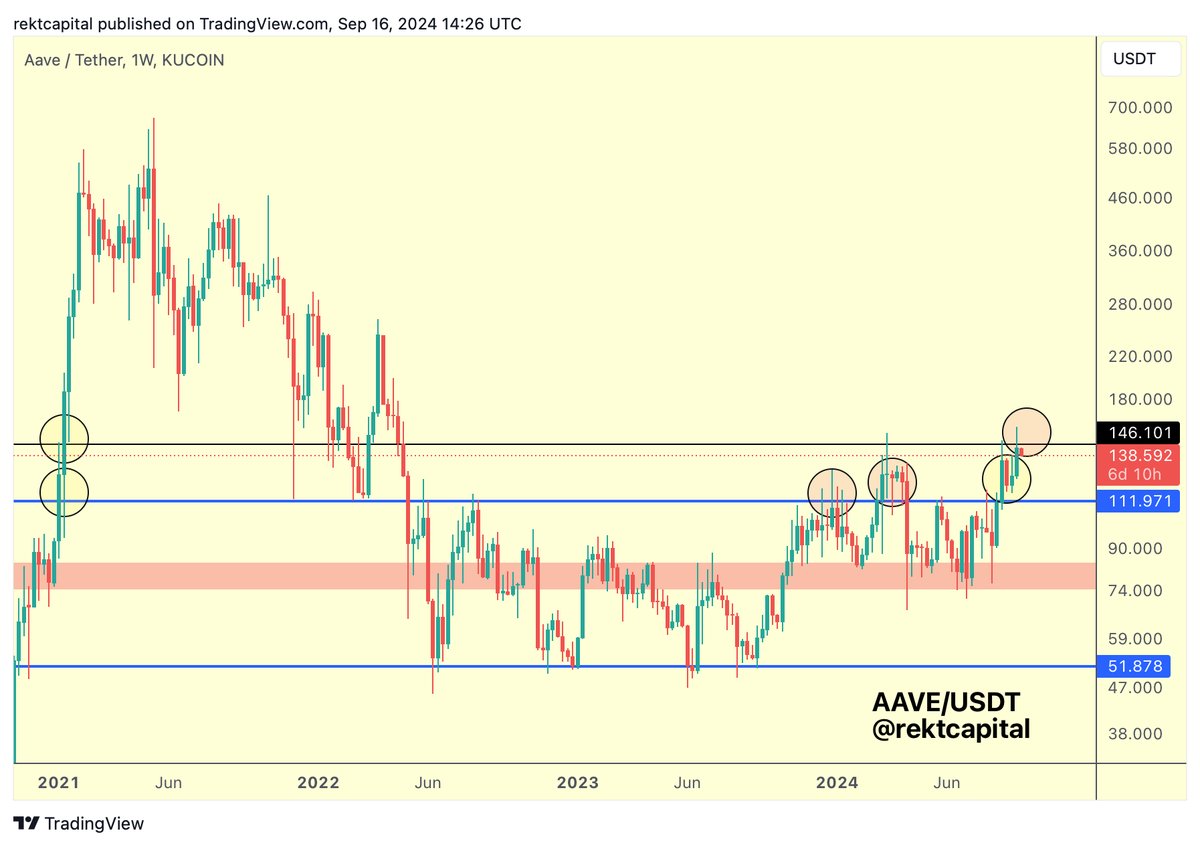

From Aave [AAVE] The recent attempt to move above the critical resistance level at $146 was thwarted, marking another rejection at this crucial point.

Crypto analyst Rekt Capital marked the importance of a close above $146 for a bullish breakout, noting that this crucial weekly close was missed. The continued inability to break above this level suggests that AAVE is not yet ready for a sustained rally.

The $146 price level has been a significant barrier since early 2022, with multiple failed attempts to close above it. The latest rejection signals the ongoing challenge for buyers, raising concerns that the market could remain range-bound for the foreseeable future.

Consolidation likely between $111 and $146

After the latest rejection, analysts predict a potential consolidation phase for AAVE. The price could remain between the $111 support level and the $146 resistance level, which has proven difficult to break.

This consolidation would allow AAVE to trade within this range until a decisive move above resistance or below support occurs.

Source:

To confirm a bullish breakout, AAVE would need to secure a close above $146. If this happens, the next price targets could reach $180, indicating renewed bullish momentum.

However, if AAVE fails to hold the support at $111, it could lead to a decline to the $90 level or lower, signaling further market weakness.

Despite these failed attempts, some bullish technical patterns are forming. The chart of AAVE shows an inverse head and shoulders pattern, a classic bullish reversal setup. Furthermore, the price breaks out of a falling wedge, a pattern that usually precedes an upward move.

These bullish signals indicate the possibility of a breakout, although the resistance at $146 must be overcome first.

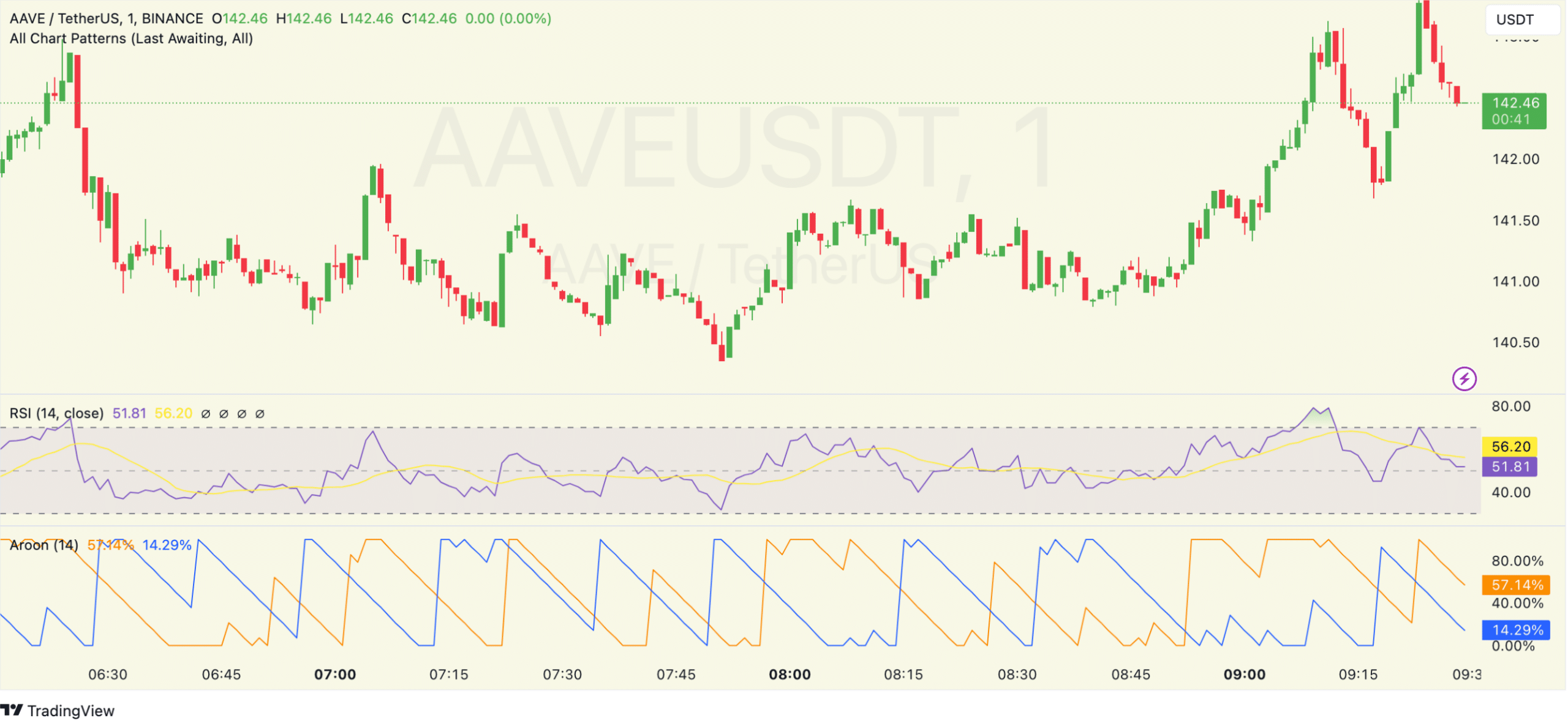

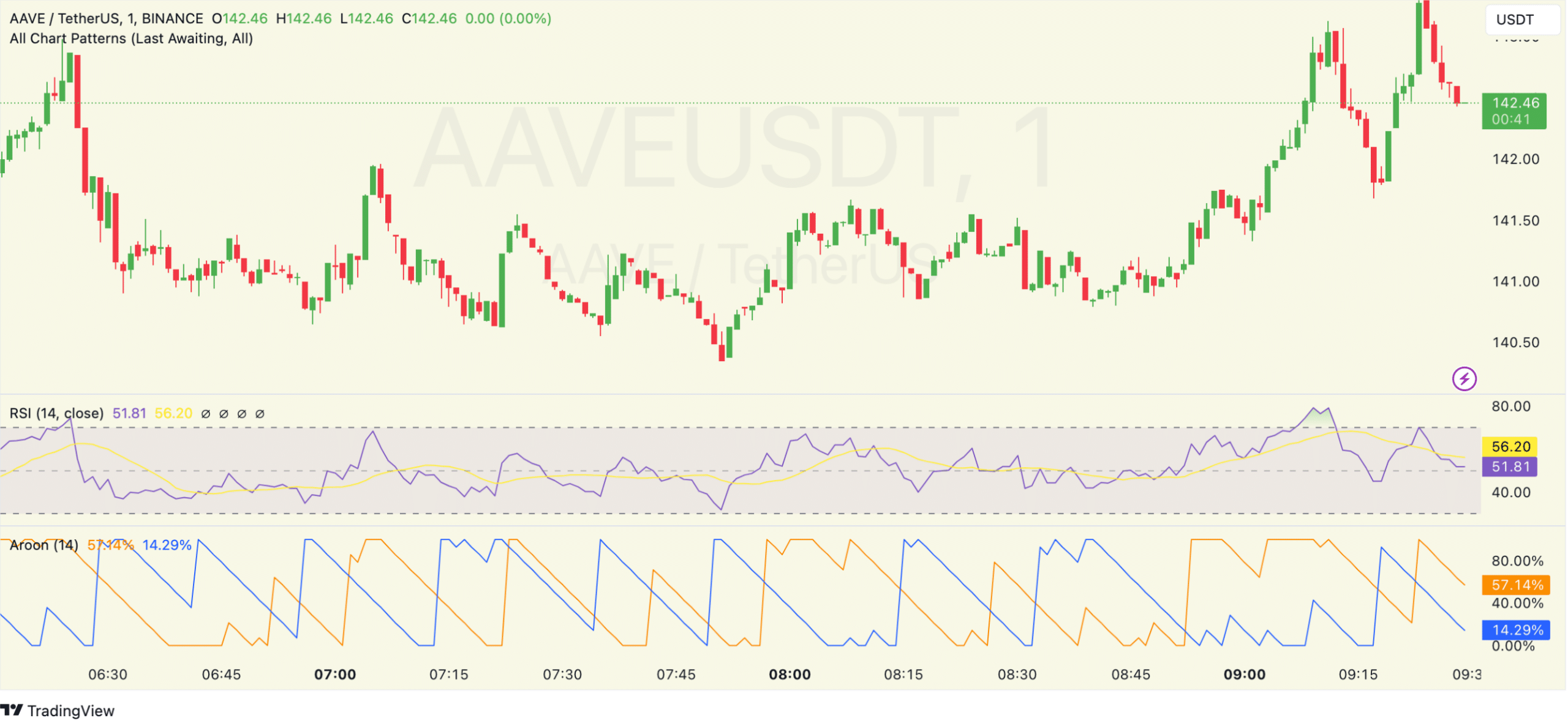

Technical indicators indicate mixed momentum

While the rejection of AAVE at $146 is concerning, technical indicators point to some bullish momentum. The Relative Strength Index (RSI) currently stands at 65.09, indicating that buying pressure is increasing, but has not yet reached overbought levels.

This suggests there is still room for upside if the bulls regain control.

Source: Trading view

Moreover, the Aroon indicator is showing a strong uptrend, with the Aroon Up line at 100%, indicating a clear upward move.

Meanwhile, the Aroon Down line stands at 14.29%, indicating minimal selling pressure. These indicators provide some optimism for traders hoping for a breakout above the resistance level.

At the time of this publication, AAVE is trading at $141.56with a 24-hour trading volume of $327.46 million. The circulating supply amounts to 15 million AAVE, giving the token a market capitalization of $2.11 billion.

Read Aave’s [AAVE] Price forecast 2024–2025

While the market is showing some signs of a bullish reversal, the key resistance at $146 remains a major hurdle to overcome before AAVE can confirm a sustained uptrend.

Traders are watching these levels closely as a break above $146 could pave the way for a rally towards $180 and above.