- USDT supply rose 0.37%, in line with Bitcoin’s 2% decline from the previous day.

- If confidence in a recovery fades, a mass capitulation may follow.

During the recent market consolidation, stablecoins have soared. Since September 9, the market capitalization of USDT and USDC has increased by $1.153 billion: USDT by $410 million and USDC by $743 million.

This coincided with Bitcoin [BTC] rising to $60.5K, a gain of 12.04% in a week.

Therefore, this capital influx was crucial to the rise of Bitcoin. With the market retreating into a bearish pullback, are investors confident of a price recovery now?

Increase in USDT supply

While Bitcoin saw a 2% drop on September 16 from the day before, USDT supply circulated jumped from $54.14 billion to $54.34 billion.

This increased liquidity could support potential Bitcoin price gains in the coming days, assuming there is less reliance on USDT as a safe haven.

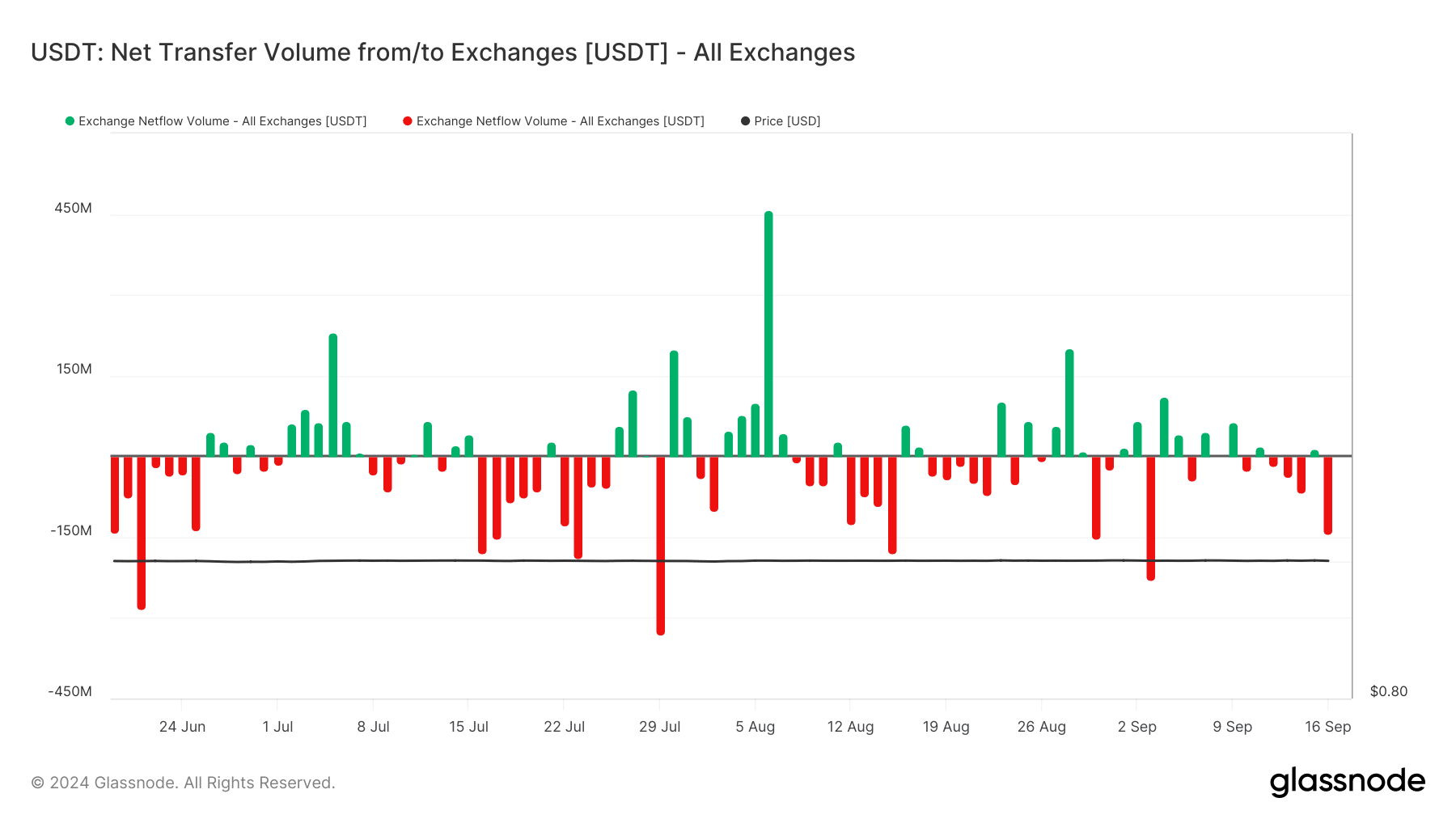

Surprisingly, the graph below is in stark contrast to this expectation.

Source: Glassnode

The tremors have caused panic among stakeholders, as evidenced by the successive negative flows. Investors may have shifted capital into USDT for safety as Bitcoin’s price fell, reflecting a liquidity shift rather than a direct correlation.

Simply put, the jump in USDT supply did not correlate with the increased demand for Bitcoin; other factors may play a role.

On September 16, Tether’s treasury beaten 1 billion USDT tokens, which caused the sharp increase in supply by 0.37%.

While this could indicate confidence in the price recovery, it could also reflect demand for liquidity or market hedging, rather than immediate optimism.

Therefore, other dynamics must be taken into account to measure true trust.

The outflow of stablecoins could lead to capitulation

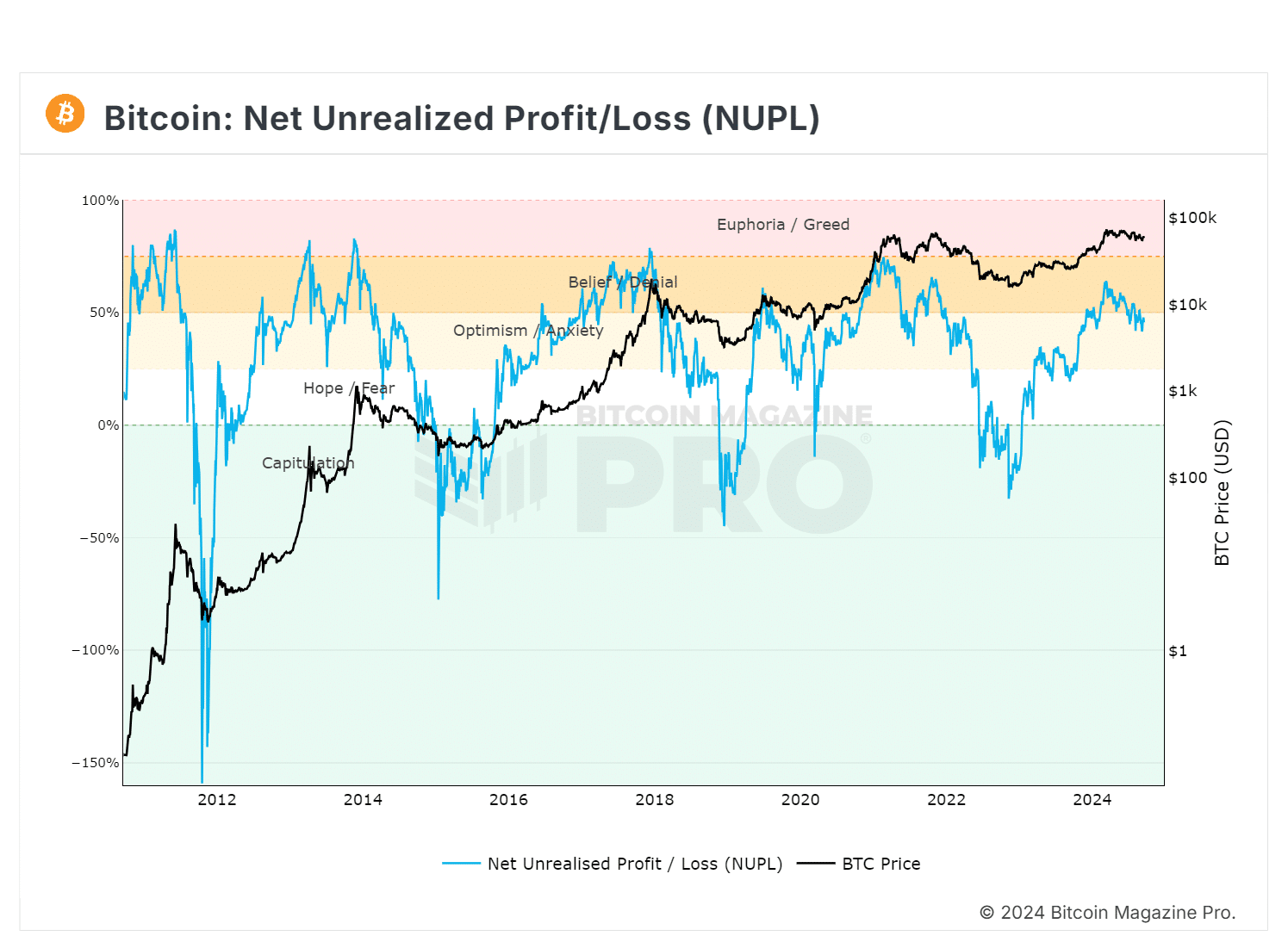

The chart shows many Bitcoin holders making profits, which is bullish but could signal a market top as a high NUPL could lead to profit taking and possible corrections.

Source: Bitcoin Magazine Pro

Conversely, rising USDT outflows could turn the NUPL negative, indicating unrealized losses and a possible selling to break even.

The exact position will become clearer after the FOMC meeting. If bulls act decisively, profit holders can keep their gains.

However, approaching the $55,000 mark could lead to greater USDT outflows, signaling a possible capitulation.

Read Bitcoin (BTC) price prediction 2024-25

For context, on September 3, a massive $230 million USDT flowed out of the exchanges on the same day Bitcoin fell almost 3%, after rising 4% the day before.

This indicated that investors were likely escaping capital, causing BTC to fall below $54,000 in just three days. If this trend continues, BTC could return to the same support level again this time.