- The Ethereum Foundation has sold more than 1,000 ETH again

- The previous sales wave was widely criticized by the community

Over the past 24 hours, the Ethereum Foundation has conducted two transactions, selling more of its ETH holdings in exchange for DAI. This move comes despite significant criticism during their previous large-scale sale of ETH assets.

The Foundation’s decision to convert ETH into stablecoins like DAI could be a step toward managing their assets. However, it could also raise concerns about the potential impact on market sentiment and price stability of ETH.

Ethereum Foundation on the road again!

According to data from Spot on chainOn September 5, the Ethereum Foundation sold 100 ETH for over 241,000 DAI.

While this first transaction did not generate any significant reactions, the most recent transaction did attract some attention. On September 6, the Foundation transferred 1,000 ETH, worth approximately $2.38 million, to a multi-signature wallet. Based on previous transaction patterns, this ETH is expected to be transferred to another wallet and likely exchanged for DAI.

Despite the scrutiny surrounding these transactions, the Ethereum Foundation still owns a significant amount of ETH – over 274,000 ETH, worth over $652 million. While the sale of 1,000 ETH has raised some concerns, another notable transaction from 13 days ago came into the spotlight. That transaction showed the Foundation moving more than 35,000 ETH to Kraken, raising questions from observers about the motives behind these sales.

At the time, Ethereum’s Vitalik Buterin responded to allegations that the Foundation had sold off assets. Yet neither he nor the Foundation has made a public statement about these latest transactions.

Ethereum’s social metrics show a lack of impact

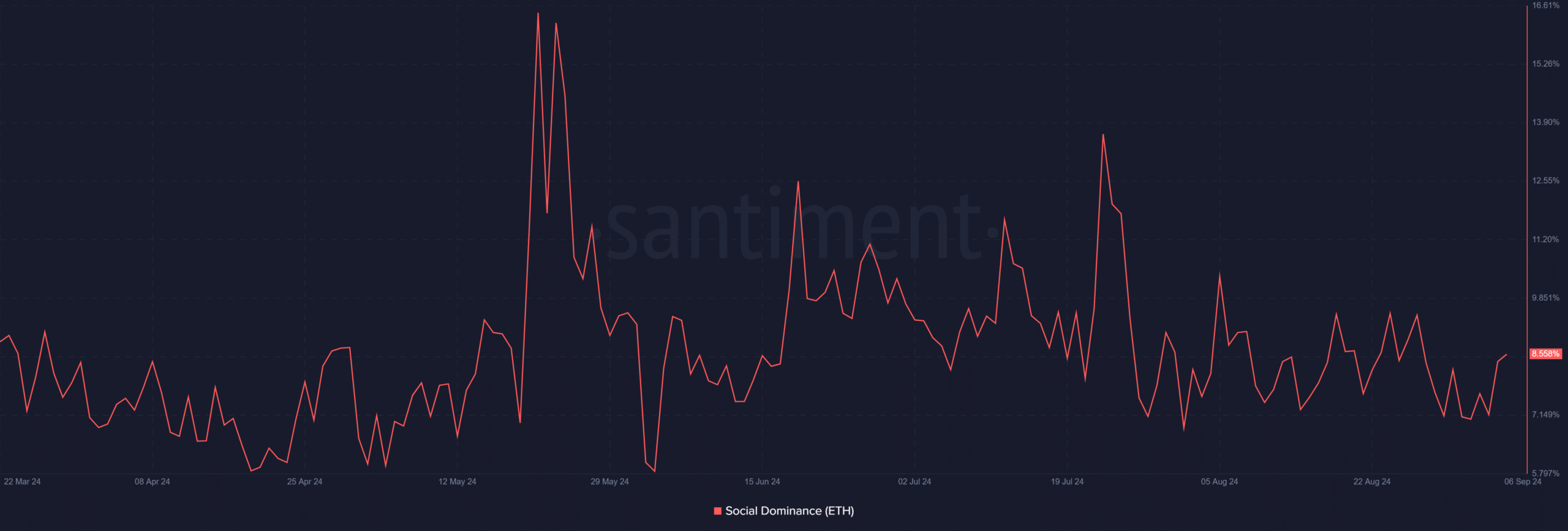

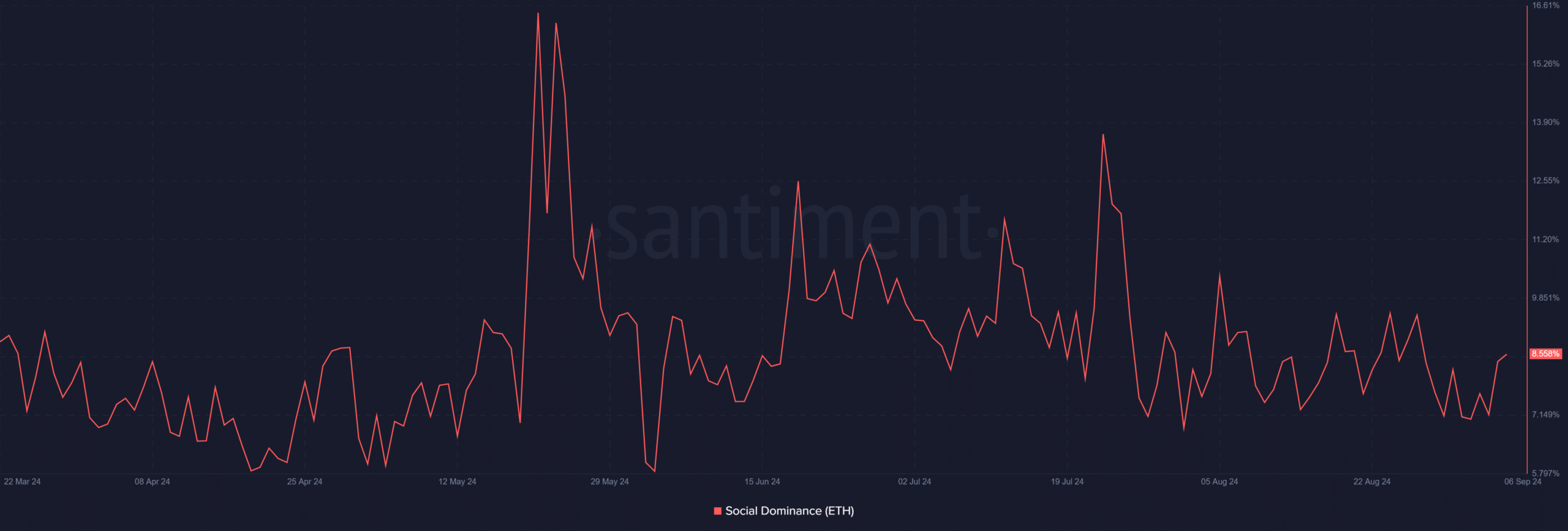

A recent analysis of Ethereum’s social dominance showed a slight increase, with Ethereum accounting for over 8% of total crypto discussions.

However, a closer look at the social context Santiment revealed that the recent sale by the Ethereum Foundation has yet to become a trending topic. Despite the Foundation’s sale of ETH, this event has not significantly affected the broader discussion within the crypto community.

Source: Santiment

Because the sale did not receive widespread attention, this means that the transaction did not meaningfully influence market sentiment.

This means that the sale is unlikely to hurt Ethereum’s price for now. While it is still early, the lack of community response points to a relatively neutral market response. One with no immediate expectations of significant price declines as a result of the Foundation’s actions.

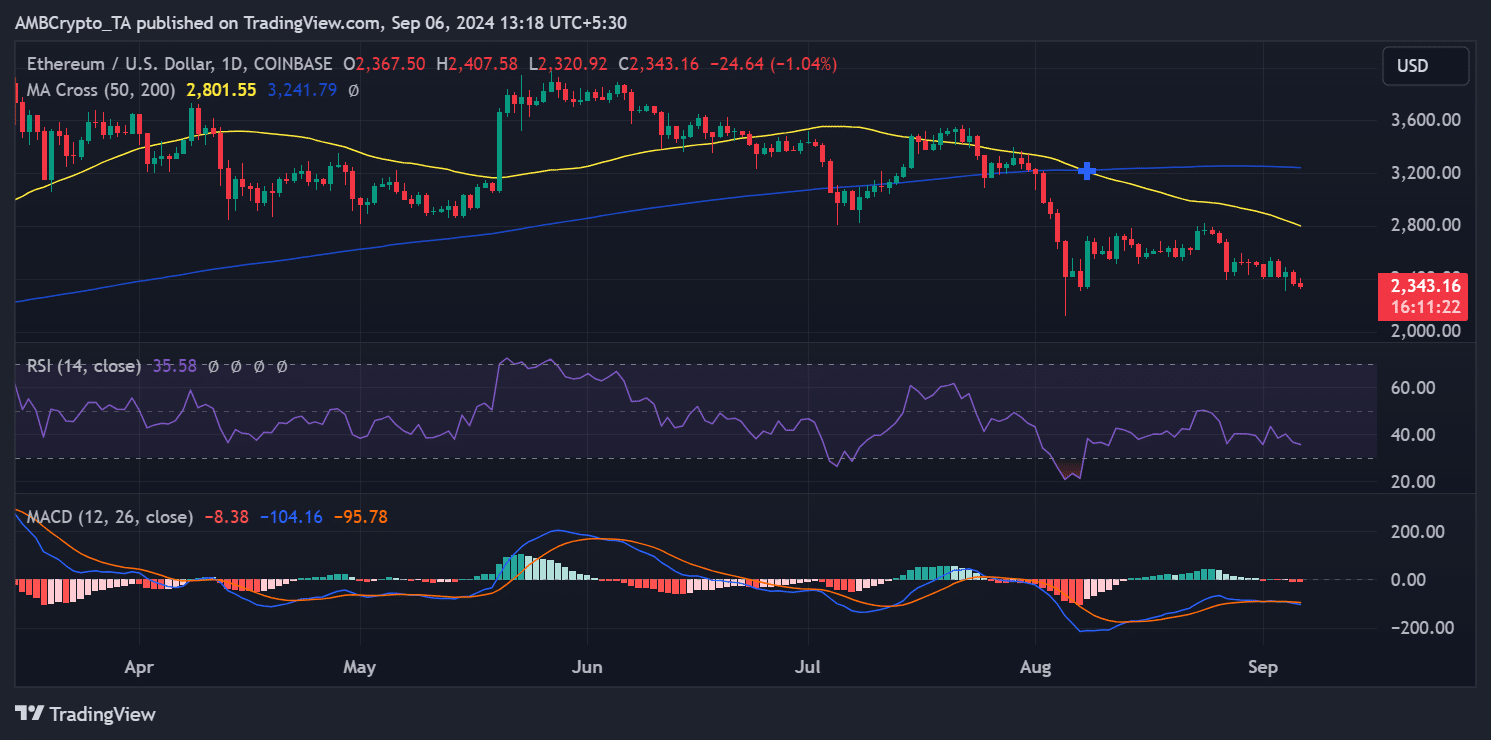

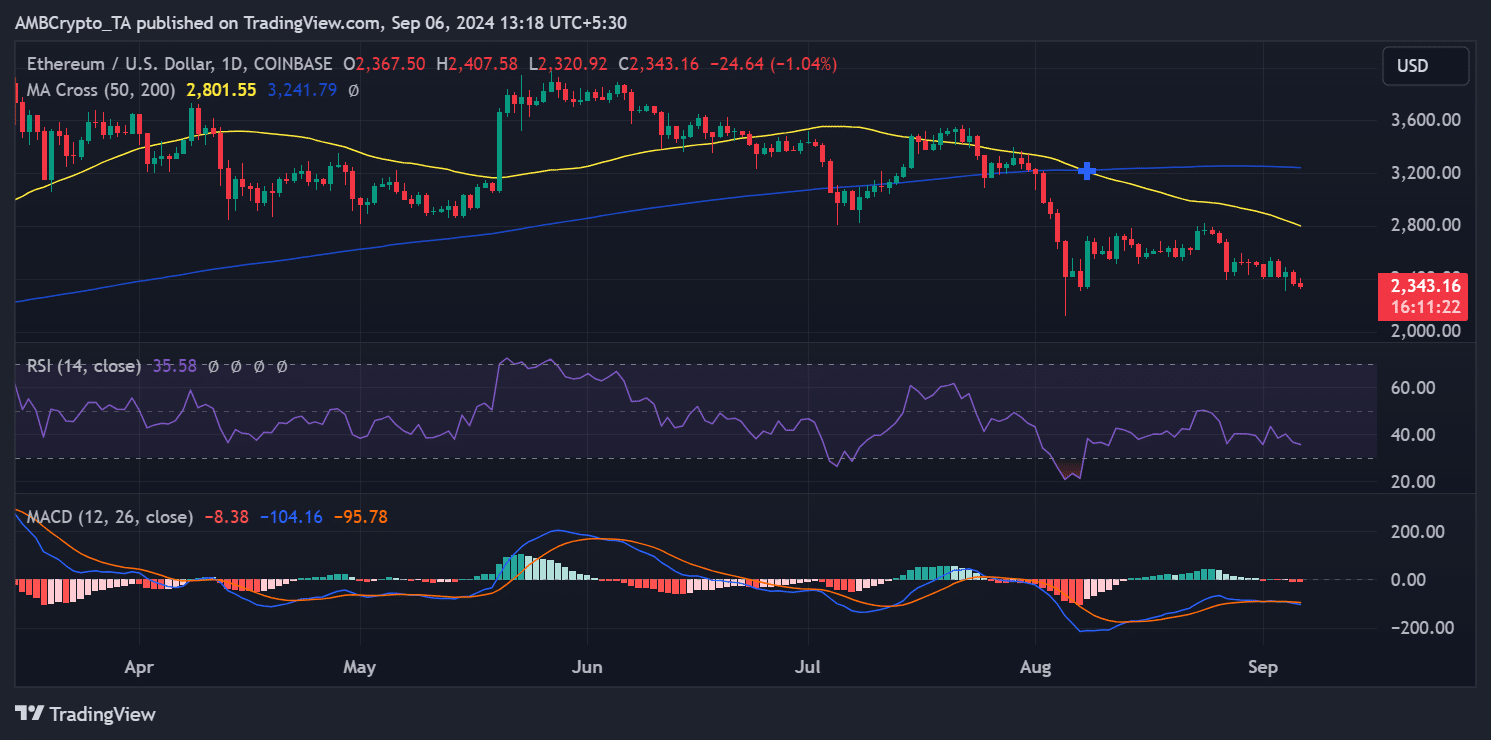

ETH continues its downward trajectory

By the end of trading on September 5, ETH was trading around $2,367, after dropping more than 3% on the charts. This bearish momentum continued throughout the last trading session, with the altcoin trading at around $2,343 soon after.

Source: TradingView

While the price of ETH could continue to decline, the recent sell-off by the Ethereum Foundation is not helping. In fact, the prevailing price action appears to be more in line with broader market conditions, as the sell-off has not yet produced a significant shift in sentiment.

– Read Ethereum (ETH) price forecast 2024-25

Furthermore, Ethereum remained firmly in a bear trend at the time of writing, as evidenced by the Relative Strength Index (RSI). Until the RSI signals a momentum shift or other technical indicators improve, ETH will continue to struggle in the short term.