- Bitcoin is showing signs of weakening demand as September, a month often associated with falling prices, approaches

- Possible US interest rate cuts and other bullish catalysts could fuel volatility

August was a volatile month Bitcoins (BTC) price. BTC started trading on August 1 at around $63,000, and just a week later the crypto’s price dropped to around $49,000. While the price later recovered to $65,000 at the end of August, it has since fallen to $59,190 at the time of writing.

Despite Bitcoin falling nearly 8% over the past month, traders expect further declines in September as the coin follows previous price action. Even according to popular analysts Ali Martinez,

“If you think August was tough for Bitcoin, keep in mind that September often produces negative returns as well.”

For example, in September 2023, the price of crypto fluctuated between $24,000 and $27,000, without making significant gains. There was also a sharp price drop of 17% in September 2021.

Will history repeat itself or will Bitcoin break this pattern?

A look at the key statistics

Several key figures already show bears taking control and positioning themselves for a possible September decline.

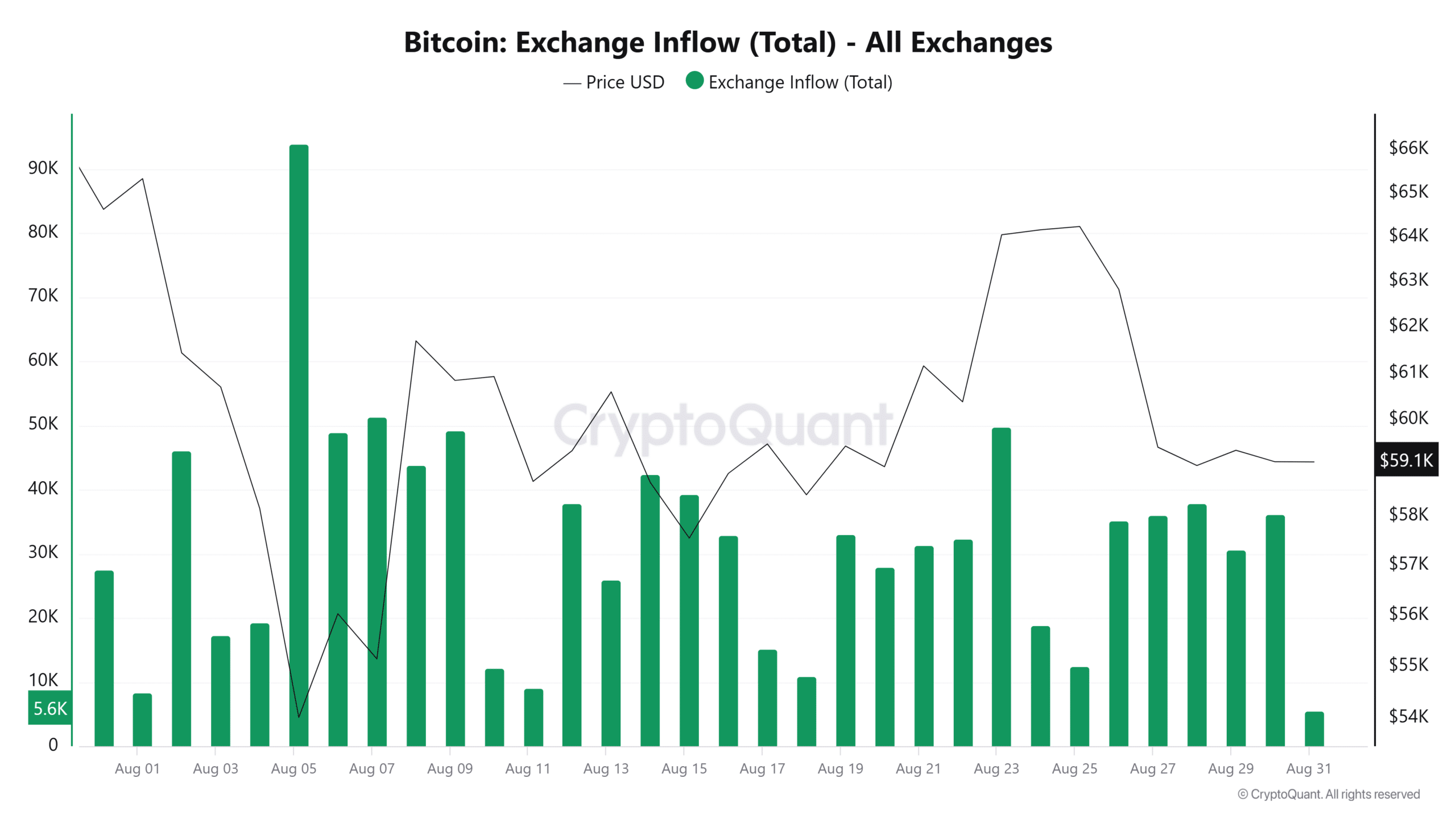

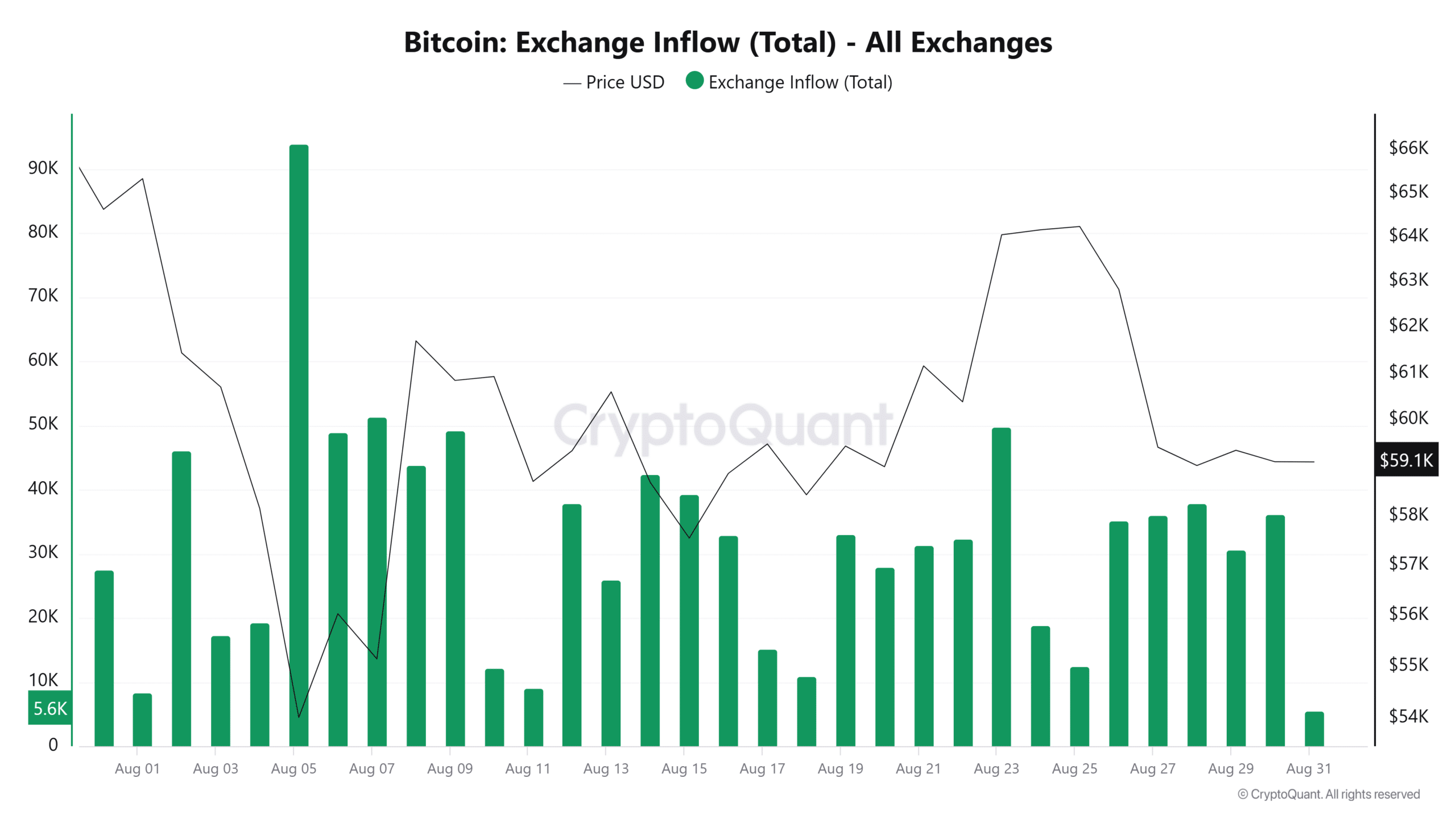

For example, data from CryptoQuant shows that currency inflows have increased significantly since late August. The inflow came shortly after the price of BTC rose above $64,000.

(Source: CryptoQuant)

This indicator could mean that after the recent recovery in prices, a significant number of traders have chosen to sell and minimize risks in case of further declines ahead.

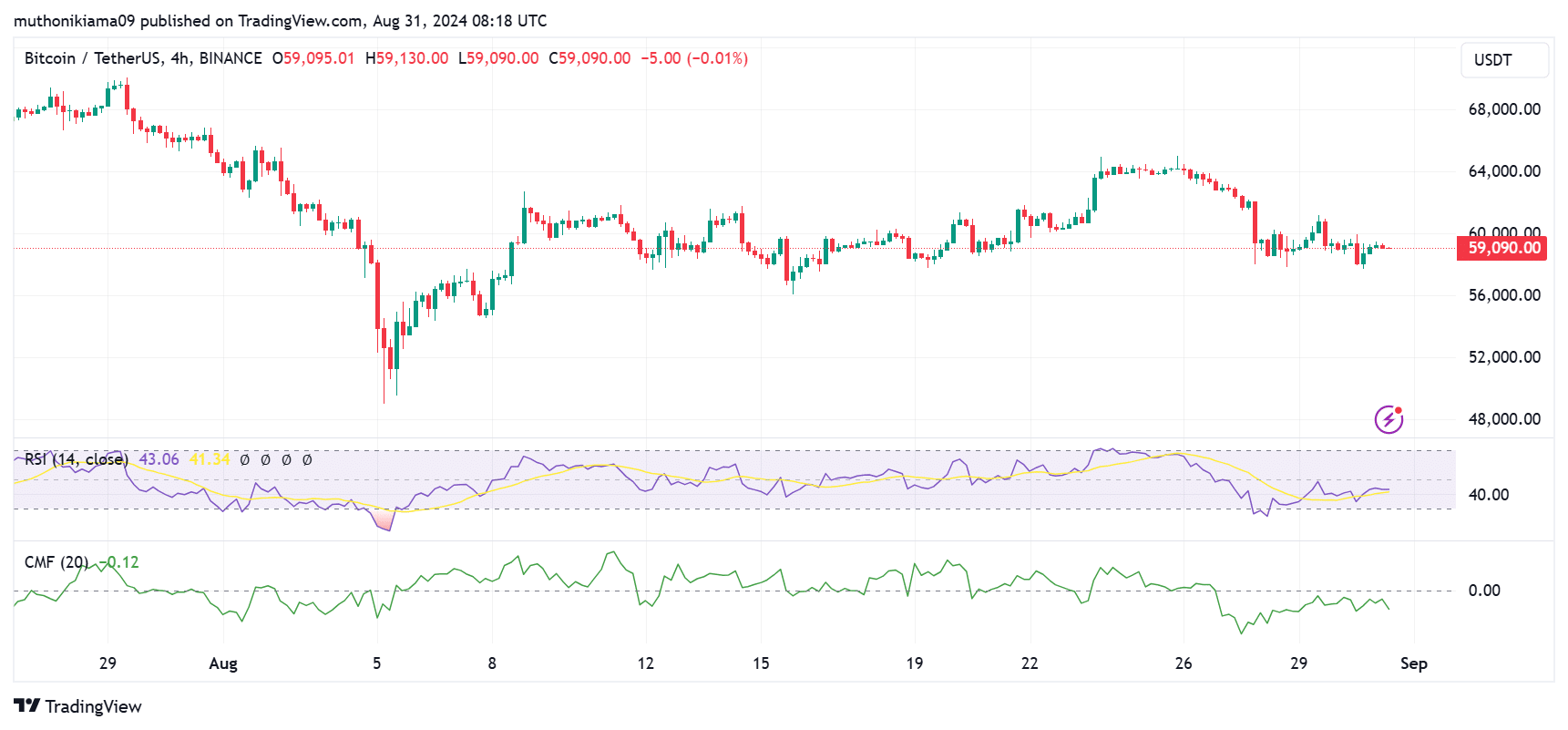

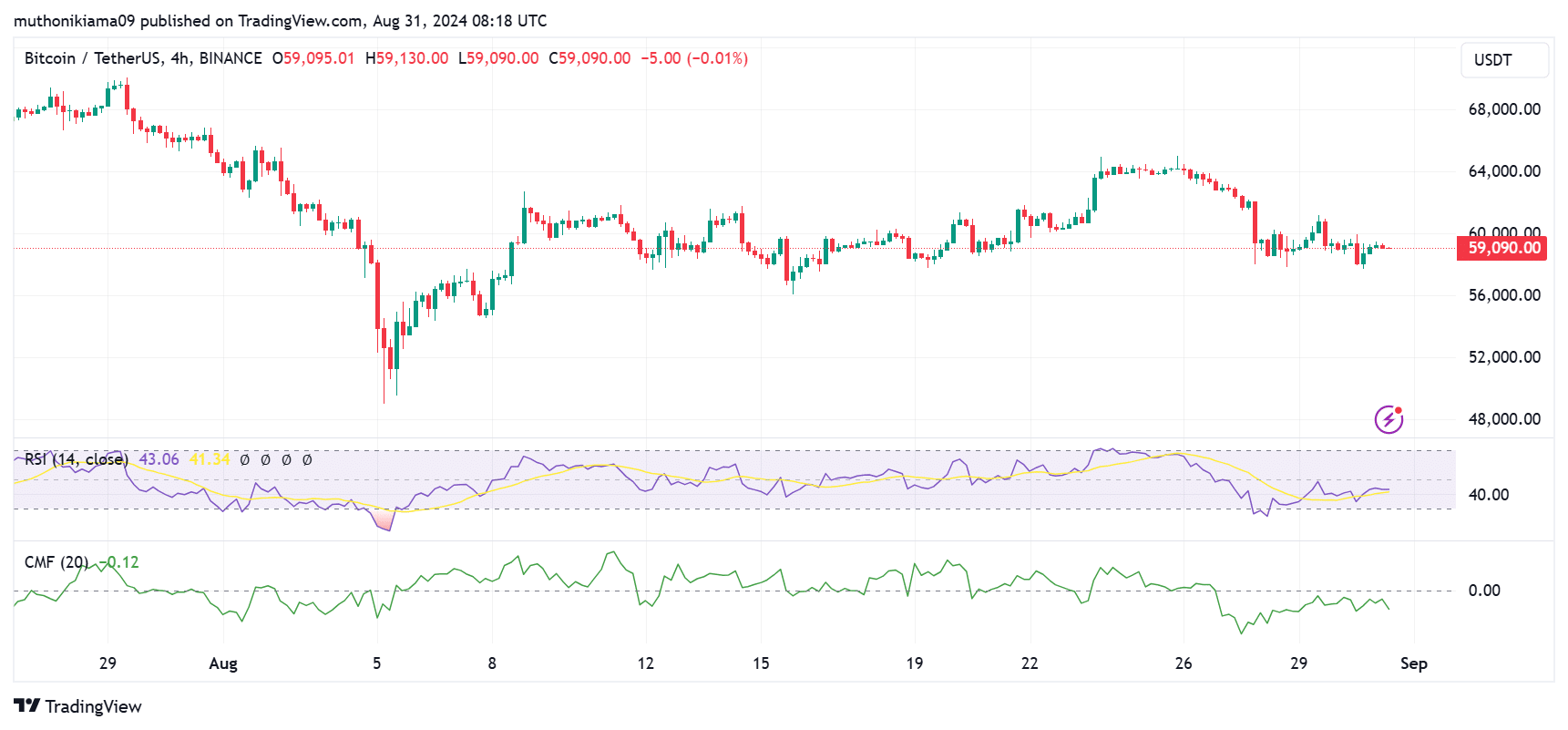

Buyers are also showing hesitation to get back into the market. Several key indicators, the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF), showed declining buyer interest at the time of writing.

The RSI at 43 suggested that sellers are still in control, and buyers are unwilling to enter at prevailing prices. The CMF has also been hovering in the negative region since August 26 – a sign of bearish dominance.

(Source: Handelsview)

On August 30, the US announced that the main PCE price index for July was 2.6% annualized. This was lower than the expected 2.70%.

Such positive macro factors usually lead to an increase in the price of Bitcoin. However, that didn’t work yesterday.

According to QCPWith the recent macro news barely having any effect on crypto prices, BTC will continue to trade within a $58k-$65k range in the near term.

Moreover, inflows into Bitcoin Exchange Traded Funds (ETFs) have weakened. For example, over the past four consecutive days, BTC has seen consistent outflows SoSoValue facts.

Will September 2024 be different?

Declining demand for Bitcoin appears to be making traders hesitant to enter the market if September turns out to be another gloomy month.

However, several bullish factors could fuel a rally in September. The positive data on the US economy has fueled speculation that the US will cut interest rates at the next meeting of the Federal Open Market Committee (FOMC).

Data from the CME FedWatch tool showed that a majority of investors expect the Fed to refrain from tightening monetary policy for the first time since March 2020. If that happens, it will fuel a rally in risky assets like Bitcoin.

Another bullish catalyst is the release of former Binance CEO Changpeng Zhao from prison. Its release date is set for September 29, and some already anticipate it could trigger a bull run.

Finally, former US President Donald Trump will debate US Vice President Kamala Harris in September. If cryptocurrency is involved, this can increase volatility.

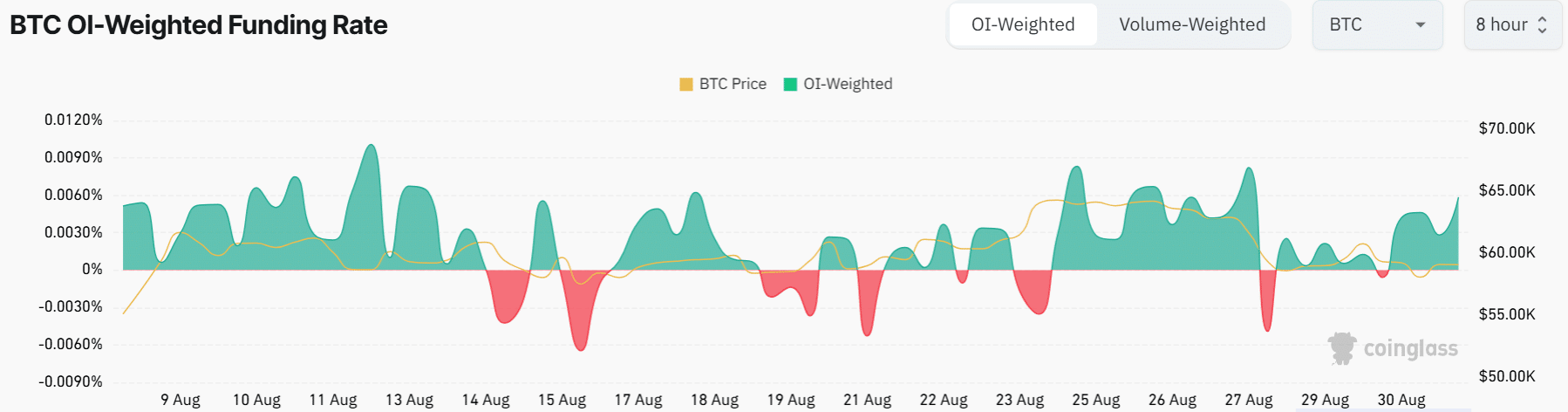

Bitcoin funding rates have also turned positive and increased significantly in recent days. This implies an increase in the number of long positions – a bullish signal as traders anticipate future profits.

(Source: Mint Glass)