- US inflation was stable in July, increasing the likelihood of a Fed rate cut

- However, BTC price remained subdued and could remain within range

US inflation remains stable, reinforcing market expectations of a likely Fed rate cut in September. This interest rate cut is expected to provide a boost Bitcoin [BTC] and other risky assets. According to the US Bureau of Economic Analysis (BEA) July’s Core PCE (Personal Consumption Expenditure) price index was 2.5% annualized.

The PCE price index rose 0.2% last month, similar to June’s value, and matched analyst estimates. The data measures price changes for goods and services, excluding food and energy, and is the Fed’s preferred variable for tracking inflation and making monetary policy decisions.

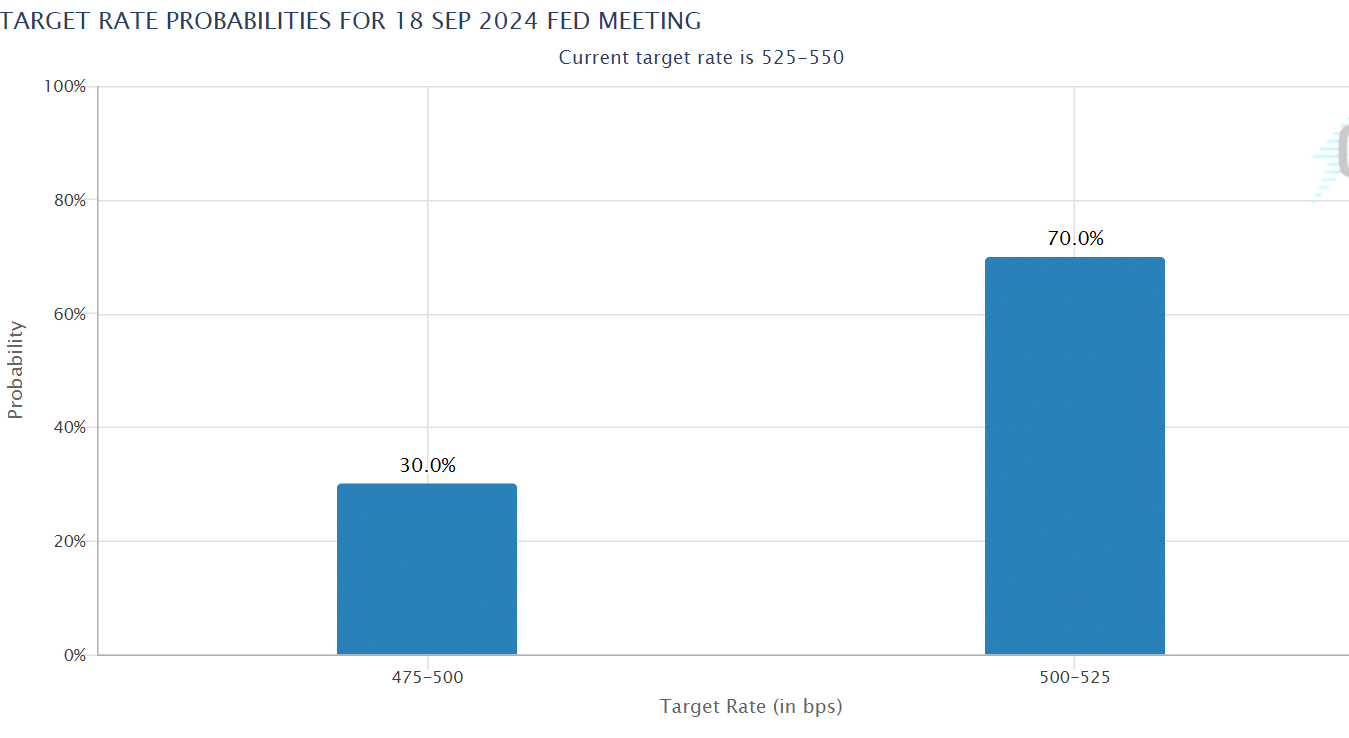

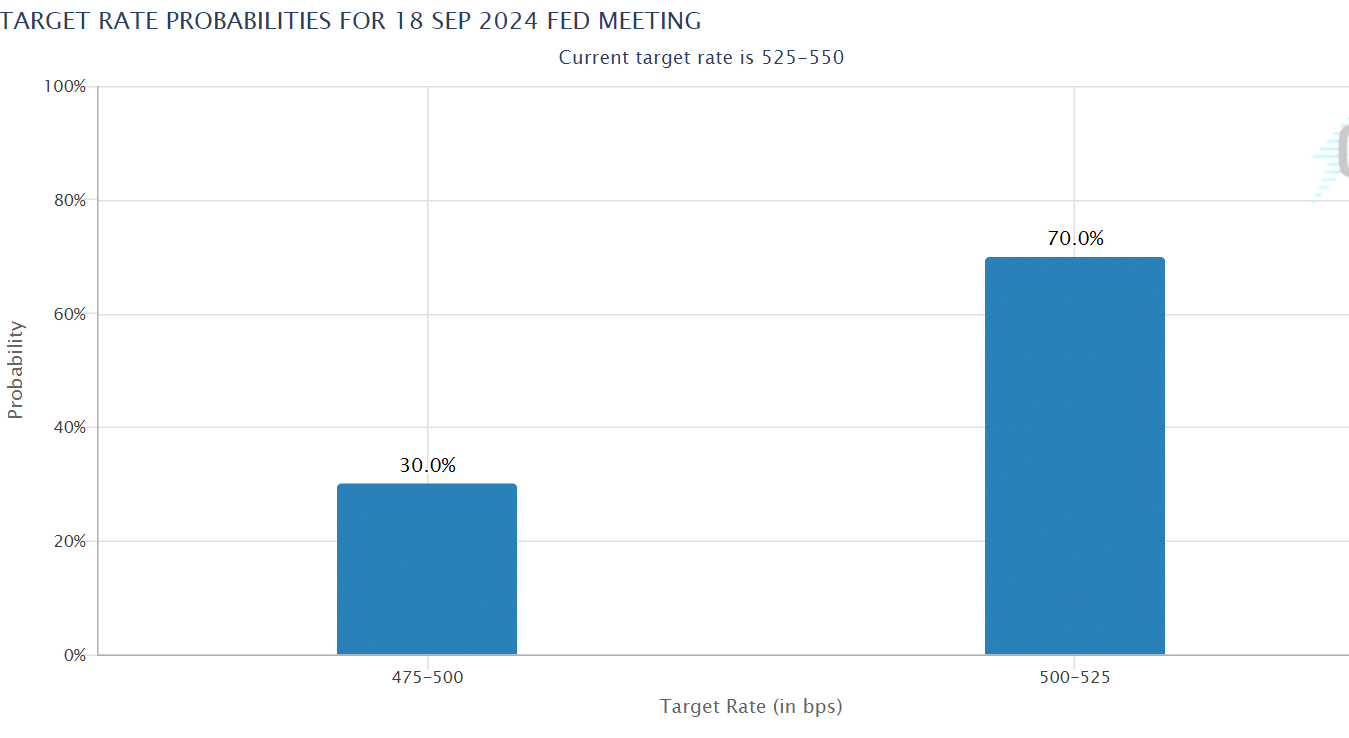

September Fed Rate Cuts Rise to 70%

That said, July’s steady inflation data reinforced the market’s belief that the Fed would likely cut rates by 25 basis points (bps) in September. According to the CME FedWatch toolInterest rate traders now estimate the odds of an interest rate cut in September at 70%.

Source: CME FedWatch Tool

That would translate to a 4% jump from the 66% seen before the July inflation data was released. Meanwhile, some traders estimate a 30% chance of a 50 basis point rate cut at next month’s Fed meeting.

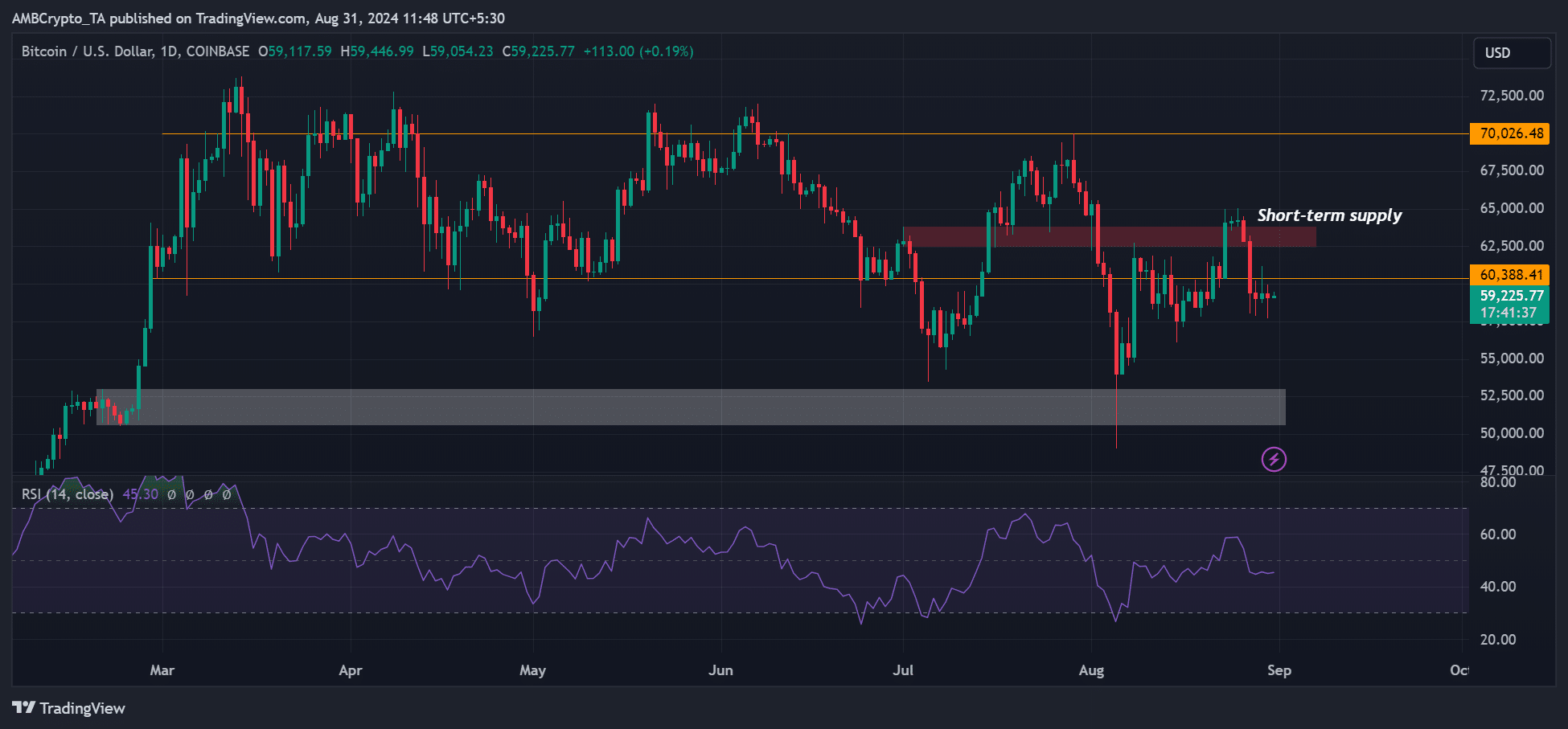

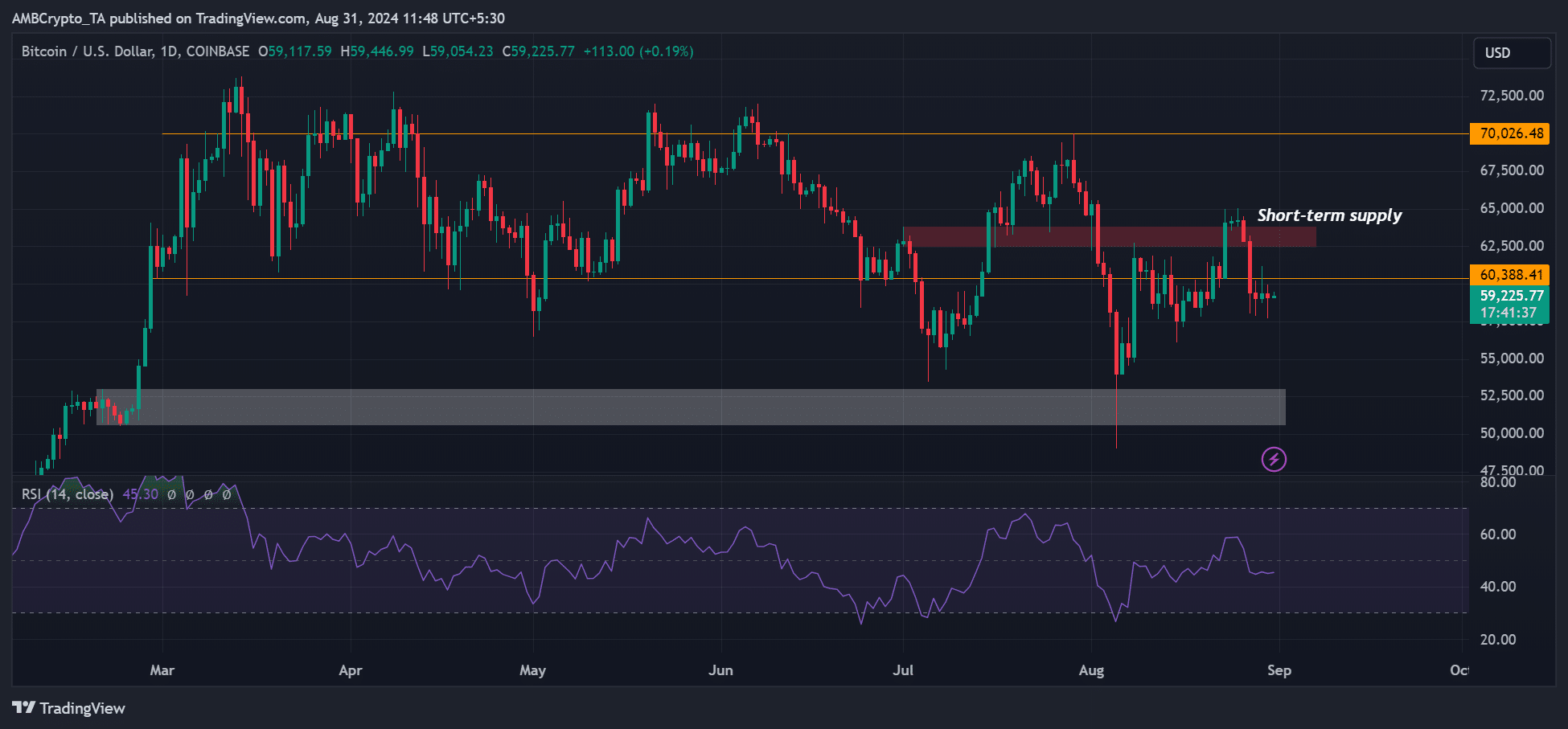

Bitcoin’s price remains subdued

The data sent US stocks higher, while BTC and crypto markets plunged and consolidated. BTC rose slightly to $59.9k before falling to $57k on Friday after inflation data was first released.

Source: BTC/USD, TradingView

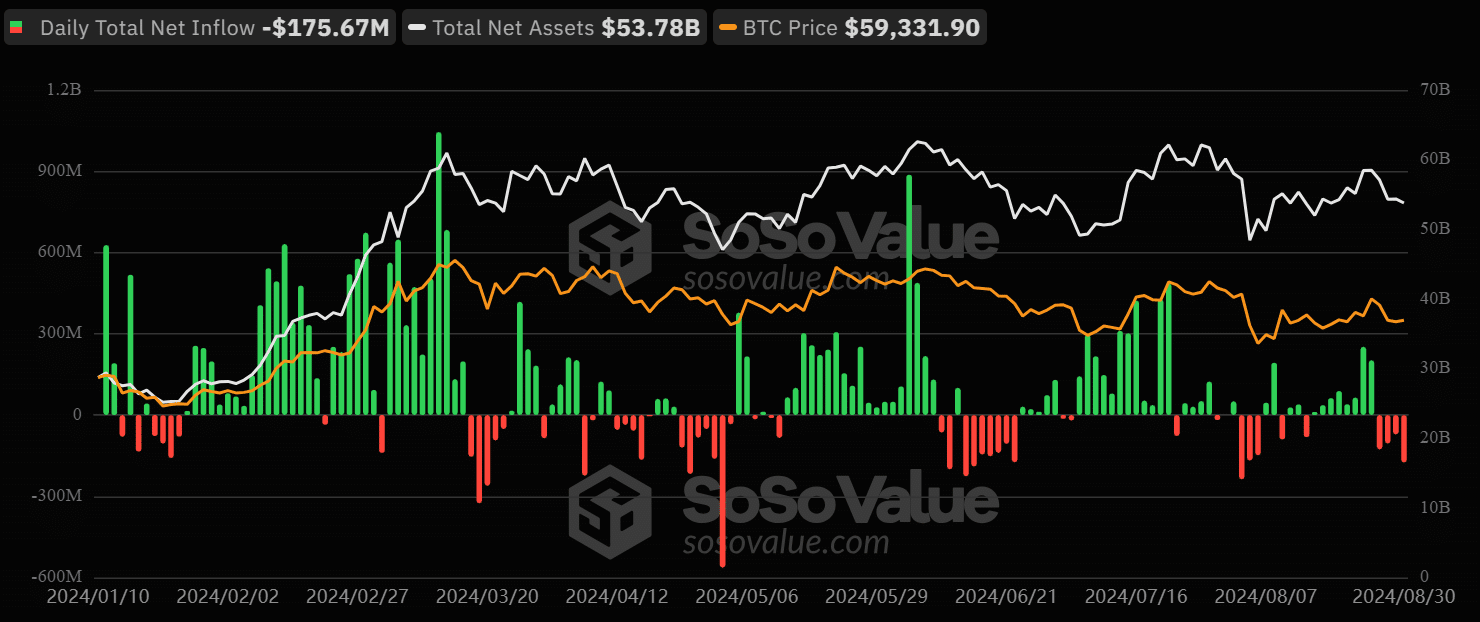

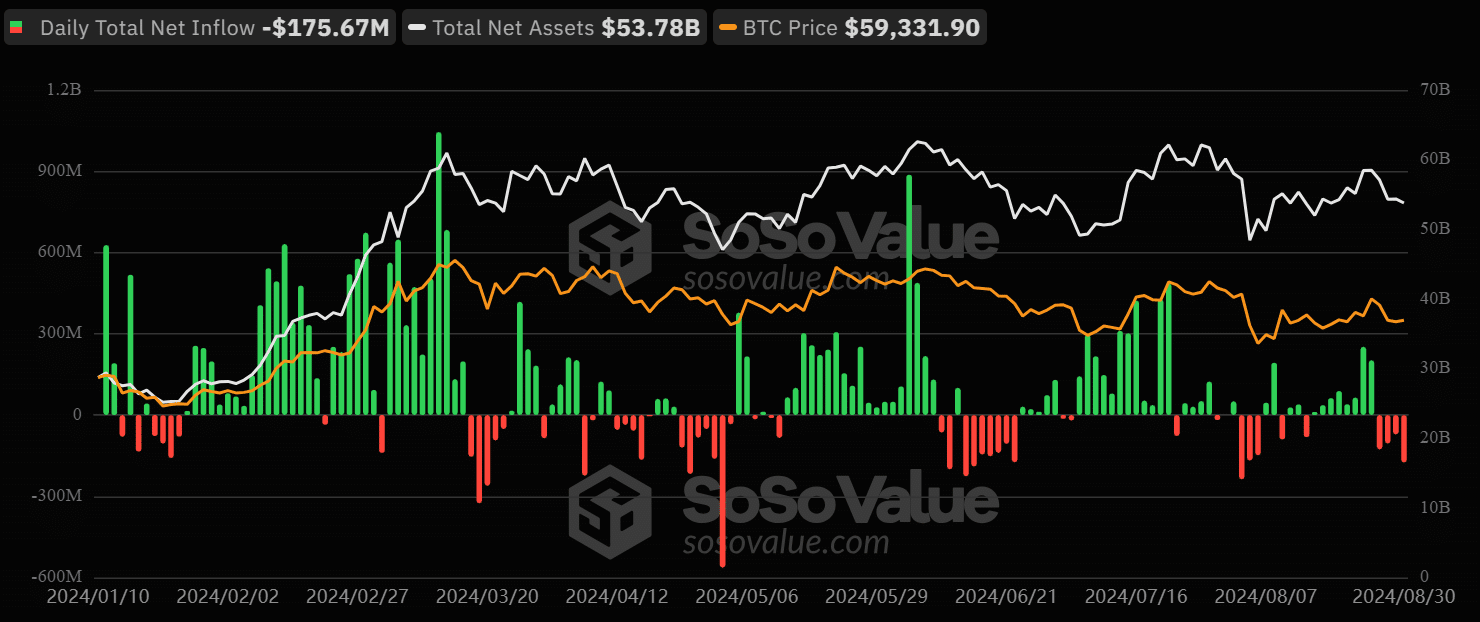

At the time of writing, the cryptocurrency was trading at $59.2k, marking the fourth day it has remained below $60k. Investors’ weak sentiment and risk-free approach were also evident in US spot BTC ETFs.

The products have been that way since Tuesday included a net outflow of $277 million, illustrating that steady inflation in July was not enough to break the weak trend.

Source: Sosowaarde

However, crypto trading firm QCP Capital noted that a potentially weaker US jobs report next week could confirm a “strong case” for a Fed rate cut in September. Meanwhile, the trading firm projected that BTC could remain range-bound.

“With recent macro news proving to have little impact on the crypto market, we believe BTC is likely to remain within the 58k-65k range in the near term as the market waits for positive catalysts to break out of this range.”