- Binance faces a massive Bitcoin pullback amid a backlash.

- Liquidations are increasing as Bitcoin EFTs experience negative net flows.

Bitcoin [BTC] Yesterday, August 28, saw a dismal day, with the leading cryptocurrency facing declines in several markets, including spot trading and Bitcoin ETFs popular in the US markets.

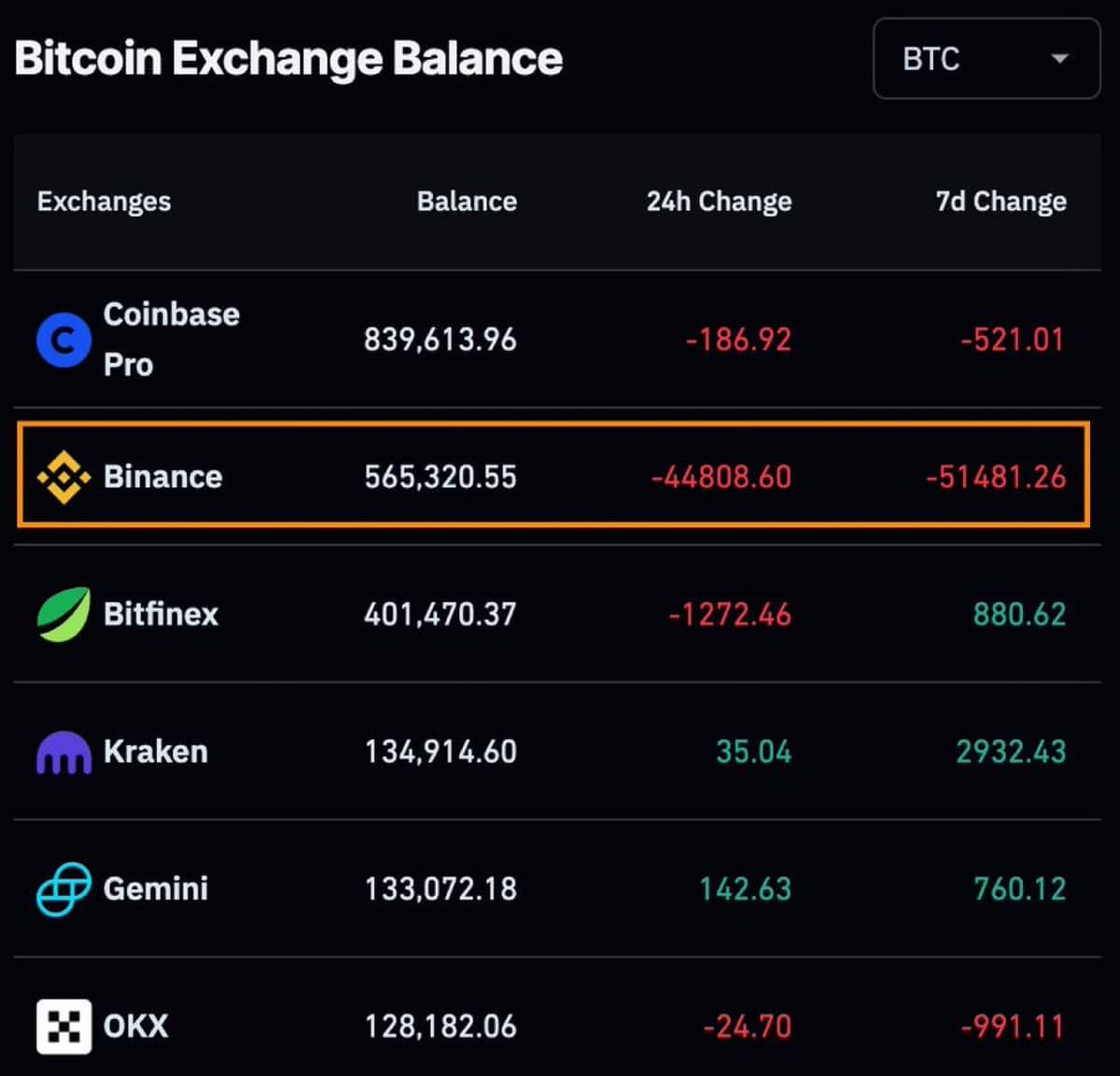

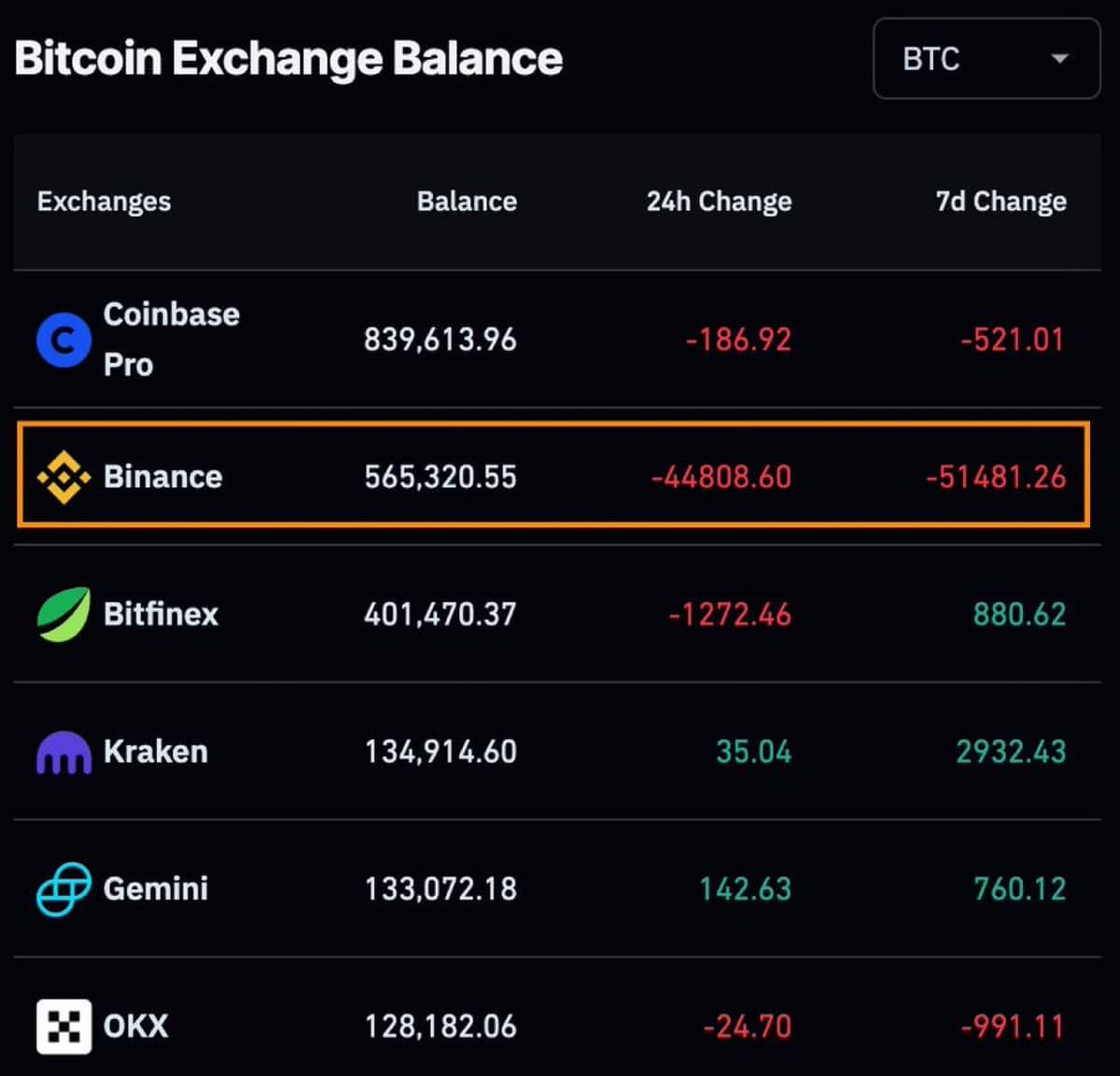

The market drop coincided with a massive outflow of 44,808 BTC, worth over $2.6 billion, withdrawn from Binance in the past 24 hours.

This significant withdrawal from Bitcoin followed allegations that Binance had seized Palestinian assets at the request of Israeli authorities. Amid the backlash, Binance quickly unblocked the accounts.

Source:

These massive Bitcoin outflows will likely have an impact on the price of BTC, with potential effects in both directions.

First, Bitcoin can be held for long-term gain, potentially driving up its price. On the other hand, a major sell-off could lead to a price drop, given the significant amount of money involved, the Bitcoin market could be shaken.

Massive liquidations

In addition to Binance’s withdrawal, 66,423 traders were liquidated in the last 24 hours, amounting to $161.12 million.

The largest liquidation occurred on Bybit’s BTC/USD pair for $3.52 million, followed by a $12.67 million liquidation on Binance’s ETH/BTC pair the day before.

Source: Coinglass

These events contributed to more than $4.8 billion in liquidations in August 2024, the highest since 2021, with two days to go.

As the market matures and becomes heavier, participants become more leveraged, leading to greater losses during strong market movements.

Source: Coinglass

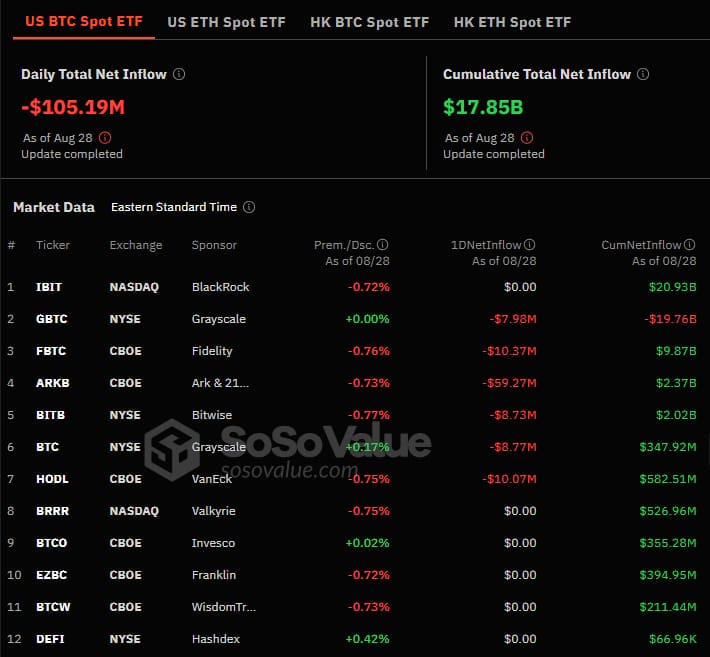

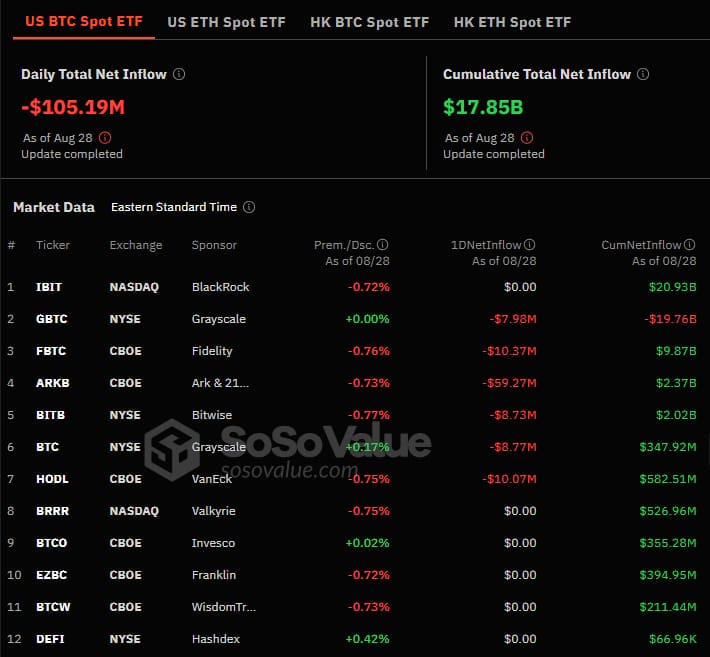

Bitcoin ETFs are facing negative NetFlow

The massive withdrawal of BTC from Binance also affected ETFs, which saw a net outflow of $105.19 million on August 28, the same day as the Binance BTC withdrawal.

Ark & 21Shares’ $ARKB led the outflows with $59.27 million, followed by Fidelity’s $FBTC, VanEck’s $HODL and Grayscale’s $GBTC with $10.37 million, $10.07 million and $7.98 million, respectively.

Source: Sosowaarde

These continued negative events raise concerns about BTC’s ability to recover as price action hovers around $60,000.

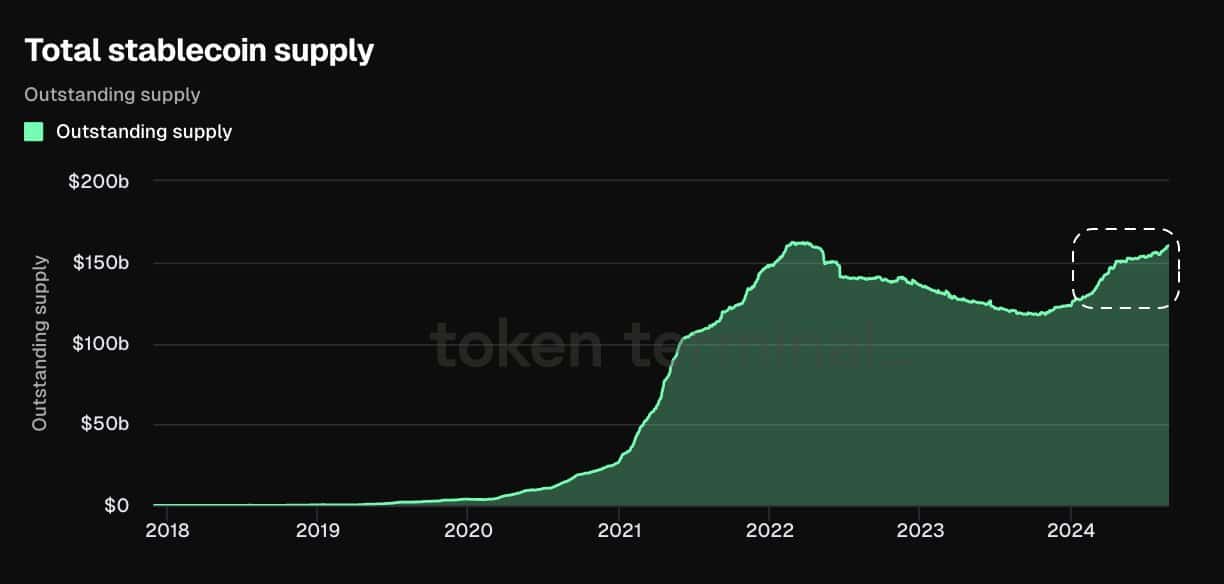

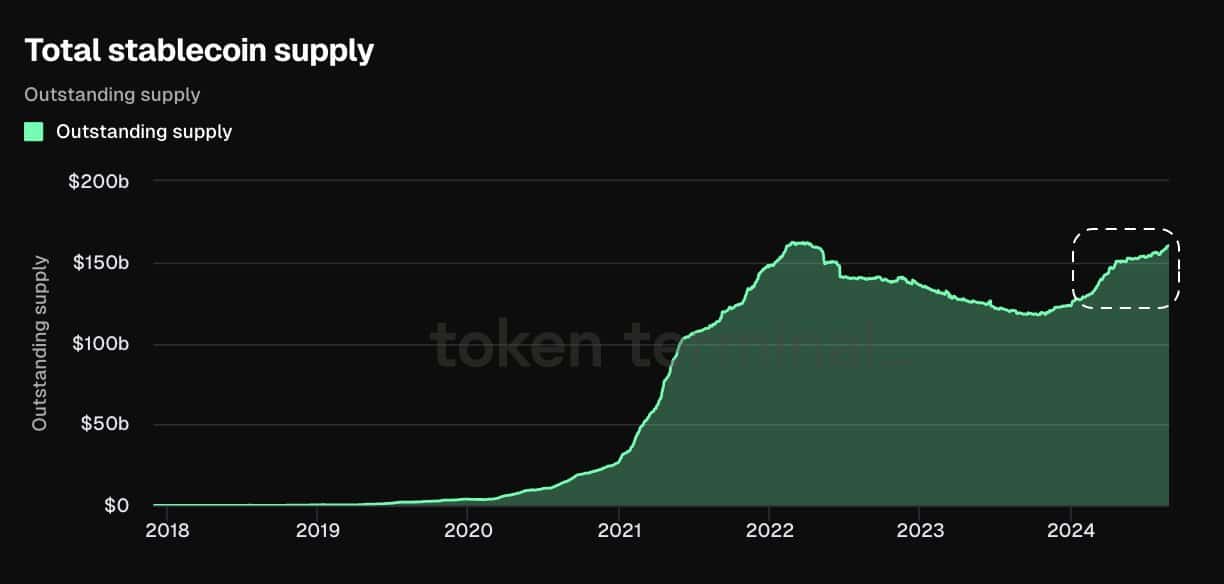

Will the supply of stablecoins help Bitcoin recover?

Despite BTC’s massive withdrawal from Binance, widespread liquidations, and negative ETF outflows, there is hope that Bitcoin’s negative correlation with stablecoins could lead to a turnaround.

Read Bitcoin’s [BTC] Price forecast 2024-25

Over the past 24 hours, more than $67 million in USDC has been minted, $70 million in USDC transferred to an unknown wallet, and another $100 million USDT transferred to Bitfinex.

Source: Token terminal

This influx of stablecoins into the market could push up prices and potentially push Bitcoin higher. With stablecoin charts near all-time highs, a turnaround for Bitcoin and other cryptocurrencies could be in the offing.