- Bitcoin holders buy $10 billion for the first time.

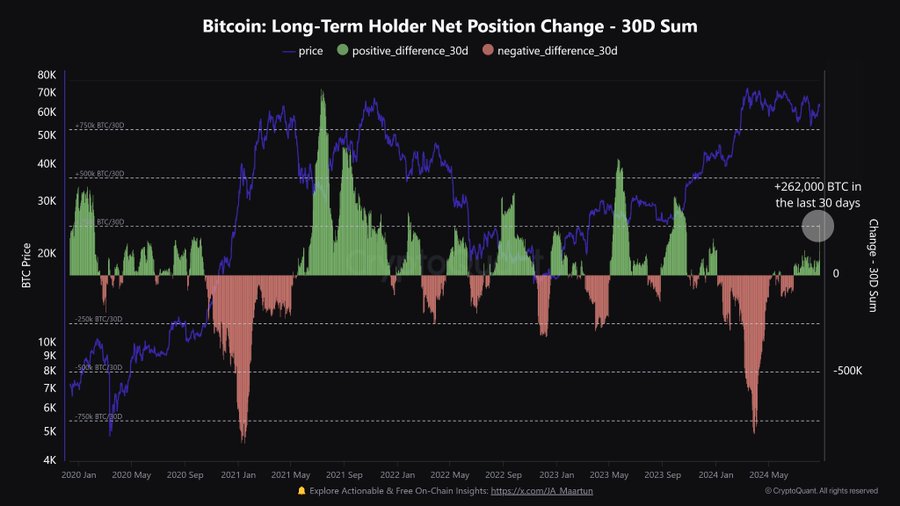

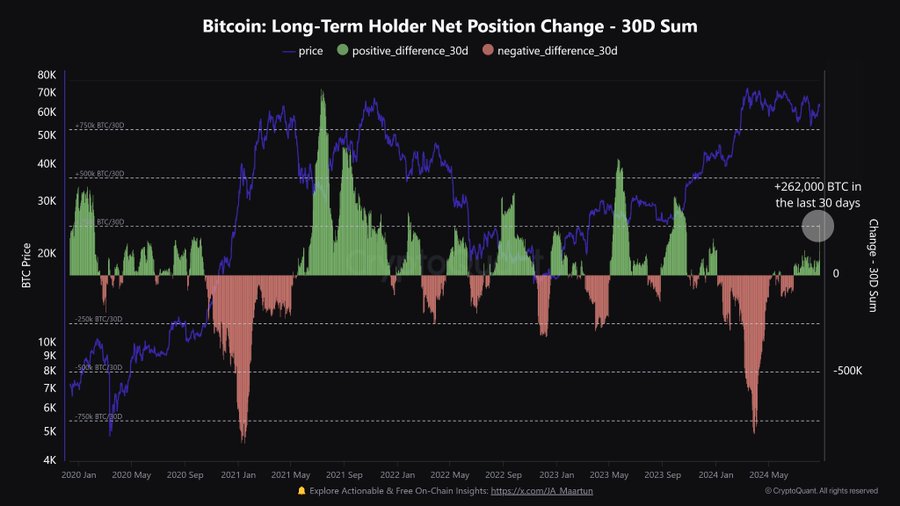

- The supply from large Bitcoin holders reached 262,000 BTC in the last 30 days.

Bitcoin [BTC]the largest cryptocurrency by market capitalization, has recently experienced a sharp decline in its prices. At the time of writing, the king coin was trading at $58679. This marked a decline of 6.69% in the last 24 hours.

Prior to this decline, BTC was on an upward trajectory, reaching a high of $64,404 this past week. However, the sharp decline on the daily charts outweighed any weekly gains, posting a decline of 1.71% on the weekly charts.

This sudden drop raises questions about panic selling and the role of long-term holders in ensuring Bitcoin’s stability.

Bitcoin holders’ long-term purchases reached $10 billion

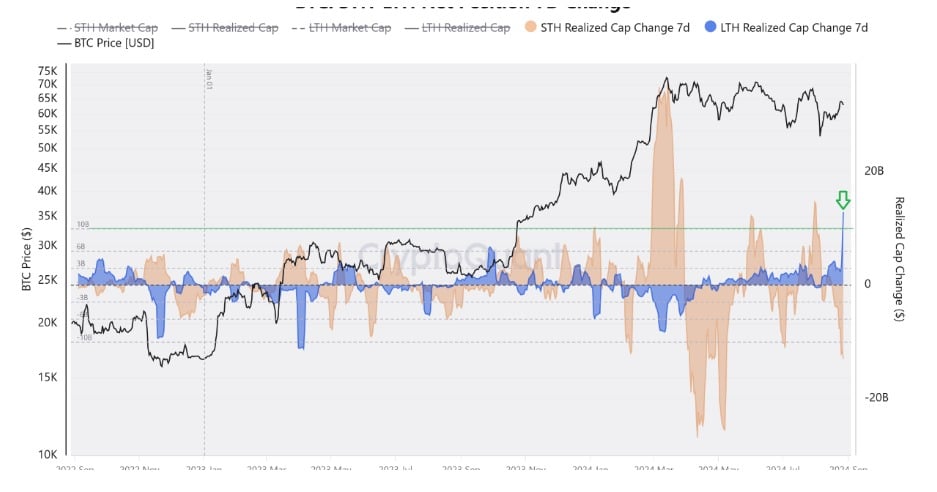

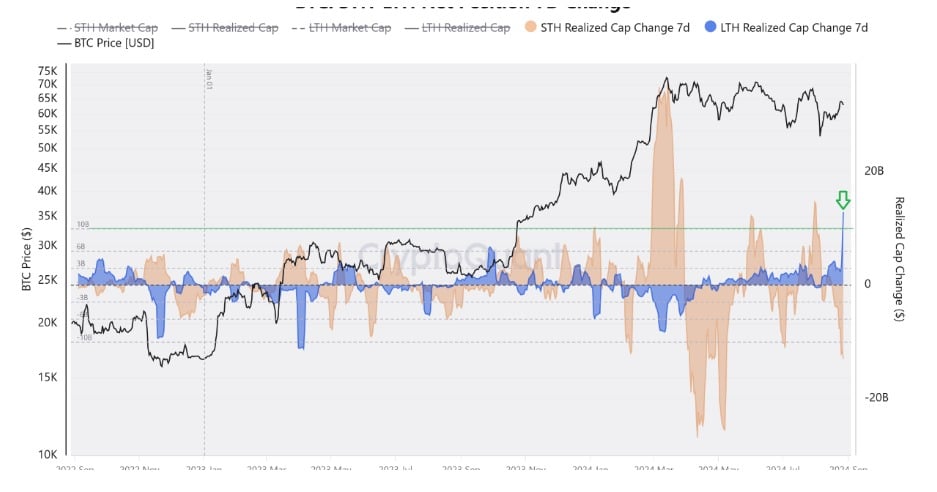

According to CryptoQuant analyst Amr Taha, long-term holders are less likely to sell, buy and hold during market downturns.

In his analysis states Amr Taha stated that long-term holders spent $10 billion to buy the crypto. Furthermore, these buyers have avoided selling as the market was currently in a recession.

In a post, the analyst shared:

“For the first time ever, realized capitalization of long-term holders has exceeded $10 billion.”

Source: CryptoQuant

Based on this observation, holders who crossed the 155-day mark continued to hold their crypto. Moreover, as has been evident over the past thirty days, institutions have increased their purchases.

Major BTC investors such as Marathon, Blackrock, Galaxy Digital, and Metaplanet, among others, have increased their holdings over the past 30 days.

These institutions are large holders and tend to build up their assets over a longer period of time.

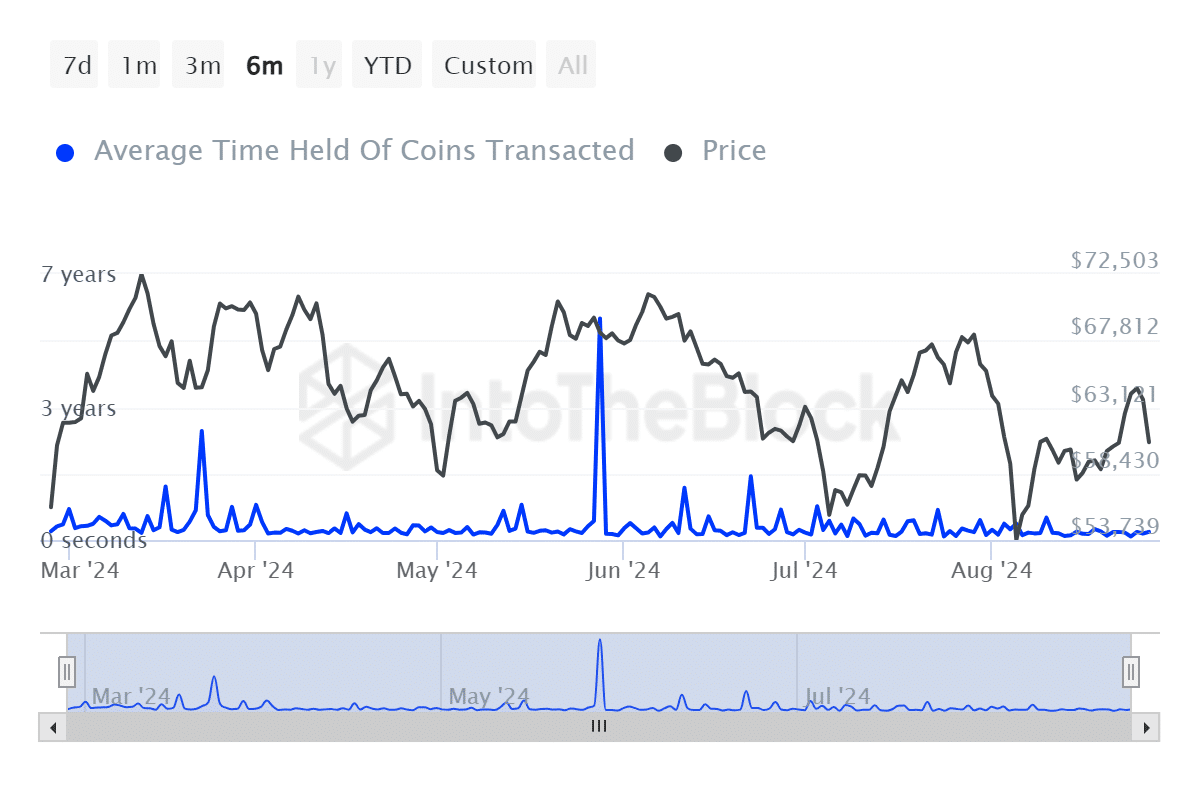

Source: IntoTheBlock

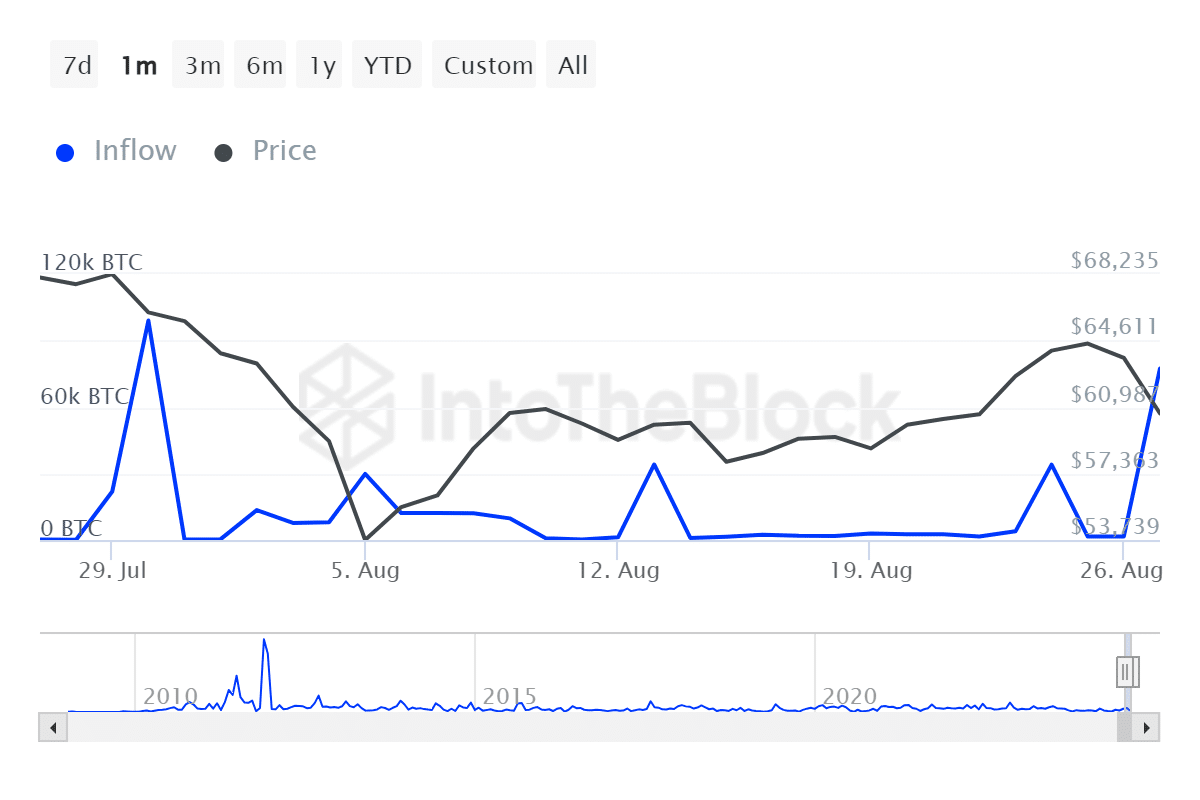

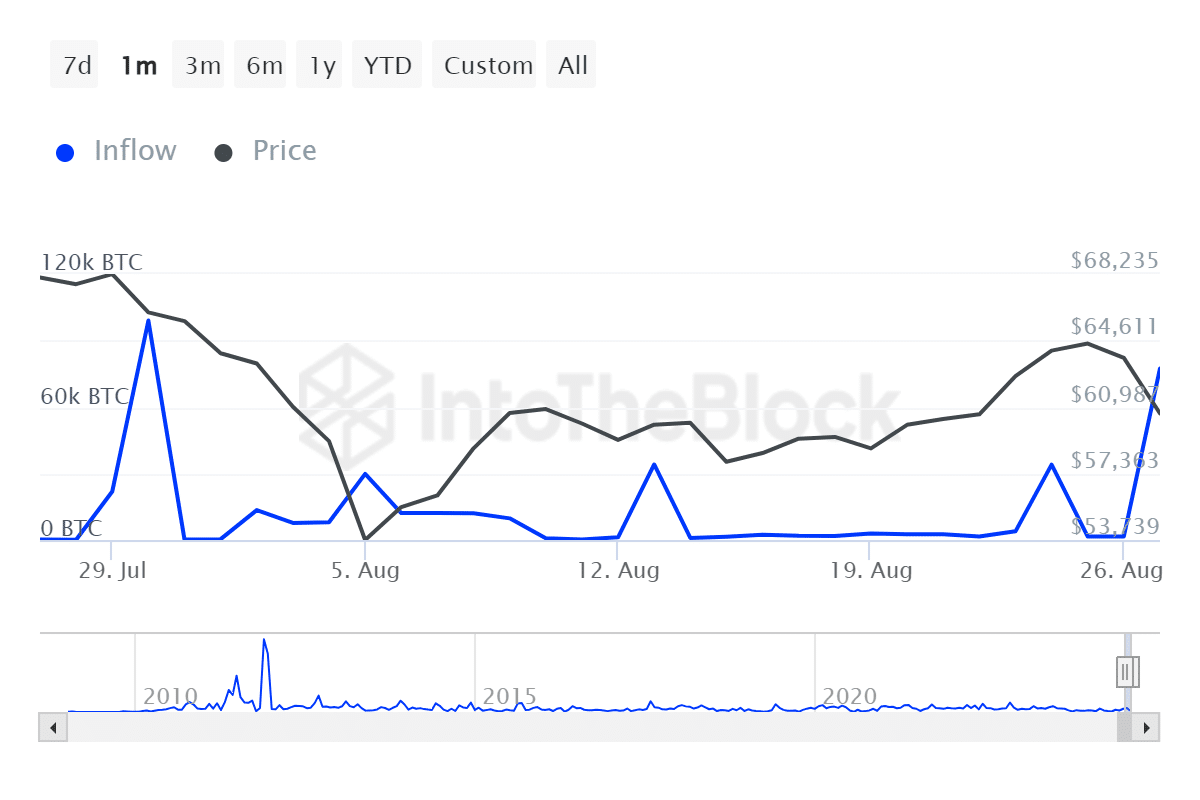

This phenomenon means that large holders have long accumulation phases. Data from IntoTheblock shows that large owners take at least five months to three years to sell their assets, while small owners tend to sell their assets.

The supply from long-term holders increased by 262.00 BTC

While long-term owners are less likely to sell, their offerings have seen exponential growth. As shared by CryptoquantLong-term holders control more than 75% of the total BTC supply.

Via their X page (formerly Twitter), they shared the analysis, noting that:

“In the last 30 days, the supply of Long Term Holders increased by 262,000 $BTC. They now hold 14.82 million Bitcoin, which accounts for 75% of the total supply.”

Source: CryptoQuant

Over the past 30 days, we have witnessed high BTC volatility reaching a low of $49577. These price fluctuations explained the increased accumulation by long-term holders.

These holders tend to buy more assets during market downturns and reintroduce them to the market during a prolonged bull market. The strategy ensures that they buy cheap and later sell with a high return.

So for long-term holders, low BTC prices are a buying opportunity to accumulate.

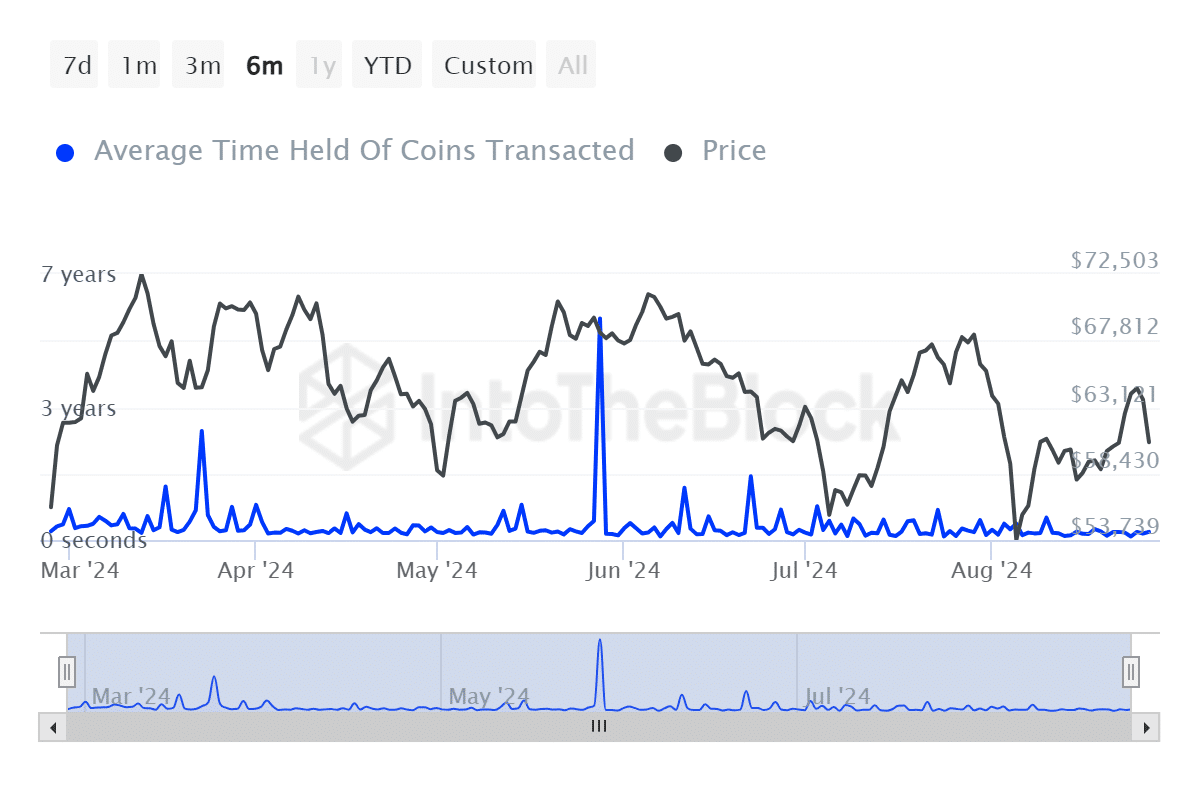

Source: IntoTheBlock

So, even though Bitcoin is going through a recession, this presented a buying opportunity for long-term holders. Increasing purchasing activity results in purchasing pressure, which in turn drives up prices.

Read Bitcoin’s [BTC] Price forecast 2024–2025

When the market crashed earlier this month, inflows from large holders increased between August 5 and 9, pushing prices back to the resistance level of $60,662.

So such a cycle is likely to repeat itself and push prices above $60,000.