- The Nakamoto upgrade is underway on the Stacks network.

- The upgrade will increase transaction speed and introduce a new asset class that enables broader transactions.

Stacks, one of the leading Layer 2 networks on the Bitcoin network, has announced a significant upgrade. This upgrade improves the speed of the network, making transactions faster and more efficient.

Additionally, the upgrade introduces a new asset class called sBTC.

Stacks begins Nakamoto upgrade

According to documents from Stacks has started the rollout of the Nakamoto upgrade on the network. This upgrade significantly improves the Stacks blockchain, initiated at Bitcoin block 840,360.

At the time of writing, the current Bitcoin block is 858,602, indicating that the Nakamoto upgrade is in full swing.

The Nakamoto upgrade aims to significantly improve transaction speeds on the network, reducing settlement times from minutes to seconds. This improvement is expected to significantly increase the efficiency and usability of the blockchain, making it more attractive to users and developers.

In addition to these improvements, the Nakamoto upgrade will pave the way Introducing sBTCa new asset class on the network.

The network will launch the new asset four weeks after the upgrade is implemented. The sBTC is designed to facilitate the seamless transfer of Bitcoin (BTC) between the blockchain and Stacks. It will also be used as gas for transactions on the Stacks network.

Importantly, sBTC is a decentralized asset backed 1:1 by Bitcoin, preserving the value and security of BTC while enabling greater functionality within the Stacks ecosystem.

How this upgrade could affect the Stacks and Bitcoin network

Stacks is recognized as the largest Layer 2 network on Bitcoin. According to company data, it has a Total Value Locked (TVL) of over $99 million CoinMarketCap.

This achievement is particularly important because Bitcoin was not originally designed as a decentralized finance network (DeFi). However, Layer 2 solutions such as Stacks have innovatively extended Bitcoin’s capabilities, enabling DeFi activities on the network.

One of the main challenges facing Stacks and other Layer 2 networks on Bitcoin is speed. The Nakamoto upgrade aims to address this issue by significantly improving transaction speeds and reducing settlement times from minutes to seconds. This upgrade is expected to improve the Stacks network and have a positive ripple effect on other related networks built on Bitcoin.

As a result of the Nakamoto upgrade, the Bitcoin network will likely see more activity as faster transaction times make it more attractive for various use cases, especially in DeFi.

This increase in activity could lead to increased demand for Stacks’ native token, STX, as more users engage with the network and its associated services.

How STX has fared in the past 24 hours

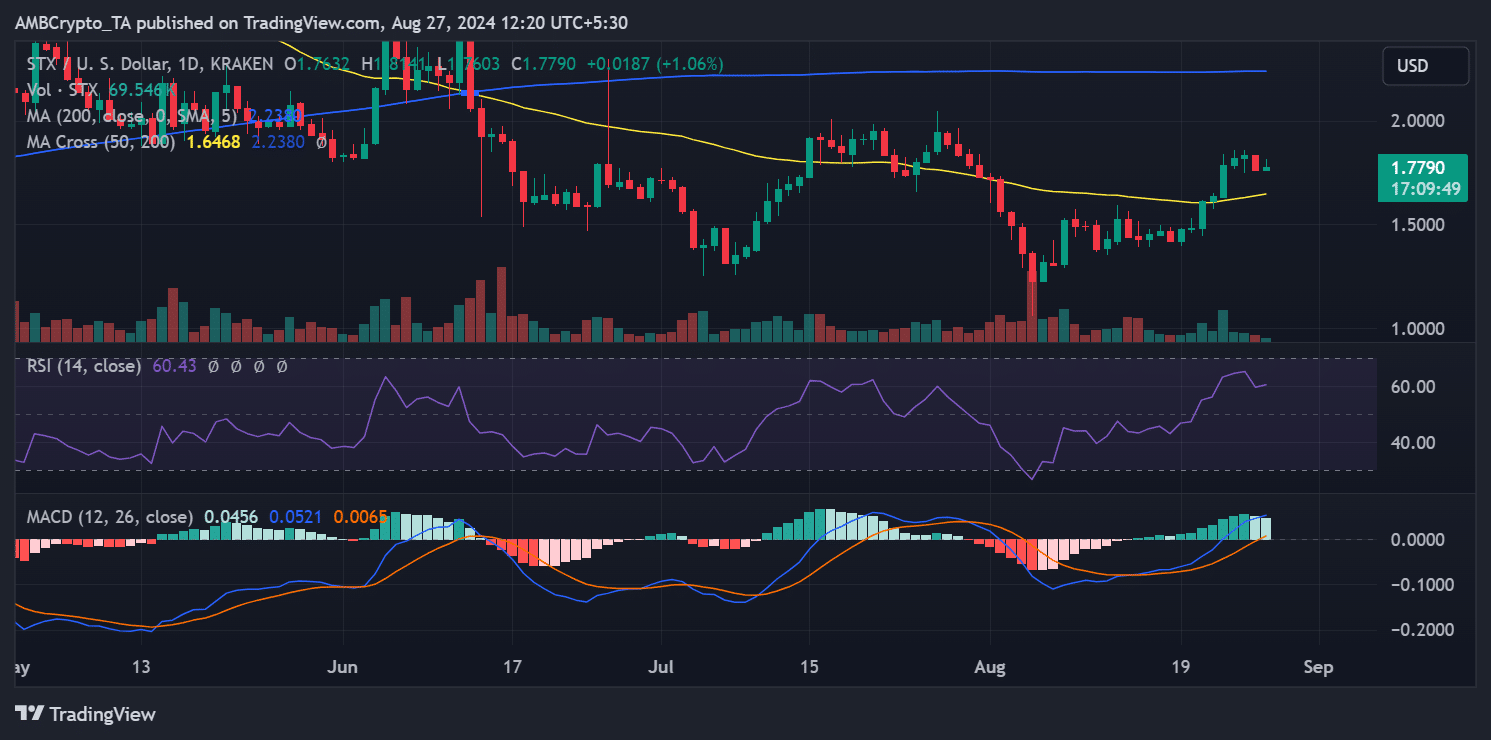

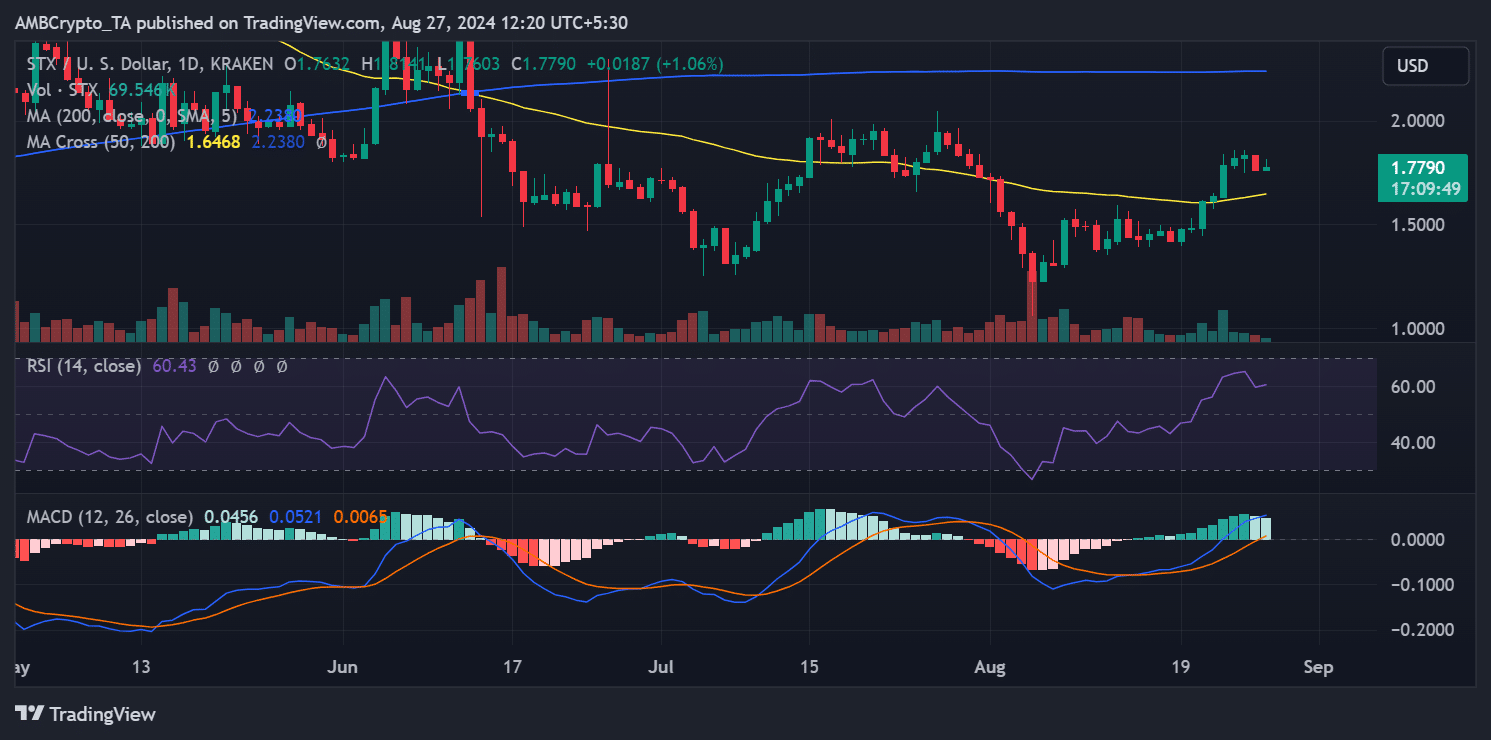

Stacks [STX] has seen significant positive momentum recently, but this trend was briefly interrupted on August 26. According to AMBCrypto’s analysis of the daily chart, STX saw a drop of over 4%.

The decline caused the price to drop from about $1.83 to about $1.76. Despite this pullback, STX quickly regained some ground, with the price rising by over 1% at the time of writing, bringing the price to around $1.77.

Source: TradingView

Realistic or not, here is the market cap of STX in terms of BTC

Importantly, the drop on August 26 did not disrupt STX’s overall bullish trend. The Relative Strength Index (RSI) remains around 60, indicating that assets are still bullish.

The RSI level indicates that despite a brief correction, broader positive sentiment and buying pressure for STX continues to support its upward trajectory.