- WIF made a strong comeback with a 79% increase in trading volume and a 13.33% price increase

- One analyst expects a continued rally to an ATH beyond $8.7

Dog hat [WIF]the largest Solana-based memecoin on the market by market capitalization, has seen a significant price recovery recently. At the time of writing, it was trading at $1.85 on the charts.

This represented an increase of 13.33% in the last 24 hours alone. However, prior to this rebound, WIF was on a downward trajectory, hitting a low of $1.07 over the past two weeks.

Despite the memecoin’s recent gains, WIF remains well below its May high of $4.07 and 60.7% lower than its all-time high of $4.8. Hence the question: do the recent gains position the memecoin for further gains?

According to SJLTrading, a popular crypto analyst and trader, Dogwifhat [WIF] may be in the early stages of wave 3 of the impulsive Elliot wave cycle.

The prevailing market sentiment

In his analysis states SJLTrading highlighted one key sign, indicating that WIF is well on its way to a rally.

Source: SJLTrading on X

According to the analyst, WIF has formed a solid impulsive Elliot wave cycle that strengthens the memecoin for strong price action in wave 5 of 5.

This means that WIF could see a strong upward move, with the potential for further significant gains. Typically, the final push in the trend is usually driven by positive market sentiment and momentum.

Additionally, SJlTrading stated that WIF may be in the early stages of wave 3 after completing a 1-2 setup. The early stages of wave 3 suggest that the memecoin is in the strongest and most extended wave of the Elliot wave cycle. Thus, wave usually results in the strongest and fastest price movement, indicating that upward momentum is expected.

Based on this analogy, WIF could reach $8.7, with the potential to expand itself if buying interest remains strong.

Is WIF ready for a rally?

While this analysis from SJLTrading offers a promising outlook, it’s essential to look at what other metrics tell us.

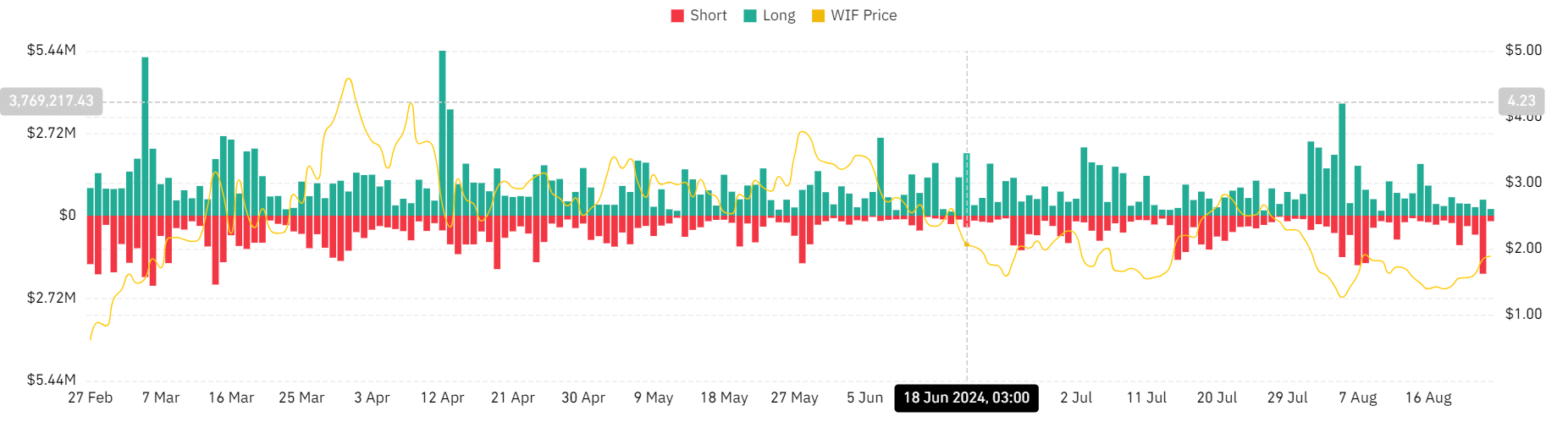

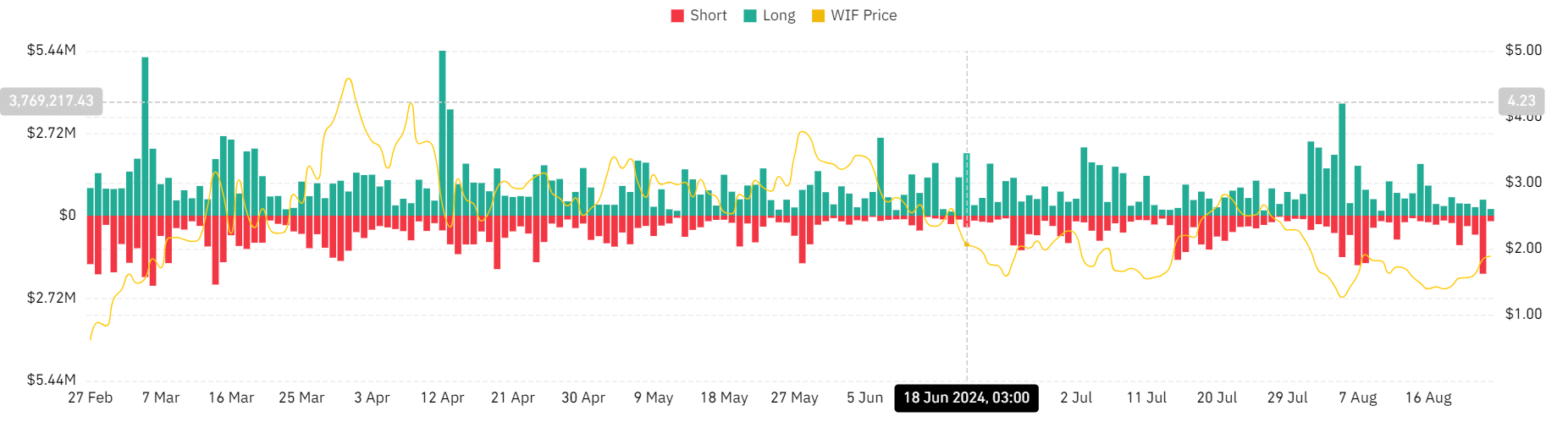

Source: Coinglass

For starters, since the August 5 market crash, liquidations for long positions have fallen from $3.7 million to $218 at the time of writing. This is a sign of increased investor confidence towards the memecoin.

Although the price of WIF has fallen over this period, long position holders have paid a premium to maintain their positions. Likewise, liquidations of short positions have increased, reaching $2 million in the last 24 hours. Therefore, those who gambled against the market have been forcibly liquidated.

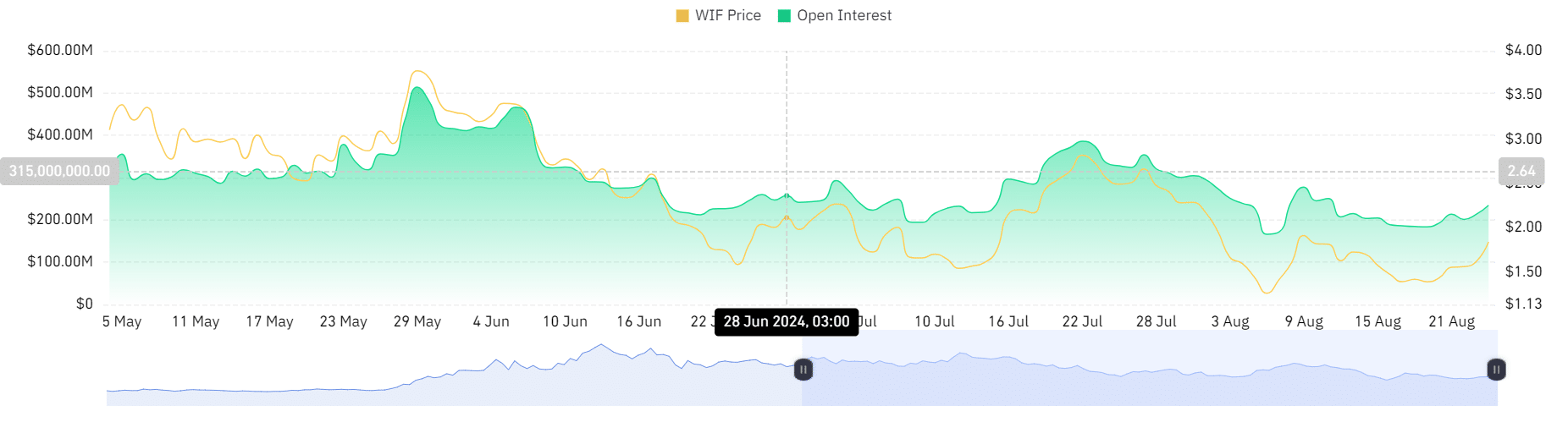

Source: Coinglass

Furthermore, Open Interest has increased from $213 million to $236.6 million in the last 24 hours.

This means that investors are opening positions now, while existing positions will continue to hold their current positions. This is bullish market sentiment as it indicates investor confidence in WIF’s future prospects.

Source: Tradingview

Therefore, if the prevailing market sentiment holds, WIF will break out of the declining channel at $1.96. A breakout from this resistance level will strengthen the memecoin and challenge the $2.3 resistance level.