- Mount Gox transferred 13,265 BTC as Bitcoin approached its 200 EMA.

- Bitcoin’s 56% dominance led the major markets since August 5.

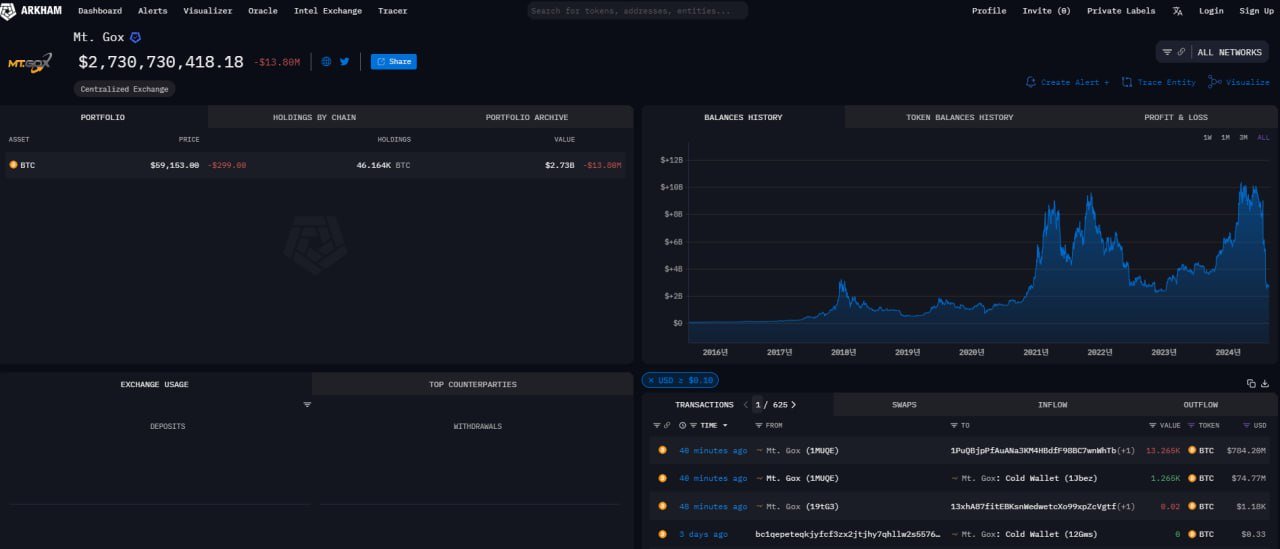

Mount Gox, once a top cryptocurrency exchange during Bitcoin [BTC] has continued its streak of transfers, recently moving 13,265 BTC worth $784 million.

Of these, 12,000 BTC moved to a new address, and 1,265 BTC was deposited into a cold wallet, leaving 46,164 BTC, worth $2.73 billion, still unmoved.

This move from Mount Gox could significantly impact future Bitcoin prices and chart patterns, especially as BTC’s current momentum slows.

Source: Arkham

Following these developments, Bitcoin started trading near its daily 200 exponential moving average at the time of writing – a key level around $63,000 – which also aligns with its local highs.

The bulls need to break this level to signal a strong uptrend. If the price falls below $56,500, the bears could regain control in the short term.

Source: TradingView

The general expectation is that Bitcoin will break above the 200 EMA and hold that position to confirm an ongoing bullish trend.

After Mount Gox transferred 13,000 BTC to exchanges, Bitcoin staged a small rally, but the king coin needs to close above the 200- and 20-day EMAs or maintain a price above $60,000 to confirm strength.

The daily timeframe RSI has already confirmed a possible retest, and the eight-hour model shows a price increase.

Altcoins also held up during yesterday’s sell-off, indicating that Bitcoin and the broader crypto market are likely to recover in the coming months.

Source: TradingView

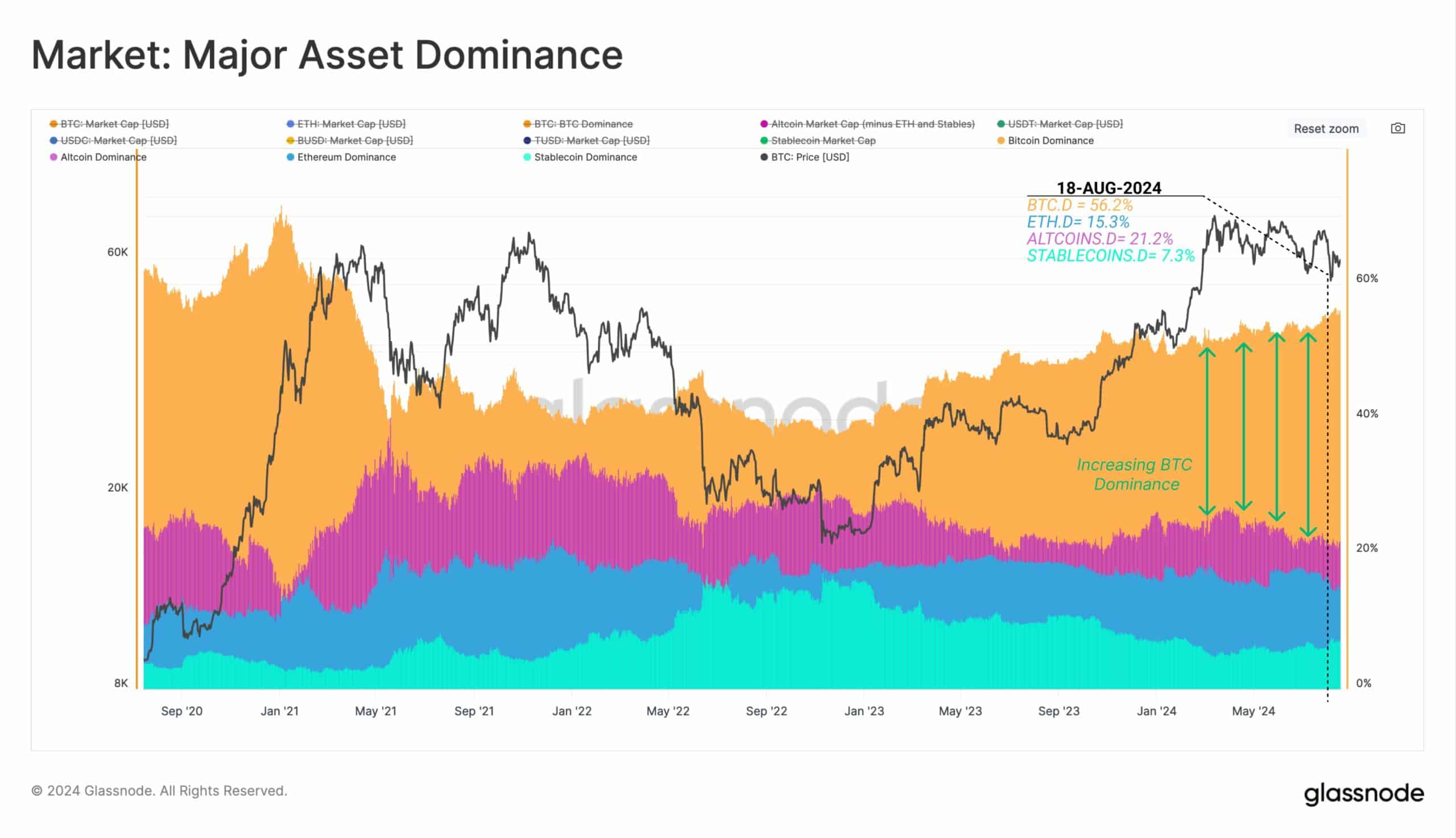

Bitcoin dominance and market correlation

Bitcoin’s market dominance grew, making up 56% of the total cryptocurrency market capitalization at the time of writing.

This increasing dominance was supported by long-term holders who continued to accumulate Bitcoin and demonstrated strong confidence in the asset’s future.

Despite market fluctuations, these holders remained committed, suggesting there is underlying accumulation pressure that could push Bitcoin’s value higher.

Source: Glassnode

While Bitcoin maintains its leading position, its influence over the entire cryptocurrency market continues to strengthen.

Bitcoin, along with markets like Gold, Silver, Nasdaq, S&P 500 and Ethereum [ETH]has been moving in sync since the early August recession.

Read Bitcoin’s [BTC] Price forecast 2024-25

Bitcoin has outperformed them all, recovering strongly from its lows despite a significant decline. While stocks are now rising this month, cryptocurrencies, including Bitcoin, still have room to catch up.

Source: TradingView

The recovery in the crypto market has only just begun and appears to have strong momentum, suggesting that growth will continue for the foreseeable future.