- Traders should keep a close eye on the resistance at $61,500 as a break above this level could confirm a strong recovery.

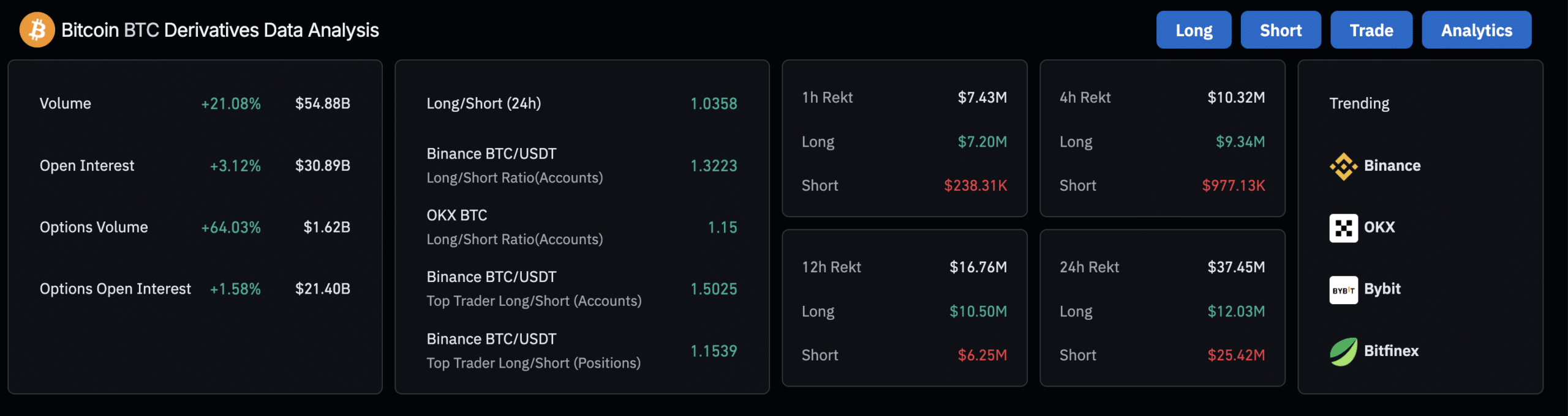

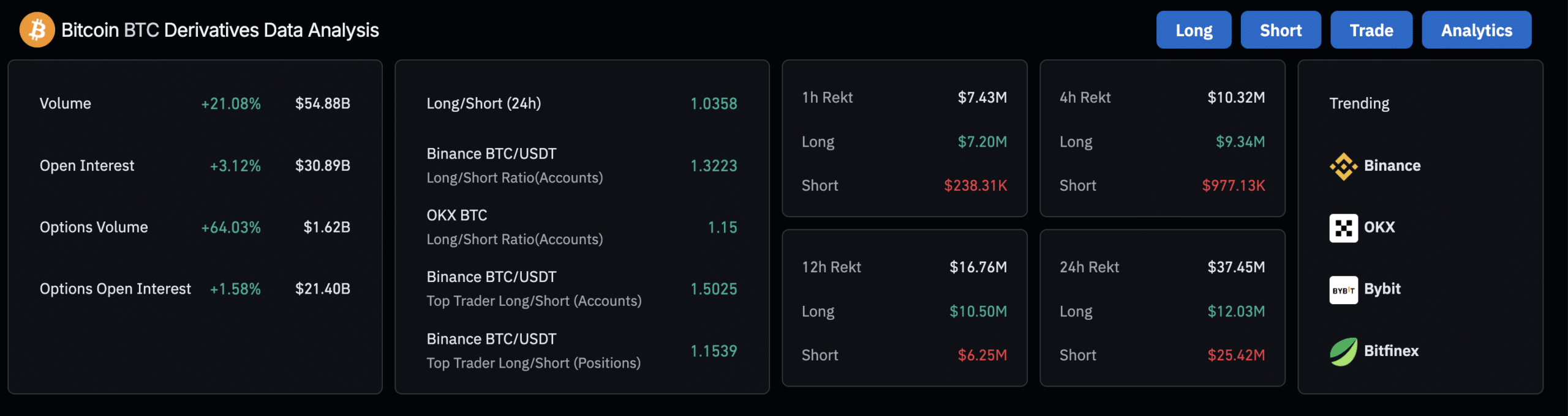

- The derivatives data showed a slight bullish edge, with the long/short ratio favoring the bulls.

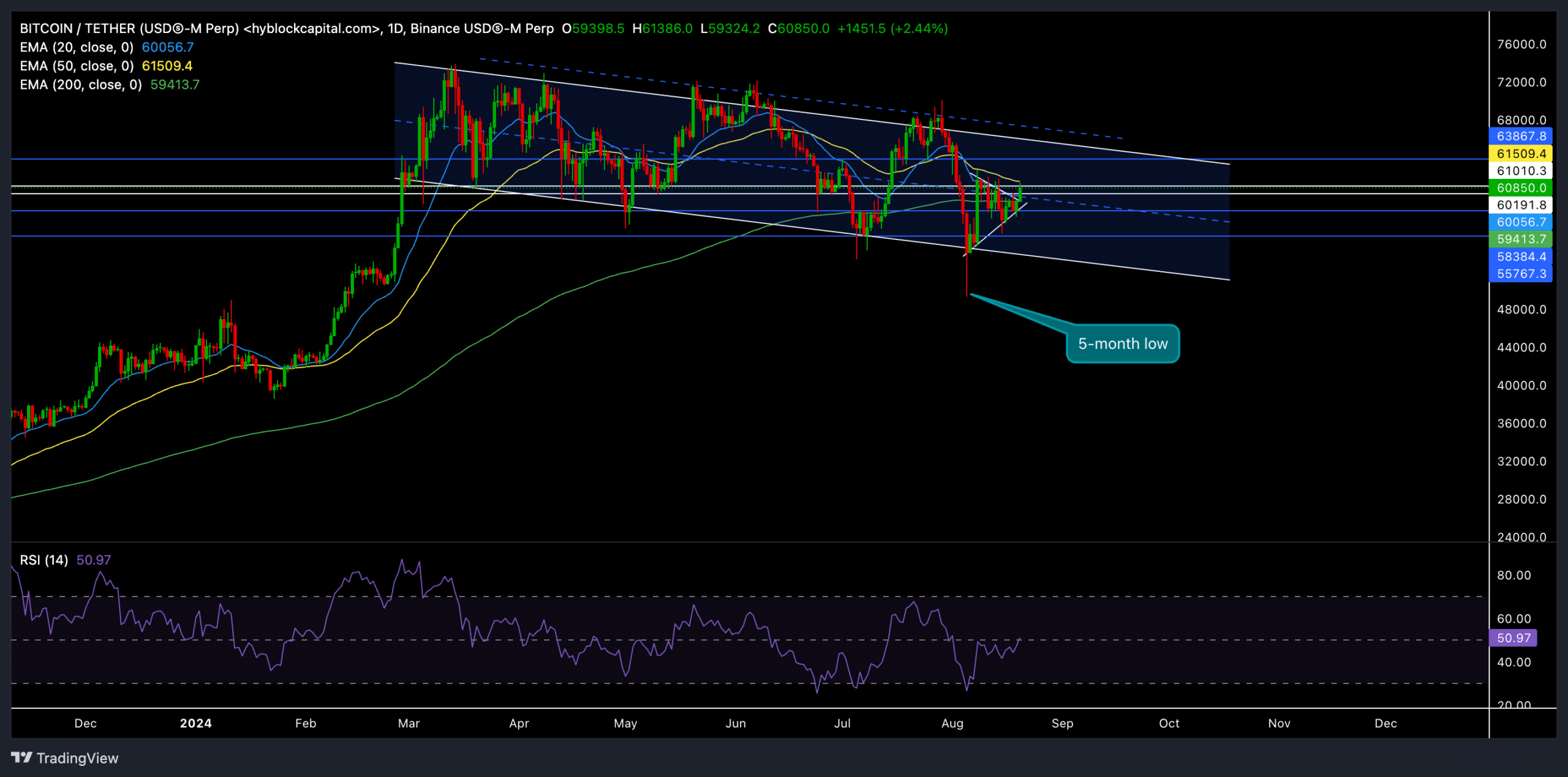

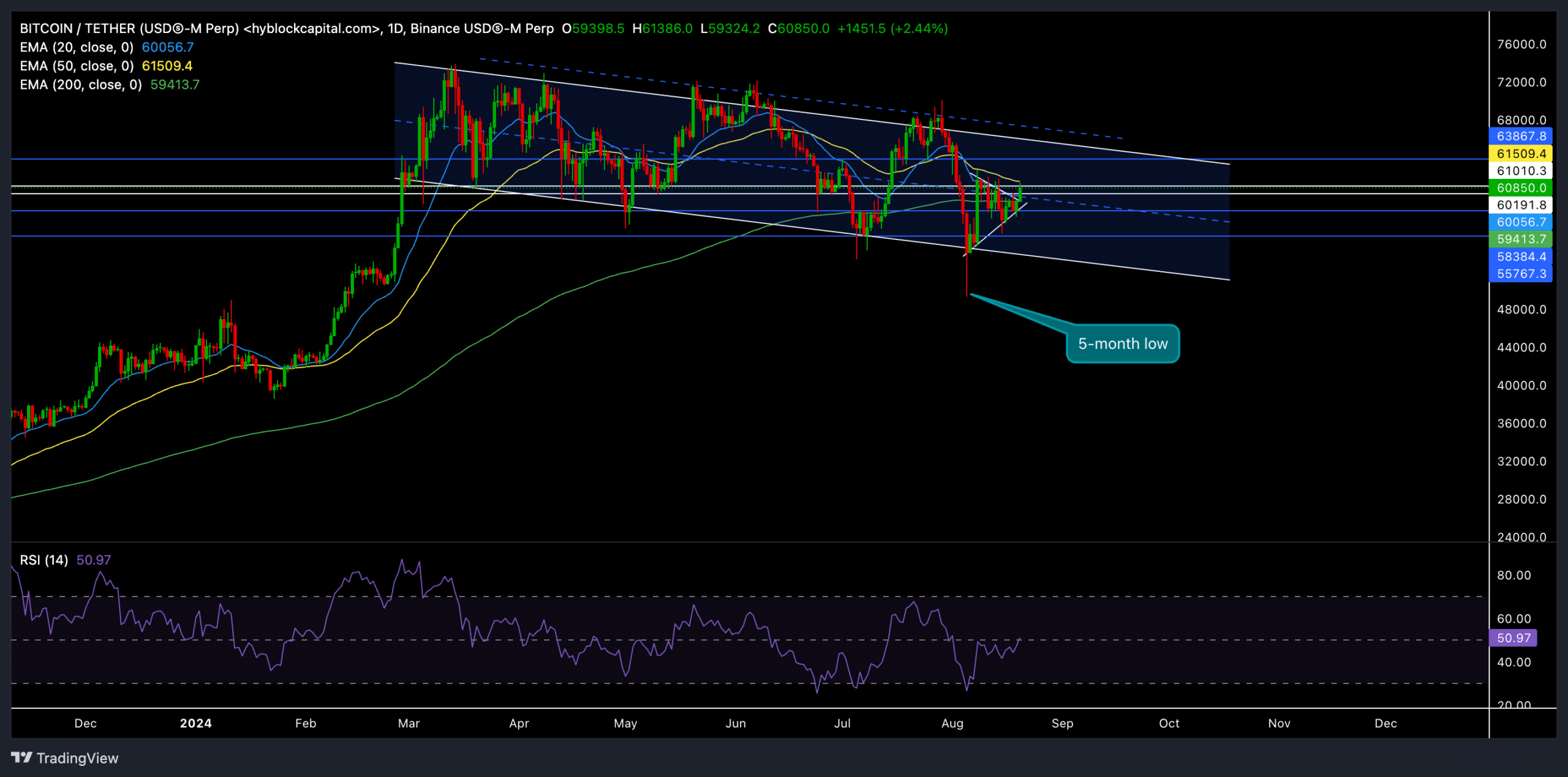

Bitcoin’s recent price action [BTC] showed a period of consolidation after a dip to a five-month low. Despite a spike in volume and a fairly modest recovery, Bitcoin remains within a crucial range that could determine its next move.

The price is currently trading at $60,850, up almost 2% in the last 24 hours. Recently, it recovered from a five-month low and found support around the $59,413 level, which coincided with the 200-day EMA.

Bitcoin is trying to recover amid market volatility

Source: TradingView, BTC/USDT

The 50-day EMA of $61,509 is a crucial level that the bulls need to regain for a sustainable recovery.

It is worth noting that the current price is hovering around these EMAs, indicating a fierce battle between buyers and sellers.

A break above the 50-day EMA could open the door to further gains, while failure to hold above the 20-day EMA could lead to a retest of lower support levels.

The RSI (Relative Strength Index) is currently just above 50 and shows a neutral attitude. This suggests that Bitcoin is at a critical juncture where its next move could determine the short- to medium-term trend.

The recent increase in volume and open interest indicate traders are preparing for a potential move, but broader market sentiment will play a key role.

Important levels to watch

At the time of writing, immediate resistance was at $61,509 (50-day EMA). If BTC can break and hold this level, the next target would be the $63,867 resistance level, followed by a potential test of the $66,000 region.

On the downside, the support at $59,413 (200-day EMA) is crucial. A break below this level could lead to a deeper correction, with the next support around the $54-$57K level.

Meanwhile, derivatives data showed a bullish tilt, with volume rising 21% to $54.88 billion and open interest rising nearly 3% to $30.89 billion.

Source: Coinglass

The long/short ratio over the last 24 hours was 1.0358, which slightly favored the lungs.

Read Bitcoin’s [BTC] Price forecast 2024-25

On Binance, the long/short ratio of BTC/USDT stood at 1.3223, indicating that many traders were still betting on a continuation of the recent rebound.

Investors should also keep an eye on external factors such as macroeconomic trends and broader market sentiment as these are likely to influence BTC’s price action in the short term.