- Polkadot was consolidating into a falling wedge pattern at the time of writing, indicating the potential for a major price breakout.

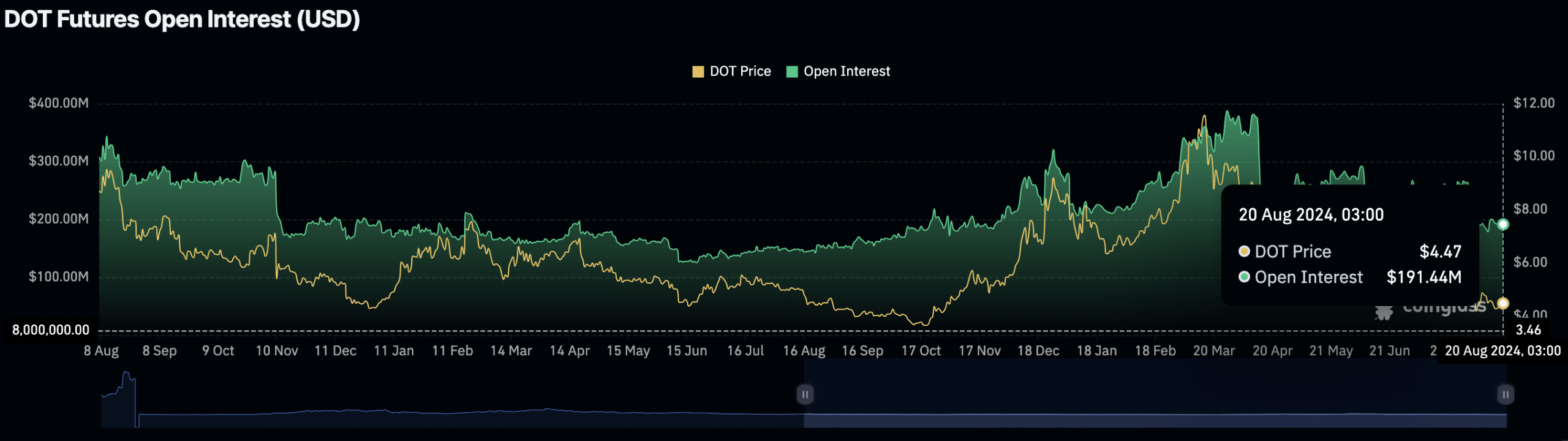

- The Futures market rose $190 million in Open Interest, indicating renewed trader confidence in DOT.

Polka dot [DOT] was trading at $4.56 at the time of writing and was up 3.68% in the past 24 hours, according to AMBCrypto’s look at Coingecko.

Its market cap has risen to $6.76 billion, positioning DOT as the 15th largest cryptocurrency.

Over the past 24 hours, the price has fluctuated, reaching a low of $4.39 before moving higher. This move indicated a potential for further growth, driven by improving market sentiment.

The 24-hour trading volume rose slightly to $104.9 million, reflecting a 1.59% increase, which could indicate greater investor interest.

Polkadot’s falling wedge pattern

At the time of writing, Polkadot appeared to be consolidating within a falling wedge pattern on the daily chart. According to crypto analyst Captain Faibik, this pattern is suggested that DOT may have –

“We have bottomed out and are ready to bounce back.”

The price recovered from the lower trendline of this channel, indicating the possibility of a near-term recovery.

The next resistance level was along the upper trendline, while support was maintained near the lower boundary of the channel.

Source:

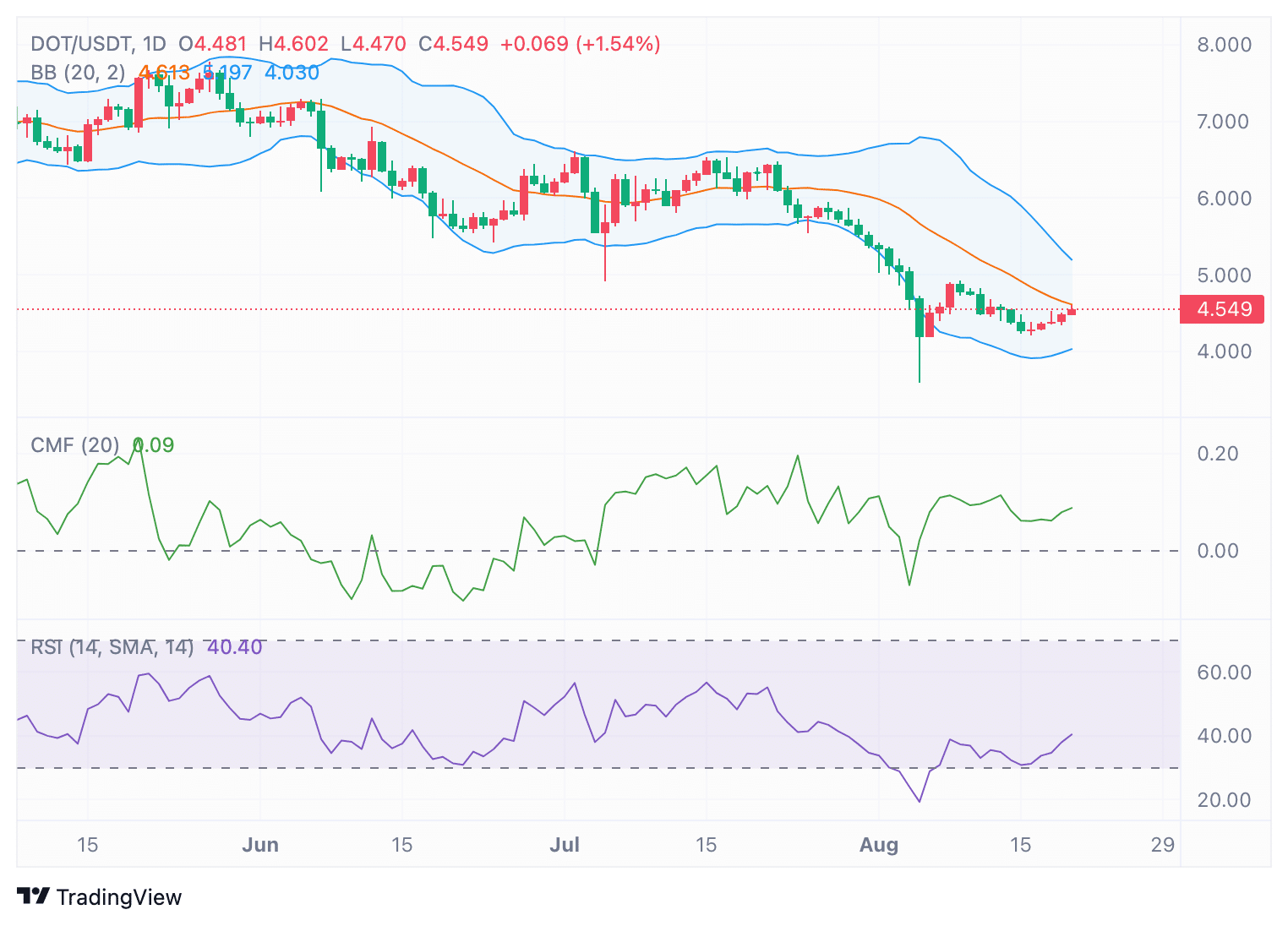

The Bollinger Bands, which measure market volatility, showed that Polkadot has been in a downtrend since mid-June and has been consistently testing the lower band.

DOT attempted to recover at the time of writing, but faced resistance around the middle band at $4.60.

A breakout above this resistance could indicate a shift to a bullish trend, while failure to do so could lead to further consolidation.

The Chaikin Money Flow (CMF) indicator stood at 0.09 at the time of writing, indicating moderate capital inflows into DOT.

This could support the recent upward move, although inflows remain relatively weak and not strongly bullish. Sustained buying pressure will require a stronger increase in the CMF.

Source: TradingView

Furthermore, the Relative Strength Index (RSI) stood at 40.40, putting DOT in bearish territory. However, the RSI has improved from previous oversold conditions, indicating that momentum is gradually increasing.

Should the RSI continue to rise above 50, it could signal a potential reversal to a more neutral or bullish trend.

Is there a threat of an outbreak?

In the futures market, DOT’s open interest was $191.44 million per Coin glass data. This marked a moderate recovery from recent lows, indicating renewed trader participation.

Despite this recovery, Open Interest remained below previous peaks, reflecting cautious sentiment among market participants.

Source: Coinglass

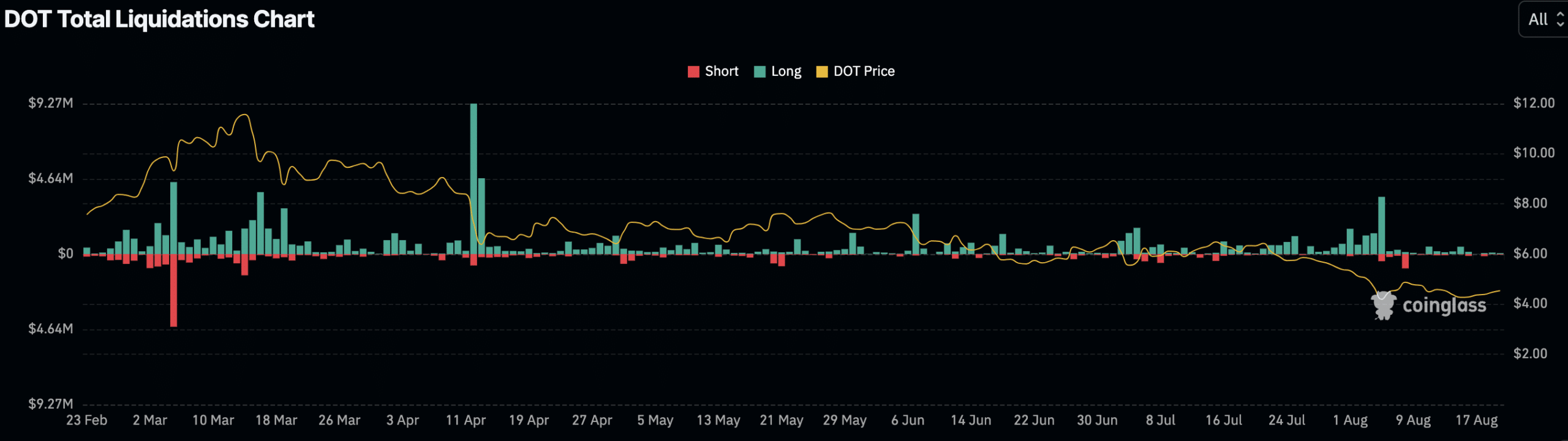

Additionally, total liquidations in DOT Futures amounted to $34.15K in short positions and $56.25K in long positions, with Binance [BNB] account for the majority.

The liquidation data showed that both long and short traders were affected, with a slight preference for long liquidations.

Read Polkadot [DOT] Price forecast 2024-2025

So traders were still dealing with the uncertainty in the market, with price volatility having an impact on both sides.

Source: Coinglass

Finally, Polkadot’s market behavior at the time of writing indicated the potential for a significant breakout as the asset tested key resistance levels within the current pattern.