- Analysts highlight several catalysts for BTC’s move to an ATH, including a potential ‘golden cross’ formation.

- Furthermore, both technical and on-chain data indicated a bullish outlook for BTC, but after a pullback.

Bitcoin [BTC] rose this weekend and briefly climbed back to the $60,000 mark. However, it has since returned to a press time price of $58,507.40.

Despite the price only rising a modest 0.14% over the past seven trading days, there has been a notable 33% increase in trading volumes, indicating growing interest.

Although the current price movement seems slow, two analysts have argued that this trend is only temporary and justifies their outlook.

AMBCrypto has elaborated on these analysts’ views and according to our independent analysis, a sharp rise in the price of Bitcoin seems inevitable at this point.

Expert opinion on why a BTC rise is imminent

One crypto analyst, Mustache, did so in a “friendly reminder.” marked an 11-year trendline pattern that BTC has respected as both resistance and support.

According to the chart he shared, it appears that this trendline is gradually becoming a crucial mainstay again, just like it was earlier this year.

Should BTC bounce off this trendline, we could witness a rapid rise, similar to previous patterns when this trendline first acted as support.

Source:

Mustache also noted that Bitcoin’s simple moving average indicates a potential rally.

He added

“The very first gold cross of the 50/100 SMA is also in the making.”

Should the 50 SMA (red line) cross the 100 SMA (blue line), BTC is expected to see a notable increase in value, possibly rising to the $60,000 zone or higher.

While this bullish outlook is clear, another analyst, Mister Crypto, does added to the optimistic sentiment. He shared a chart demonstrating BTC’s performance after Bitcoin’s halving.

In both scenarios he presented, between 2016 and 2020, BTC experienced a significant price increase after the halving, reaching new all-time highs each time.

Source:

Mr. Crypto described this pattern as:

“A #Bitcoin supply shock is coming”

This suggests that the value of BTC could soon fluctuate between $60,000 and $70,000 if this historical pattern continues.

Golden Cross could fuel BTC’s rise to $70,000

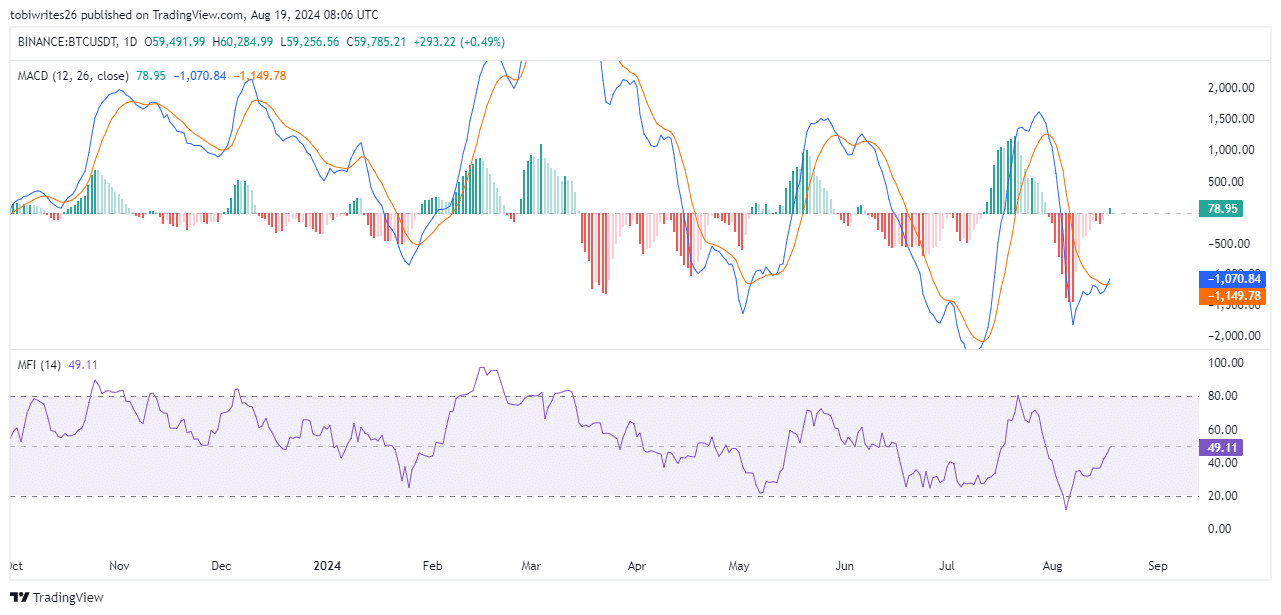

According to the latest analysis from AMBCrypto, BTC has just witnessed a golden cross on the moving average convergence and divergence (MACD) technical indicators.

A golden cross forms when the MACD line (blue) crosses the signal line (orange), which is a sign of a bullish turn that typically predicts significant upward movement in the price.

Source: trading view

For example, when this pattern last appeared on July 12, the price of BTC rose from a low of $56.5k to a high of around $70k on July 29. If this pattern holds, BTC could reach similar highs in the coming weeks.

Further analysis of the Money Flow Index (MFI) – a technical indicator that aggregates price and volume data to identify overbought or oversold conditions and anticipates price reversals – indicates that bulls are gradually taking control of the market.

The MFI has risen steadily in recent days and currently stands at 49.11. Should this uptrend continue, Bitcoin could soon be trading at or above $70,000.

Expected decline before a step-up

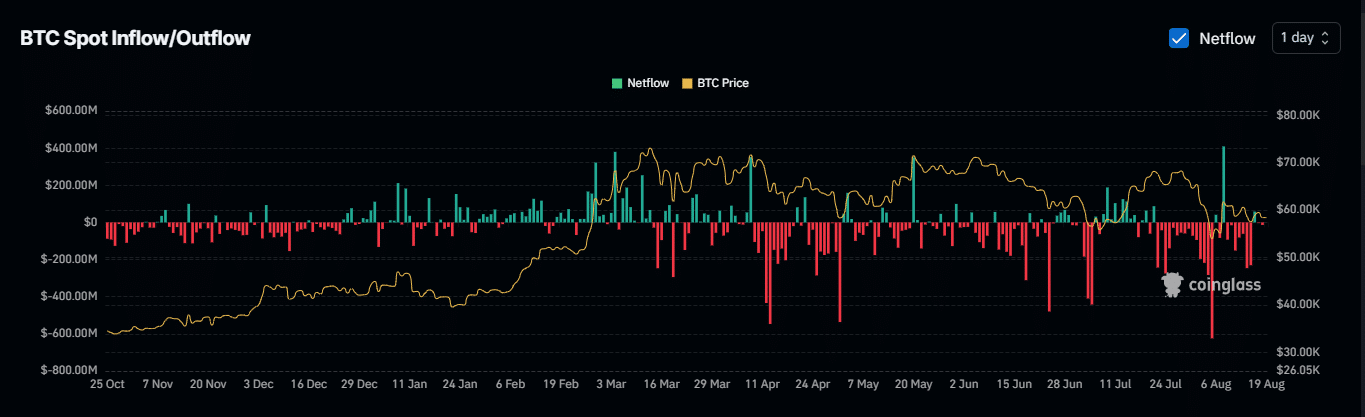

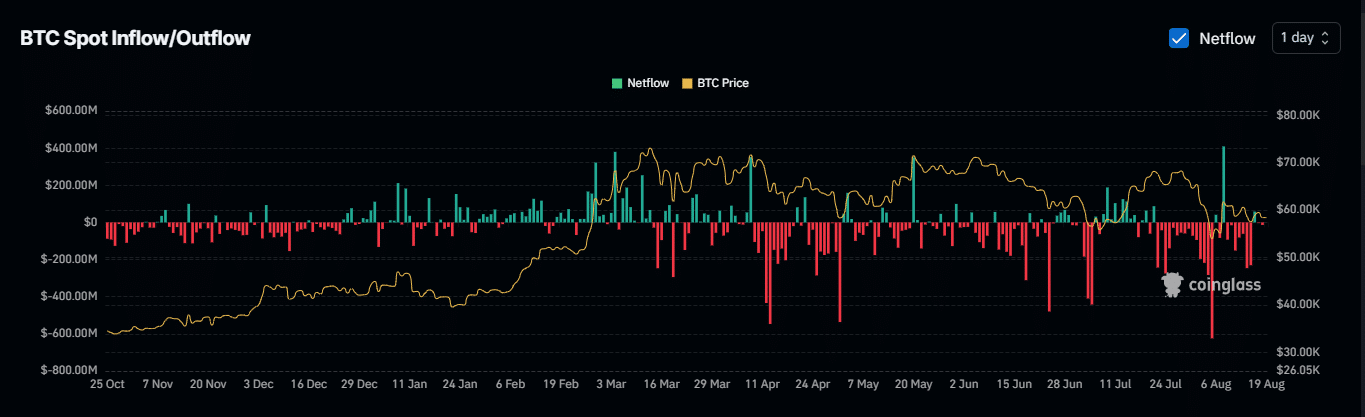

Analysis of Netflow on BTC over weekly and daily time frames Mint glass indicates a predominantly bullish trend.

A negative net flow suggests that BTC holders are transferring their assets from exchanges to cold storage, implying that they have no intention of trading their BTC in the near future.

This reduction in BTC supply on the exchanges could drive up demand, potentially pushing prices higher.

Source: Coinglass

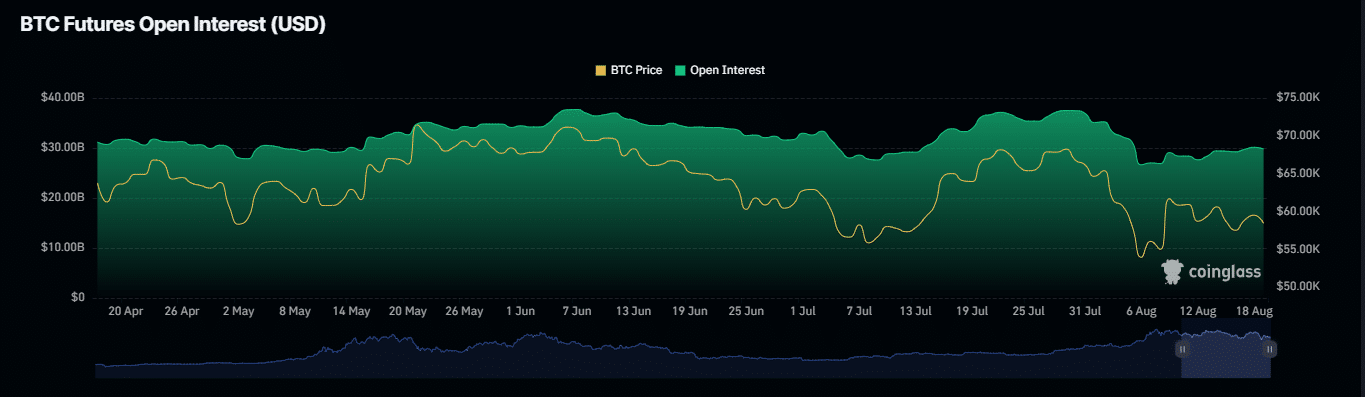

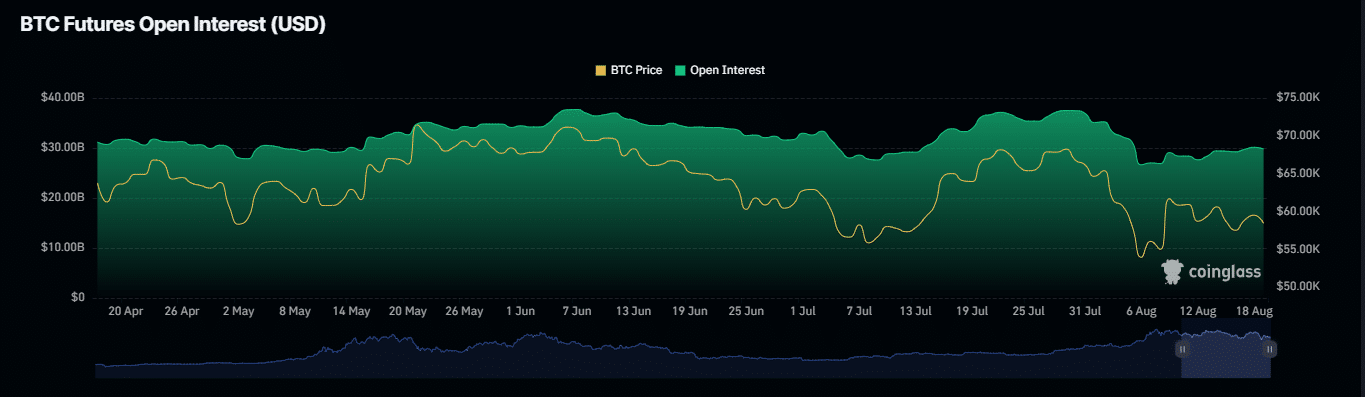

The open interest (OI), which represents the total number of unsettled derivative contracts such as futures or options, provides further bullish signals.

Source: Coinglass

From August 12 to August 19, OI rose from $27.64 billion to $29.81 billion, indicating growing bullish momentum in anticipation of a rally.

However, in the short term, many long traders have faced liquidation according to a Coinglass dataset.

Read Bitcoin’s [BTC] Price forecast 2024-25

This happens when traders with long positions are forced to close out their contracts when the market turns against them, often resulting in a sell-off to meet margin requirements.

This situation suggests that Bitcoin could experience downward pressure before surging to potentially new highs.