In a video update On YouTube, crypto analyst Rekt Capital delved into the dynamics of Bitcoin’s price movements through the lens of the PI Cycle Top Indicator, a predictive tool that has attracted attention for its historical accuracy in pinpointing the peaks of Bitcoin bull runs.

Here’s a look at how high the Bitcoin price could go this cycle

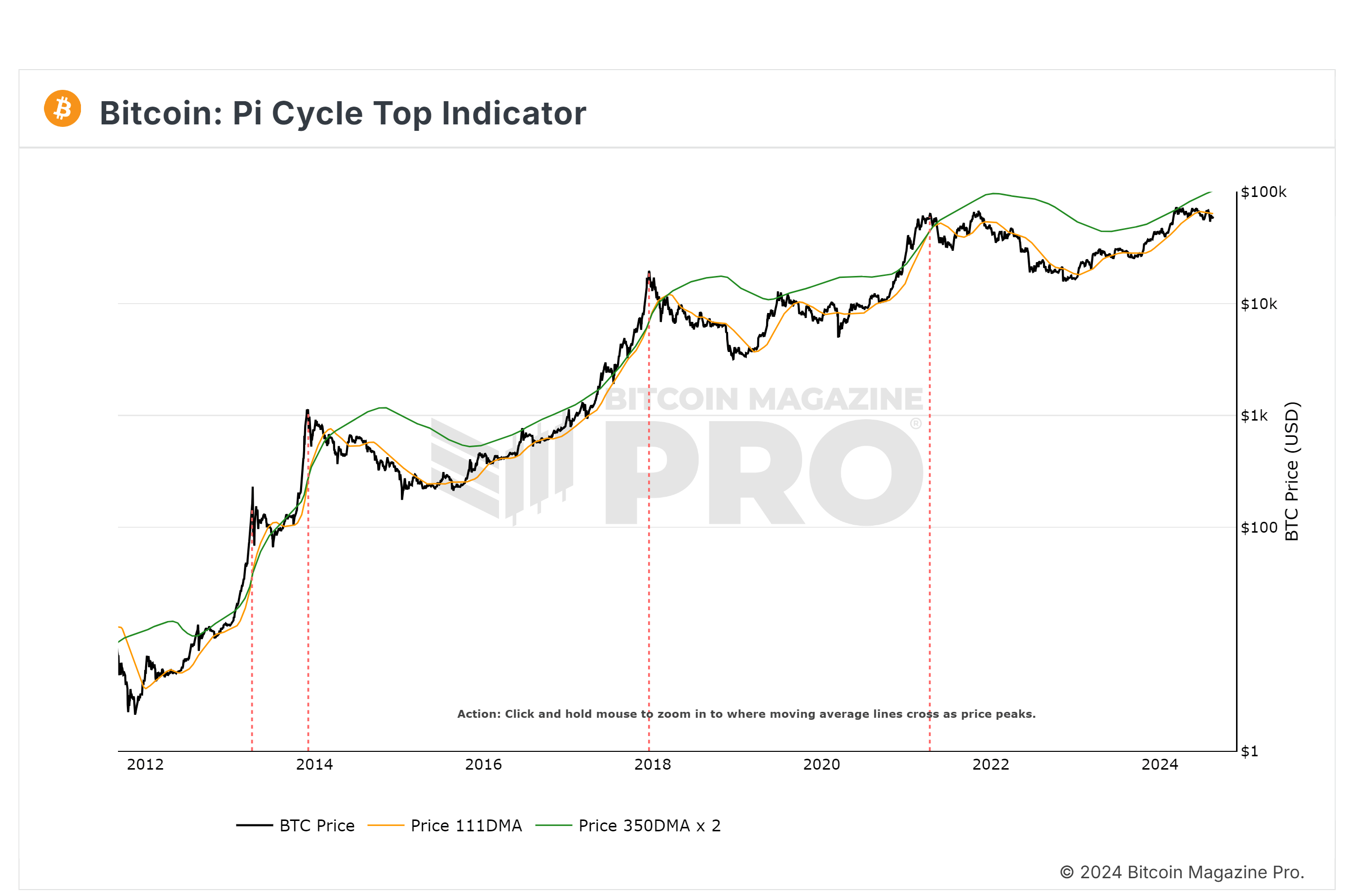

The PI Cycle Top Indicator works by tracking two main moving averages: a 111-day moving average (colored orange in Rekt Capital’s visual analysis) and the 350-day moving average (shown in green) to gauge comprehensive market trends. A crucial aspect of this tool is the ‘crossover’ event where the short-term moving average rises above the long-term average, which historically signals a Bitcoin bull market peak within a few days.

However, current market data shows that these two moving averages are diverging rather than converging, indicating that the conditions for a bull market peak are not yet in place. “Since these two PI cycle moving averages are currently diverging from each other, the bull market peak is nowhere near,” Rekt Capital explains in its video.

Related reading

The 111-day moving average serves as a critical benchmark in Rekt Capital’s analysis. During bear market phases or pre-halving years, this moving average acts as a barometer for bargain opportunities, fluctuating around it in downtrends. Conversely, in half-years such as 2020, it tends to act as a support level, supporting upward trends that lead to new all-time highs.

“Any dip below this moving average is a buying area,” Rekt Capital noted, highlighting the strategic importance of this level during different market phases. Currently, Bitcoin is trading below this moving average, around $59,000, which has not happened for a significant period of time since the year before the halving, marking a potentially undervalued state compared to historical patterns.

The analysis suggests that if Bitcoin reclaims the $63,900 level – just above the current position of the 111-day moving average – it could end the current buying opportunity, paving the way for further upside moves. “We are about $5,000 away from reclaiming this region. Not much needs to happen for Bitcoin to recover and reclaim this region to end this buying opportunity,” said Rekt Capital.

Related reading

Another element of the PI Cycle Top Indicator is the 350-day moving average. This average is typically revisited at later stages of the market cycle, often acting as resistance before an upward deviation occurs.

“Upside deviations beyond the green moving average, which is when we see parabolic price action taking place,” Rekt Capital noted, citing past events in 2013 and 2017 where such moves were observed. The current green moving average is around $96,000, indicating significant upside potential before parabolic risks materialize.

Rekt Capital’s analysis suggests that while Bitcoin is still far from reaching the $96,000 mark, historical patterns predict that it will eventually approach and possibly even exceed this level, leading to a short-lived period of rapid price appreciation.

“[We are] doesn’t come close to this green moving average because it’s around $96,000, so we’re still almost $30,000 away from this region […] Once we get past $96,000, we need to understand that the clock starts ticking and then really starts ticking for the end of the ball run and that we may have a period of just a few months where Bitcoin will rise uninterruptedly, with pullbacks of course. the analyst explained.

Looking ahead, Rekt Capital emphasized the importance of monitoring the convergence of these two moving averages for signs of a potential bull market peak. “We need to see a rise in the Pi cycle moving average before that crossover can occur to some extent,” he stated, indicating that a sharp increase in price action is needed before a final crossover becomes a reality can be.

At the time of writing, BTC was trading at $58,695.

Featured image created with DALL.E, chart from TradingView.com