- Litecoin rose 10.32% on the weekly charts, while analysts expected a 40% rally.

- Over the past seven days, whale transactions amounted to $17.3 billion.

Over the past two weeks, the crypto market has experienced significant volatility. Despite the fluctuations, Litecoin remains [LTC] has defied the trend to chart its unique path.

To this extent, LTC’s price action has caused analysts to speculate on a continued bull run.

A major factor influencing LTC market sentiment is the positive whaling activity. Over the past three months, LTC has witnessed a continued increase in the number of large holders, reaching $3.6 billion in large holder trades on the daily charts.

The prevailing market sentiment

Due to the current price movement of Litecoin, analysts are looking for a major breakout. Analyst Crypto whales similarly bet big on the altcoin, noting that:

“Litecoin has broken the falling wedge pattern on the intraday chart. This breakout signals the end of the previous downtrend. Expect a potential bullish move of 40% after this breakout.”

According to his analysis, the altcoin will reach a resistance level of $94.7 last seen on April 12. Other analysts like Crypto surf use a historical cycle to advocate for long-term care in a future-oriented manner.

Crypto Surf stated:

“Based on previous cycles, LTC should start its bull run 15 to 19 months after the Bitcoin price halving, and 6 to 8 months after the $BTC halving. So between October 2024 and March 2025.”

Litecoin: What Price Charts Suggest

Litecoin was trading at $67.62 at the time of writing, having posted a 10.32% gain on the weekly charts. However, the altcoin’s trading volume has fallen 24.8% to $205.5 million on the daily charts.

However, despite the downturn in trading, LTC saw a strong upward move.

Source: TradingView

The altcoin’s Advance Decline Ratio (ADR) stood above 1 to 1.93, indicating increased buying activity. This suggested that LTC reported more highs than lows, indicating a positive outlook among investors.

Also, the altcoin’s RVGI was positive at 0.31, indicating strong upward price movements. This meant that the closing prices are higher than the opening prices at the time of writing, which is a bullish signal.

Source: TradingView

Moreover, the Aroon line showed a strong upward movement. The Aroon Up line at 100% was above the Aroon Down at 7.14%, indicating that the uptrend was strong and sustained.

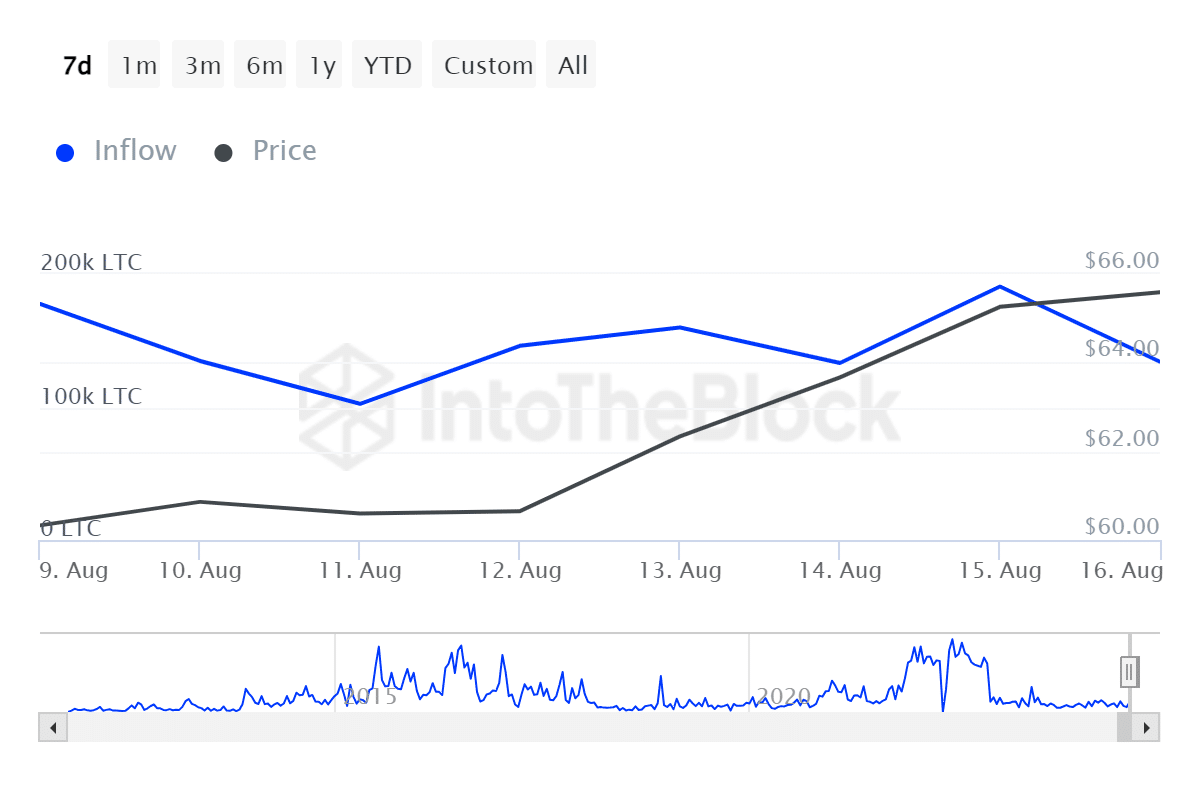

Source: IntoTheBlock

Looking further, LTC has enjoyed significant inflows from large holders, indicating positive sentiment among whales.

Data from IntoTheBlock shows that Litecoin’s large holder inflows on the weekly charts have remained high, peaking at 190.5k tokens. These transactions have reached a value of $17.3 billion in the past week.

So there was greater confidence among the whales in the future potential and confidence in its direction.

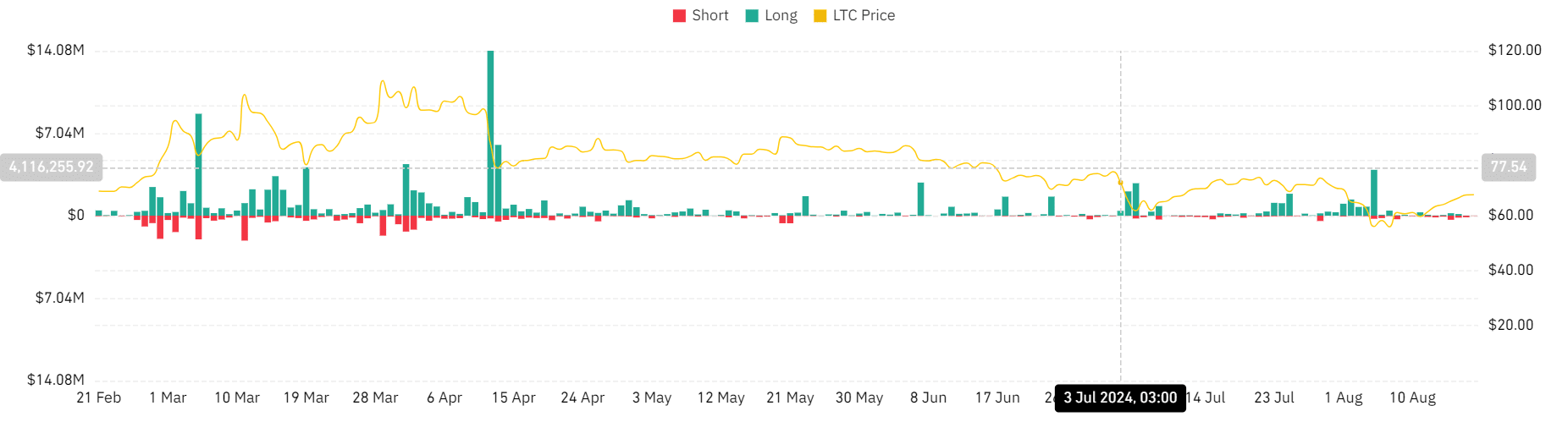

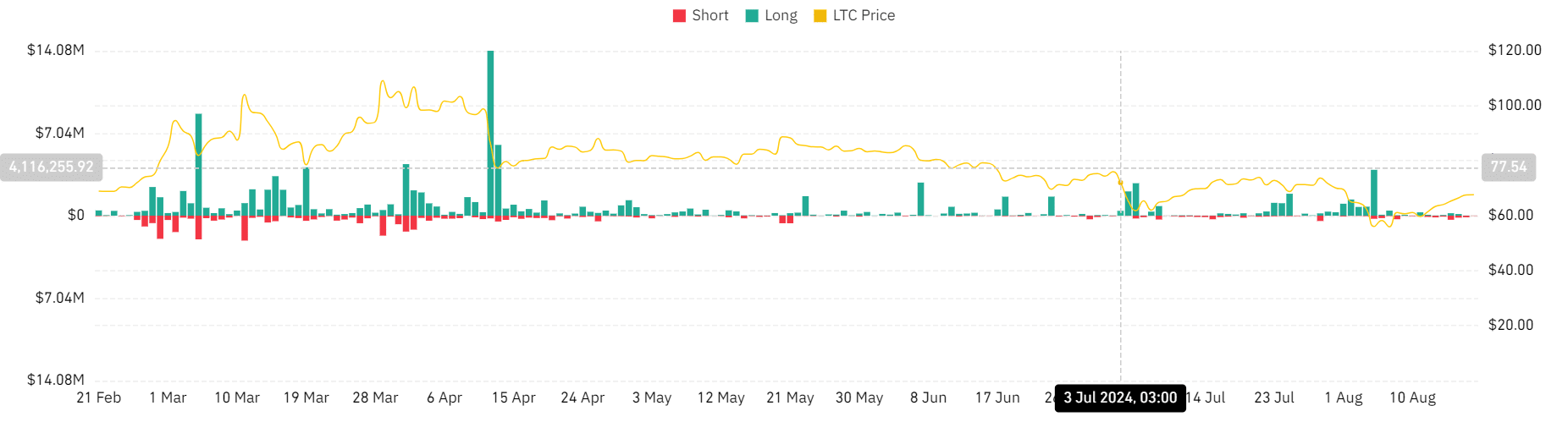

Source: Coinglass

Finally, AMBCrypto’s analysis of Coinglass data showed that the liquidation of the altcoin’s long positions has decreased over the past two weeks. Liquidation is down from $3.9M to $8.2K at the time of writing.

Investors were confident in the altcoin’s direction, and lows failed to liquidate their positions.

Is your portfolio green? View the LTC Profit Calculator

Therefore, LTC enjoyed positive market sentiment accompanied by strong upward price movements.

In case the daily candlestick breaks above the resistance level at $69.02, the altcoin will break through to the resistance level at $76.67.