- AAVE remained in a bull trend at the time of writing.

- The asset will see a golden cross if the token maintains its price trend.

Aaf [AAVE] closed last week on a positive note and showed strong performance. However, there has been a decline in the past 24 hours.

Despite this recent downturn, indicators suggested that the price could be poised for a further uptrend in the coming week.

AAVE shows mixed signals

According to AMBCrypto, AAVE was trading at around $112.37, marking a daily increase of over 1.30%.

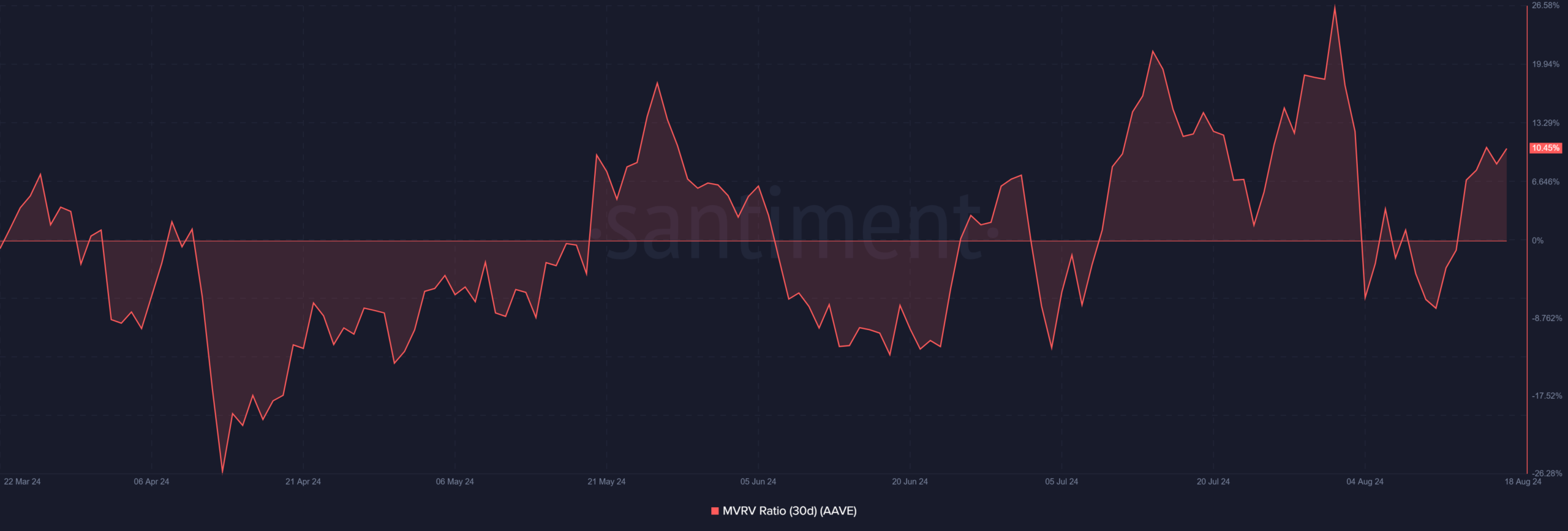

The long and short moving averages (blue and yellow lines) provided support around $99.86 and $97.67 respectively, indicating a solid base for the price.

The Relative Strength Index (RSI) is at 60.76, which indicates that the index is in bullish territory, but not yet overbought. This leaves room for further upside before the RSI reaches an overbought condition (typically above 70).

The Moving Average Convergence Divergence (MACD) line is at 1.32 and the signal line is at 1.60, both in positive territory.

Source: TradingView

However, despite these bullish indicators, the data remains forthcoming CoinMarketCap showed that it was among the losers of the past 24 hours, losing more than 1%.

This recent dip earned it a spot among the biggest losers, reflecting short-term volatility or profit-taking. Interestingly, AAVE still stood out as the second highest gainer over the past seven days, with a notable increase of 18%.

Approaching a golden cross

AAVE was positioned for positive price movement at the time of writing, with the moving averages suggesting a golden cross could develop if the price continues to rise.

A golden cross, where the short-term moving average crosses above the long-term moving average, is typically seen as a strong bullish signal.

The next major resistance for AAVE is around the $120 level, a psychological barrier that previously acted as resistance.

If AAVE can successfully break this level, the next target could be around $130, which represents a previous high. It also serves as the next logical resistance zone.

While the indicators are largely bullish, with the RSI and MACD supporting the case for further upside potential, traders should be cautious about potential retracements.

In the event of a pullback, AAVE could find support around the long moving average of $99.86 and the short moving average of $97.67.

However, if the AAVE falls below these moving averages, it could signal that bearish sentiment is developing again. The price could test the USD 90 level, where previous support was located.

Holders enjoy profits

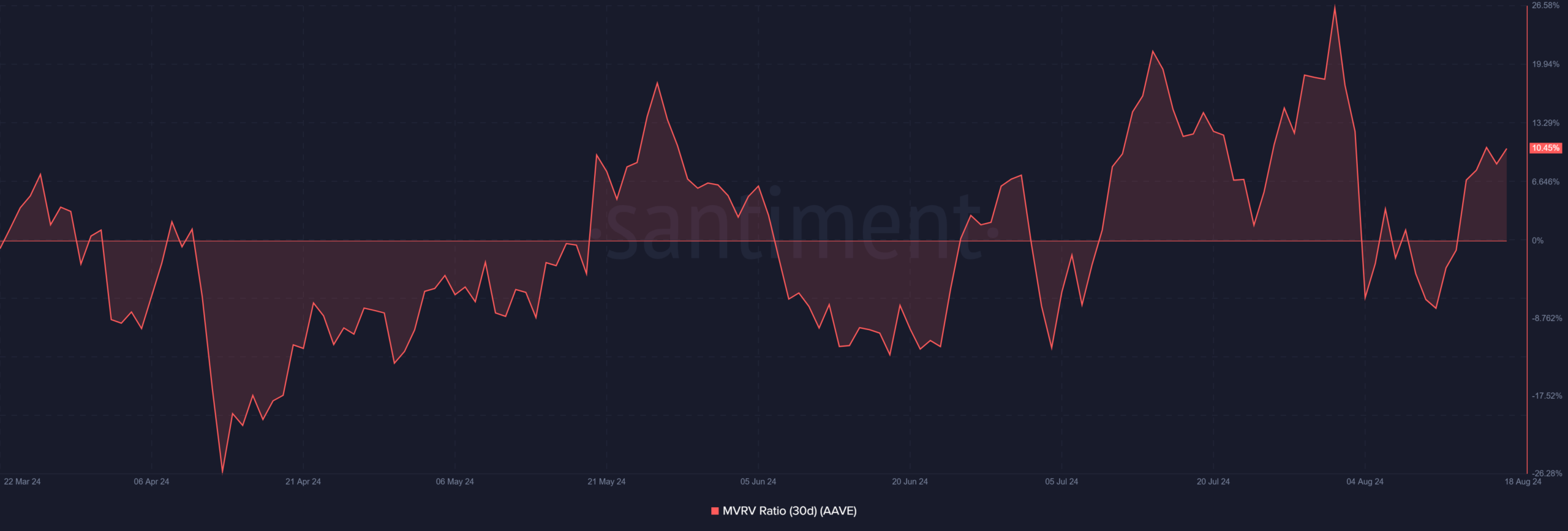

An analysis of AAVE’s 30-day market value to realized value (MVRV) showed that holders were profitable at the time of writing.

The MVRV climbed above zero on August 13 and has been in positive territory ever since. At the time of writing, the MVRV was approximately 10.45% per Santiment facts.

Source: Santiment

Realistic or not, here is AAVE’s market cap in BTC terms

This trend indicated that holders who purchased AAVE in the last 30 days have an average gain of more than 10%.

A positive MVRV ratio generally reflects strong market sentiment. It suggests that current holders are not only making a profit, but also confident in the value of the asset.