- The historical correlation between Bitcoin and the US dollar is poised for another cameo during this bull run.

- Bitcoin is approaching its fair value price as long-term holders have accumulated more BTC.

Price movement patterns often repeat, which helps predict future prices of assets like Bitcoin [BTC] and other cryptocurrencies.

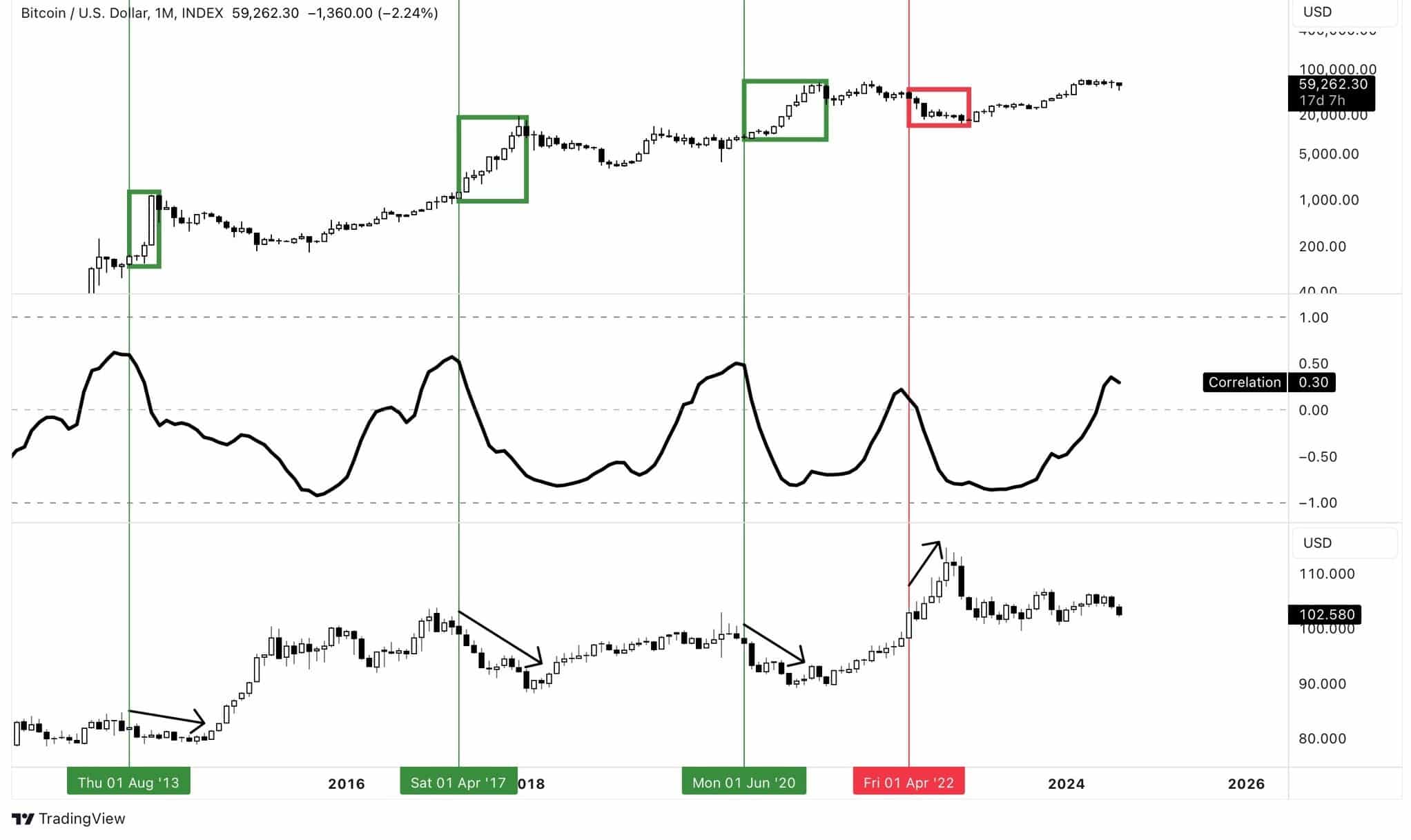

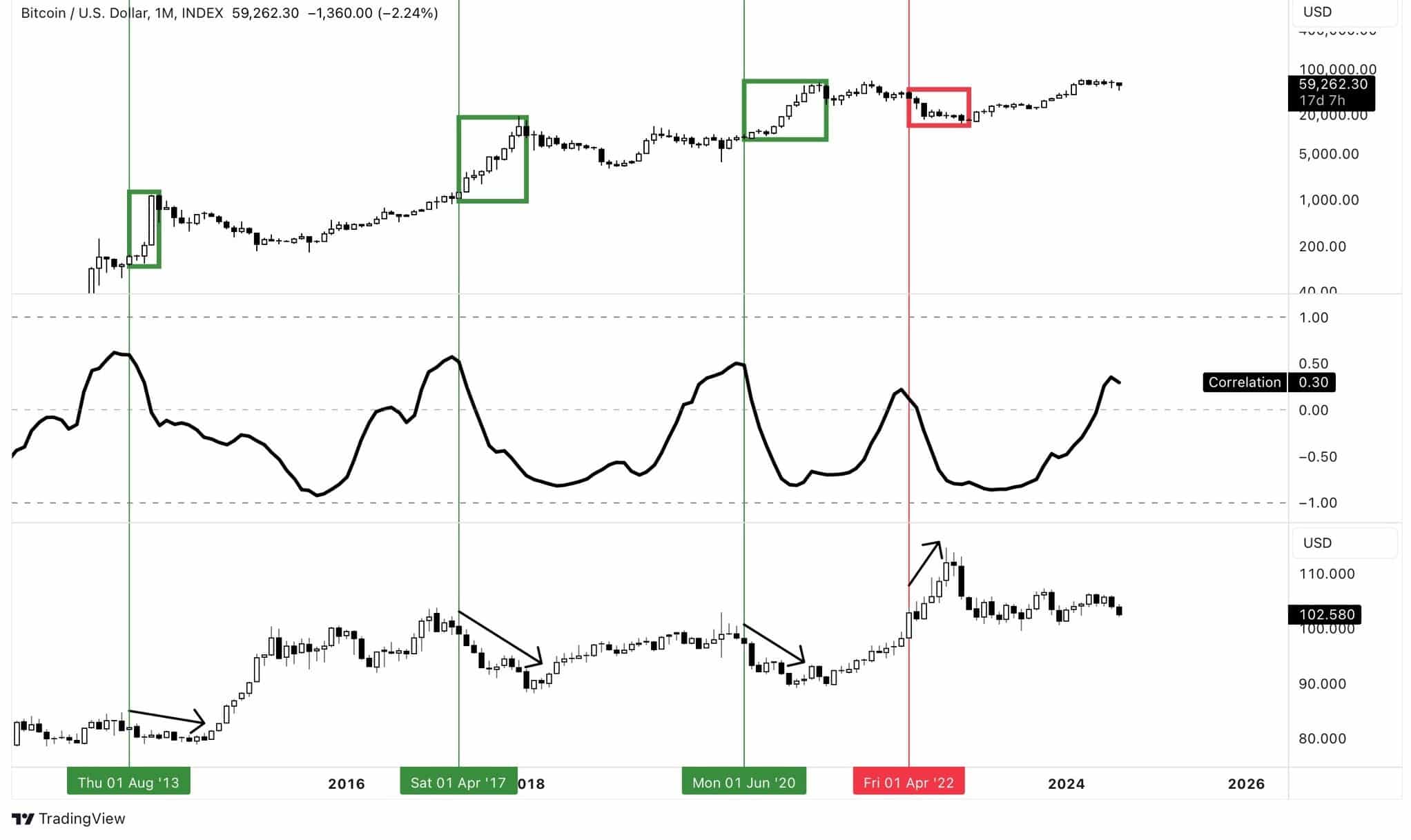

Analyzing the BTC/USD and DXY charts next to their correlation coefficient revealed an important pattern: when BTC’s monthly correlation to DXY shifts from positive, it indicates a big move, but the direction is not certain.

Historically, this has led Bitcoin to the tail end of a bull run 75% of the time, or to a decline 25% of the time during a bear market.

Source: TradingView

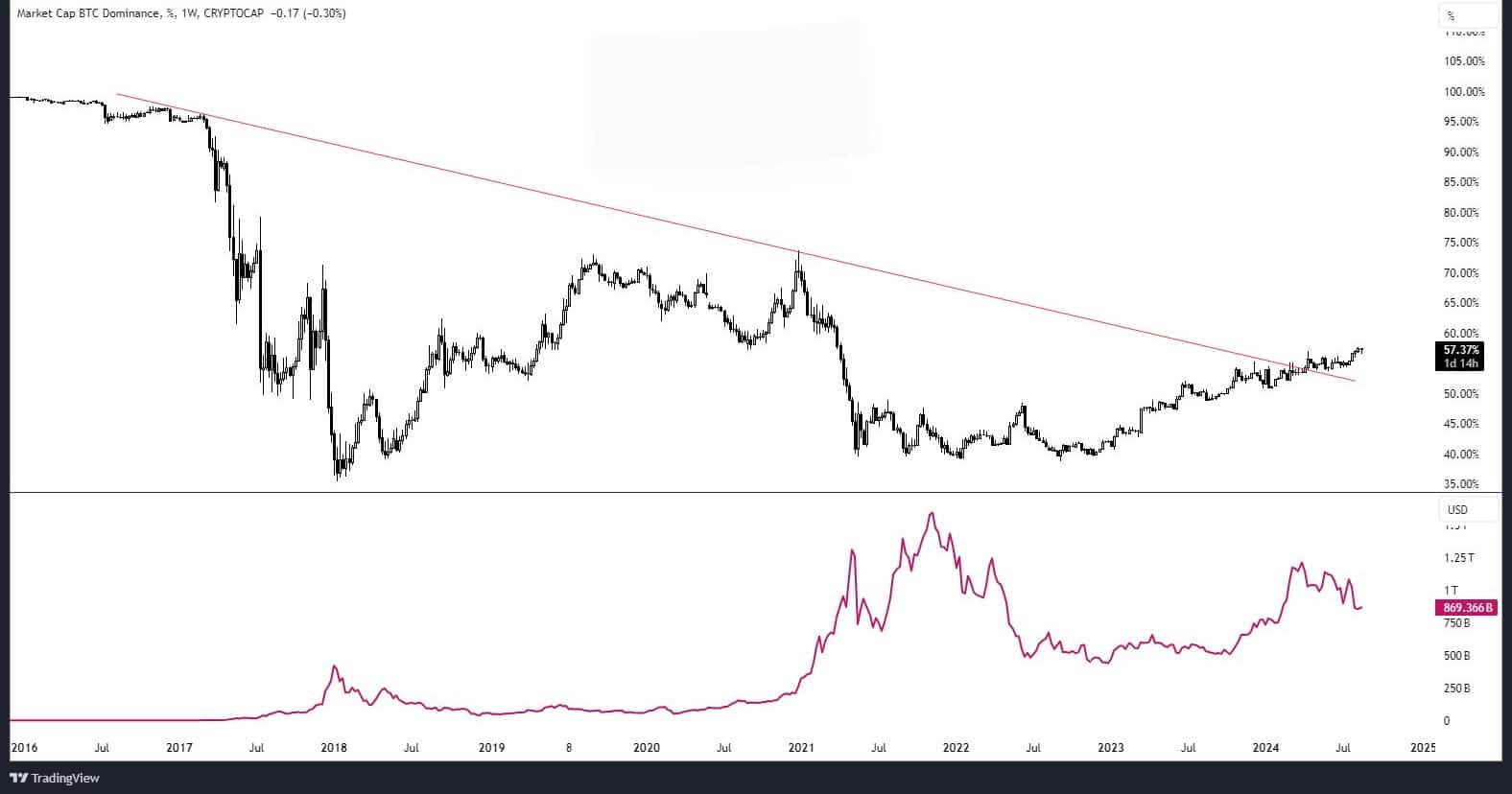

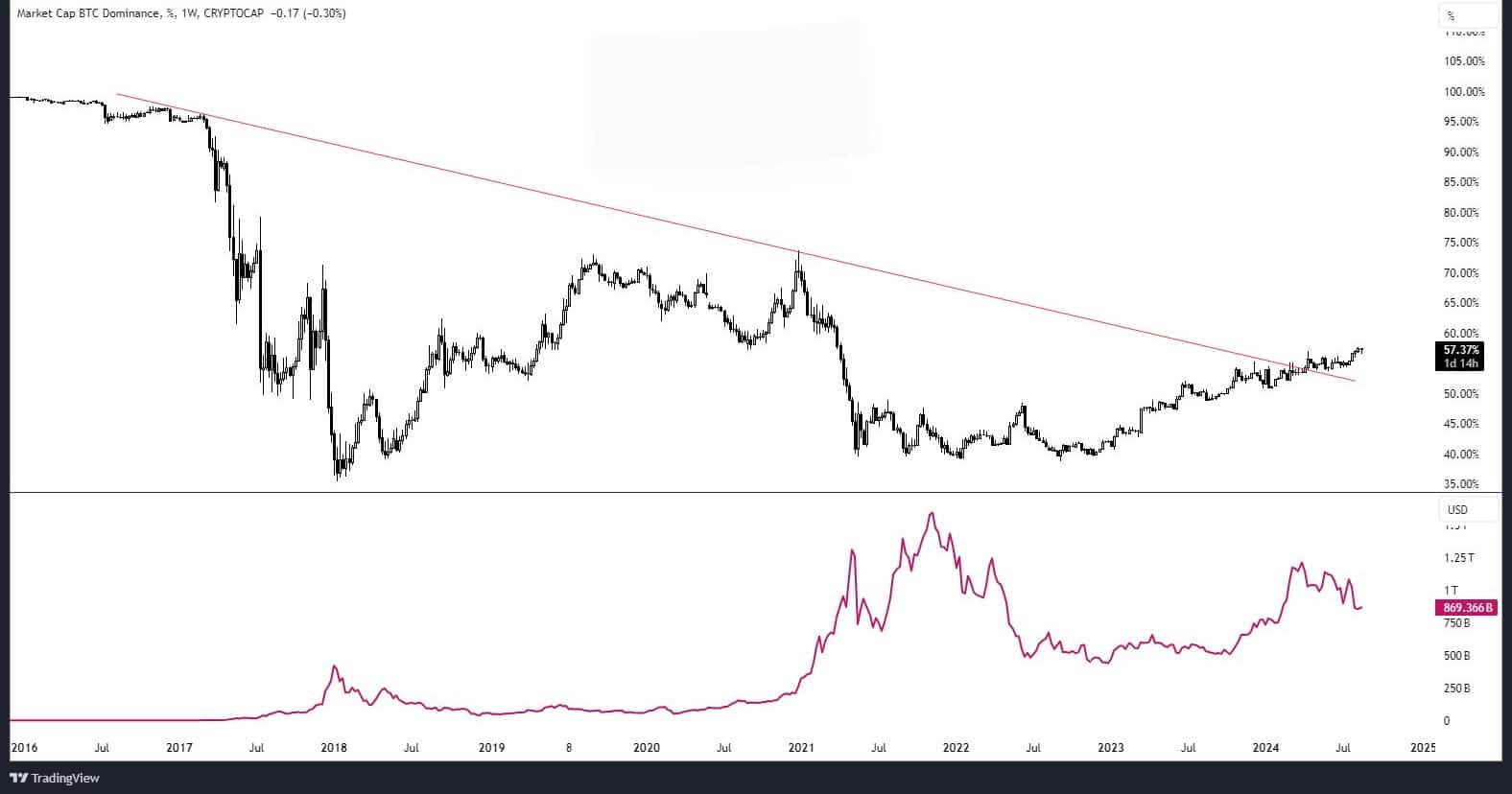

Many analysts are unsure about Bitcoin’s next direction, but AMBCrypto has the answer. First, Bitcoin’s weekly dominance chart has broken out of a descending trendline, indicating potential strength.

Despite recent price declines, Bitcoin has regained the $60,000 level. Meanwhile, altcoin market caps appear to have bottomed out and are now starting to trend upward.

This indicated that Bitcoin and other cryptocurrencies may be preparing for a significant upward move.

Source: TradingView

However, CryptoQuant’s Spot-Perpetual Price Gap on Binance remained negative, indicating continued selling pressure on Bitcoin.

This gap, caused by aggressive liquidations and short positions, suggested that the BTC price was approaching its fair value. This indicated a potential opportunity for investors to buy, indicating that Bitcoin is likely headed higher.

Source: CryptoQuant

Bitcoin’s historical risk levels

The chart below highlights a risk level for Bitcoin, which helps with long-term buying and selling points in the market. At the time of writing, the risk level was around 0.5, indicating low risk and a favorable buying opportunity.

Traders and investors may want to consider dynamic dollar cost averaging in this region before risk levels rise, indicating the need to sell larger quantities.

Source: Into The Cryptoverse

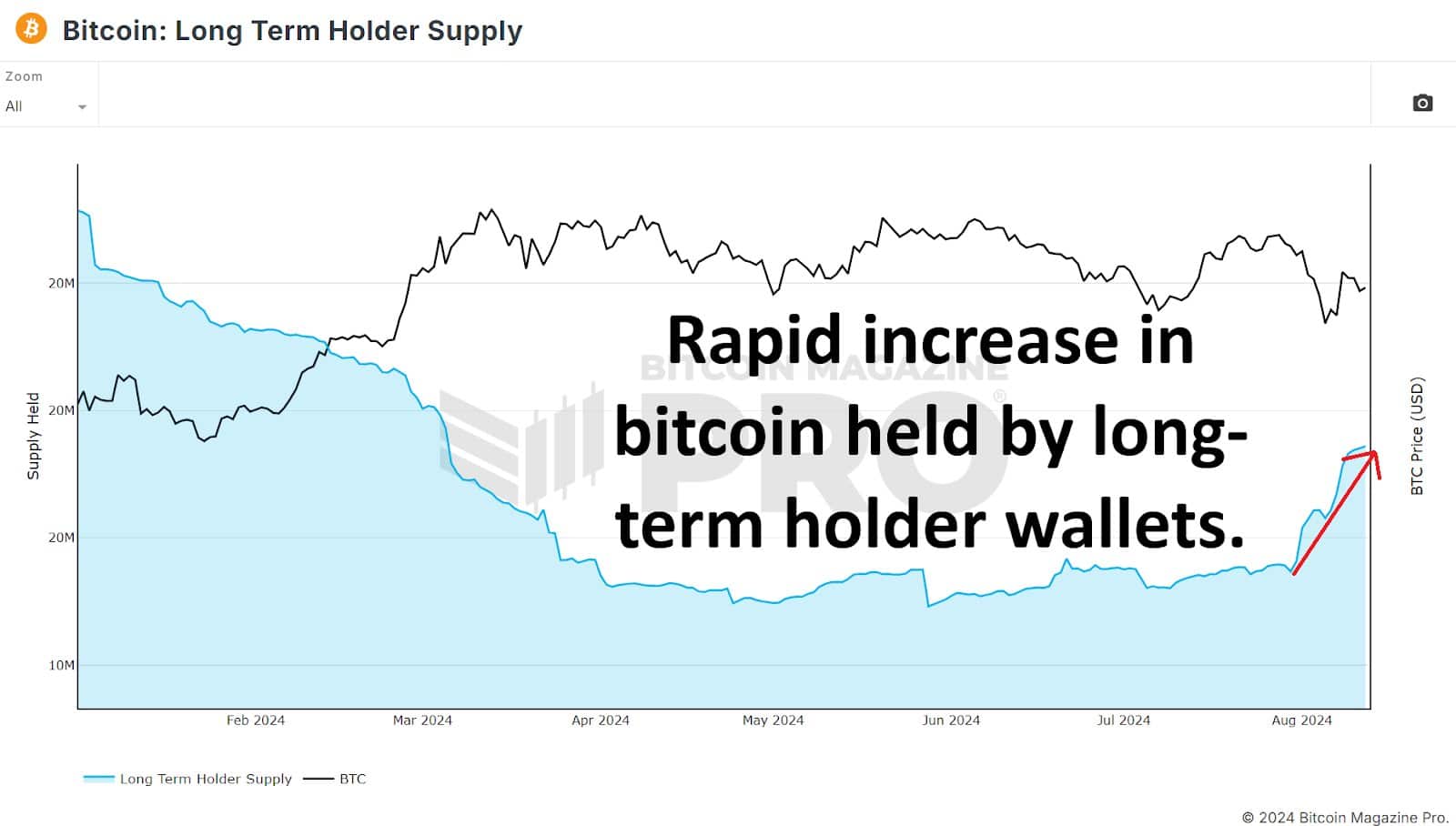

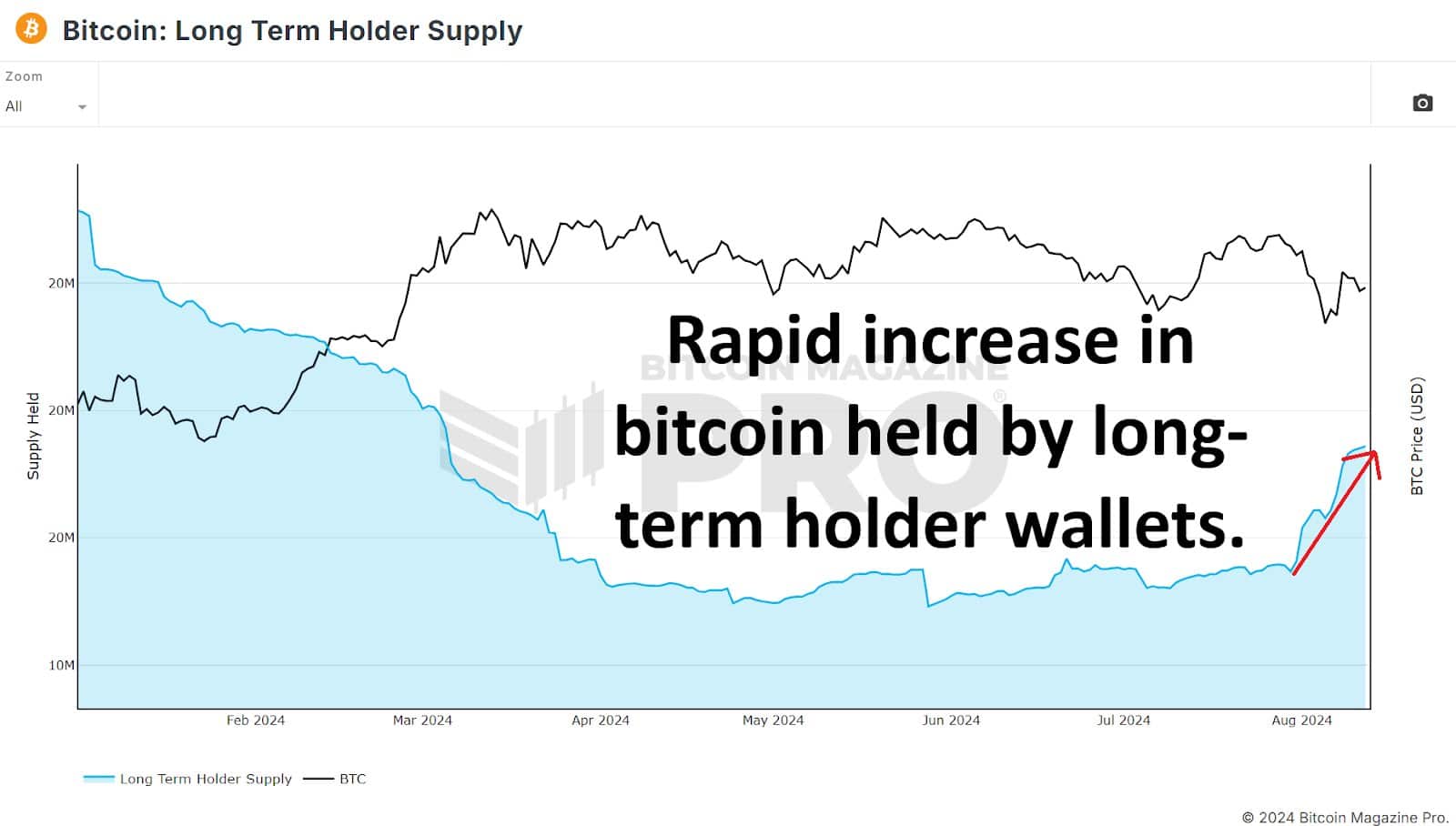

Additionally, over 500,000 BTC have been added to long-term wallets since July 30, indicating a bullish trend for Bitcoin.

This wave indicated that whales and institutions were actively accumulating Bitcoin, reflecting growing confidence in its future value.

Source: Bitcoin Magazine PRO

Is your portfolio green? Check out the BTC profit calculator

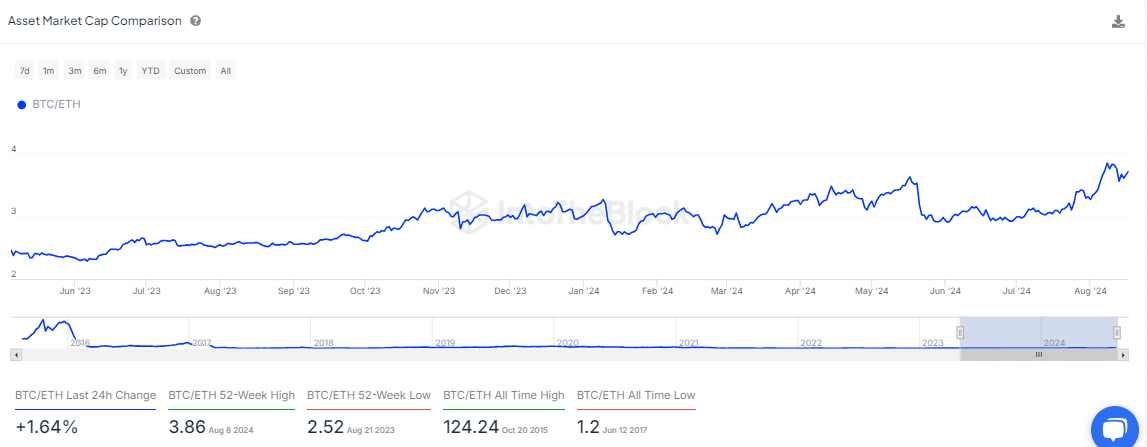

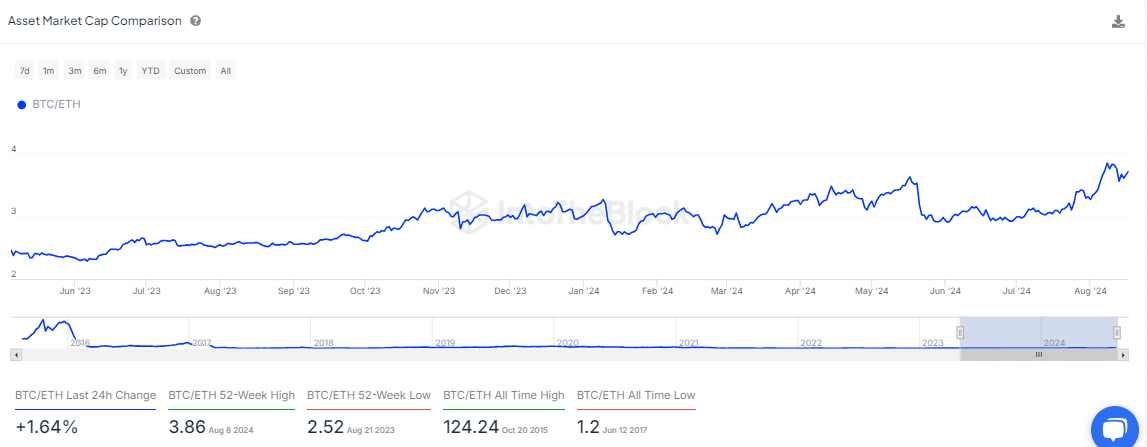

Finally, Bitcoin was gaining strength against Ethereum at the time of writing. The BTC/ETH market cap ratio has been steadily rising in August, indicating stronger accumulation of the king coin.

This trend suggested that Bitcoin was poised for further upward movement.

Source: IntoTheBlock