- Bitcoin remained above a crucial support level at the time of writing.

- Indicators showed that BTC was trading below its possible market bottom.

Bitcoin [BTC] Bulls have taken a backseat in recent days as the king of cryptos’ volatility fell. It was interesting to note that while BTC consolidated, it managed to stay above a crucial support level.

This suggested that if things fall into place, the coin could start an upward rally in the coming days.

Bitcoin’s crucial support level

According to CoinMarketCapBitcoin’s weekly chart remained red and its price has risen only marginally over the past 24 hours.

At the time of writing, the king of cryptos was trading at $59,443.16 with a market cap of over $1.17 trillion.

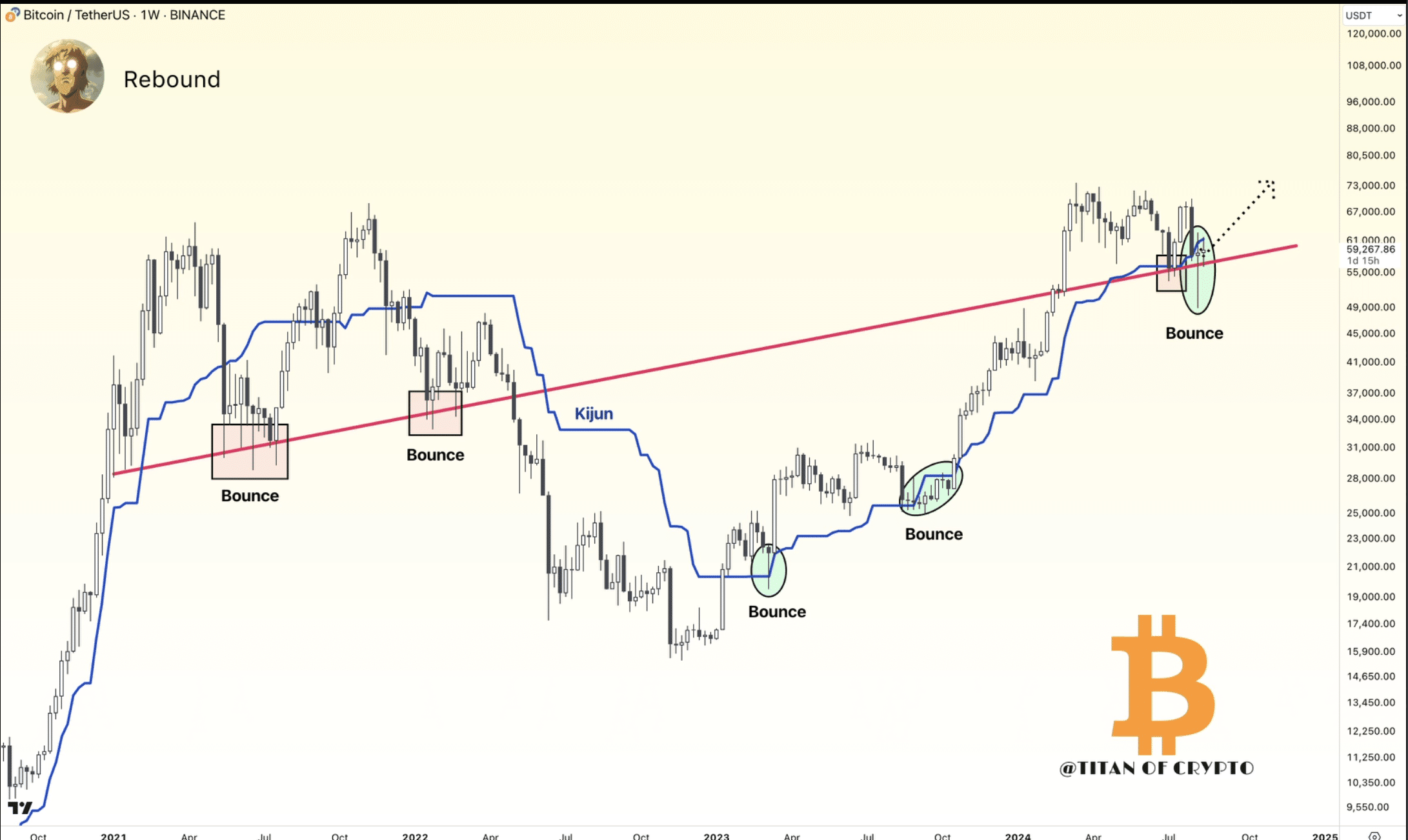

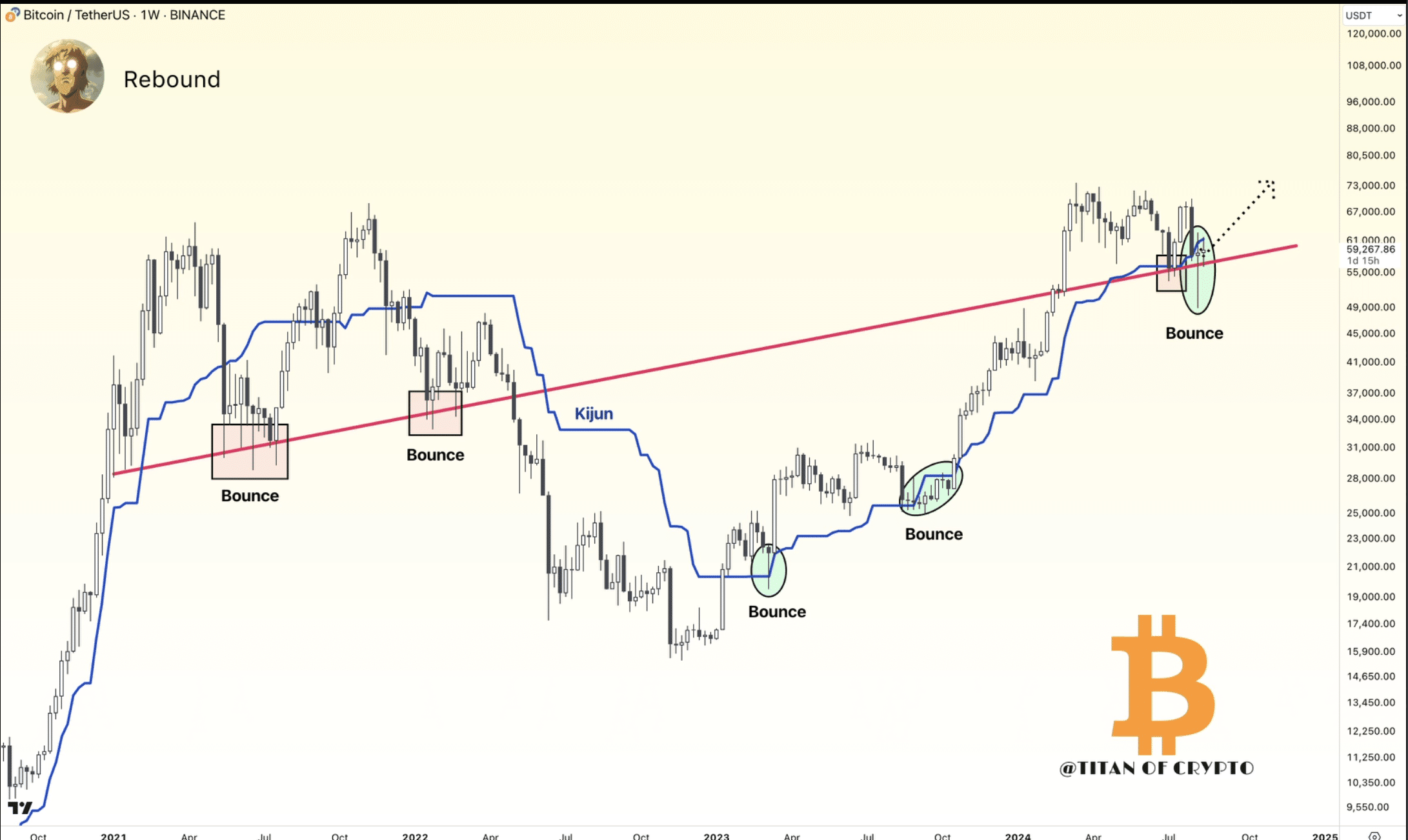

Meanwhile, Titan of Crypto, a popular crypto analyst, posted a tweet pointing out an interesting development: the price of BTC was trading just above a critical trendline (red).

Source:

It is notable that BTC has not closed a candle below the red line. Similar events took place in 2021 and 2022. During those events, Bitcoin recorded promising rebounds after touching the same red line.

If history repeats itself, investors may soon witness BTC gaining bullish momentum.

Will history repeat itself?

AMBCrypto then reviewed the coin’s on-chain data to see what they suggested regarding a recovery.

According to our analysis of CryptoQuant’s factsBTC’s foreign exchange reserves fell, indicating an increase in buying pressure.

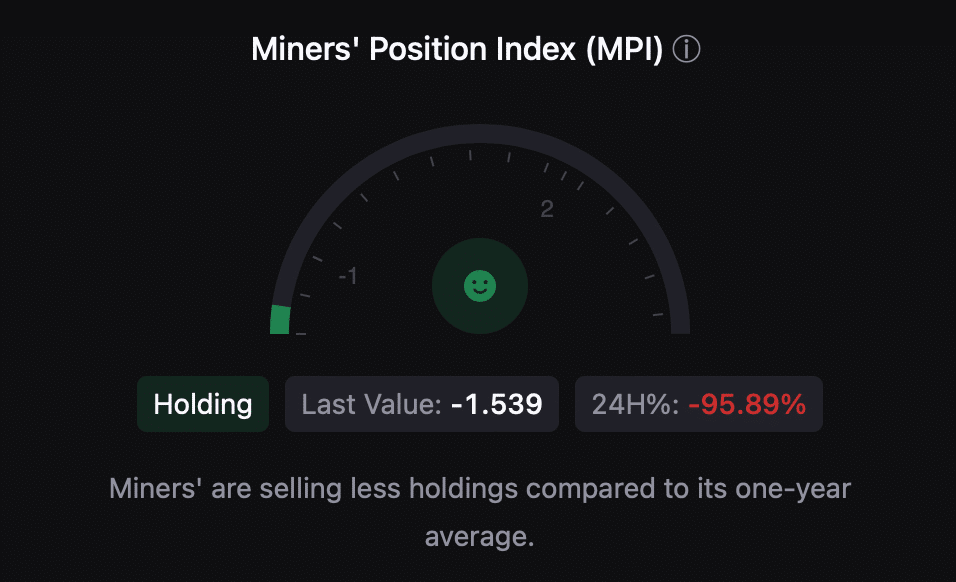

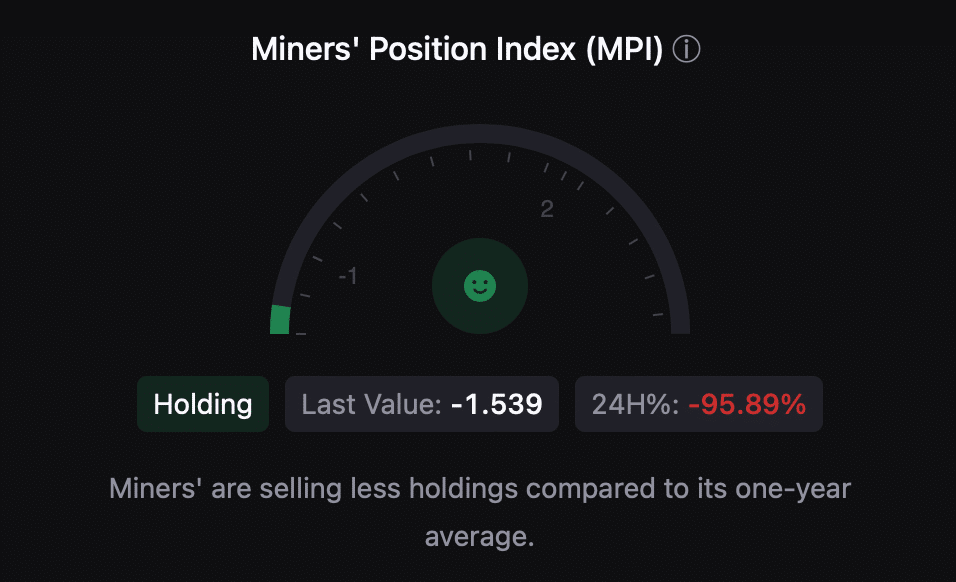

King Coin’s Miners’ Position Index (MPI) suggested miners were selling fewer assets compared to the annual average.

This meant that miners had confidence in BTC and expected its price to rise in the upcoming top.

Source: CryptoQuant

Moreover, BTC’s binary CDD was also green, meaning that the movement of long-term holders over the past seven days was lower than the average. They have a motive to hold on to their coins.

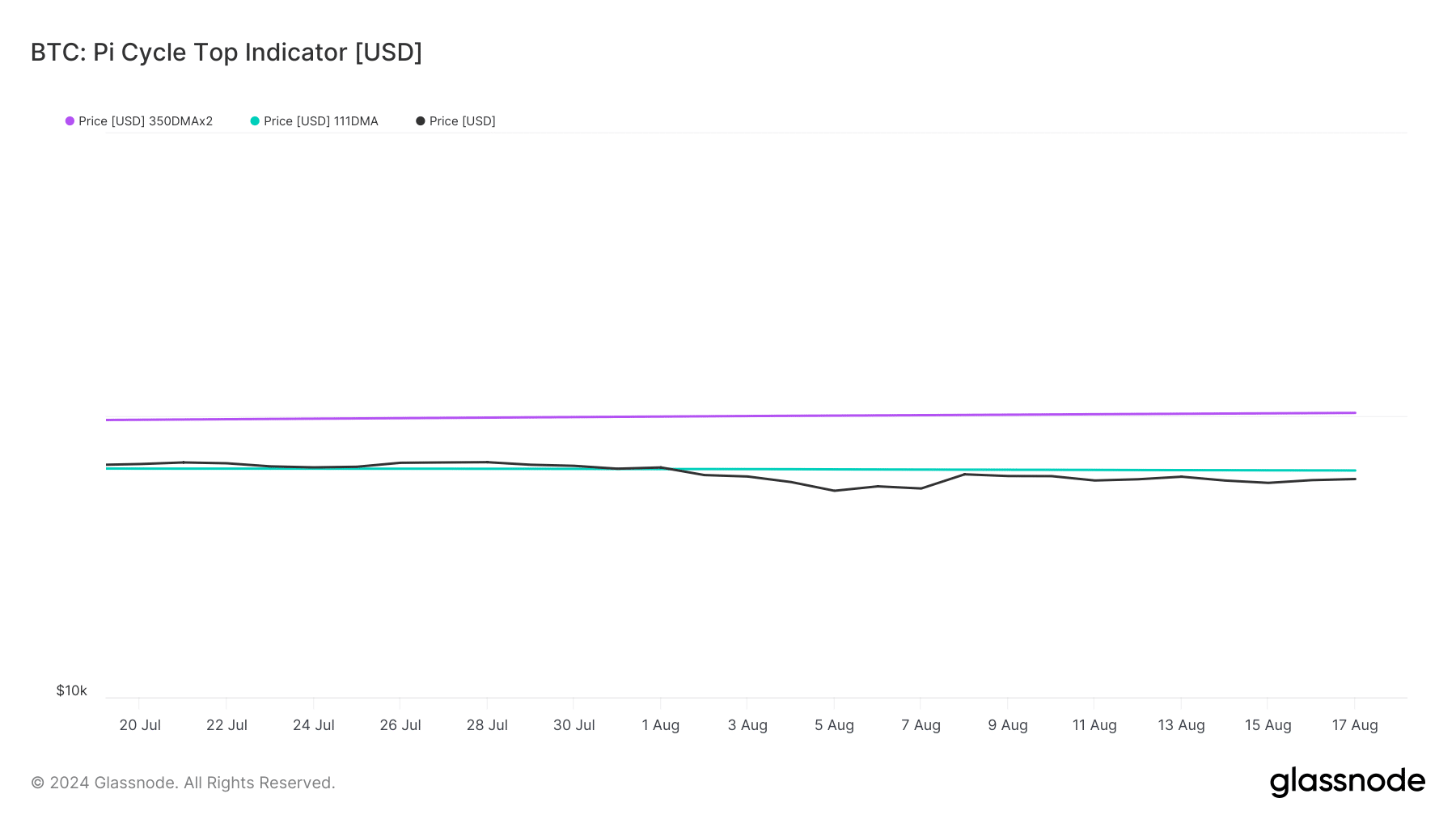

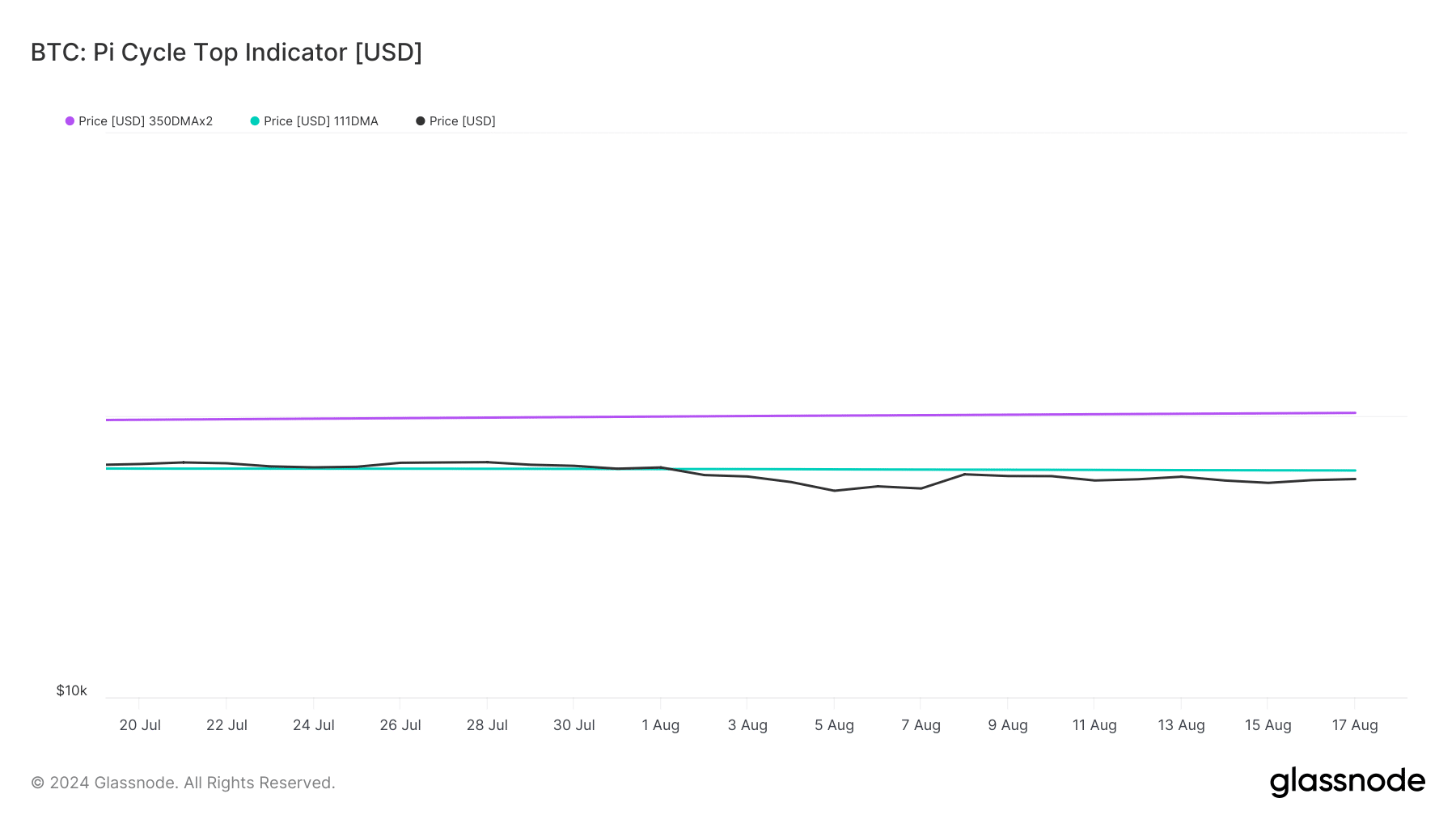

Our look at Glassnode’s data revealed another bullish indicator. BTC’s Pi Cycle Top indicator indicated that BTC’s price was resting below its possible market bottom of $63.7k.

The indicated that there was a good chance that BTC would achieve that goal.

AMBCrypto reported rather that BTC was also following another historical trend, which could result in a massive bull rally in the fourth quarter of 2024.

Source: Glassnode

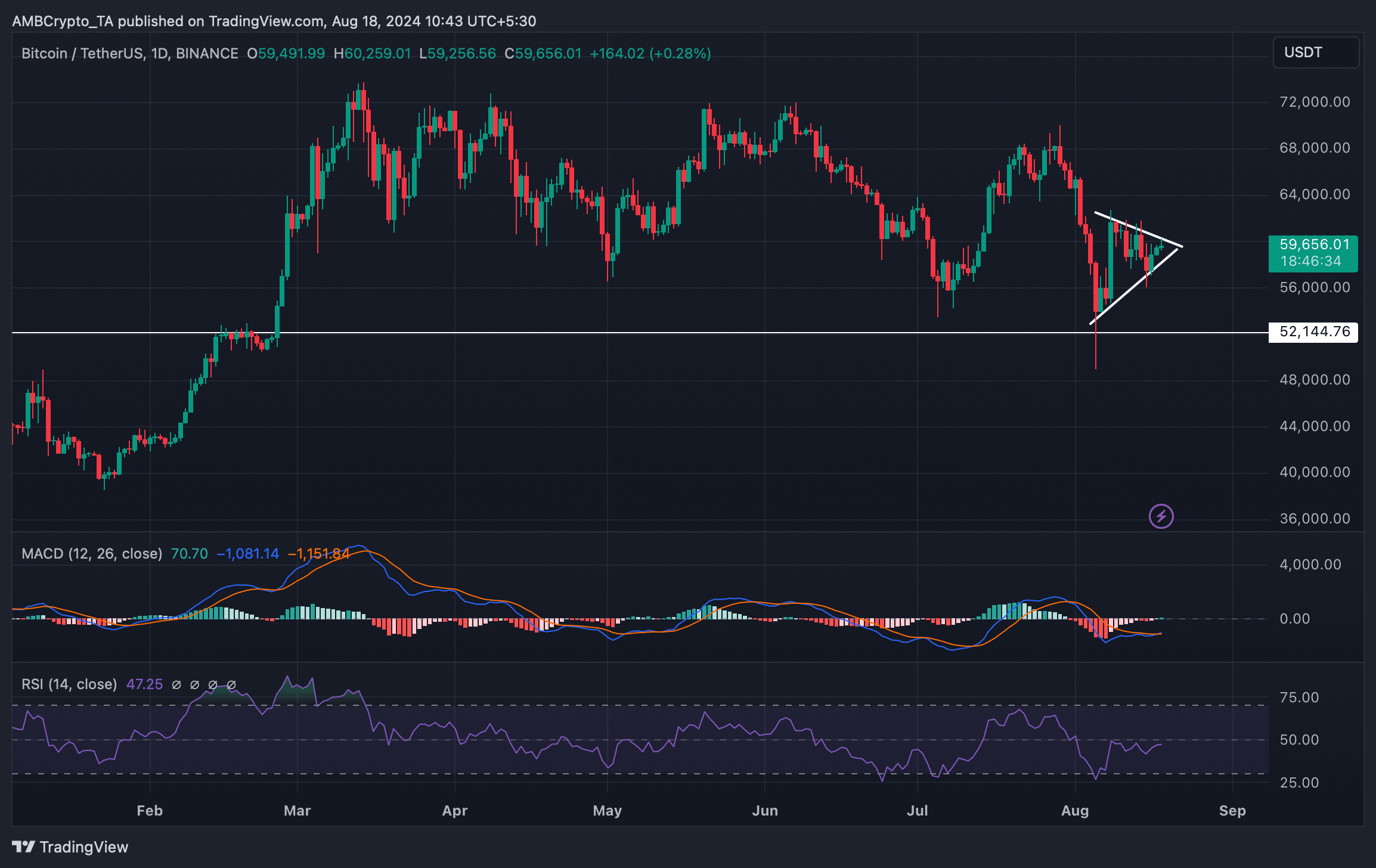

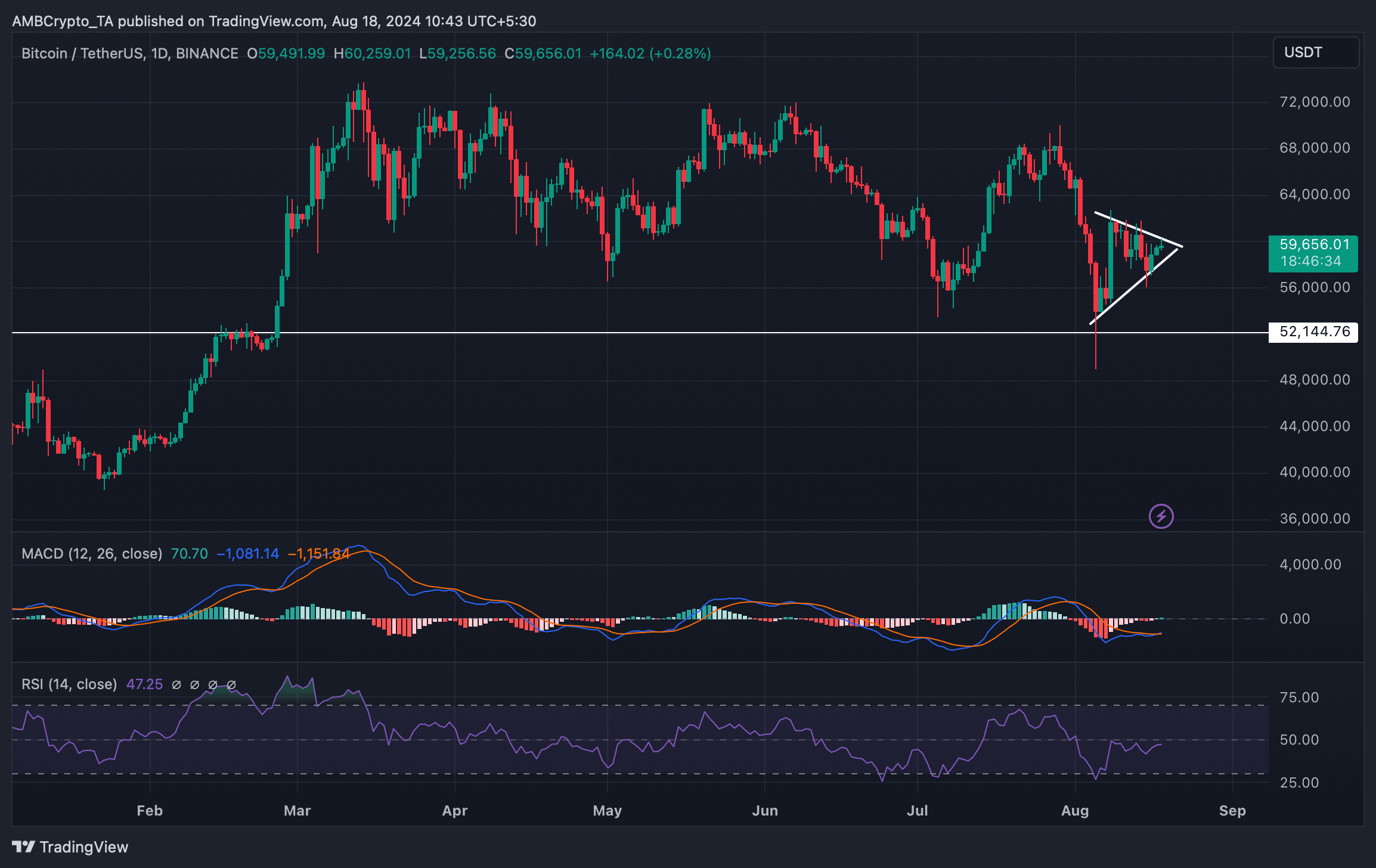

AMBCrypto then looked at Bitcoin’s daily chart to better understand what to expect in the short term. Our analysis revealed a bullish symmetrical triangle pattern on the chart of BTC.

The technical indicator MACD showed a bullish crossover.

Is your portfolio green? View the BTC profit calculator

The Relative Strength Index (RSI) also recorded a rise, indicating a successful break above the pattern.

However, if BTC fails to close above the aforementioned red line support, it could fall to $52,000.

Source: TradingView