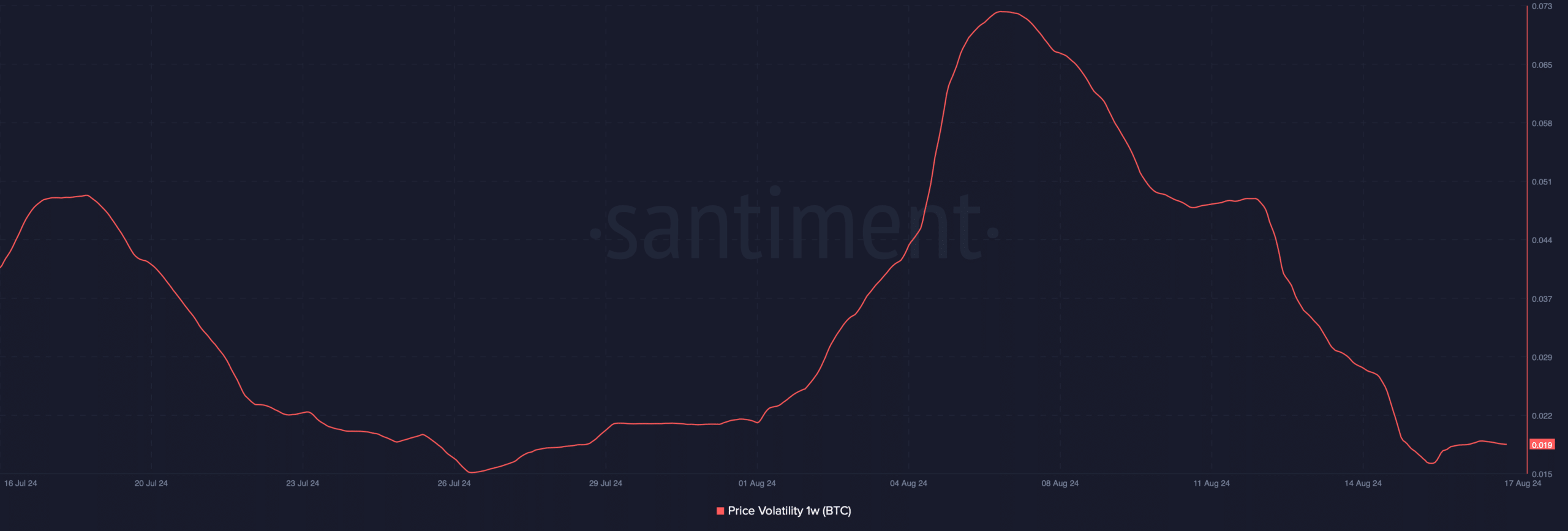

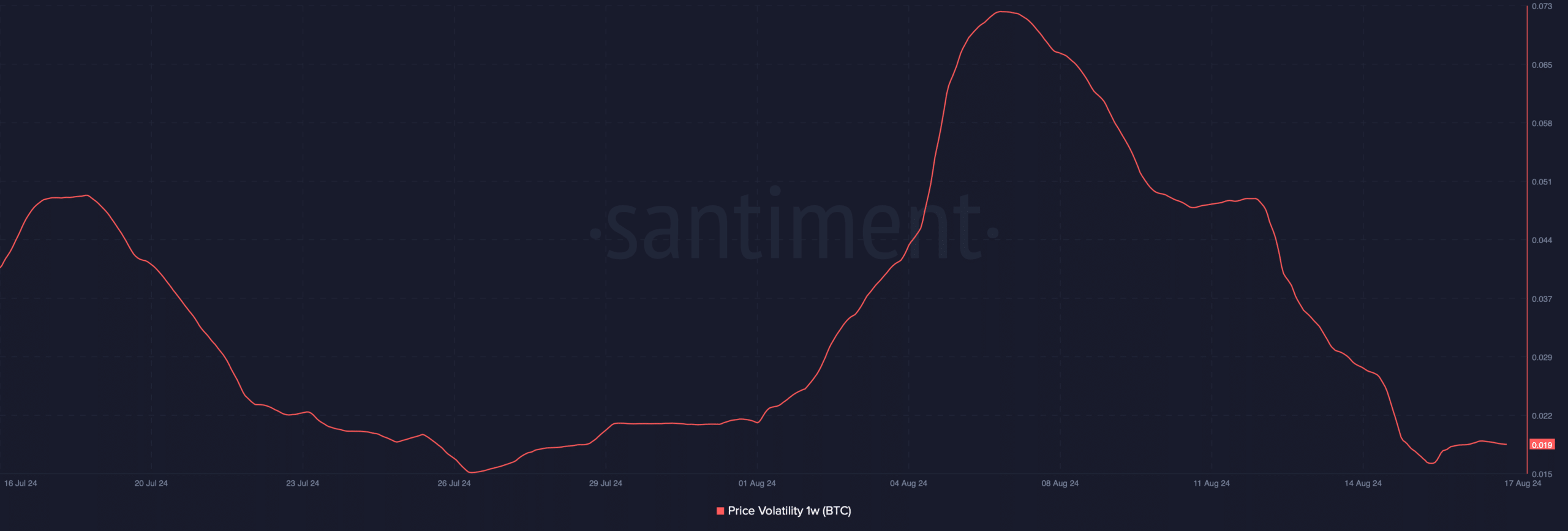

- BTC price volatility dropped last week as it was in a consolidation phase

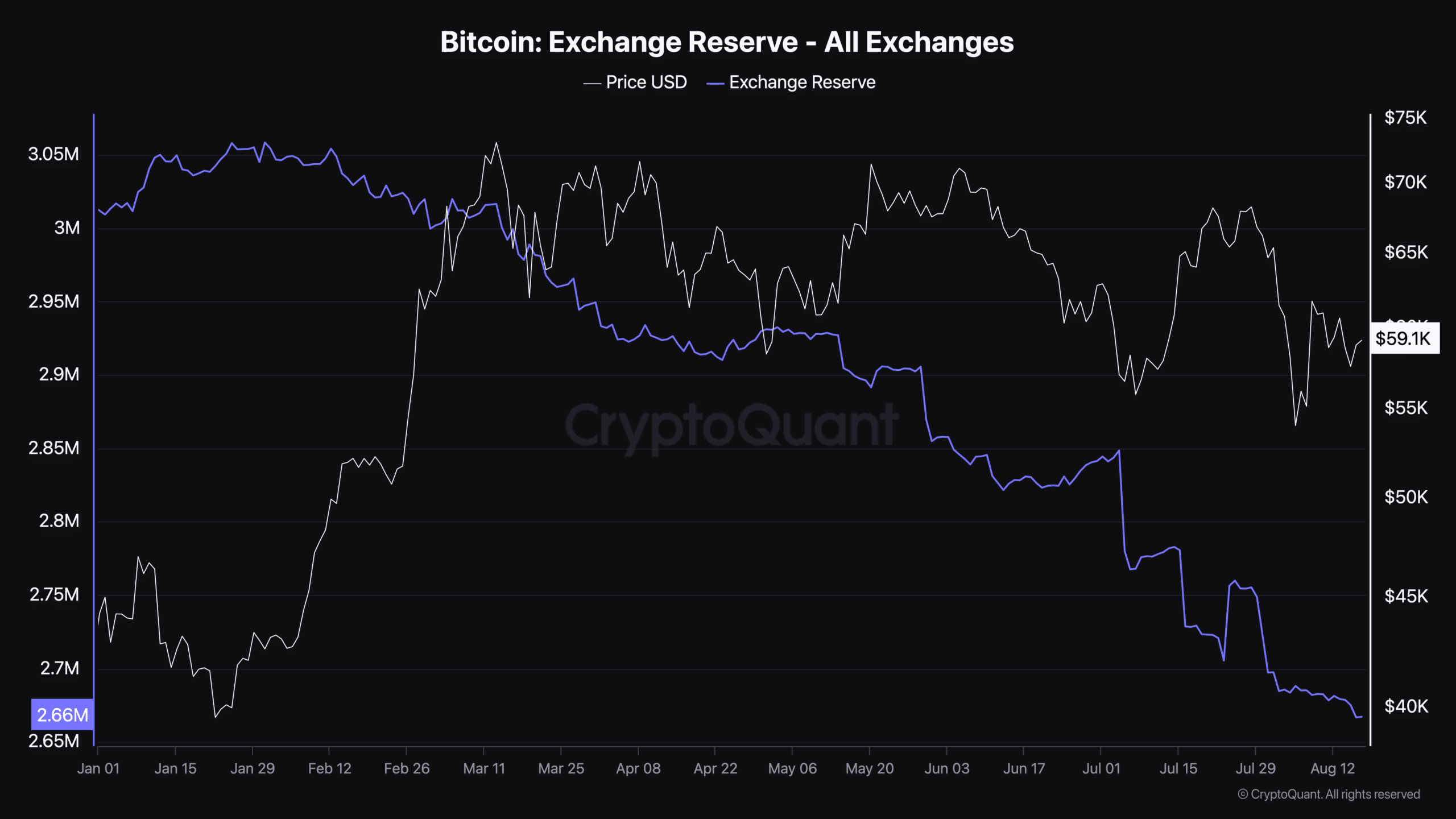

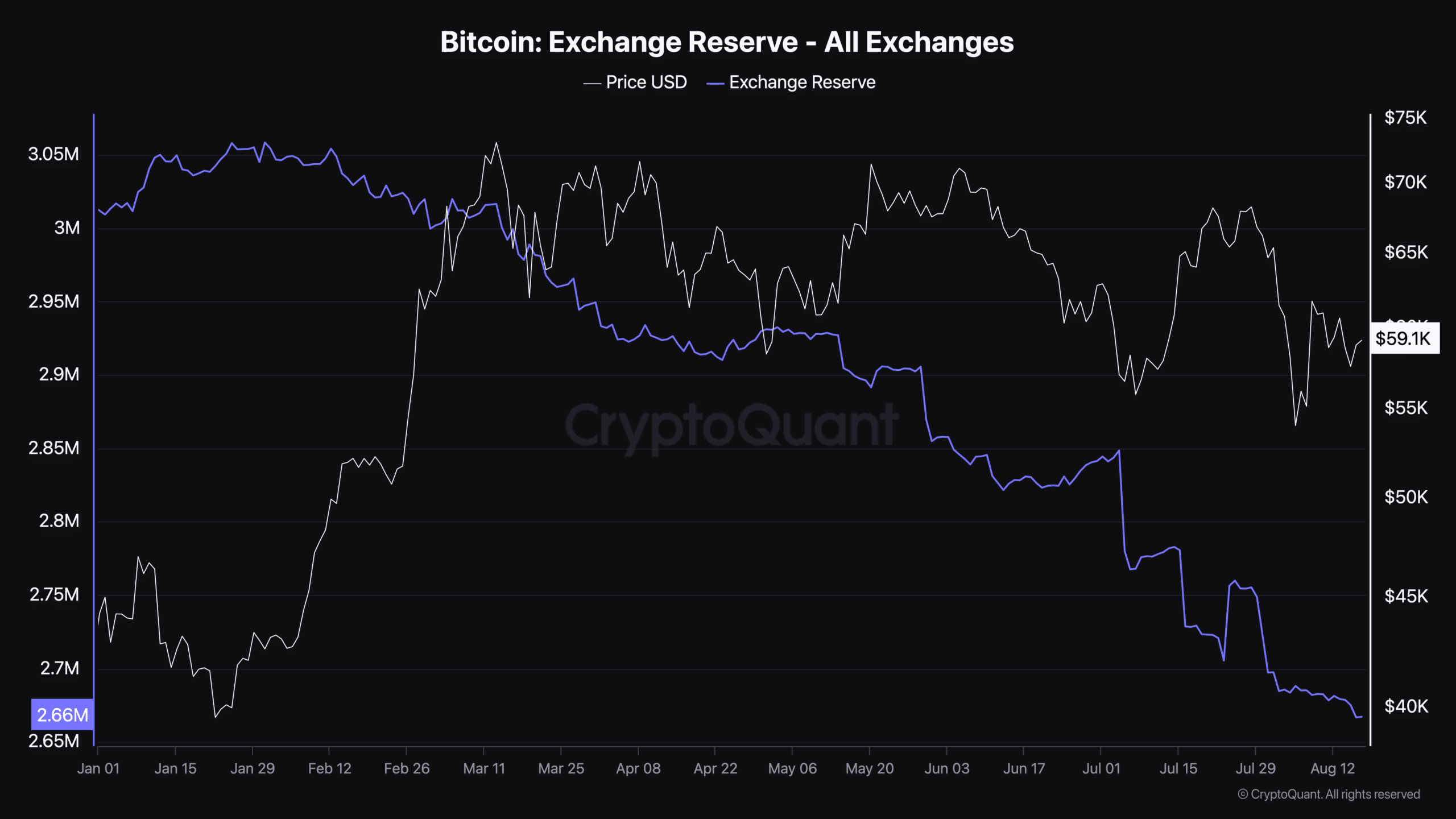

- Meanwhile, BTC’s foreign exchange reserve also declined, indicating rising demand

Bitcoin [BTC] hasn’t shown much volatility in recent days as the price seemed to hover around $60,000. Meanwhile, BTC demand surged, which could soon impact the price.

That’s why it’s worth taking a closer look at what’s going on.

Why is Bitcoin Consolidating?

CoinMarketCaps facts revealed that the price of BTC has fallen 2% in the past week – not a big drop. On the contrary, over the past 24 hours the value of the crypto has increased by 1%. At the time of writing, BTC was trading at $59,172.68 with a market cap of over $1.17 trillion.

The fact that the cryptocurrency’s volatility dropped last week was further proven by the massive drop in the 1-week price volatility chart over the past few days.

Source: Santiment

Quinten, a popular crypto analyst, recently shared one tweet That was a possible reason for the decline in volatility.

According to the same, BTC may be following a historical trend, one that it has shown after every halving. He argued that since BTC has been in a consolidation phase for a few weeks now, the price of BTC could rise in the fourth quarter of 2024 if history repeats itself.

The bull rally might as well see the king of cryptos reach an all-time high on the charts.

BTC demand is increasing

As Bitcoin consolidated, demand for the cryptocurrency also increased.

AMBCrypto’s analysis of CryptoQuant’s data revealed that BTC’s foreign exchange reserves fell significantly in 2024. This implies that BTC was under supply pressure. Whenever demand increases and supply decreases, it signals a price increase in the coming weeks or months.

Source: CryptoQuant

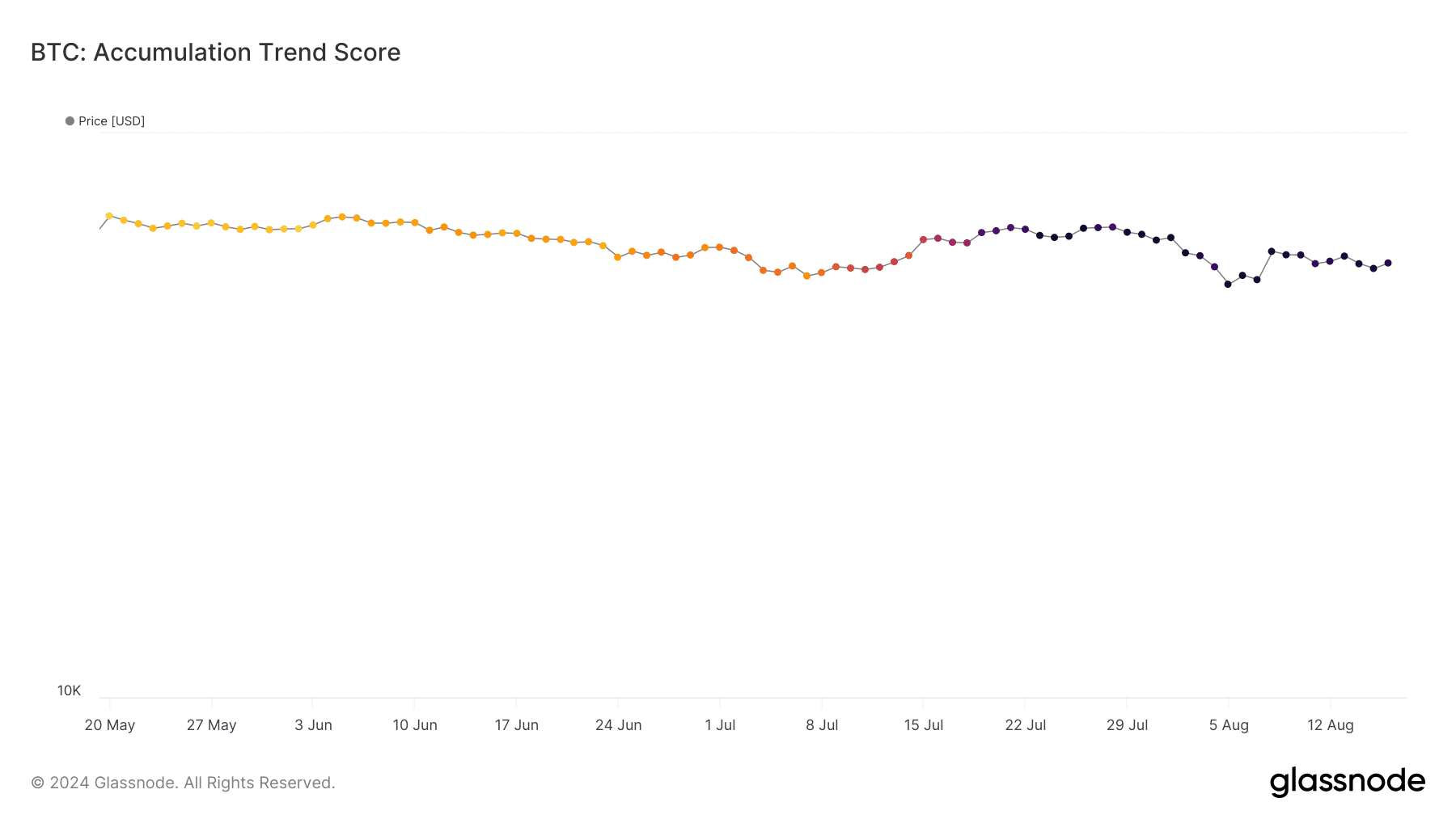

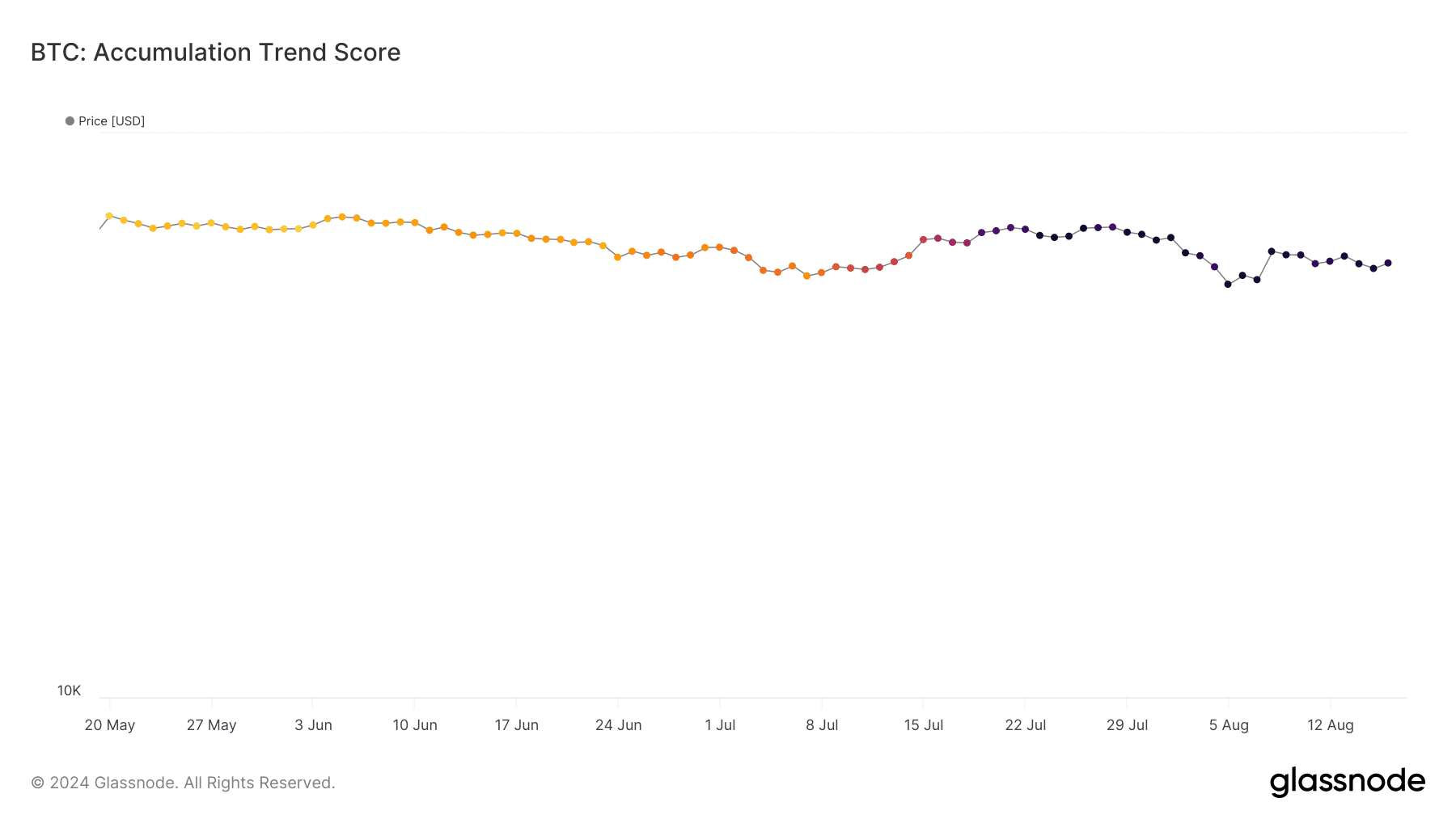

We then looked at Glassnode’s data to verify the rising demand for BTC. According to our analysis, the crypto’s accumulation trend score had a value of 0.94 at the time of writing.

To start, this metric is an indicator that reflects the relative size of entities actively accumulating coins on-chain in terms of their BTC holdings. A value closer to 1 is a sign of high buying pressure, while a value closer to 0 indicates that investors are not accumulating.

Therefore, this metric confirmed the fact that demand for Bitcoin has increased, which could result in a bull rally in the fourth quarter.

Source: Glassnode

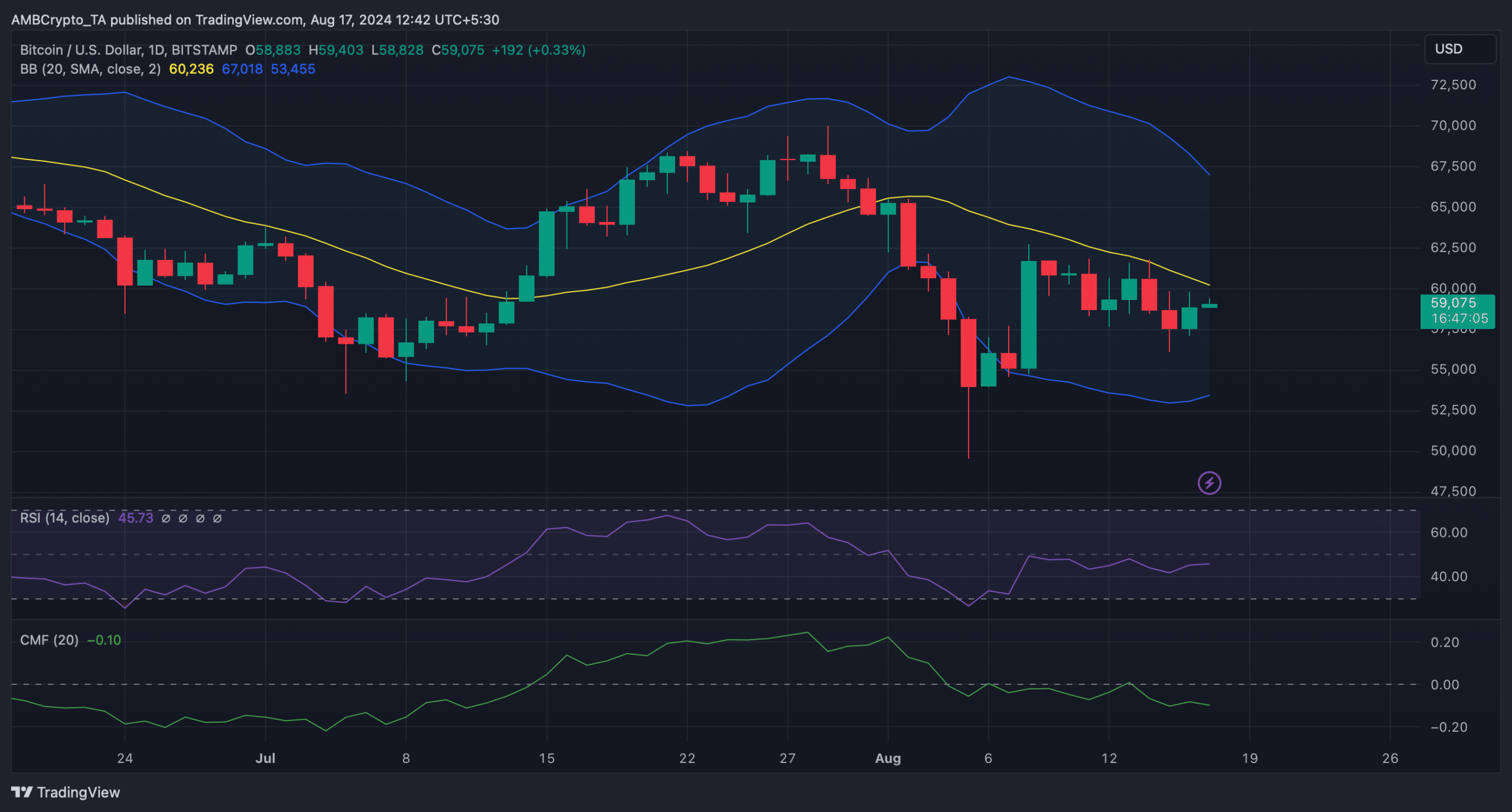

Finally, we reviewed the cryptocurrency’s daily chart to find out what to expect in the short term.

The Bollinger Bands revealed that BTC was about to test its resistance near the 20-day Simple Moving Average (SMA).

Is your portfolio green? View the BTC profit calculator

The Relative Strength Index (RSI) also registered a rise, indicating that BTC could break above its 20-day SMA. On the contrary, the Chaikin Money Flow (CMF) looked bearish as it moved south on the charts.

Source: TradingView