- Synthetix’s development activities underscore the network’s growing efforts to attract more users

- However, SNX’s bearish performance is fueled by whales and institutional selling pressure

Synthetix was one of the most promising crypto projects during the 2021 bull run. However, it has struggled to stay in the spotlight since the DeFi segment has become more saturated. Similarly, its native token SNX has also been on a bearish spiral lately.

Can Synthetix make a comeback? Well, this DeFi protocol has gone through battles in an attempt to maintain its relevance. Think about this – Synthex saw strong development activity recently, ranking it as the top DeFi protocol in terms of DA in the past 30 days.

A precursor to a big step for SNX?

The aforementioned increase could be related to some of the latest announcements of the project. The protocol recently announced a new integrator protocol called TLX, which allows for leveraged trading. In reality, TLX announced just two days ago it managed to reach over $400 million in leveraged tokens traded.

Synthetix is also reportedly working on a new offender integrator. These observations point to the possibility of increased demand for SNX within the Synthetix ecosystem.

SNX has been in a bearish trajectory for almost five months. The press time price tag of $1.29 represented a 75% discount from $5.28 – the highest YTD price tag achieved in March.

Source: TradingView

SNX’s press time price appeared lower than the price level during the previous bearish phases. Hence the question: can it bounce back? Well, on-chain data revealed some interesting findings regarding the SNX token.

Whales and addresses and others…

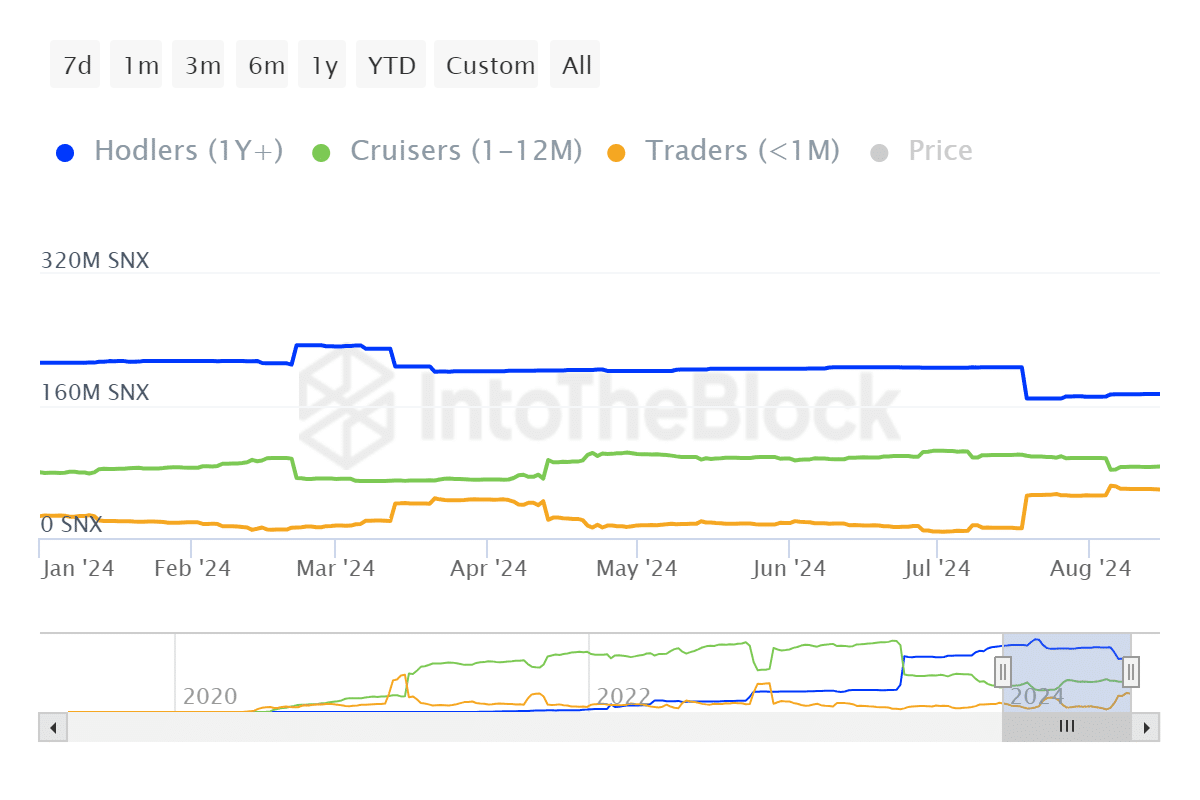

About 98% of all addresses with SNX were at a loss at the time of writing, while only 0.76% were in the money. This suggested that there was very low accumulation at or below the price level at the time of writing. This matched the time equilibrium showing that the number of HODLers has decreased by 37,830,000 SNX over the past 8 months.

Source: IntoTheBlock

The number of SNX traders has increased over the past two months, indicating a preference for short-term price gains. As a result, SNX has failed to maintain a decent uptrend. Meanwhile, ownership statistics show that whales have contributed to the selling pressure over the past thirty days.

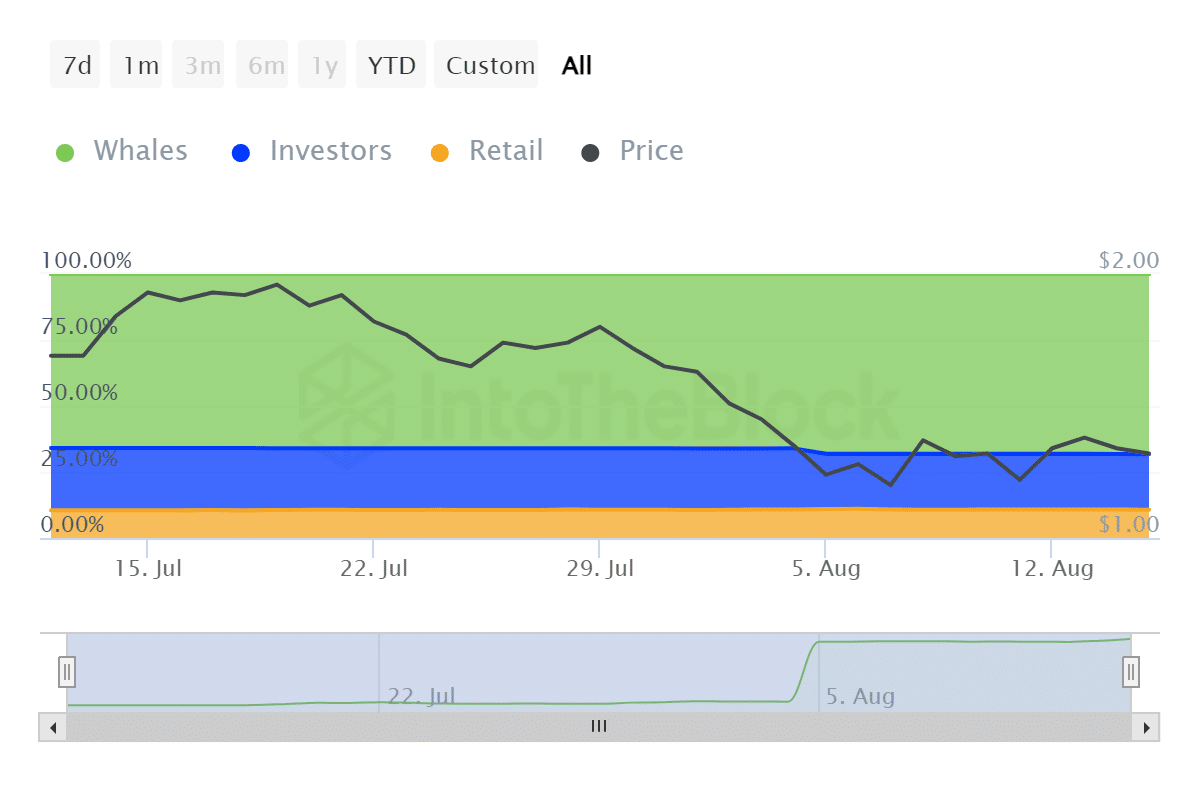

Whale address balances have fallen by approximately 7.3 million SNX over the past four weeks. The number of investor addresses fell by 7.78 million coins during the same period. However, retail addresses recorded positive growth with approximately 490,000 SNX.

Source: IntoTheBlock

The takeover by private holders indicated a possible shift in sentiment.

However, retail buyers may not have much influence on the market. SNX could remain subdued unless we see a shift in whale and investor positions in favor of accumulation.