- The Bitcoin miners’ reserve has decreased significantly.

- Sales have also fallen to one of the lowest levels in history.

Bitcoin [BTC] miners have faced major challenges as Bitcoin hashrate has reached record levels.

These issues are further exacerbated by the recent halving and the significant price drops BTC has experienced in recent weeks.

Bitcoin hashrate spikes

Analysis showed that the Bitcoin hash price, which measures profits per unit of hashrate, fell to an all-time low last week.

On August 4, miners earned only $35 per petahash per day, which is the lowest rate recorded historically.

AFurthermore, the Bitcoin hashrate spiked, reaching an unprecedented level of 673 exahashes per second.

This increase in hashrate means an increased difficulty in mining, making it more challenging for miners to successfully mine new blocks.

This difficulty is exacerbated by recent reductions in transaction fees, which further increases the financial pressure on miners.

Miners are selling their assets as the Bitcoin hashrate rises

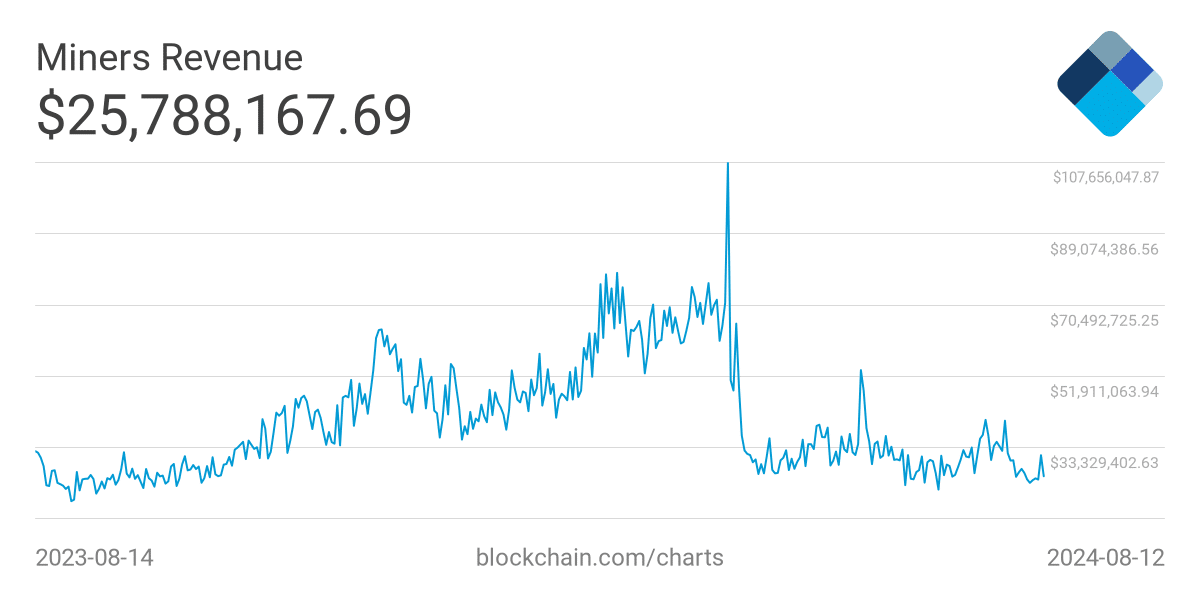

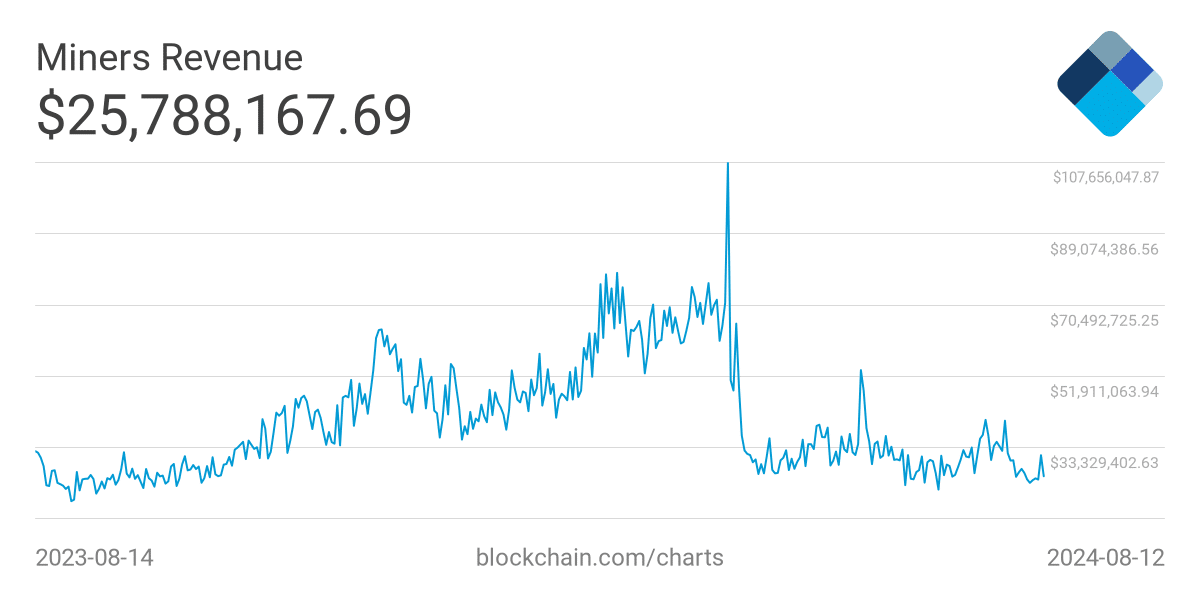

AMBCrypto’s analysis of miner revenues revealed a significant downturn after Bitcoin’s halving.

The chart shows that daily revenues fell from about $50,000 to $30,000, according to data from Blockchain.com.

This decline was further exacerbated by a recent increase in the Bitcoin hashrate, which pushed revenues up to around $25,000 – a near-historic low for miners.

Source: Blockchain.com

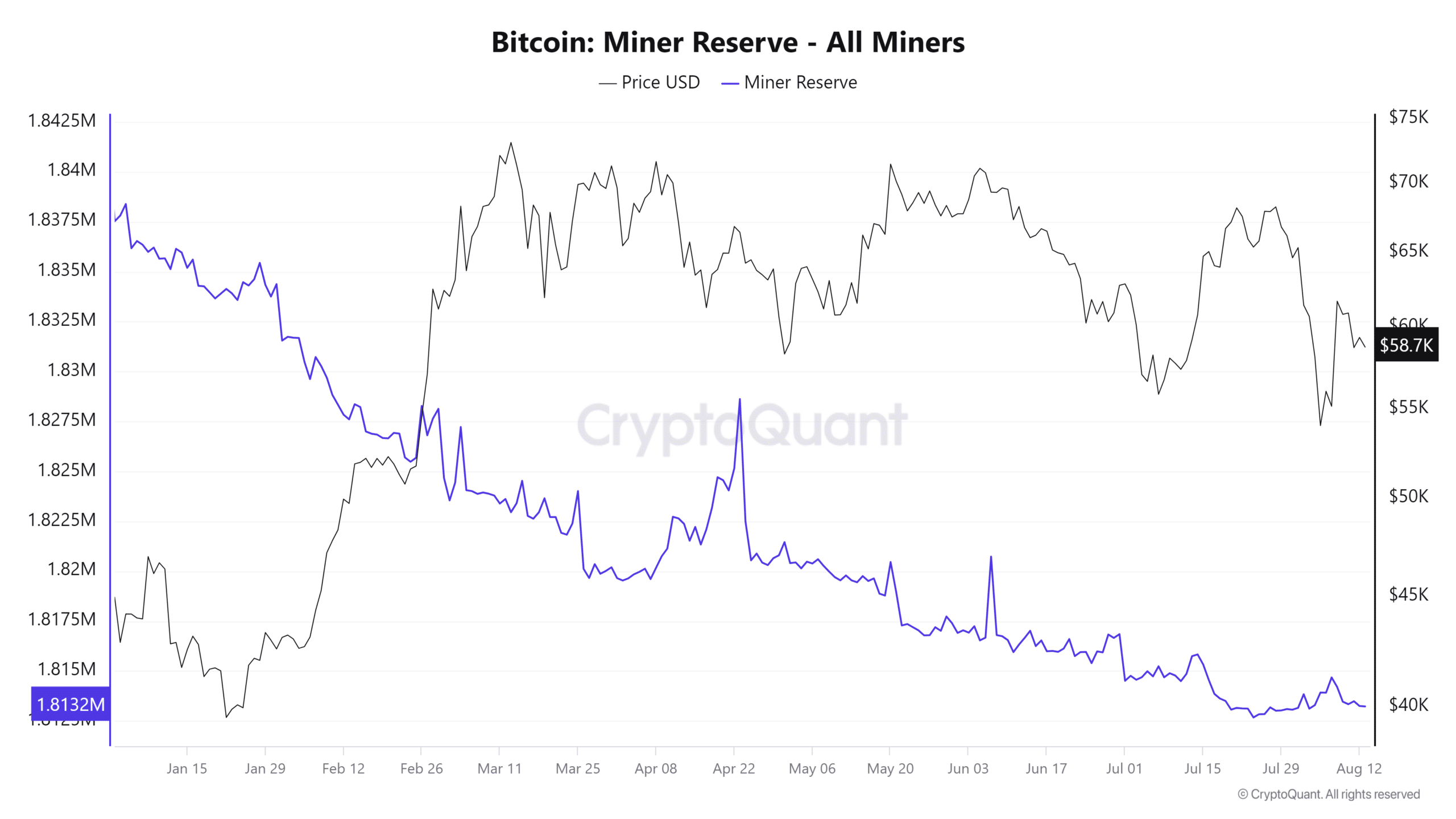

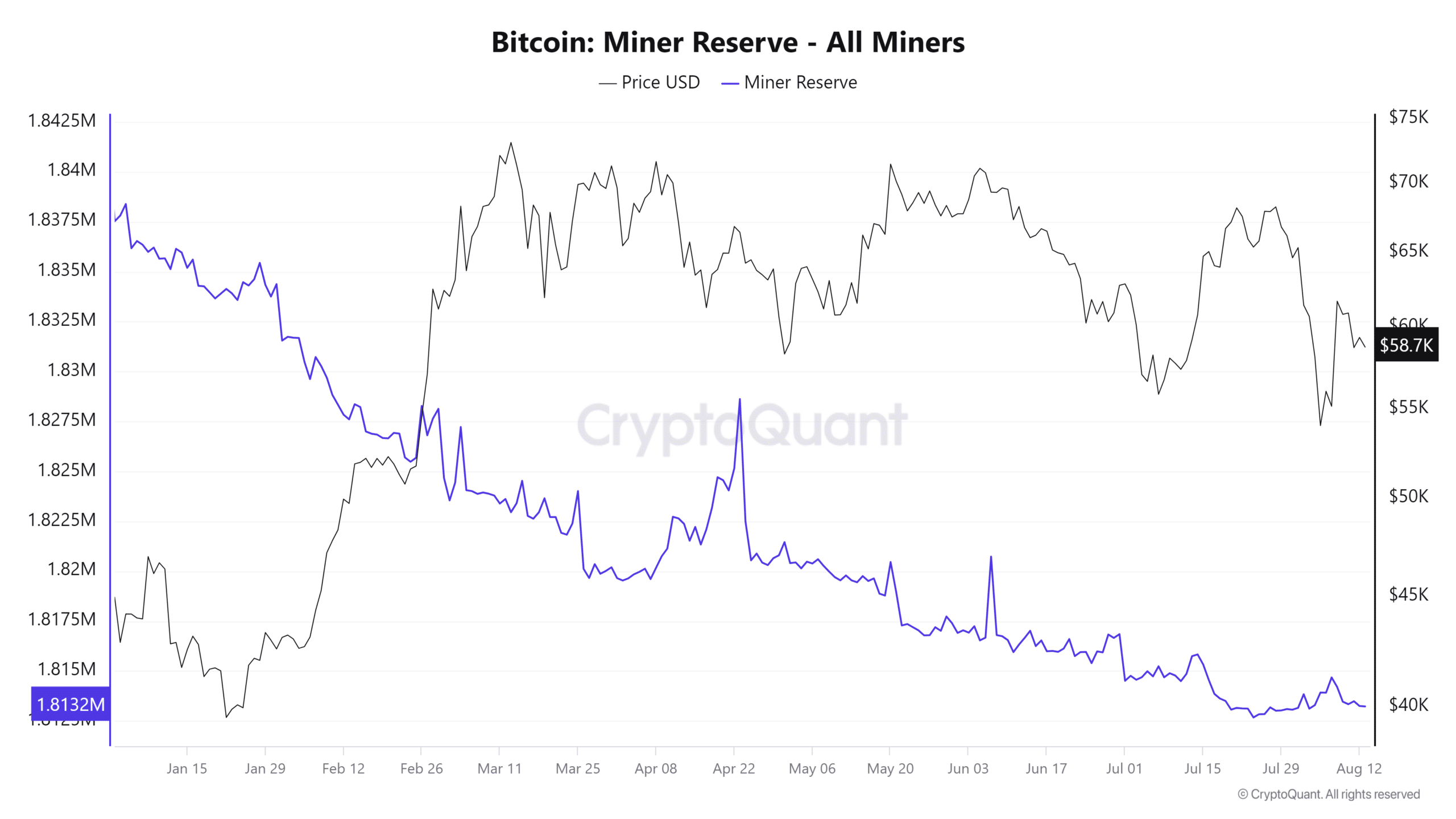

This decline in revenue, coupled with the continued decline in Bitcoin prices, has also impacted the miner’s reserve.

Data from CryptoQuant showed a noticeable drop in reserves since April, down to around 1.813 million BTCs at the time of writing.

If hashrate remains high, miner reserves are likely to decline in the coming months.

Source: CryptoQuant

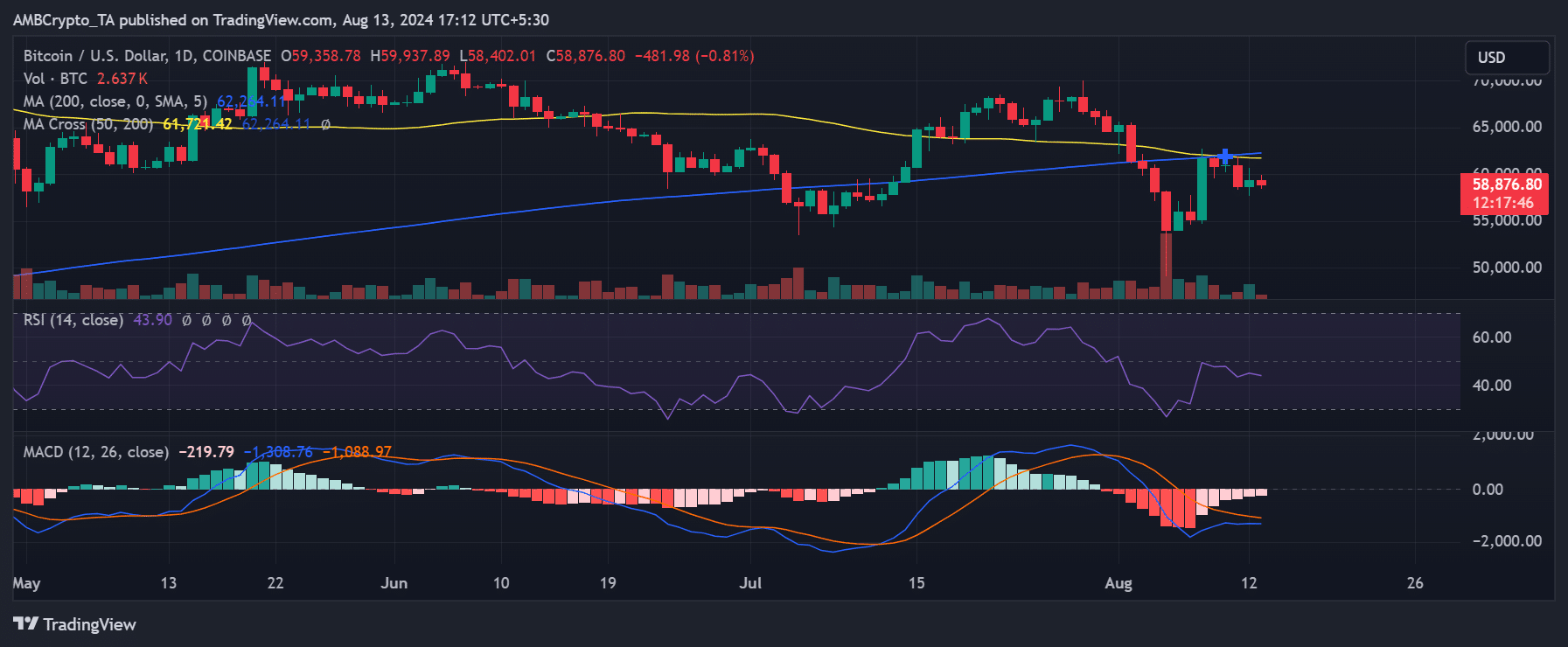

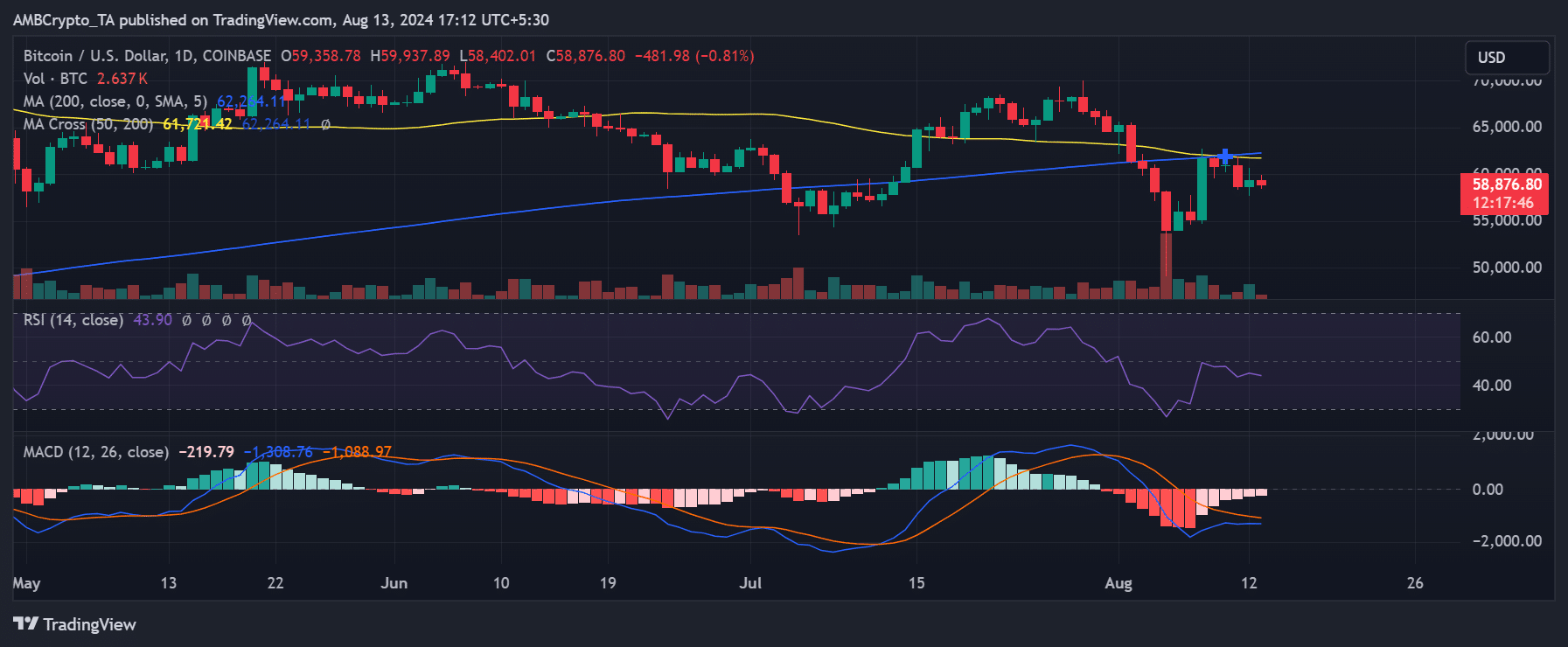

Bitcoin’s Weak Climb Is Being Tested

Bitcoin saw a slight rebound in its last trading session, rising more than 1% to around $59,358. Since then, however, the company has lost almost 1% of those profits, with a trading value of about $58,800.

This recent price action extends the volatility pattern of recent weeks.

Source: TradingView

AMBCrypto’s look at Bitcoin’s technical indicators, including the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), indicated a continued bearish trend.

Is your portfolio green? Check out the BTC profit calculator

At the time of writing, the RSI remained below the neutral threshold, and the MACD lines, along with the histogram, were below zero, indicating continued bearish momentum.

A shift to a positive price trajectory could help miners mitigate the challenges of the currently high Bitcoin hashrate.